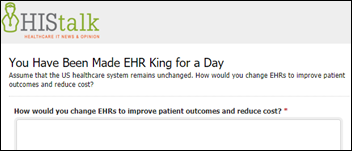

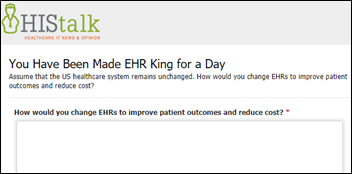

I asked readers how they would change EHRs to improve outcomes and reduce costs while still meeting the requirements imposed by the US healthcare system. That’s the basic question EHR vendors face every day. Some of the excerpted answers I received are as follows. Non-clinician responses are indicated with an asterisk.

* Keep them headed in the direction they’re on: platforms supporting standardized open APIs. The Fortune article was hysteria-feeding bias by writers who don’t understand economics, technology, or healthcare. Chopra had the best take in the article: MU was a messy process but it was a necessary down payment that will yield benefits to patients for years to come.

Create true app store-type environment being opened up by the recent mandate for FHIR APIs, a way to totally separate the data entry issue from the clutches of current vendors. The most practical complementary situation in the interoperability realm would be a timeline approach to presenting links to patient specific information for the caregiving team. There are many candidates whose product offerings could be customized to fulfill this.

* Allow doctors to create/buy their own EHRs with no regulatory restrictions on interoperability other than summary reports, lab interfaces, and pharmacy interfaces. This puts agency back into the hands of the frontline clinicians themselves and allows us to cut the complexity out of entrenched vendor products and brings e-health back to the basics, where it belongs.

* I would move EHR interoperability to something more similar to the SWIFT financial network. A cooperative would operate a set of datacenters and network. Transactions on this network would be defined by a set of standards (HL7+X12 but with a strong opinion on what that actually means.) Messages would be routed from the providers to the cooperative then onward to other providers or insurers or wherever. Failure to reply to requests with the appropriate clinical information would result in an increase in the transaction fee that the networks charge for submitted claims.

Say you don’t return a request for patient data promptly or fail to submit an HL7 ADT message when a trigger happens — some percentage of your claims for the next year will be put into a general fund that supports the network. Awards are given from the general funds to whistleblowers who point out failure and non-compliance. Additional failures or non-compliance will result in a steadily increasing withholding from each payment your org receives. Failure to join the network or repeated non compliance with the requirements will lead to loss of Medicare and other government payments. US digital service and some CMS lawyers form the initial public committee that organizations go before to submit complaints against each other, appeal decisions, etc.

* All big systems were designed around billing, and the visit is the hub. That should be tossed out and redesigned so patient is the hub.

* Phase out Meaningful Use. Halt any usability mandate initiatives (let free market decide). Pass legislation that makes it much more difficult to sue for patent infringement. For EHR software that is released and used in production at publicly funded health systems, screenshots, videos, and specific descriptions of functionality / workflow should be shareable with open public (excluding PHI stuff) i.e. greatly limit an EHR vendor’s ability to nix content from web with IP protection claims

* I would allow malpractice carriers to drive the market need for effective electronic clinical documentation through how they price premiums rather than CMS reporting requirements. That should shift the market dynamic away from a great billing product to one built around patient safety.

*Interoperability: generate rich patient records with specific variability and define a set of assertions that are associated with those cases. Send them via CCDA and FHIR and ensure that each EHR can receive, reconcile, and directly incorporate all data into their EHR.

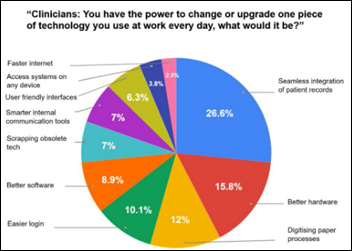

Usability: generate a standard set of the top 10 nursing and physician workflows — give the workflow 100 points. Then for every time the user has to switch contexts from the patient to the computer, deduct seven points. Every time the user has to switch from the keyboard to the mouse, deduct five points. Every keystroke the user has to enter to do a search – deduct one point. Grade it based on standard: 90 percent A, 80 percent B, 70 percent C, 65 percent D.

