News 5/16/14

Top News

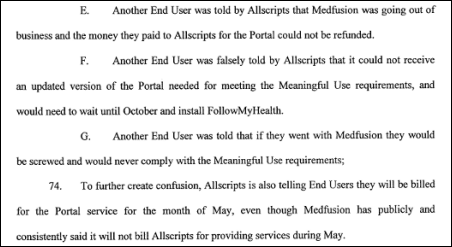

Medfusion files suit against Allscripts, claiming the company didn’t live up to its agreement to resell Medfusion’s patient portal to EHR customers of Allscripts. Medfusion says Allscripts owes it $5 million, with damages potentially tripling the lawsuit’s value. The lawsuit claims:

- The companies signed a five-year agreement valid through July 17, 2014.

- Allscripts delayed implementation and billing of the Medfusion portal for more than a year for some customers, creating an unpaid backlog for Medfusion and causing the companies to amend the agreement to require Allscripts to start billing new customers within 30 days. Medfusion says that backlog cost it more than $10 million.

- Because Meaningful Use requirements were expected to boost demand for patient portals, Allscripts agreed to include the Medfusion portal in every new Enterprise and Pro deal it signed and market the product as its only portal solution.

- Allscripts refused to integrate Medfusion’s online forms capability.

- The companies amended their agreement to give Allscripts 55 percent of net revenue and recurring charges while Medfusion would get 45 percent.

- Allscripts acquired Jardogs early in 2013 and announced it without warning at HIMSS13, where Medfusion was co-marketing its portal with Allscripts.

- Allscripts started marketing the Jardogs product as its preferred solution (FollowMyHealth) before its contract with Medfusion ran out and also started converting customers waiting to have Medfusion’s portal implemented to the FollowMyHealth product.

- Allscripts created marketing material that compared the FollowMyHealth product to Medfusion’s with the conclusion that its own product was better.

- Allscripts stopped developing its end of any portal enhancements and blamed Medfusion when clients reported issues.

- Medfusion accused Allscripts of breach on April 14, 2014, saying it had not paid $5.5 million worth of outstanding invoices. Allscripts, it says, sent payment of just under $1 million in response and disputed the remainder.

- Medfusion says customers told it that Allscripts made misleading statements in trying to get them to sign three-year contracts with Allscripts, including that: (a) Allscripts had terminated the agreement due to Medfusion problems; (b) Medfusion was going out of business; (c) Medfusion wasn’t providing portal updates and the customer would have to implement the Allscripts product to qualify for Meaningful Use; and (g) customers would be invoiced for May even though Medfusion wasn’t invoicing Allscripts that month because of their dispute.

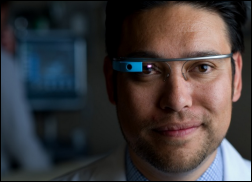

From Hobie Cat: “Re: Google Glass. Being handed out to all medical students at UC Irvine. The link made the rounds this morning with the subject, ‘Does this have HIPAA violation written all over it?’ Perhaps someone from UC Irvine can chime in with thoughts on how they’re approaching HIPAA. I’ll also be curious about how patients respond to this technology during rounds and the perception of a student talking to themselves and head nodding toward the ceiling to wake up Glass while in the room with the patient… ‘Just turning on the Glass, yo!’” The medical school says students in their first two years will use Glass during anatomy and clinical skills courses, while those in their third and fourth years will wear it during their hospital rotations, especially in the ED and OR. Google stores the information saved by off-the-shelf Glass, so in the absence of a business associate agreement with Google (which they probably won’t sign since it’s a consumer device) and because Glass doesn’t encrypt, I would say its use in patient care settings is a HIPAA problem. However, the UCI announcement says they are using proprietary software that is HIPAA compliant, probably the Pristine system they were piloting earlier this year, so they are trusting their vendor.

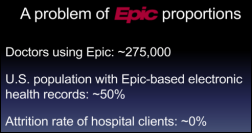

From TooMuchCoffee: “Re: UK’s Royal Devon. Going to Epic, although ‘affordability is a huge issue.’ At least they’ll get something that works – NHS spent billions on a failed decade-long project involving GE Healthcare and other vendors that produced nothing.” Royal Devon and Exeter NHS Trust chooses Epic as vendor of choice. It will now undertake a 12-week study to see if it can afford it.

From Fighting Accountants: “Re: Northwestern telestroke team. Congratulations for winning the Innovation Award at their annual nursing fair. They save lives and improve outcomes where it wouldn’t otherwise be possible. Not all health IT is as painful as an EMR.”

