News 9/22/23

Top News

Digital-first care management and virtual care infrastructure vendor UpHealth files Chapter 11 bankruptcy after a court rules that it owes an investment bank $31 million for arranging a SPAC merger to take the company public.

UPH shares that peaked at $28 in late 2021 are now worth $1, valuing the company at $17 million.

Reader Comments

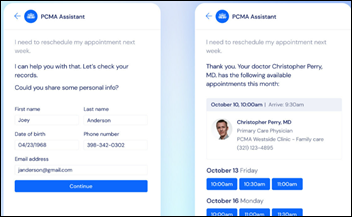

From Nasty Parts: “Re: Verinovum and Robin Healthcare. Both are being shut down by their primary funding entities. First time I’ve seen that.” Unverified, although several Verinovum employees recently added “open to work” to their LinkedIn profiles and Robin is no longer listed as a Khosla Ventures portfolio company. Verinovum offers healthcare data curation, while Robin Healthcare sells a smart assistant that creates clinical documentation for orthopedics.

HIStalk Announcements and Requests

Last call: sponsors who are participating in the HLTH conference can be included in my guide by completing a short form with their details.

I was checking something on the HIMSS24 website and noticed that it will offer exhibitors a reverse expo. I don’t recall that HIMSS has done this in the past, but HLTH and ViVE tout their hosted buyer programs and new HIMSS conference operator Informa specializes in that. I’m also reminded that HIMSS is no longer based out of Chicago, at least from a legal standpoint, having followed many corporations that moved their HQ to the tax haven of Netherlands.

A Reader’s Notes from the Nashville Healthcare Sessions

- HCA says its nursing school will have 30,000 students when it reaches capacity by the end of the decade.

- One investor says their firm is interested in behavioral health investments but is considering AI solutions for staffing and recruiting. They are worried that policymakers could pass knee-jerk AI regulations.

- Another investor says they aren’t interested in point solutions and those that are narrowly focused on management of single conditions and will instead look at platforms or something that ties into bigger workflow and tools. They predict AI use in drug discovery, supporting payer-provider services, and radiology image analysis.

- A Humana executive says interoperability will be a $1 billion opportunity by 2025.

- A16Z sees a lot of AI noise that the industry can’t absorb and predicts that many of the ideas will fail or will be merged into something else. They are concerned about ONC’s proposed algorithm transparency rule and the requirement that EHRs implement risk management practices for third-party predictive models.

- Aneesh Chopra thinks providers will be biggest beneficiary of AI, with the best opportunity being to help patients interpret their own data.

Webinars

October 25 (Wednesday) 2 ET. “Live Ask Me Anything Webinar: The Power of Data Completeness.” Sponsor: Particle Health. Presenters: Jason Prestinario, MSME, CEO, Particle Health; Carolyn Ward, MD, director of clinical strategy, Particle Health. Is fragmented data impacting your organization and its ability to scale quickly? Our experts will discuss the advantage of having a 360-degree, real-time view of your patients. Access to analytic-ready data supports proactive care by enabling rapid clinical decision-making, stratifying high-risk patients, developing and using personalized treatment plans, lowering cost, and quickly closing care gaps.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Hospital-at-home technology vendor Inbound Health, which was spun out of Allina Health in late 2022, raises $30 million in a Series B funding round.

Denmark-based Corti, whose AI platform analyzes medically related telephone calls to make recommendations and generate documentation, raises $60 million in a Series B funding round.

Virtual digestive health vendor Vivante Health raises $31 million in Series B funding.

People

Angie Franks (About) joins Kalderos as CEO.

About hires Jonathan Shoemaker, MA (Allina Health) as CEO.

Impact Advisors promotes John Stanley, MBA and hires Roger Weems, MSHA, MBA (Premier) as chief growth officers.

Announcements and Implementations

Symplr adds survey management capabilities to its compliance platform, allowing healthcare organizations to conduct internal surveys to document conflict of interest, safety culture, and vendor compliance.

Biofourmis enhances its Digital Clinical Trials solution with AI-powered data management automations and integration with 40 devices.

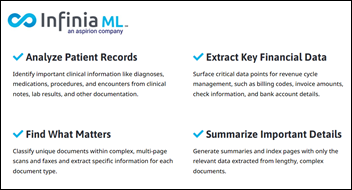

The American Medical Association reviews the use of CPT codes for digital medicine, noting a lack of alignment across insurers and limited widespread use. The report finds that while payers are working directly with health tech companies to provide services for specific disease areas – hypertension, behavioral health, and physical therapy – those services are often disconnected from the patient’s PCP or medical home.