Error reporting: Put the EHRs under FDA CFR and require they publish all harms with their customer notice to a Federal EHR Adverse Event Reporting System (FEHRAER?). All potential patient safety or safe use issues reported to the same system, but perhaps we would mine those for trends and allow them to remain non-public.

When someone cheats on their MU reporting or MU certification, a change in suit color is in order. Not just fines. but hard time.

* Centrally managed (decentralized storage) common health record structure that all EHR technology vendors and providers of all types are forced to contribute to. This would break up monolithic EHR vendors, stimulate creativity, and allow each provider to select the tools used to contribute to a commonly defined health record. This would solve the interoperability issues and allow the market evolve quickly. Basically we follow the ubiquitous app store approach. We could use a distributed ledger approach to record management.

* We need to focus on the paradigm that exists around our transition from paper-based, trust-based, fee-for-service charting to an electronic health archive and medical billing support infrastructure. There is no direct correlation between the two worlds. And I am not talking about the change felt by payers and providers. We have not changed the patients’ encounter as dramatically as we need to in order to support new world order in healthcare.

Patients are typically scheduled in much the same way as before. The Doctor’s office visit is mostly the same. And what is scary is the huge push and hyper focus for MORE office visits. A vastly different office visit is required. And since everyone is a consumer, we all share the same responsibility to adapt.

One very tangible change would be patients acknowledging that their visit with the physician is being recorded. Recorded sessions will be saved for 24 hours until the medical record has been appropriately updated and accurate labs and meds are ordered and prescribed. This one process change has many downstream benefits to both accuracy and integrity. There are ways to incorporate many levers to assist, however, it starts with changing the patient’s point of view of a doctor’s visit.

* Systems that you can easily dictate into via headset, for example, as you are performing assessments, “breath sounds diminished in left lower lobe, slight wheeze in left upper lobe, strong, loose, productive cough. Resp Rate 14, pulse 84”, etc.

having discussions with patients, “Mr. Gonzales indicates shortness of breath walking up one flight of stairs”. System would be smart enough to catalog information discretely in the right places in the right way to make it interoperable.

Alexa-like recall of important information or tasks “Alexa, please reconcile Mr. Jones medication list and show me any discrepancies” “Alexa, what is Mrs. Smith risk of 30 day readmission and what should we do to mitigate it?” “Alexa, what routine care items / screenings is Ms. D’Meanor due for?”

* At the health system level at a minimum, standardization of content based on evidence should be required. Utilizing 4,000 different order sets, customized care plans with zero evidence, lack of consistent clinical decision support should be disallowed. EHRs only get better when the information available at the point of care is better.

Implement National Patient Identifier, and mandate that it cannot be SSN. Get rid of the old school “funny Money” mentality of charges that all the stakeholders can get an accurate view of value in health care, and not monopoly money gross revenue nonsense that is currently what is floated out there.

* I think we need some UPS-style time and motion studies to understand how to make the EHR more natural and complementary to physician and clinician practice. Some future improvements should be possible based on this understanding, for example:

- Narrowing what is on a screen based on context in the patient encounter

- Narrowing what is on a pick list based on context

- Improving adoption and usability of no-touch UI’s

There is a lot to be learned for the major EHR vendors from the computer gaming industry on having commands and data elements be contextual. I think we need to shatter the “project mentality” in EHR rollouts and just assume optimization never is finished. If any investment deserves the the continuous improvement process, it’s this one.

* Get rid of the need to document every single minutiae. Let the doctors decide and be responsible for what they enter in (if they start making mistakes or not entering important information, it’s on them and their insurance). Have a simpler interface for physicians, and another a complex one for “scribers” (could be the same as what’s currently offered). What’s required for simpler interface should be arrived at by a mix of EHR vendors and physicians (AMA), make this required for certified software. This you could be standardized across the US. If the doctors don’t like it, they can switch to the scribers interface and go nuts but no complaining anymore about the interface. Only the simple interface should be required for the software to be certified.

If the bean counters want something tracked and entered in, let them pay for it in the term of scribes, etc. This will easily track the true cost of of all this data entry which is currently being paid through physician time. Since they love tracking costs, they should love this, right?