From Joey Junior: “Re: Mayo. Heard any rumors about the Cerner-Epic faceoff?” I haven’t. I will defer to readers.

From Concerned: “Re: voice mail messages. I need HIStalk reader insight. A large academic hospital organization would like to store their voice mail messages on Exchange Server. I don’t feel that this is ideal, but does it actually violate HIPAA?” I’m sure an expert will weigh in, but my interpretation is that voice mails left by patients (which I assume is the content you are referring to) are not covered by HIPAA since they didn’t start out in electronic form, the provider didn’t listen to them initially, and nobody suggested the patient leave PHI-containing voice mails. Providers leaving messages for each other might be problematic, though, but the server is still inside the firewall and the messages can’t be forwarded outside or accessed without security credentials. I haven’t convinced myself, so let’s hear some other viewpoints.

HIStalk Announcements and Requests

Several of the reader-submitted items you see here came from the all-purpose contact form, which accepts comments and attachments and whisks them straight to my inbox, where they may age gracefully until I get to them.

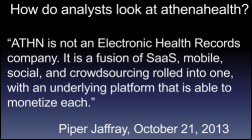

Highlights from HIStalk Practice this week include: Xerox fares poorly when it comes to state Medicaid management systems. GA-HITREC’s Dominic Mack, MD weighs in on the HIMSS 2014 Regional Extension Survey results. Physicians have differing opinions about the business model of CrowdMed, which is looking to turn a profit via crowdsourced medical advice. ONC approves ANSI for a second term as an approved creditor for its HIT certification program. Athenahealth finds itself in the same quagmire as Facebook and Tesla. "Anonymous" sends letters to 30 patients alerting them to the ease of stealing their medical information. A solo-practice physician becomes the first in New Jersey to attest for MU Stage 2, thanks to help from NJ-HITEC. Thanks for reading.

This week on HIStalk Connect: Dr. Travis discusses the state of patient engagement and questions whether the Patient Engagement Framework, developed by the National eHealth Collaborative and HIMSS, is an ideal tool for benchmarking progress. Researchers at Johns Hopkins develop a smartphone-based carbon monoxide breathalyzer that they hope will provide smoking cessation programs the tools to objectively measure smoking abstinence more easily. Cedars-Sinai Health System announces that it has formed a partnership with MemorialCare Health System to create a shared health technology VC fund called Summation Health Ventures

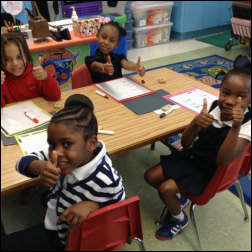

Ms. Barnes sent this photo from her Mississippi kindergarten classroom, for which we as HIStalk readers provided write-and-wipe boards and markers (you can see them in front of the students) in response to her DonorsChoose grant request. She reports that the class is using them for practicing their writing and they wouldn’t have them otherwise because of district budget cuts.

Acquisitions, Funding, Business, and Stock

Oscar, a technology-powered startup that sells medical insurance only to New York residents so far, raises another $80 million in funding, bringing its valuation to nearly $1 billion.

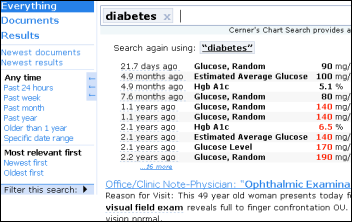

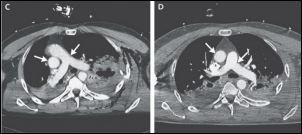

The VA chooses Agilex and Calgary Scientific for enterprise viewing of radiology images on a variety of devices.

People

Applied Health Analytics hires Craig Smith (The Advisory Board Company) as president of its Coalesce consulting division.

Lee Fowinkle (McKesson) joins InformedDNA as CTO.

Announcements and Implementations

Mercy Hospital (MO) breaks ground on its four-story, 120,000 square foot, $50 million virtual care center that will house its 300 telemedicine program employees for remote management of ICU, stroke, cardiology, sepsis, radiology, pathology, nurse on call, and home monitoring.

Health Care Cost Institute, a non-profit funded by UnitedHealth Group, will in Q1 2015 make available to the public medical claims data from private insurers, the first non-government healthcare pricing data to be released. Aetna, Humana, and Kaiser Permanente have signed on.

