Top News

The Greater Madison Convention & Visitors Bureau estimates the economic impact this week’s Epic user group meeting is $6.5 million, second only to the World Dairy Expo. Despite being behind the cow show, Judy Faulkner was apparently pleased to tell her 15,000 customers and employees that Epic now serves 51 percent of US patients and 2.4 percent of the world’s. She also reports that 86 percent of Epic implementation projects over the past two years have come in under budget.

Reader Comments

From Wild Duke: “Re: Caradigm. Did a major executive purge. Chief Medical Officer Brandon Savage and SVP of Product Management Mark Johnson both gone. COO Nigel Mason is heading back to GE. CTO Neal Singh is now running the show.” A Caradigm spokesperson responded to our inquiries by saying, “I can confirm that earlier this week Caradigm made some organizational changes within our product teams to drive greater alignment and focus on our healthcare analytics and population health solutions.” We’ll call it unverified since companies can’t comment on the status of individual employees.

FromPit Viper: “Re: VA. Under Secretary Petzel is resigning.” Unverified, but Pit Viper has been a good VA source previously. Robert Petzel, MD is Under Secretary for Health in the Department of Veterans Affairs.

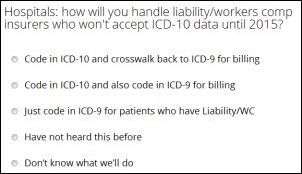

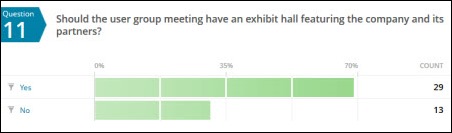

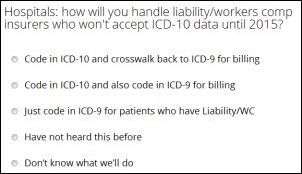

From Would Like to Know:“Re: ICD-10. CMS is not requiring it for coding Liability Insurance, No-Fault, and Workers Comp until April 1, 2015. For vendors that rely on UB-04 billing data, this exception is causing some angst. We’ve heard hospitals will code in ICD-10 and then either crosswalk back to ICD-9 or code to ICD-9 for these insurers. Would you be able to survey hospitals about this? I love HIStalk and have promoted it inside my company, plus we are now a sponsor.” Thanks. I created a poll that will take hospital folks maybe 10 seconds to complete. I’ll share the results here in a few days.

From Movie Sign: “Re: open.epic. Epic’s big announcement to the world of modern startups looks like it was designed by an amateur. It doesn’t help accusations that legacy vendors are out of touch.” Nobody seems to know anything about open.epic other than what’s on the site, which indicates that it’s a connection from EpicCare to personal health devices. Folks attending UGM probably got more details.

HIStalk Announcements and Requests

Thanks to Jennifer Dennard (@SmyrnaGirl) of Billian’s HealthDATA for hosting Thursday’s #HITchicks tweetup, which happened to be the first TweetChat I’ve ever attended. The discussion covered women in the healthcare C-suite, mentoring, HIT week, and, my favorite: should women have to “harden” or “soften” themselves when in positions of leadership. I agreed with the consensus view that women (and men) must remain genuine and true to themselves. Nice job moderating, Jennifer!

Thanks to Jennifer Dennard (@SmyrnaGirl) of Billian’s HealthDATA for hosting Thursday’s #HITchicks tweetup, which happened to be the first TweetChat I’ve ever attended. The discussion covered women in the healthcare C-suite, mentoring, HIT week, and, my favorite: should women have to “harden” or “soften” themselves when in positions of leadership. I agreed with the consensus view that women (and men) must remain genuine and true to themselves. Nice job moderating, Jennifer!