Have a tool to download record from patient portal, in an open and readable format. Even better two formats, one human readable, and one machine readable. Make this required and always available if you want to be certified.

Have tool in patient portal and in EHR to submit feedback on the software. A copy goes to the vendor, one to the health system, and a copy goes to regulators, available through FOIA to anyone (once personal details are scrubbed).

Not really something that can be done on EHR side but:

Make health systems pay for failing to share patient’s records (if the above functionality fails). Make this an increasing cost based on delay and also based on the amount of money the health system generates (not profit, as they’re all not-for-profit).

Make the health system generate a single, detailed bill. If the health system is not-for-profit,” it should have both the cost of the material and how much they charge for it in the bill. If the bill goes out past a certain date, the patient doesn’t have to pay it. Let them deal with paying outside the network, etc.

* I worked in financial services technology in 90s and early 00s. If you free the data, innovation will come. We’re in generation 1. There are whole entities just forming that normalize, curate data. Better user centered design will come when SME for particular problems are able to enter at a price point commensurate with value. Add-on and systems next to the EHR will become primary home for tasks for specialized workflows. EHRs that can build and partner for these models will succeed. The ones that stay data locked will be the last system stand alone docs have before getting eaten by local mother ship. That could take decades. Ones that unlock data and become integration partners have a chance at survival.

The larger orgs that command a premium $ in their practice and have a handle on ROI and total cost of practicing will bring support for doctors into exam room. MGH in Boston has been doing this for almost a decade.

There is no perfect technology. Our ability to acknowledge data integration is key is tantamount.

Although politically undesirable, move to a unique patient identifier/set of unique keys per patient would help immensely.

Since early 2013, the Texas Medical Association has recommended to ONC that they should require all EMR data elements to be XML tagged using a single national standard, much like the accounting profession successfully uses XBRL. With a universally-understood tagged data structure, physicians and hospitals would ideally be able to pick up their databases and move them quickly and cheaply between vendors. Vendors then would be forced to compete on their user interface, including usability.

XML is just one approach for tagging. FHIR is analogous to this approach, but it’s not being used in a “pick up your database and change” way, as far as I know.

If, in 2013, the ONC had started us on the XML tag journey (or its equivalent), we would be far, far closer to true interoperability and data sharing.

* Leverage the massive amount of data that has already been collected over the past 10 years. Utilize machine learning to automate the largely repetitive tasks done by clinicians. A run-of-the mill CAP admission already gets the same order set anyway, with the same billing codes. There is no need for things like this to be done manually every single time. Machine learning should be able to take care of 80 percent of the tasks currently done by clinician end users. The other 20 percent are the unique clinical situations where we need clinicians to use their experience and critical thinking skills to solve complex medical problems beyond the capabilities of machine learning.

Mandate interoperability and provide real teeth to enforcing this with real consequences for facilities, systems, and technology that does not share all the data. This includes providing all to the patient. Don’t let perfection stand in the way of progress when it comes to interoperability – start with something and expand on it.

Relegate the EHR to a database and allow for customized solutions as an overlay for specialties and individual workflow.

Stop punishing doctors with data entry and find an alternative to capture of information and allow them to return to the art and joy of medicine.

Require justification form variation from standards of practice established and proven holding clinicians accountable for that variation when they find alternative paths and treatment protocols.

Make the technology a part of medical education and allow those individuals to contribute to rethinking the solutions, workflow, and layout. They are unencumbered by the baggage of paper notes and as digital natives would have new and innovative ideas that we could use. They are also deeply invested in fixing this unholy mess since they are forced to use this archaic solution and are often the data entry clerks of choice as the most junior clinical employee, wasting all their training time on updating the system — residents spend 70+ percent of their time in their basement room updating the EMR not seeing patients.

My notes would be minimal, perhaps even written primarily by the patient. Diagnoses would be common language and not all the absurd detail ICD-10 brings. Real-time costs would be part of ordering and someone other than me could figure out the charging in the end. Make the screens as simple as an iPad, intuitive so that they just work as expected.

I use a wiki and was exploring some of the extended character sets. I was startled to learn that the…