News 6/24/15

Top News

Google’s research division creates a prescription-only vital signs tracking wristband that will provide research-quality data for clinical trials. Testing of the device — which monitors heart rhythm, skin temperature, and environmental factors — will begin this summer and the company hopes to earn FDA approval.

From The PACS Designer: “Re: USB computer. The Intel Compute Stick can be used anywhere with a wireless keyboard and could be used in wireless more via the HDTV USB port.” The $150 USB gadget turns an HDMI-ready TV or monitor into a computer, with the Atom-powered Windows 8.1 version including 2 GB of memory and 32 GB of storage. Intel suggests such use as digital signage, home entertainment, or as a thin client. User reviews on Amazon are mixed, mostly complaining about slow performance, iffy Wi-Fi, the single USB port, and the limited storage capacity. You could get a Chromebook, Android tablet, or almost a low-end laptop (certainly a refurb) for about the same money and then you’d have the keyboard, monitor, and USB ports.

From Graham: “Re: your comment about the healthcare status quo stifling innovation with political influence and financial clout. Regulatory capture will deepen for the next five years. It’s going to be a very rough ride, particularly in the USA where money is so influential in government. But eventually the stink will become too great for the treasure to ignore and change will happen.” My theory is that no matter what change begrudgingly occurs, the same companies and people will end up with all the money, just like that economic theory that you redistribute the wealth of the world’s 100 richest people and they would have it back within 10 years. That’s OK as long as overall healthcare cost and quality is improved – we’re wasting untold fortunes on US healthcare, so at least we should perform better or spend less.

From James: “Re: Cache database. InterSystems claims it’s the fastest object database. I’d like to substantiate that claim by trying out their benchmark, but have made an inquiry with no response. Do your readers have insights?”

HIStalk Announcements and Requests

I always forgot to observe HIStalk’s birthday, which I believe was June 6. I started writing it in 2003, so that makes it 12 years old.

The folks at FormFast made a generous $1,000 donation to my DonorsChoose project, which was even more effective because of the matching funds provided by an anonymous health IT vendor executive (your company’s donation is welcome as well). I put the total $2,000 donation on the educational street quickly, as follows:

- iPad Minis, math manipulatives, and write and wipe boards for a K-2 class in Lake Charles, LA.

- Two Kindle Fires for small group math exercises in a Grades 5-6 class in New York, NY

- A STEM bundle for a Grade 4-5 class in Glasford, IL.

- A STEM bundle for a Grade 2-3 class in Knoxville, TN.

- Electronics kits for STEM lessons for Grade 6-8 intellectually disabled and autistic students in New York, NY.

- Wireless math manipulatives for a Grades 6-8 class in Shreveport, LA.

- A STEM bundle for a Grade 5 class in Little Falls, MN.

- Math games for an 8th grade class in Niagara Falls, NY.

Webinars

June 30 (Tuesday) 11:00 ET. “Value Based Reimbursement – Leveraging Data to Build a Successful Risk-based Strategy.” Sponsored by McKesson. Presenters: Michael Udwin, MD, executive director of physician engagement, McKesson; Jeb Dunkelberger, executive director of corporate partnerships, McKesson. Healthcare organizations are using empowered physician leadership and credible performance analysis to identify populations, stratify risk, drive physician engagement, and expose opportunities for optimized care. Attendees will learn best practices in laying a foundation for developing a successful risk-based strategy.

I’m running a summer special on both produced and promoted webinars since the industry is like a snoozing man in hammock for the next few weeks and I get antsy when it’s quiet. Sign up by July 31 and get a sizeable discount. Contact Lorre. We get good turnout — especially when companies take our advice about content, title, and presentation – and the ones we produce keep getting hundreds of views well after the fact from our YouTube channel. The record is held by the one Vince and Frank did on the Cerner takeover of Siemens, which has been viewed over 5,000 times.

Acquisitions, Funding, Business, and Stock

Fantastically named Myelin Communications acquires Dodge Communications, which does quite a bit of public relations work for health IT vendors. That also pairs Dodge with an odd sibling – Duet Health, which sells patient engagement technology.

![]()

Accretive Health, which has been on a financial rollercoaster and executive merry-go-round since its strong-arm patient collection techniques got the attention of Minnesota’s attorney general in 2011, lost $80 million in 2014 as net services revenue dropped nearly 60 percent.

Aurora Health Care (W) takes a lead investor role in StartUp Health, giving it early access to digital health investment opportunities and technologies.

Heal, which desperately wants to be Uber in offering $99 doctor house calls in Los Angeles in San Francisco, raises $5 million in funding for expansion. The company uses technology such as AliveCor ECG, CellScope otoscope, and electronic medical records.

Sales

St. Barnabas Hospital (NY) chooses Strata Decision’s StrataJazz for decision support.

Dublin-based Beacon Hospital signs for Slainte Healthcare’s EHR, hoping to become Ireland’s first digital, paperless hospital. Hint: as in US “paperless” hospitals, the folks making the proclamation aren’t watching the pallets of paper coming in via the loading dock, the elimination of which would send the hospital into immediate chaos.

