Top News

Cerner reports Q2 results: revenue up 20 percent, adjusted EPS $0.40 vs. $0.34, meeting estimates of both. Orders for the quarter totaled $1.08 billion, the best Q2 in the company’s history.

Reader Comments

From Medium-Sized Data: “Re: data extraction. I challenge all of the companies promising world-changing analytics to extract all of your HIStalk posts to produce a list of hot topics by month and year, a cool infographic, or a detailed report.” That would be pretty cool. There’s a wealth of information in those old posts: tracking vendors that promised something that was never delivered, big announcements that were just hot air, and public perception items trended by vendor based on positive or negative HIStalk mentions. Companies are welcome to take a swing at it, and if they come up with something useful, I’ll toot their horn.

From Watertown Boy: “Re: athenahealth. In a recent email to clients, they announced what appears to be their problem in over counting some of the MU items. What happens to practices that already submitted this year?” A July 21 email to customers says athenahealth “identified a need to improve our calculation logic” and will complete that work by July 25, adding its apology to customers whose performance numbers will suffer as a result. Athenahealth provided this response:

There is no impact on eligible providers who have already successfully attested for Meaningful Use (MU) this year. Athenahealth takes great pride in the integrity of our data and we proactively monitor guidance and interpretations issued by the Centers for Medicare and Medicaid Services (CMS) to ensure our system remains accurate and up to date. Accordingly, when changes that affect our measure calculation logic are identified, athenahealth works to make the appropriate system changes and notifies clients of all recalculations, as we did this week. In the event of system changes that impact MU measure calculations, athenahealth supports providers who have yet to attest by recalculating all associated data to determine the best time for those providers to attest with the most up to date data.

From WellTraveledGal: “Re: Beacon Partners. Announced mass layoffs of sales and consultants. Paul Sinclair, formerly of Cerner and UnitedHealth / Ingenix, joins as sales VP.” President and CEO Ralph Fargnoli provided this response:

We have not had mass layoffs of sales and consultants. Beacon Partners continues to grow because of the excellent work our experienced team of healthcare professionals is providing to health systems throughout North America. Recently, we have realigned some of our business development and consulting personnel to better support the operational, clinical, and financial performance engagements of our clients, and to meet our goals for continued growth. As we execute our business objectives for the second half of the year, we are actively recruiting for both business development and professional services positions.

From Boy Wonder: “Re: MU timeline for 2014. I wonder when your readers think CMS will announce a decision on the proposal to change the MU timeline for 2014? It better be quickly since many providers will be targeting Q4 as their one and only shot at MU2.”

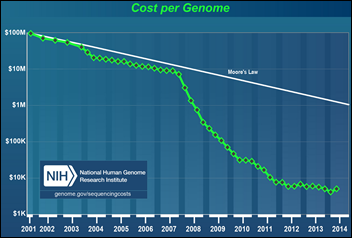

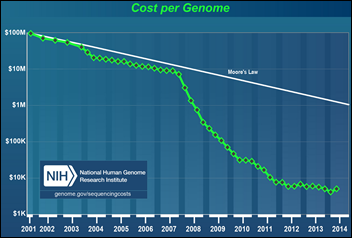

From The PACS Designer: “Re: genome discovery. Genome sequencing will cost as little as $1,000, according to the CEO of Illumina. The company has an improved MyGenome app.” It’s a pretty amazing advance, but the really amazing one would be to figure out how we’re going to pay for treating the new problems such testing reveals. We love snazzy new diagnostic techniques and decisive interventions, but aren’t so great at making them affordable. The most amazing development would be to figure out a way to get people to lose weight, exercise, and turn off their phones and interact with others in a genuine rather than electronic way to move the population health needle. Genomic discoveries are cool, but our health problems have little to do with a lack of technology.

HIStalk Announcements and Requests

This week on HIStalk Practice: MGMA begins the search for a new CEO. Kansas Health Information Network and ICA announce a record number of HIE connections. Harbin Clinic and Cigna team up for collaborative care. ONC alludes to a specific interoperability timeline by 2015. PCC Director of Pediatric Solutions Chip Hart discusses the sometimes challenging world of pediatric HIT. The HIStalk Practice Reader Survey is live. Thanks for reading.

This week on HIStalk Connect: Dr. Travis discusses the new interest in health data aggregation from Google, Samsung, and Apple. Researchers with Cedars-Sinai have successfully tested a biological pacemaker concept in pigs. TechCrunch reports that women’s health apps are leading in the mHealth segment in both funding and consumer engagement.

My latest pet peeve: going to a company’s site and getting hit with one of those intrusive pop-up “your opinion is important” windows asking me if I want to take a survey. No, actually what I’d like to do is instantly leave any site that is clueless about annoying its web visitors with pop-ups. It’s nice to know your customer better, but nicer still to not drive them away with heavy-handed tactics whose only benefit is to make some marketing VP feel like they are contributing to business success. At least the HIMSS version doesn’t require answering before proceeding, so even though it’s annoying, I can live with it.

