News 8/31/22

Top News

Politico points out that the HHS Office for Civil Rights can’t keep up with investigating healthcare cyberattacks, helping healthcare organizations better protect themselves against attacks, and enforcing HIPAA.

The office lacks funding, staff, and other resources. Fewer than 100 OCR investigators, some of whom are tasked with other duties, are expected to deal with 53,000 cases this year.

A 2023 budget increase, if passed, will allow the office to hire 37 more investigators.

HIStalk Announcements and Requests

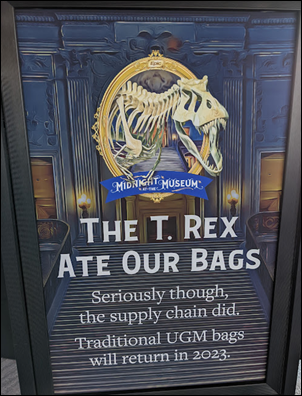

I failed to add some of Dr. Jayne’s photos in her Monday recap of Epic UGM, so check out the updated version.

Webinars

September 22 (Thursday) 1 ET. “ICD-10-CM 2023 Updates and Regulatory Readiness.” Sponsor: Intelligent Medical Objects. Presenters: June Bronnert, MSHI, RHIA, marketing director, IMO; Julie Glasgow, MD, marketing manager, IMO. The yearly update to ICD-10-CM is almost here. Prepare your organization for a smooth transition, and avoid any negative impacts to your bottom line, with an in-depth look at the upcoming changes. Listen to IMO’s top coding professionals and thought leaders discuss the 2023 ICD-10-CM coding changes. This webinar will review additions, deletions, and other revisions to the ICD-10-CM code set and how to make sure you get properly reimbursed.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Post-acute care coordination software vendor Olio Health raises $13 million in a Series A funding round.

Critical event management technology company Everbridge reportedly considers putting itself up for sale, causing its share price to jump 17% in after-hours trading. The Vermont-based company went through a proxy fight earlier this year with an activist investor who called for Everbridge’s sale in the midst of falling share prices. David Wagner (Zix) joined the company as CEO in July.

Healee raises $2 million in a seed funding round led by Nina Capital. The company’s white-label technology helps providers set up telehealth, digital appointment scheduling, and patient check-in services.

Medical product RFID tracking vendor Biolog-ID announces plans to go public in a $300 million SPAC merger.

Sales

- ScionHealth (KY) will implement Cadence’s remote patient monitoring and virtual care technology across its 18 community hospitals.

People

Former National Coordinator and Health Evolution founder David Brailer, MD, PhD joins Cigna as EVP/chief health officer.

Nilesh Patil (Emids) joins WellStack as chief growth and strategy officer.

Medhost names CFO Matthew Higgins president of MedTeam Solutions, its newly consolidated and expanded line of business services.

Steve Gottfried (Curasev) joins Myndshft as VP of business development.

New York-Presbyterian Hospital promotes Rhonda Bartlett, DBA, RN to VP of digital services.

Announcements and Implementations

Blessing Health System (IL) implements Wolters Kluwer Health’s POC Advisor for sepsis detection and patient management at Blessing Hospital and Illini Community Hospital.

Conduit Health Partners announces GA of remote patient monitoring nursing services.

Children’s Hospital New Orleans will use Cleveland Clinic’s e-radiology service to ensure that its clinicians have around-the-clock access to pediatric radiology experts.

Lee Health (FL) expands its virtual care services with remote patient monitoring capabilities from Health Recovery Solutions.

Redox announces a major expansion of its interoperability operations in Canada.

Government and Politics

The VA names Lynette Sherrill deputy assistant secretary for information security and CISO.

Lyster Army Health Clinic at Fort Rucker Army Base (AL) and the 78th Medical Group at Robins Air Force Base (GA) will go live on MHS Genesis next month.

Other

Morris Hospital & Healthcare Centers (IL) recognizes Nikki Jackson as its Fire Starter of the Month for her work as an applications specialist within its IT department. CIO John Wilcox says Jackson’s value was especially evident during the Kronos timekeeping outage last year: “Nikki was able to build a temporary timekeeping system for us through iShare, something many organizations that were in the same situation weren’t able to replicate. It really displayed what Nikki is able to do for our organization every day.”

West Virginia University Medicine opens its first pediatric telemedicine and specialty clinic in an effort to help families in rural, southern parts of the state access care.

Sponsor Updates

- Surescripts joins Civitas Networks for Health as a strategic business and technology partner.

- Ascom receives FIPS 140-2 certification for the Myco3 smartphone.

- Baker Tilly publishes a new case study, “Real-world evidence help medical device company navigate CMS reimbursement rule.”

- Bamboo Health donates technology to Jefferson County Public Schools, the Louisville Tool Library, and UpLouisville.

- Nordic releases a new video highlighting its metadata-driven pipeline.

- Oracle Cerner releases a new podcast, “How data and tech advancements enabled innovation in the Middle East.”

- KLAS rates Clearwater as a top performer in its new research report reviewing the security and privacy consulting services market.

- Clinical Architecture celebrates its 15th anniversary.

- Direct Recruiters hires Guru Brandes-Swamy (LetsGetChecked) as director of analytics for its healthcare IT and life sciences practice.

- Texas Children’s Hospital CIO Myra Davis joins Divurgent’s advisory board.

- Ellkay publishes a new customer success story, “WakeMed Health. Connectivity and Error Reduction Produce Big ROI.”

- KLAS recognizes Impact Advisors for exceeding client expectations in its new research report reviewing the security and privacy consulting services market.

Blog Posts

- Back to school: Top scholarly tools for 2022 (AdvancedMD)

- The Future of HIM Audits (AGS Health)

- What is value-based care? ACOs and the future of healthcare (Arcadia)

- Three Ways to Manage the Healthcare Supply Chain in An Era of Disruption (Ascom)

- Tips for managing patient-provider communications during a practice merger (Bravado Health)

- Optimize Orders in Meditech Now to Save Providers Time Later (CereCore)

- 4 Characteristics to Look for in a Change Management Partner (CTG)

- The Healthcare Economy’s New Conundrum (Optimum Healthcare IT)

- The Power of Data is Expanding: Reflections from the CMS HL7 FHIR Connectathon for 2022 (Diameter Health)

- Making the Case for Value-Based Care: BCBS Execs Speak Out (Enlace Health)

- Digital Care Management: The Evolution of Patient-First Solutions (Get Well)

- How data supports initiatives to automate implant orders (GHX)

- St. Luke’s University Health Network’s Cloud Transformation Journey (HCI Group)

- Tips for Hiring and Managing Remote Workers (Healthcare IT Leaders)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

.

.

"A simple search on the named authors (when presented) reveals another carefully concealed attempt at Epic influence..." The site is…