I updated my iPhone 5 to iOS 7.0 last night (it took about an hour) and, so far, so good. I did have to delete about 2GB of videos to make room for the update, so beware if you are low on storage. I am excited about the new camera features, which include Instagram-like tools for enhancing photos and a faster shutter speed (which will be perfect for taking stealth photos of shoes at MGMA.) The iTunes Radio is also fun and should give Pandora a run for its money, especially since it’s ad free. I listened to a few tunes using the Bluetooth in my car, but then realized that too many tunes may be a quick way to eat up all the data included in my cell phone plan. Finally, the overall navigation is enhanced in several areas, resulting in fewer swipes to get where you are going.

I updated my iPhone 5 to iOS 7.0 last night (it took about an hour) and, so far, so good. I did have to delete about 2GB of videos to make room for the update, so beware if you are low on storage. I am excited about the new camera features, which include Instagram-like tools for enhancing photos and a faster shutter speed (which will be perfect for taking stealth photos of shoes at MGMA.) The iTunes Radio is also fun and should give Pandora a run for its money, especially since it’s ad free. I listened to a few tunes using the Bluetooth in my car, but then realized that too many tunes may be a quick way to eat up all the data included in my cell phone plan. Finally, the overall navigation is enhanced in several areas, resulting in fewer swipes to get where you are going.

Welcome to new HIStalk Platinum Sponsor Prominence Advisors. The company, founded by former Epic managers who hire Epic superstars, provides the country’s foremost healthcare organizations with Epic expertise, with over 90 percent of the company’s employees being Verona alumni. Prominence is a QlikView healthcare implementation partner, levering its knowledge of Epic’s data model to help organizations aggregate data from multiple systems to spot trends, predictively improve patient care, optimize revenue cycles, and monitor operational performance. High-profile projects require extraordinary, high-performing talent and Prominence has earned the reputation of deep domain expertise and exemplary character as it provides services in analytics, strategy, and execution. Thanks to Prominence Advisors for supporting HIStalk.

Bored? (a) sign up for email updates so you’ll be the first to know; (b) repeat for HIStalk Connect, where your signup gets you really cool HIT innovation news from Travis, Lt. Dan, and Kyle; (c) connect with us on Facebook, Twitter, and LinkedIn, including the HIStalk Fan Club that Reader Dann created a long time ago that now has 3,242 members, making my mom very proud even though she’s not sure why; (d) peruse and occasionally click the ads of the folks who keep me in keyboards and check them out in the Resource Center and Consulting RFI Blaster; (e) send me rumors, pictures, or whatever interesting stuff you have using the secure Rumor Report form that goes straight to my inbox along with any attachments you’ve included; (f) check out the Webinar Calendar and vow to learn something; and (g) accept my appreciation for your support of HIStalk in whatever form that support takes (just reading it counts a lot.)

Upcoming conferences: Inga will be at MGMA in October, I’ll be at the mHealth Summit in December. That’s all we have on our dance cards for now.

HIStalk Webinars

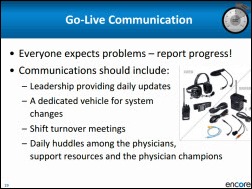

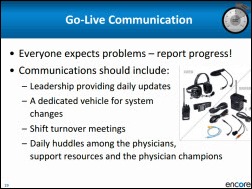

Encore Health Resources will present “Full Speed Ahead: Creating Go-Live Success” on Tuesday, September 24, 2013, 1:00 – 1:45 p.m. Eastern, featuring William Sangster, MD. Dr. Bill will impart wisdom, I’ll say a few words that will be far less wise, and a lucky attendee will win a $50 Amazon gift card door prize. Register now.

Speaking of webinars, we’re doing quite a few of them and I could use a few more CIO-type reviewers. Here’s how it works: I’ll send you a link to the recorded rehearsal, you’ll spend 30 minutes or watching it and jotting down suggestions for improvement, and you’ll earn the same gift certificate as the Encore door prize winner. Let me know if you’re interested. Thanks to the folks who have been reviewing all along – your feedback is making the Webinars better and more enjoyable for everyone.