Listening: Phantom Planet, Southern California indie pop that’s been around for 20 years minus a hiatus or two.

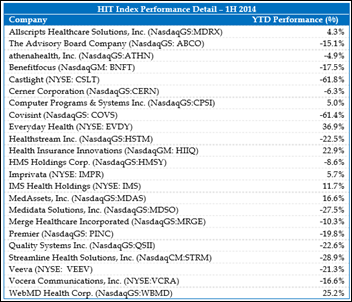

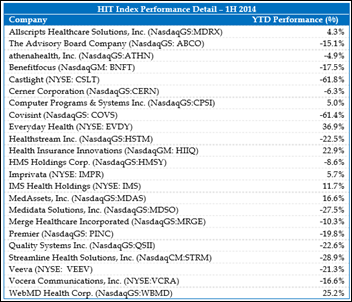

Acquisitions, Funding, Business, and Stock

Quality Systems, Inc. (the NextGen people) reports Q1 results: revenue up 8 percent, adjusted EPS $0.13 vs. $0.24, beating revenue estimates but falling short on earnings. The hospital unit continues to turn in poor performance with a loss of $3.5 million. Overall, bookings were down, earnings were down, and expenses were up.

Streamline Health reports Q1 results: revenue up 7 percent, EPS –$0.16 vs. –$0.24.

The parent company of Lumeris announces $71 million in new financing from new and existing investors, which it will use to boost its population health management capabilities and expand from eight to 20 markets for its value-based care solutions. The parent company’s other companies are Accountable Delivery System Institute (accountable care education), Essence Healthcare (Medicare Advantage plan), and NaviNet (communication network).

Sales

Aspirus (WI) chooses Strata Decision’s StrataJazz to help manage costs in its six hospitals.

New Haven Community Medical Group (CT) chooses athenahealth’s PM, EHR, and patient portal.

In England, North Bristol NHS Trust signs for CSC’s Lorenzo EHR, replacing Cerner Millennium. Lorenzo was the only choice offered with the now-defunct NPfIT, but previous owner iSoft and then CSC repeatedly botched implementations and missed deadlines, which was arguably the main reason that NPfIT went up in a $20 billion taxpayer-funded mushroom cloud in 2013. North Bristol admitted that its $37 million Millennium system was nothing but trouble right after its December 2011 go-live, much of that due to its own failings in not testing and training well, shortcutting data migration, and letting IT run the project. The go-live resulted in cancelled surgeries, incorrectly assigned appointments, and patients who were sent home because doctors couldn’t access their records. The trust also admitted it had underestimated Millennium’s cost, drawing the ire of government officials demanding to know why the average trust implementing Cerner was spending three times as much as those going live on System C’s Medway, which was later acquired by McKesson and then recently sold off to Symphony Technology Group as McKesson dumped its European IT business.

Announcements and Implementations

NEA Baptist Clinic and Hospital (AR)

will go live on Epic inpatient and outpatient in the next couple of months as the 100-bed hospital plans for its first EMR. They’re part of Baptist Memorial Health Care of Memphis, TN.

Healthcare Growth Partners issues its always-insightful and downright eloquent healthcare IT mid-year review. This snippet is as brilliant as anything that’s been said about our healthcare challenges:

Inefficient markets typically result in a mispricing of goods and services. The cause is often due to monopolies, poor regulation, and a lack of market transparency. Each is a contributor to inefficiency in the US healthcare economy, but the primary shortcoming is the lack of market transparency, or information, needed to define the cost and quality of goods and services, otherwise known as value. In many markets, information is a tool for power and a proprietary competitive advantage. However, healthcare is not like most markets. Healthcare information is unique because it serves both a humane and a commercial purpose. At stake is the health of family, friends, neighbors, and ourselves, as well as the economy and corporate profits. Healthcare information exploited for the benefit of a few compromises the efficiency of the healthcare system as a whole. Nothing makes this clearer than the abysmal statistics of healthcare in the US. The power and profit potential for disruptive innovation in this nearly $3 trillion market is unfathomable. The advent of transparency will translate into a myriad of opportunities to drive down costs, improve outcomes, generate higher profits, and result in a stronger economy.

