Ben Hilmes, MHA is president of Healthcare IT Leaders of Alpharetta, GA.

Tell me about yourself and the company.

I’ve been in the industry for 25 years, going back to grad school. I have an MHA and am a fellow with the American College of Healthcare Executives, so I’ve been active in all of those industry channels. I spent 22 years with Cerner in a variety of roles, and when I left, I was running our US not-for-profit client organization that was about a $2.5 billion business as well as the outsourcing function called ITWorks. I then transitioned to Adventist Health as a chief integration officer, where I had responsibility for IT, informatics, analytics, and enterprise PMO. In April 2023, I joined Bob Bailey and Healthcare IT Leaders as president of the company. It has been an exciting five months.

I’m also doing a podcast called “Leader to Leader.” We will have a guest every month who is relevant in the industry, names that people know. Our first topic was revenue cycle outsourcing, a good conversation with Doug Hire, former COO of OptumInsight. We also talk about leadership. I think this industry is starving for really, really good leaders. Any insights I can pull out of these incredible people about their leadership journey and share those with the audience, we’re doing that.

What services are clients seeking?

Our services fall into three categories. EMR, with the main players like Oracle Health, Epic, Meditech, and Athenahealth. A second grouping is workforce management, human capital management, and ERP, with players such as Workday, UKG, and Oracle ERP. The third area is helping clients on their cloud journey, which can be as simple as how to do rationalization and get them out of the data center all the way to helping them migrate even the most complex of things, including EMRs, to the cloud.

Vendors and suppliers are getting out of the services business. We’ve seen a massive migration away from services from the primary vendors. Secondly, health system cost pressures are challenging them to think differently about how they get things done. Doing those things with a large system integrator sometimes doesn’t achieve the price point that they are looking for. We have found ourselves in a unique and exciting spot for a lot of those clients that need work done across those portfolio of technologies, being able to go direct to them or even working with some of our great partners like Deloitte, Accenture, PwC, KPMG in partnership to get their overall price points to something that is acceptable and sustainable by these clients to get work done in a challenging market.

Why are EHR vendors moving away from running a separate services organization?

It’s pretty simple. It’s margin. If you think about the Cerner transition, Cerner was at its core a software company. Oracle is even more of a software company, from a focus standpoint, than Cerner. When they acquired Cerner, they started getting out of some of these services businesses that were low margin. Cerner was doing that a little bit toward the end, getting rid of revenue cycle, starting to jettison low-margin CommunityWorks, their community hospital deployments. They were pushing those out to a couple of partners to do those end to end.

We have seen that trend almost in all of the software suppliers. The services business creates risk. It’s hard work. It creates a lot of noise and then doesn’t generate the kind of margins that these organizations demand and expect for either their shareholders or their overall business performance.

If the vendor can’t generate adequate margins on services, how can a third-party company?

The poor health systems that end up with one or two points of margin feel like they’ve had a great success. Software suppliers are well above that 70% or 80% margin. Services business run somewhere in that 30% to 40% margin range. We do a really good job of managing our overall overhead and spend. We don’t have a tremendous cost pressures from R&D with all of the development activities that a software company needs. We find a nice margin spot somewhere in the middle. That works for us and our shareholders while enabling us to create price points for our customers and clients that work for them.

Big healthcare organizations outsource big functions such as IT and revenue cycle management, but not infrequently bring them back in house not long after. Will we see the same buyer’s remorse with health systems who scale back data centers to move to the cloud and then find the eventual cost to be excessive or unpredictable?

I’ve been involved in outsourcing IT, revenue cycle, and hosting. Every one of those tends to be really, really strong out of the gate. But at some point, there is pressure to achieve margins. The overall service model changes over time. You see the vendors start tweaking that service model, whether it’s leveraging more offshore or leveraging less-expensive, less-experienced resources. We see it time and time again, trying to leverage technology to drive more efficiency or trying to do more with less. Every time I have seen that, there was a degradation in overall client experience.

I suspect that you will see a similar trend as people move to the cloud. There may be enough incremental benefit in the movement to the cloud to offset that, so maybe it’s a little different business model. I think it’s too early to tell, but it’s interesting that when you are in a lot of those conversations, while it’s not the exact same thing, it sounds a lot the same. At the core, you are outsourcing this function to a different organization. It will be interesting to see if it follows the same trends.

How will Oracle’s ownership change the former Cerner business?

We can plainly see the number of clients that are transitioning away from Oracle Health to Epic or some other supplier. That trend continues to grow. It was eye-opening at Oracle CloudWorld to see what Oracle is doing with Cerner. Some decisions are positive, while others make me scratch my head. But at the end of the day, Oracle is an incredibly formidable company that will eventually get it right. We need them to get it right. This industry needs a balance in that space. Having a strong player in Oracle Health is healthy for the industry.

I spent 22 years at Cerner, starting when we had 1,700 associates. We grew to 30,000 and had a lot of fun getting there all under the leadership of Neal Patterson and the vision that he had. It was almost emotional listening to Larry Ellison’s speech at CloudWorld, because if you listened closely and had the legacy information that I have, he is still talking about the same vision that Neal had around healthcare and the role that these systems can play in transforming this industry, whether it’s the national network, robotics, or analytics and insights. It was the race to get healthcare digitized. When we did, then it was going to be the fun stuff, and Larry is excited about that.

