Top News

The board of Teladoc Health fires CEO Jason Gorevic after 15 years in that role. CFO Mala Murthy will take over as interim until a permanent successor is recruited.

TDOC shares rose slightly on the news, valuing the company at $2.4 billion, but have lost nearly 50% of their value in the past 12 months. They are down 95% from their all-time high in February 2021, shortly after the company acquired Livongo for $18.5 billion and before Teladoc took a $13.7 billion write-down of that business in February 2023.

In related news, telehealth competitor Amwell risks having its shares delisted by NYSE due to low share price. They are at $0.72 after losing another 10% following the announcement, valuing the company at $208 million. AMWL shares have lost 67% in the past 12 months and are 98% off their all-time high from early 2021.

Reader Comments

From Bluebella: “Re: grammar. You need this shirt.” Actually not, since I am judgment-free on spoken grammar, and in fact I relish hearing (and using) regional accents, word usage, and unusual expressions. Those are real-time artifacts of our upbringing, over which we had no control. I am only annoyed by sloppiness in the written word, where people expect strangers to read their thoughts, but are too lazy or indifferent to edit or to even bother reading what Siri spat out. The first-impression distinction between looking unintelligent versus merely lazy and disrespectful to the reader doesn’t much matter. Hopefully the bar will be raised by AI tools, where even poorly expressed and error-ridden writing can be easily turned into polished prose as smoothly as Google Translate converts Spanish to English.

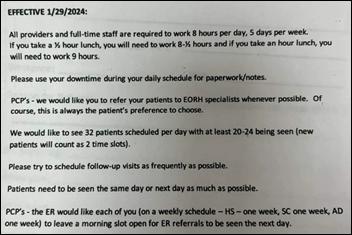

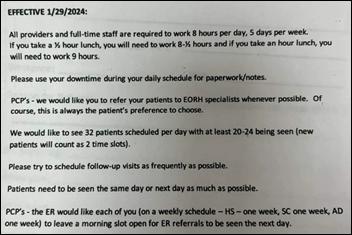

From Ormond: “Re: physicians. A doctor posted this email sent to PCPs by the local hospital.” I assume that the EORH identifies the source as 140-bed East Ohio Regional Hospital, which ironically is owned by a psychiatrist who bought the hospital after it was closed by a for-profit company that has since gone out of business. This memo, assuming it is authentic, could be interpreted as an order – unwisely documented in writing — to commit billing fraud by overriding medical needs and patient preference to book business for EORH’s specialists and to crank out follow-up visits. Patients must be no-showing those medically questionable follow-ups frequently if PCPs are expected to schedule 32 patients per day while seeing only 20-24.

HIStalk Announcements and Requests

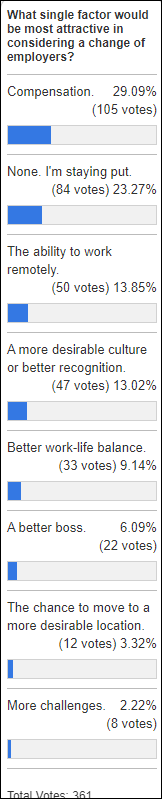

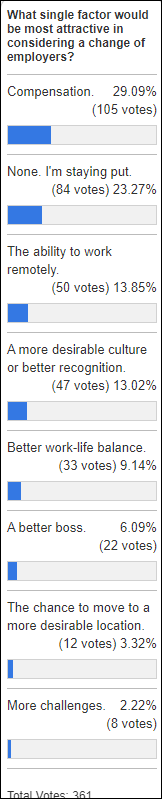

Cash beats the touchy-feel stuff for employers who want to retain poll respondents as employees, although the ability to work remotely remains a hot button.

New poll to your right or here: What healthcare-related organization frustrated you the most in the past 12 months?