The report says that companies that sell out for high multiples have these characteristics:

- SaaS delivery that generates recurring revenue

- Pricing alignment so that the company makes money when the customer realizes value

- Scalable distribution that lowers the cost of acquiring a new customer

- Providing value that will carry into the post-ACA environment instead of just exploiting current system flaws

- Rights to the data created by their customers

- Market leadership, strong management, and growth

Government and Politics

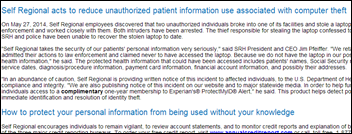

Women & Infants Hospital of Rhode Island will pay $150,000 to settle data breach charges resulting from a 2012 incident in which 19 unencrypted backup tapes containing the information of 12,000 prenatal diagnostic center patients disappeared. That’s not a federal HIPAA fine – $110,000 of the payment is a state civil penalty, $25,000 is for attorney fees, and $15,000 will fund an attorney general data security education campaign.

The GAO will release a report next week that outlines Healthcare.gov’s go-live problems, the cost to fix them, and the work remaining.

FTC Commissioner Julie Brill, concerned about a May report that showed 12 mobile health and fitness apps were sharing user information with 76 companies, says that third-party data use is where “the rubber hits the road when it comes to patient harm.” Despite urging that consumers be given more control on the use of their information, Brill says that no new regulations are planned.

A California appellate court dismisses a class action lawsuit that sought $1,000 for each Sutter Health patient whose information was stored on a stolen computer, a suit that had exposed Sutter to a potential $4 billion payout. The court found that the state’s Confidentiality of Medical Information Act requires proof of unauthorized access to patient information, not just possession of the physical form of the data (a hard drive, in this case) by an unauthorized individual. One of the attorneys for the patients originally said that an unencrypted computer storing the information of 4 million patients should have been stored in a windowless room under lock and key instead the office that was broken into.

The Wall Street Journal profiles William LaCorte, MD, a Louisiana internist who has pocketed $38 million as his share of 12 Medicare fraud lawsuits he filed, mostly against drug companies. He even named his newly purchased 34-foot boat Pepcid. The article also mentions a former pharmacy that found whistleblower lawsuits to be a more lucrative business, having netted it $425 million so far.

Former Procter & Gamble CEO Robert McDonald, in his confirmation hearings for Secretary of Veterans Affairs, says the agency needs to “continue to expand the use of digital technology to free human resources” and “create, with the Department of Defense, an integrated records system.”

Innovation and Research

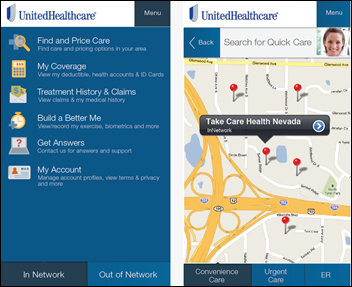

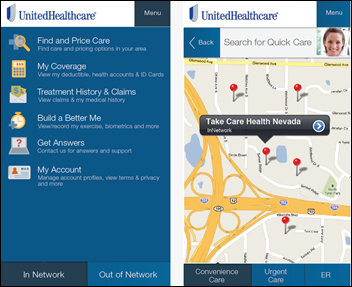

UnitedHealthcare makes its Health4Me app available to all consumers, not just its customers. It providers doctor search and medical price review.

Technology

Allscripts receives an Intel Innovation Award for its Windows-powered Wand mobile EHR navigation system.

Google’s Google X research group will analyze genetic and molecular information from 175 volunteers to define a healthy human, hoping that the Baseline Study’s new diagnostic tools will allow Google’s computers to find patterns that allow earlier detection of disease. That project may or may not be related to the company’s recently announced glucose-measuring contact lens.

Other

The administrator of Bradley Healthcare and Rehabilitation Center (TN) says employees really like its new PointClickCare EHR, but adds that the system caused Medicare payment delays in its first two months. The system was configured to use the facility’s five-digit ZIP code instead of the required nine-digit code and nobody knew how to open warnings from its intermediary about incorrectly formatted claims. The facility admits that it should have trained users better before going live.

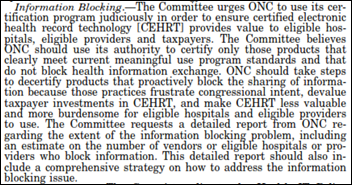

An NPR report says HIPAA was created to protect patients, but healthcare organizations are intentionally or unintentionally using it to protect their own interests, such as hospitals that refuse to give patients their own medical records claiming it’s a HIPAA violation, when in fact the law intended the opposite. It also mentions that VA management used HIPAA threats to squelch potential whistleblowers.

A patient who starting shooting in the psychiatric unit of Mercy Fitzgerald Hospital (PA) is shot by the psychiatrist he wounded, who returned fired using his personal firearm despite the hospital’s policy barring on-campus weapons except by on-duty police.

Sponsor Updates

- Elsevier Clinical Solutions will use the clinical evidence platform of Doctor Evidence LLC in its Evidence-Based Medicine Center.