Acquisitions, Funding, Business, and Stock

Health tech business accelerator Healthbox selects its first Nashville class of seven companies, each of which will receive a $50,000 seed investment and four months of mentorship. Chosen were:

DreamIt Ventures launches DreamIT Health Baltimore, a partnership with The Johns Hopkins University and BioHealth Innovative, to accelerate the growth of early-stage HIT companies.

HIMSS acquires Health Story Project, which focuses on standards related to non-EHR clinical documentation such as transcription and electronic documents.

Sales

Skilled nursing and rehab operator Greystone Healthcare Management selects HealthMEDX as its HIT solution.

The New York Office of Mental Health awards health system integrator CGI a $48.7 contract to implement an EMR platform, including NTT DATA’s Optimum. Document Storage Systems will provide additional implementation services for the vxVistA EHR.

Vanderbilt University Medical Center (TN) will deploy MedAptus Technical Charge Capture solution to code and bill hospital-based procedures.

UC San Diego Health System (CA) selects Merge iConnect Access to image-enable its Epic EHR.

Self Regional Healthcare (SC) selects McKesson Paragon .

The New York City Health and Hospitals Corp. awards IBM an one-year, $10 million contract to build an analytics platform to improve patient care and operational efficiency.

The Torrance Memorial Medical Center (CA) selects Daylight IQ for disease-based clinical protocols.

People

Bronson Healthcare (MI) hires Paul Peabody (Palomar Health) as VP/CIO.

Emmi Solutions names Steve Martin (Merge Healthcare) as SVP of sales.

Ron Strachan (Community Health Network) is named CIO of McLaren Health Care.

Health Care DataWorks Co-founder Jason Buskirk is named CEO, Ivo Nelson becomes board chair, and John Gomez is engaged as a development consultant.

Announcements and Implementations

Fairfield Memorial Hospital (SC) goes live on Cerner.

Duke University Health System reports that it has installed Epic ahead of time and under budget throughout the entire system, including 223 outpatient facilities and Duke University Hospital. Epic says it was one of the company’s biggest single-day go-lives with 16,000 Duke employees trained. Competing Research Triangle health systems WakeMed and UNC are also implementing Epic.

Pacific Alliance Medical Center (CA) deploys electronic patient signature and e-forms solutions from Access.

Government and Politics

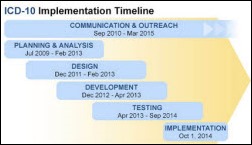

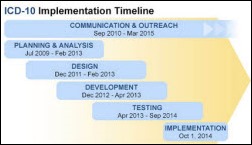

CMS publishes an online ICD-10 implementation guide to help practices, small hospitals, and payers navigate the ICD-10 transition.

ONC names GenieMD the winner of its Blue Button Co-Design Challenge for its app that helps users diagnose their symptoms, find providers, and learn more about medical conditions.