People

McKesson names Kathy McElligott (Emerson) as CIO/CTO.

Ed Kopetsky, CIO of Stanford Children’s Health, is presented with a lifetime achievement award from a Bay Area business publication group.

Staff scheduling system vendor OpenTempo names Andy Comeau (Cerner) as CEO, with former President, CEO, and Co-Founder Rich Miller moving to chief strategy officer. Andy’s LinkedIn profile has an artistic but news-worthless long shot of him standing unrecognizably in front of a mountain (which I’m using above anyway to make a point), so perhaps it’s a good time to recite the LinkedIn photo rules: (a) use a professional head shot only, not one cropped out of a frat party group photo or police lineup; (b) post the photo in large size and high resolution so that news sites can use it without excessive graininess – LinkedIn will automatically thumbnail it so that clicking brings up the high-res version; (c) don’t get artsy-craftsy with a picture taken at a weird angle, with head or chin cropped out, or with a mountain in the background. LinkedIn is for business and profiles should include an appropriate photo, although mine doesn’t because the LinkedIn police made me take by Carl Spackler photo down (kudos to them for recognizing it, though).

EXL names Scott McFarland (McFarland & Associates) as SVP/GM of its healthcare business.

Announcements and Implementations

McKesson releases Paragon Clinician Hub, a Web-based navigation and workflow tool, as part of Release 13.0. Also included in Release 13.0 is integration with Zynx Health’s ZynxOrder order set management.

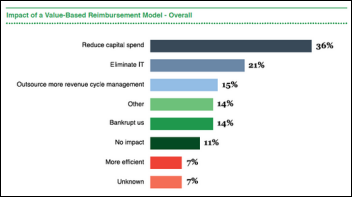

Peer60’s revenue cycle management report finds that CFOs are worried about value-based payment models and are anxious to reduce capital spending and IT costs. A pessimistic 14 percent of respondents say value-based payments will “bankrupt us,” while the roll-up-our-sleeves types are focusing on ICD-10 migration, improving the patient experience, and improving point-of-sale collection.

ZirMed announces a Denial and Appeals Management solution.

Nuance will include data analytics from Jvion in its Advance Practice Clinical Documentation Improvement to compare clinical documentation to payments and quality scores.

T-System joins the CommonWell Health Alliance.

A statistically lacking HIMSS survey of health information organizations (75 responses) finds that Direct messaging is popular for care coordination, but connectivity to EHRs isn’t great.

Other

Orange County (CA) Health Care Agency requests double its original estimate of $796,000 to complete the second phase of its Cerner behavioral EHR project for mental health patients, with the total project cost increased to $8.8 million.

The Providence, RI newspaper observes that less than 15 percent of the state’s physicians use the state’s HIE, which cost $25 million in federal money plus the state’s cost. A representative from the state medical society says, “It will make docs’ lives easier eventually, but so far, it’s only made insurance companies and EHR companies happy.”

The American Society of Clinical Oncology publishes a formula to assess the cost vs. benefit of new cancer drugs, the first step in developing software that can be used by oncologists at the point of care. One drug that costs nearly $10,000 per month in generating $2.8 billion per year for its manufacturer scored a zero in net health benefit.

Weird News Andy says, “You CAN handle the truth” in describing the $13 bacteria-killing door handle invented by two Hong Kong high school students. WNA also proclaims “strangling her legs” in describing a case study of a woman with temporary leg nerve and tissue damage caused by squatting too much in her skinny jeans, which were so tight doctors had to cut them off.

Sponsor Updates

- ZeOmega posts “Payer/Provider Collaboration: What Works?”

- Coalfire Systems analyzes the security of InstaMed’s healthcare payment solutions and concludes that they “have the most effective data security controls available in healthcare today.”

- Experian Health partners with two companies to offer healthcare organizations a credit card processing device that meets the October 1 deadline for implementing EMV chip-authenticated credit card standards.

- AirStrip offers “Shifting Our Thinking to Prepare for the Future.”

- Besler Consulting offers a podcast on the “QualityNet Hospital-Specific Report.”

- Clinical Architecture offers “Understanding ICD-10-CM – Part III – A Terminology by the Book.”

- Atlanta public radio highlights Clockwise.MD in “Local App Reduces Time Spent in Urgent Care Waiting Rooms.”

- Gartner positions Commvault in the Leaders quadrant of the Magic Quadrant for Enterprise Backup Software and Integrated Appliances.

- CoverMyMeds offers “Proactive, Analytical and Interoperable Trends Affecting Today’s EHR Systems.”

- Culbert Healthcare Solutions offers tips for “Allscripts Upgrade Services.”

- AirWatch offers “Virtual Training Experience available with AirWatch Labs.”

- Burwood Group is named one of “Chicago’s Best and Brightest Companies to Work For.”

- Anthelio Healthcare Solutions will exhibit at the 2015 TxHIMA Convention June 28-30 in San Marcos, TX.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…