I would not count them out, as they continue to invest heavily. I heard it – he was very clear about healthcare being their number one focus. For a company the size of Oracle to boldly say that, coming from their chairman’s mouth directly, was a pretty big statement. But the clients are saying, let’s get on with it. We need to get there faster. We have real challenges today. You are seeing a lot of clients say, we can’t wait any longer and we are making the move.

That creates a ton of opportunity for businesses like ours. As clients transition to Epic, we can play a meaningful role in helping them deploy that new solution. Secondly, there’s a large balloon effect. When you transition hundreds of resources over to a new project, such as Epic or some other system they have selected to deploy, you have to maintain all the legacy systems during that time. Our firm steps in incredibly nicely in that space with our managed service capabilities to provide all of that legacy support, all of that bridge strategy for these IT organizations as they go through the transition. Lastly, as they move to the new systems, we are rapidly stepping into the managed services space, being able to take on the application support for these organizations as they continue their journey on their new platform.

Where will innovation come from, or what areas will be ripe for a technology solution?

If you go through the major buckets of labor in healthcare, nursing is probably the best example. It’s a big spend and there’s a big gap. When I was at Adventist Health, we were spending 3X of our budget on contract labor, mostly in nursing. That’s not a sustainable model. So, how do I think about leveraging technology to create efficiencies? We were evaluating virtual options, such as patient care centers, to offset some of the work that nurses were doing in clinics. All the pre-work that could be done virtually.

Backing up, we were evaluating, on both the ambulatory and acute sides, going end to end looking at overall jobs to be done and breaking them down into two categories — things that have to be done in the physical environment and things that could be done in a virtual environment. As you start to think about those things that could be done virtually, you can start to think about virtual call centers, leveraging offshore capabilities, et cetera, to fill some of those voids. It was interesting on the acute side how many functions fall into the “we could do that virtually” category, and the same model could emerge. You’re going to see a lot of virtual nursing come to play, leveraging different technologies to provide those capabilities in a different way than physically being present.

The other place that is ripe for technology innovation is revenue cycle. You can’t just throw more people at it because we don’t have more people, people are expensive, and it doesn’t seem to be making any difference. Cost-to-collect for health systems is starting to get really out of hand. When I was at Adventist, we were looking at north of 5.5% cost to collect, which is unsustainable. We were at how we could leverage technology, offshoring, or some other business model to help us deliver a more efficient and higher-performing service.

Healthcare systems spend a lot of money on technology on the back end, but what patients see often remains clipboards and scanned documents. Are the technology changes in revenue cycle more consumer facing or more process oriented on the back end?

Revenue cycle is pretty broad. A lot of people think about it only on the back end. But a lot of the innovations are coming to play on the front end, engaging the consumer differently to create stickiness and increase and improve the overall patient experience. The challenge is that there are a lot of siloed solutions and data sets that don’t, at this point, create the intended outcome, which is to improve the overall experience, improve efficiencies, improve data capture, improve overall quality and outcomes.

For example, uniformity in how you communicate with your patient population or member population. You have four or five different technologies that do some sort of that, whether it’s a bot, a text, some kind of chat function, or a portal. How do you make those all seamless? We were faced with that challenge through our consumer strategy development when I was at Adventist Health. Working with these is almost like going back to the EMR of the early 1990 before you got to the single platform thought, the enterprise thought, You had silos of data, and the challenge was interop and getting these systems to communicate together. I think you’re facing the same challenges on the consumer side, and the front end of the rev cycle is front and center on that.

On the back end, there needs to be more innovation and stronger alignment with the payers. Providers and payers are going to have to come together and find unique ways to solve the real problems. Right now, providers have their agenda and payers have their agenda. I have been in tons of these dialogues with payers trying to think about new ways to address some of the challenges in the revenue cycle. In terms of innovation, I haven’t seen anything that’s leapfrog groundbreaking, but the business model tends to get in the way, which is unfortunate. But I still hold that promise that big orgs are going to come together. Clear minds are going to come to the table, and they are going to put the real focus, which is the patient, at the center of their objectives and start to find ways to bend the cost curve, create more efficiency, reduce the overall spend on revenue cycle, get claims adjudicated faster, all those functions. There’s an intersection between the payer and the provider that needs to be resolved

What are the key elements of the company’s strategy over the next few years?

We will continue to lean heavily in on our core focus around our staffing functions, across our three pillars of EMR, workforce management, and cloud. We will lean heavily into the managed service space. It’s about improving our overall revenue line to balance the staffing revenue with a recurring revenue. I believe we have the tools, the right people, and the capabilities to not only deliver a better managed service to our clients, but at a better price and with better outcomes. That’s exciting for us.

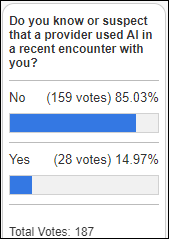

I could sit here and echo all the other pundits out there that talk about AI and all of the fun things around that, which is exciting, exciting stuff. But we don’t fully understand how it’s going to play out. So when I look out two to three years, we’re going to learn a lot about those things. It’s a little bit beyond that to really understand the true application of those things and how they can improve the overall healthcare experience, the delivery, the industry itself. But it will be exciting to see

.

Comments Off on HIStalk Interviews Ben Hilmes, President, Healthcare IT Leaders

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…