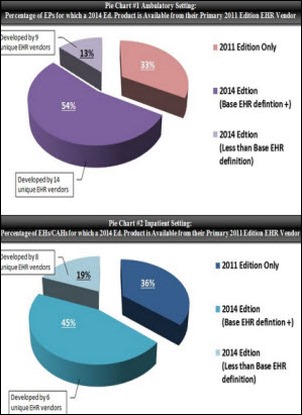

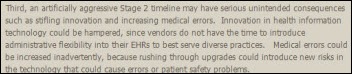

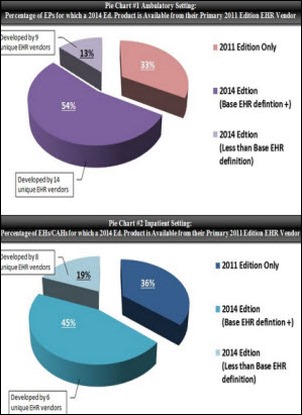

From an ONC post I missed last week: 54 percent of EPs have 2014 Edition EHR technology available to them from their primary 2011 EHR vendor; 45 percent of EHs/CAHs have 2014 Edition EHR technology available from their primary 2011 Edition vendor. An additional 13 percent of EPs and 19 percent of EHs/CAHs have a primary 2011 Edition EHR vendor that is on track toward providing a 2014 Edition solution. Translation: one out of three providers attested with EHRs that are potentially not on track with 2014 Edition technology. Another interesting nugget: 31 percent of the 861 ambulatory EHR vendors on the Certified HIT Product List and 49 percent of the 277 inpatient EHR vendors don’t have a single MU attestation. In other words, look for a sizable reduction in the number of vendors listed for 2014 Edition certification.

From an ONC post I missed last week: 54 percent of EPs have 2014 Edition EHR technology available to them from their primary 2011 EHR vendor; 45 percent of EHs/CAHs have 2014 Edition EHR technology available from their primary 2011 Edition vendor. An additional 13 percent of EPs and 19 percent of EHs/CAHs have a primary 2011 Edition EHR vendor that is on track toward providing a 2014 Edition solution. Translation: one out of three providers attested with EHRs that are potentially not on track with 2014 Edition technology. Another interesting nugget: 31 percent of the 861 ambulatory EHR vendors on the Certified HIT Product List and 49 percent of the 277 inpatient EHR vendors don’t have a single MU attestation. In other words, look for a sizable reduction in the number of vendors listed for 2014 Edition certification.

Here’s a new ONC video on interoperability.

Other

The CMS Office of the Actuary projects that healthcare spending will increase at an annual rate of 5.8 percent from 2012 to 2022, or one percent faster than the GDP.

A former advisor to Australia’s billion-dollar eHealth system calls it “shambolic,” with incorrectly loaded data and doctors who don’t have the software to read it. The medical association pegs the odds of finding useful information for a given patient at 0.5 percent.

John over at EMR and EHR Videos has a Google Plus Hangout video featuring the always-fascinating Dr. Nick, aka Nick van Terheyden, MBBS, CMIO of Nuance Healthcare. You can also get on the update list and check the schedule of future events that are streamed live.

The Milwaukee newspaper runs an article about the growth in lucrative Epic consulting jobs, featuring a cool photo of Mark and Drew from Nordic, which has 350 employees and is adding 20 per month after bringing in $38 million in investor money in the past year. Frank Myeroff of Direct Consulting Associates is quoted in the article as saying the number of Epic consulting firms may approach 2,000. Also mentioned are Vonlay and BlueTree Network.

In Canada, Jewish General Hospital goes on diversion and elective imaging tests are postponed when its data center overheats, taking all of its servers down Thursday morning.

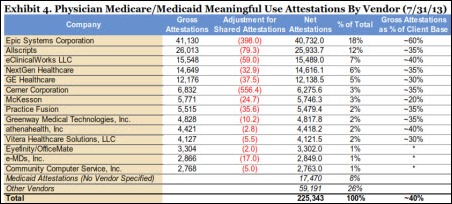

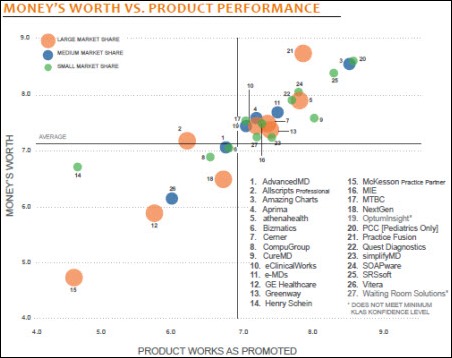

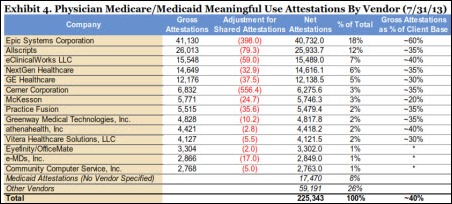

A report by Wells Fargo Securities says that CMS’s July attestation data suggests that the replacement EHR market will heat up in 2014 as practices drop productivity-sapping EHRs in favor of those products with a higher MU attestation rate. The report also says, “Replacement activity could

intensify further if CMS ever decided to audit providers who pocketed the Medicaid incentives instead of using them to fund actual EHR adoption. “