Forget ChatGPT – the most impressive AI product is Suno, which can generate amazing songs given the user’s specifications. I requested a dark, operatic metal song about a menacing stranger ringing the doorbell, which generated a really cool, Nightwish kind of Flying V head-banger that you can stream here. Musicians now get to join writers and artists in questioning their future given AI’s ability to create similar works at any user’s command, and given the huge financial stakes, musicians will be lawyering up to figure out whether Suno’s training used their work or creates music that sounds like theirs.

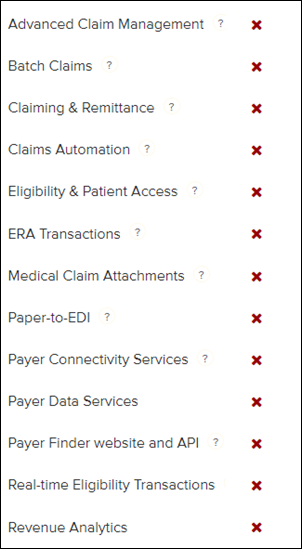

Thanks to these companies that recently supported HIStalk.

I asked what the #1 realistic first step should be for improving US healthcare outcomes, cost, and accessibility. Lots of folks missed the “realistic” part and went right for the healthcare Hail Mary, but I like that they were thinking big. Anyway, here’s what people said, with responses combined and the total count listed where appropriate:

- Single payer / universal coverage / Medicare for all / public option (33)

- Eliminate employer-sponsored health insurance (8)

- Full transparency / simplification of prices charged by doctors, hospitals, and clinics (4)

- Standardize claim format / implement uniform pricing / pay the same price for procedures and prescriptions (3)

- Set a higher tax on processed foods or improve food quality / offer incentives for maintaining a healthy weight (3)

- Increase payments to primary care providers / add family medicine providers (3)

- Create national HIE that is run by CMS / increase interoperability (2)

- Get rid of insurance as the backbone of healthcare / require paying cash (2)

- Set Medicare pricing for all patients, adjusted regionally

- Expand VA eligibility

- Take the government out of the healthcare business

- Reform the tort system

- Add medical schools to increase the supply of physicians to lower salaries, which is the biggest cost

- Increase spending on primary care for children

- Remove payers from physician decision-making and workload

- Develop a plan and incentives to move from a sickness model to a wellness model

- Add more clinical hospitals in outer suburbs or rural areas

- More emphasis, access, and education on preventative care / pay physicians based on preventative care services instead of increasing payer profits as providers struggle (2)

- Increase accessibility to digital health products without a prescription

- Reduce documentation requirements

- Eliminate smoking

- Eliminate conglomerates and mergers / don’t allow for-profit entities and private equity to buy health systems

- Require private equity and publicly traded firms to divest all hospital / clinic assets

- Pilot virtual-first health plans

- Clean up and consolidate data for analytics and decision-making

- Remove CMS from HHS control and turn it into a public benefits corporation

- Mandate use of a consumer usage transparency tool with binding real-time estimates, insurance coverage details, and quality metrics for procedures

- Keep providers independent

- Make the entire healthcare industrial complex non-profit

- Create a national license for telehealth providers

- Implement and enforce mandatory staffing ratios

- Pay physicians based on panel size and management instead of RVUs

- Eliminate lobbyists and campaign contributions

- Eliminate direct-to-consumer drug advertising

- Better detection and prevention of fraud

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

The Global X Telemedicine and Digital Health exchange-traded fund lost 2.4% of its value in the past 30 days, 22% in the past year, and 42% since it was launched in mid-2020. A $10,000 investment at launch would be worth $5,680 now versus the $15,360 you would have earned by just buying the S&P 500 index.

People

Christine Swisher, PhD (Project Ronin) joins Oracle as VP of health data intelligence.

Announcements and Implementations

UnitedHealth Group hasn’t updated its Change Healthcare cyberattack update page since March 27. The Optum solution dashboard shows 23 of 137 applications restored. UHG got screwed if it actually paid the $22 million in speculated ransom that showed up on the hacker’s Bitcoin blockchain over a month ago. Meanwhile, the company sides with the plaintiffs in asking the court to centralize the cases in the US court in Nashville, which is Change’s home city, for efficiency.