- Perceptive Software’s Acuo Vendor VNA earns DIACAP certification as part of its 2012 DoD contract to manage clinical content for US Army and Navy hospitals around the world.

- Etransmedia Technology shares the process of taking a state-of-the-art urology practice with on-site PT through their EHR implementation and decreasing the cost of clinical documentation by 75 percent.

- Allscripts EHR solutions connect to the State of Arkansas HIE.

- Ingenious Med CEO Hart Williford shares four core beliefs that have enabled him to transition companies from startup to explosive growth and maintain company morale.

- Truven Health Analytics links clinical data to claims, enhancing oncology-focused outcomes research studies.

- Shareable Ink’s CTO Stephen Hau discusses its expansion to an iPad version and the risks and successes involved.

- e-MDs ranks fifth overall in the Medscape EHR Report 2014.

- ACO Buena Vida y Salud (TX) partners with Sandlot Solutions to connect with the Rio Grande Valley HIE (TX) using Sandlot Connect.

- The Association of Community Mental Health Center of Kansas will implement Netsmart’s CareManager while the Kansas Health Information Network will implement Netsmart’s CareConnect solution.

EPtalk by Dr. Jayne

Jenn tweeted about this recent Washington Post piece on Maintenance of Certification (MOC). Since I now have to maintain certification in both clinical informatics and my primary specialty, it hit close to home. Although board certification is technically “voluntary,” in my market it’s a necessity – no payers will credential you if you’re not certified.

I agree with the author that merely having certification doesn’t add a lot to my actual practice of medicine. I don’t treat chronic disease or deliver babies any more, other than in an absolute emergency. I do, however, perform a mean laceration repair and reduce dislocations like a boss. None of that is on my board exam, however.

You may be asking what this has to do with healthcare IT. It’s this: nearly everything for MOC is online and some of it is a true pain. Plus, there’s not a lot of content for some of us who are largely administrative or don’t have true continuity practices.

Case in point: my Board offers a handwashing module for MOC. If you’re in traditional practice, you’re supposed to survey your patients then key in the results and analyze them. If you’re not in continuity practice, they give you mock data that you still have to key in and analyze. How hard would it have been for them to preload the data? I’m sure the argument is I need to have the experience keying in data since the others do, but that’s ridiculous.

We’re claiming that primary care physicians should be quarterbacking healthcare delivery teams and working at the top of their licensure, yet we have them manually keying in data for recertification. Physicians at my institution are burning out at an alarming rate. This is just one more thing we ask them to do. Manually keying data isn’t a good use of our time.

On the flip side, some organizations have tried to partner with EHR vendors to extract data for quality studies. My vendor used to do this for two specialties but ended up stopping it, supposedly because the burden of keeping up the code was too great and the functionality wasn’t adopted widely by customers.

I have to admit I’ve been somewhat of a slacker with regards to MOC for my newly-minted clinical informatics subspecialty. I’m in the middle of an online cultural competency module for my primary specialty that I keep having technical difficulties, with so the idea of digging into other content doesn’t excite me.

I do obtain regular Continuing Medical Education credits, typically double what is required by my Board, which is four times what is required by my state licensing board. That’s the most valuable to me as far as keeping up because I can choose CME that’s relevant to what I actually see in practice. Cramming for a test once every 10 years (even when I can listen to all the lectures on my handy-dandy iPod) doesn’t say much about my skills listening to patients or being a clinician who can actually speak with patients in a way that they understand and makes them confident in the treatment plan.

Readers may ask, if we don’t have ongoing board certification, how will patients tell if we’re quality physicians?

It’s my great hope that eventually when we are truly meaningful users of EHR technology (not the government-speak kind of MU, but the real kind) we’ll be able to show what kind of physicians we are. How many of Dr. Jayne’s patients had failure of their laceration repairs? How many had unexpected scarring? Was her documentation readable and did she provide a patient plan in a way that the average person with a fifth-grade reading level could understand? Did she communicate back with the patient’s primary physician and arrange a follow up?

A friend of mine does minimally invasive knee replacements. He puts all of his data on his website for the world to see. He’s published multiple studies on his outcomes. All he does is knees. To me, seeing his data (including infection and complication rates) is a much better marker of his skill and competency than knowing he passed a board exam that covered the rest of the realm of orthopedic practice.

Before EHRs, trying to mine paper charts for that kind of data was nearly impossible. Most of my colleagues who were doing outcomes research used separate databases and registries and there was a lot of manual entry. Now we have the ability to study our populations at a moment’s notice. As a CMIO, I provide my physicians a sheaf of reports each month that let them know how they’re doing with respect to national standards and also to their peers. That kind of data will drive behavior change far more than reading a board review book might.

I’m hopeful for the future, but meanwhile I’m stuck with the expense and tedium of MOC.

What does your CMIO think of MOC? Email me.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…