Weird News Andy, who as he says is “putting the ‘News’ in Weird News Andy for the past five minutes,” notes that Cleveland Clinic is shrinking. Employees were told this week that $330 million needs to be trimmed from the clinic’s 2014 budget and layoffs may be required.

At least it wasn’t healthcare: a BBC TV news anchor grabs a pack of copy paper instead of the intended iPad and bizarrely carries it around while reading the news. Anchors there hold the iPad to pretend they are technology-savvy journalists instead of talking heads reading off a screen, an illusion suffering mightily from this incident.

Sponsor Updates

- The Colorado Technology Association names Ping Identity winner of its Technology Company of the Year award.

- HCI Group posts an article titled “Credentialed Trainers – Secret Superstars of the Install.”

- Lifepoint Informatics serves as a gold sponsor for next month’s G2 Lab Institute Conference in Arlington, VA.

- Sunquest is attending ASCP in Chicago this week, exhibiting in Booth #219.

- Direct Recruiters is named a Weatherhead 100 winner as one of the 100 fastest growing companies in Northeast Ohio.

- Jeff Bell, director of IT security and risk services for CareTech Solutions, joins the HIMSS Privacy and Security Committee for a two-year term.

- CCHIT certifies that Medseek Empower enterprise patient portal is compliant with the ONC 2014 Edition criteria and awards it certification as an EHR Module.

- Merge Healthcare reports that radiologists use its certified EHR technology more than any other, according to HHS MU attestation data.

- Drummond Group certifies that two SuccessEHS products, SuccessEHS 7.0 and MediaDent 9.0, are compliant with ONC 2014 Edition criteria.

- CIC Advisory launches a Facebook page to provide an interactive forum on the operational and regulatory challenges facing HIT execs.

- API Healthcare President and CEO JP Fingado participated in this week’s Healthcare Workforce Information Exchange demonstration.

- Hospital Physician Partners (FL) reports on its experience using Ingenious Med’s business analytics platform.

- Xerox researchers address the challenge of big data and what to do with social media analytics.

- HCI Group details three areas a good credentialed trainer can impact during an EMR implementation.

- Beacon Partners outlines six steps to minimize ICD-10’s negative impact on revenue cycle.

- Nordic Consulting reports that its $38.3 million influx of capital from investment partners has allowed it to increase service offerings, bolster staff to over 300, and grow clients and partnerships to over 75.

- Quantros hosts an Advisory Panel this week to discuss the commercial viability of data in an intermediary role and the value of bundled safety products.

- Clients attending this week’s Verisk Health user conference prepared 2,000 food packs for Second Harvest Food Bank of Central Florida’s Hi-Five Kids Pack Program.

- Vitera Intergy EHR is tested and certified as a complete EHR under the Drummond Group’s EHR ONC-ACB program and is an ONC 2014 Edition-approved solution.

- Anita Archer, Hayes Management Consulting’s director of regulatory compliance, co-authors a HIMSS-published article entitled, “ICD-10 Documentation for State Medicaid Agencies (SMA) Health Conditions Categories.”

EPtalk by Dr. Jayne

Lt. Dan tweeted this morning about Google’s launch of Calico, a company that will focus on “the challenge of aging and associated diseases.” The venture will be led by Arthur Levinson, chairman and former CEO of Genentech. He’s also a director of drug giant Hoffman-La Roche and chairman of Apple.

My initial response to the announcement was that there are some significant conflicts of interest here. Others have had that thought as well, with Time posting a piece about it in the context of previous Google vs. Apple conflicts that received scrutiny from the Federal Trade Commission. My mind, however, was going more towards the conflict stemming from having a company like Google — which controls vast amounts of information about seemingly everything and everyone — cozying up with the pharmaceutical and genetic sphere.