A Kaiser Permanente study finds that AI triage of patient-sent messages allowed one-third of them to be diverted to other employees, saving time for the physician who otherwise would have had to read and route them.

A NEJM-published study finds that semaglutide — and presumably the other GLP-1 drugs that are best known for weight loss and Type 2 diabetes control – is effective for treating certain types of heart failure. A study published last week tentatively showed that the drugs may slow the advance of Parkinson’s disease symptoms, while previous research suggested their value in reducing inflammation. Interesting work remains to be done to determine whether the unexpected benefits are due to the intrinsic properties of the drugs or the improved general health of patients after they lose weight. I predict that barring any discovery of catastrophic side effects, GLP-1 drugs will be the most significant of all time in terms of life extension, or at least right up there with vaccines, penicillin, and insulin.

Government and Politics

The owner of two telemedicine companies pleads guilty to his involvement in defrauding Medicare of $110 million. Telemarketing companies generated lists of Medicare beneficiaries, then paid the telemedicine companies to find providers who would generate prescriptions for durable medical equipment without contacting the patient (seems like those providers should be charged as well, but DoJ didn’t say). The telemarketing companies then sold the orders to DME suppliers so they could submit false claims. The LinkedIn of Steven Richardson, aged 40, includes years running a South Florida “healthcare marketing group” whose work looks like a Medicare fraud keyword list in “assisting patients with their diabetic testing supplies, pain, and compound management.” I Google-stalked his Florida house, which looks pretty nice for spending time wearing an ankle monitor.

CMS drops the requirement that providers submit appropriate use criteria (AUC) as a condition of being paid for performing advanced diagnostic imaging. The long-delayed AUC program was implemented as part of the Protecting Access to Medicare Act in 2014.

Other

A major New York Times article looks at data analytics firm MultiPlan, which tells payers how much less than the billed price they should pay providers for out-of-network cases. MultiPlan pockets up to 35% of the savings, sometimes earning more than the billing provider, with the patient potentially on the hook to pay the difference. MultiPlan’s president and CEO as of March 1 is former Cerner executive and Oracle Health GM Travis Dalton. MPLN shares are at $0.84, down 27% in the past 12 months, valuing the company at $550 million as it faces NYSE delisting. Dalton’s shares at signing were worth $13 million plus $2 million per year in salary and bonuses. MultiPlan went public via a SPAC merger in October 2020 at an implied valuation of $11 billion, with share price having dropped 91% since. Financials aside, I might have to side with the company on this one and instead blame self-insured employers and payers who create a network that has no available providers, sending desperate people to specialists who may well have sold their practices to private equity firms who love out-of-network billing.

Sponsor Updates

- Lotus Weight Loss & Wellness (KY) reports a 30% increase in new patient visits after implement EClinicalWorks EHR and Healow Open Access software.

- Experity will exhibit at the Urgent Care Association Conference April 13-17 in Las Vegas.

- Findhelp will present at the National WIC Association Annual Education and Training Conference April 7-10 in Chicago.

- FinThrive releases a new Healthcare Rethink Podcast, “Population Health is Becoming Precision Community Health.”

- Health Data Movers publishes a new “Cancer Data Abstraction.”

- Inovalon releases a new INovators Podcast, “AI in Healthcare: The Value of Innovative Technology, Paired with Clinical Expertise.”

- Mobile Heartbeat will exhibit at AONL 2024 April 8-10 in New Orleans.

Blog Posts

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

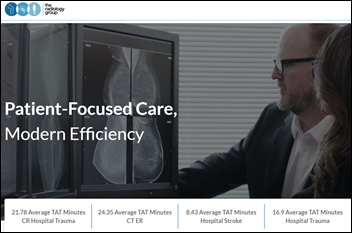

This is a great point—many discussions about patient wait times still focus on staffing or technology, while the real issue…