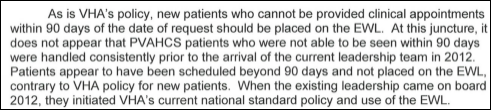

Government and Politics

HHS’s Medicare Fraud Strike Force charges 90 people, including 27 clinicians, for fraudulently billing Medicare for $260 million. The defendants were charged with a variety of activities that include paying pharmacy kickbacks, billing for undelivered products and services, charging the government for 1,000 unneeded power wheelchairs, and laundering money using Medicare beneficiary information. HHS also announced that it has indicted the Brooklyn surgeon who billed Medicare for $85 million worth of surgeries that he didn’t actually perform.

ONC chooses ANSI for a second three-year term as the accreditor of its certification bodies.

Innovation and Research

A study of primarily Iowa VA hospital ICUs finds that telemedicine didn’t reduce 30-day mortality rates or length of stay.

Other

A free, eight-week online course, “Exploration of SNOMED CT Basics,” runs through June 13 if you have time to double up on the video lectures to finish in time.

The Chicago-area nurses union National Nurses United launches a heavy-handed campaign against “experimental, unproven medical technology” (specifically, EHRs.) Much of it rings true, unfortunately, even the dot matrix printer.

Roshni Nadar Malhotra, the only child of a technology billionaire from India, will spend $168 million to build a network of Johns Hopkins-affiliated health clinics starting in New Delhi. She says IT will be a key component.

The Pittsburgh business paper reviews the federal tax forms of West Penn Allegheny Health System, noting that Allscripts was its second-highest paid contractor at $7.3 million.

Employees of a company that won a $1.2 billion HHS contract to process paper insurance applications from health insurance exchanges are staring at computer screens with nothing to do, a whistleblower claims. The whistleblower says the employees have been told to refresh their screens every 10 minutes to give the appearance that they are accomplishing something. Serco, the British contractor that won the big contract, is under investigation in England for overbilling the government. I wrote about the company in October 2013, including the patient harm it caused when it took over the largest pathology labs in England’s NHS in 2009.

An editorial by Newt Gingrich on the VA’s problems says the VA and DoD need to integrate their IT systems (which is much more of a DoD problem than a VA problem):

Every effort to integrate Department of Defense and VA medical record systems has failed. The result has been an absurd process of transitioning from active duty health services to VA health services. At a time when you can instantly make airline and hotel reservations or get money from an ATM worldwide in seconds, it takes 175 days to transition a veteran’s care from the Defense Department to the Department of Veterans Affairs. The DoD and VA spent $1.3 billion to build a joint electronic medical record system for their health care services before the two secretaries announced in February that they were abandoning the effort. This is on top of the over $2 billion the Defense Department has spent on a failed upgrade to its own electronic medical system.

The mHealth Summit opens its call for presentations for the 2014 meeting, due June 27. The meeting will be December 7-11 in National Harbor, MD.

Interesting: a suspicious fire in the medical records department of a psychiatric hospital in Trinidad and Tobago erupts one month after the health authority requested copies of the hospital’s medical equipment purchasing records. The hospital, which is looking at EHRs, says it will have to create records by asking patients about their history. It hopes to make a second set of paper records for patients to take home.

Weird News Andy says when it comes to cancer vs. measles, it’s no contest for this patient. Mayo Clinic doctors try a desperate cancer treatment in injecting enough genetically modified measles virus into a female patient to inoculate 10 million people. The doctors say the use of viruses to fight cancer, known as oncolytic virotherapy, has been tried since the 1950s and in this patient’s case, seems to have worked.

Sponsor Updates

- Extension Healthcare sponsors the National Coalition for Alarm Management Safety.

- Capario shares five facts about eligibility verification.

- Capsule’s Halley Cooksey relates the NFL draft to selecting a committee to evaluate technology.

- PatientKeeper posts its summer conference event schedule.

- Orchestrate Healthcare posts an article called “What is Healthcare IT Integration?”

- HDS will attend MUSE on May 27-30 in Dallas.

- Park Place International offers seven tips for project managers to get and stay organized.

- Jennifer Crowley from MedAptus discusses the importance of time in the daily life of a provider.

- The Outsourcing Center names Springhill Medical Center (AL) and Allscripts winners of its 2014 Outsourcing Excellence Award in the Best Healthcare category.

- TriZetto will offer grouping, edit, compliance and pay-for-outcomes logic from 3M in its NetworX Pricer and NetworX Modeler solutions.

- Iatric Systems launches Business Associate Manager as a tool for compliance with the HIPAA Omnibus Final Rule.

- Sentry Data Systems completes a Service Organization Control 3 examination.