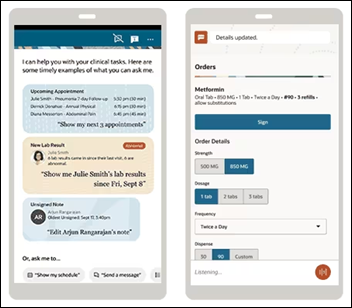

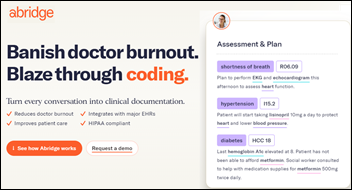

Meditech will add the Suki Assistant ambient listening solution to Expanse via a new Suki extension for Chrome.

Scripps Health will pilot the use of generative AI to draft responses to patient messages, saying that message counts have increased by 50% since the onset of COVID-19, with the average doctor receiving 44 per day.

Arcadia announces an AI assistant that creates patient summaries, which it says will save 50% of the case manager time that is required to gather and interpret medical record data.

Texas Tech University Health Sciences Center launches the Institute of Telehealth and Digital Innovation.

The American Academy of Pediatrics warns about the unintended consequences of auto-populating a newborn’s EHR with pertinent data from the charts of the parents. It cites a newborn’s record in which one of the mother’s listed problems was intimate partner violence by the baby’s father, who didn’t have access to the mother’s records, but could have seen the entry via his legal access to the baby’s chart. An employee noticed the entry and removed it. It concludes that EHRs allow clinicians to limit access to potentially harmful information without running afoul of information blocking regulations.

Other

The Madison newspaper describes how Epic’s growth affects the Verona, WI area as the company begins construction on its sixth campus and considers building a seventh. Epic plans to increase its headcount to 13,300 by next year and has bought more farmland to expand its Verona footprint to 1,700 acres, requiring the construction of new roads, interchanges, and widened bridges that officials hope will ease traffic backups for commuters.

Penn Medicine internist Jeffrey Millstein, MD says that value-based care has made it hard to get short-notice appointment with PCPs who are paid to manage populations and meet payer metrics rather than treating infections and acute pain. Patients are turning instead to urgent care centers and EDs, disappointed that the doctor with whom they have developed a rapport is not available. He recommends limiting comprehensive annual visits to highest-risk patients and replacing routine physician visits with support team virtual outreach for low-risk patients.

The Marshall Project covers for-profit prison medical provider Corizon Care, which attorneys say is using the “Texas Two-Step” bankruptcy method to avoid paying malpractice claims and debts. Corizon created a new company, moved its debt to it, then filed bankruptcy for the new company. It offered plaintiffs $5,000 each to settle their lawsuits, advising them they would probably get nothing otherwise. Meanwhile, the now debt-free and malpractice-free part of the business, much of it involving taxpayer-funded contracts, was moved to another newly created company. Several companies have used the Texas-only tactic – including Johnson & Johnson, which was trying to dodge talcum powder lawsuits – but all were either rejected by federal courts or remain in litigation.

Sponsor Updates

- RCxRules adds 11 private equity-backed specialty medical groups to its Revenue Cycle Engine customer base.

- AGS Health publishes a white paper titled “Optimizing HCC Coding for Accurate Reimbursement in Healthcare.”

- Findhelp releases a new report, “Meeting the Moment: Community Organizations Nationwide See Challenging Times Ahead.”

- Lucem Health releases a new episode of the This Week in Clinical AI Podcast.

- Medhost will exhibit at the TORCH 2023 Fall Conference September 26-28 in Round Rock, TX, and at the NRHA Critical Access Hospital Conference September 27-29 in Kansas City, MO.

Blog Posts

- Want to improve patient safety? Up your EHR’s usability (Nordic)

- The Top 4 Things Healthcare Organizations Want in an IT Vendor (Impact Advisors)

- Embracing DE&I in Your Recruitment Strategy (Direct Recruiters)

- Ensuring EMR Data Can Support Strategic Performance Improvement from the Start (Divurgent)

- Leveraging Networking as a Strategic Approach for Patient Acquisition in Weight Loss and Medical Spa Clinics (EClinicalWorks)

- Improve Your Call or Contact Center Experience (Five9)

- Healthcare cybersecurity threats: August 2023 (Fortified Health Security)

- Maximizing Your Investment: EHR/EMR Consulting (HealthTech Resources)

- Defining Change Management for Your Organization (Impact Advisors)

- Thoughts on AI Consciousness (Keysight)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…