For quite some time, I’ve had concerns about so-called personalized medicine. Farzad Mostashari tweeted about this earlier this week, sharing why personalized medicine might be bad for all of us. The focus of the opinion piece is that when people increase focus on themselves and their personal choices, they tend to decrease focus on population-based health, such as global vaccination efforts and other public health initiatives. It also mentions pharmacogenetics, where drugs can be targeted for patients who have certain mutations present. It mentions the example of vemurafenib as a drug for metastatic melanoma, which can help 25 percent of patients live seven months longer.

This kind of data leads me to my chief concern with personalized medicine – is it cost effective, and who is going to pay for it? Vemurafenib costs $56,400 for a six-month supply. (Surprise, when I did my Google search to find out the cost, I discovered it is made by Genentech.) If it only works 25 percent of the time for patients with a specific mutation, and their lives are only extended seven months, should we be routinely recommending it? As a primary care physician who has cared for numerous terminal patients, I understand the appeal. If it helps a father live long enough to see his daughter married, or a mother long enough to see her son graduate from college, these are the Hallmark moments we all want to think of. But in our situation where the healthcare system is collapsing under its own weight and excess, I could really make the argument that spending $56,000 to help fight diabetes, obesity, or heart disease for many patients is a better investment of our increasingly scarce healthcare dollars.

One could argue that personalized medicine is for those who can afford it, but then we will have the counter argument about healthcare being a right and about treating everyone equally. Eventually we have to come to the realization that we can’t afford to provide these expensive treatments for everyone no matter how hard our heartstrings are tugged. As a family physician, I’m all for health promotion and disease prevention. I am not, however, in favor of extending life just because we can, and I think this venture has the potential to drive efforts in the wrong direction.

I recently saw an elderly patient in her mid-90s who has been blessed with extremely good health. She has taken care of herself all her life, watched her weight, didn’t drink alcohol, and didn’t smoke. Her only “vice” was wearing high heels every day, which has caused some orthopedic problems. As for medications, all she takes are pain relievers that she takes as needed for aches and pains. She is a remarkable lady. She has been widowed for more than 30 years, outliving most of her close friends and some of her family members. She doesn’t want to live forever.

When people think of halting the aging process, I think they expect it to be something like the movie “Cocoon,” where you have a bunch of sassy septugenarians frolicking around. How are we going to fund retirement for these folks? Will they understand that if they’re going to live to be 100 they need to work until they are at least 75 or 80 because the average person cannot save enough money to fund a 35- to 40-year retirement during a 45-year working life? We already have people who can’t save enough money for retirement period, let alone an extended one. The focus on instant gratification and the “me” generation can only skew that further as people spend their current income rather than saving it.

Anyone who has worked on a medical/surgical unit at a hospital has seen the people who are not as fortunate as my ultra-healthy patient. What about the people whose lives have been prolonged through multiple invasive treatments but who are debilitated and have a very low quality of life? Wouldn’t it make more sense to talk about palliative care for the obese smoker who has had four heart attacks, multiple cardiac catheterizations and a bypass, and can’t walk to the bathroom without being exhausted than to bankrupt his family by pursuing more invasive treatments?

I’m sure the argument here is that they want to come up with technologies to help that patient have a better quality of life, but I’m not sure I buy it. Looking at the players involved (Genentech, Roche, Google, and probably multiple intermingled board members from other companies) this feels more like a profit-driven venture than a humanitarian one. Like commercial space travel, it will be only for the ultra-wealthy and will potentially divert resources and attention from important work that could benefit all patients.

What do you think about Calico? Email me.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

From The Fixer:

From The Fixer:

The story from Jimmy reminds me of this tweet: https://x.com/ChrisJBakke/status/1935687863980716338?lang=en