- Summit Healthcare joins the federal initiative for standards-based healthcare communication DirectTrust.

- Black Book names ADP AdvancedMD, Allscripts, Aprima, Care360 Quest, eClinicalWorks, eMDs, Greenway, Kareo, McKesson, and Optum to its list of top EHR, PM, and billing vendors.

EPtalk by Dr. Jayne

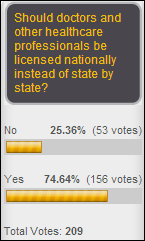

I was excited to hear about HR 4077 , which would exempt physicians and other healthcare professionals from antitrust laws when they take part in contract negotiations with health plans. Although it doesn’t apply to Medicare, Medicaid, or other governmental payers, it seems like it could help independent physicians as they fight the big payers. Having been part of such a physician network in the past (although it was determined that we violated antitrust laws and our contracts were voided) it could be a help for many providers.

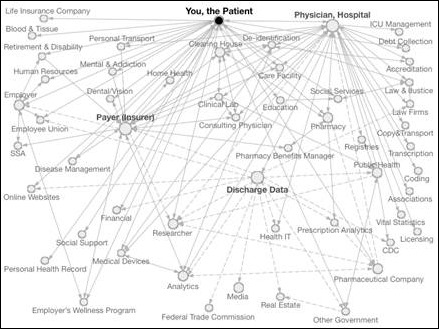

My informaticist friend @techydoc tweeted a link to this healthcare data map last week. It’s amazing all the places our data goes, sometimes whether we want it to or not. Apparently one place data doesn’t go, however, is to my mom’s doctor appointment. Her physician recently moved from one practice location to another within the same physician group. Despite the fact that they’re on a common EHR platform and also have an HIE in place, she was told they had to key in all her information again. It’s a shame they didn’t catch her last name and give a better answer, because I implemented the EHR and HIE in question. Sounds like someone needs an in-service.

HIStalk Practice picked this up first, but I wanted to throw in my two cents on this study that concluded that costs rise when hospitals own physician practices. The data used for the analysis was for the period 2001-2007. It doesn’t take into account the shared savings plans that have come into play during the last six or seven years. There are also just too many confounding factors present. To get an accurate analysis, I think you’d have to have to control many more of the variables. Maybe in a couple of years we can get some robust data from Accountable Care Organizations that have both employed and independent provider participants.

From The Major: “Re: site visits. As usual, thanks for sharing. I have been through a site visit (as a consultant, and my client was the jerk) like that. We had an hour ride back from the site to his hospital, where I naively told him he wouldn’t learn anything if he didn’t listen and ask good questions.” Several readers wrote to commiserate about my recent site visit experience. I’m happy to report that I received a note of apology and a cookie basket for my staff. Either the CMIO understands his behavior wasn’t appreciated or one of his accompanying colleagues is trying to smooth things over for him.

From Oceans Eleven: “Re: site visits. A long time ago we were an early adopter of a particular vendor. Based on our success, we eventually did about 100 site visits over the first few years. What became apparent after the first few minutes with a couple of them was that they had no intention of signing with any vendor. Much to the chagrin of the sales guys, we immediately scaled back our planned agenda and sent them on their way to the beach, which was probably the covert reason for the visit.” I’ve looked at dozens of products over the years and that approach hadn’t occurred to me. I’m thinking the next site visit we do might have to consider geography as well as how similar the facility is to ours. Besides, it’s been a long winter and I’m feeling a little pale. I’m sure an increase in my Vitamin D would be beneficial.

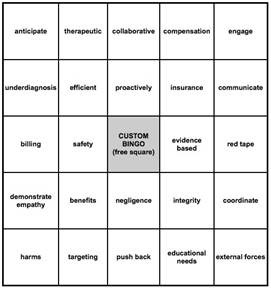

Anyone who has ever engaged in a friendly game of Office Bingo should appreciate this card, courtesy of a reader at Authentic Medicine. I used it during a recent pep talk from our chief medical officer. She was trying to explain why it was a good idea that all the experienced emergency physicians are being let go so we can replace them with cheaper independent contractors who don’t know our hospital or our patient population. Did I mention the emergency department is barely a third of the way through with a massive construction project that has required everyone involved to bend over backwards to preserve quality patient care? The hospital is transitioning in a little over a month – it will be interesting if nothing else since we’ll have new residents and new attending at the same time. I reached BINGO after barely a handful of sentences.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis, Lorre.

More news: HIStalk Practice, HIStalk Connect.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…