Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…

Allscripts to Acquire Eclipsys for $1.3 Billion, Misys to Sell Its Stake

Allscripts announced this morning that it will acquire Eclipsys for $1.3 billion in an all-stock transaction. Misys PLC, the 55% owner of Allscripts, also announced that it will sell most of its interest in the company to allow the acquisition to proceed, reducing its holdings to less than 10% of the merged companies.

The proposed transaction values Eclipsys at $1.3 billion, a 19% premium to Tuesday’s closing share price.

Allscripts CEO Glen Tullman will serve as CEO of the new company, while Eclipsys CEO Phil Pead was named as its chairman.

Tullman was quoted in the announcement as saying,

We are at the beginning of what we believe will be the single fastest transformation of any industry in US history,and the combination of the Allscripts Electronic Health Record portfolio in the physician office and leadership in the post-acute care market, with Eclipsys’s market-leading hospital enterprise solution creates the one company uniquely positioned to execute on this significant opportunity. Our vision and the vision behind ARRA is to leverage information technology to create collaboration between providers in all care settings, helping to improve the quality and lower the cost of care. The merger of Allscripts and Eclipsys creates one company with the scale, breadth of applications and client footprint to bring that vision to life by connecting providers in hospitals, physician practices and post-acute organizations across the country.

The deal is expected to close in 4-6 months.

The companies will hold a webcast at 8:00 this morning Eastern time, open to all here or by telephone at (877) 666-7021.

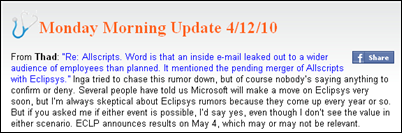

Rumor of the merger was reported on HIStalk on April 12 by Thad.

Update: the company has created a new site about the merger that includes a FAQ, merger benefits, and facts about the combined companies (warning: PDF).

Excellent move on the part of both companies. A great alternative to Epic.

Allscripts hosted a meeting Monday showing integration options with Eclipsys with some of their mutual clients (NYP, Lahey, etc). This didn’t go well for Allscripts, clients dont like the product and hate the integration obtions. One client calling it an abortion, one other saying it is a good attempt but falls short. They also commented negatively on AllScripts management saying they sell well, but can’t execute. Privately the clients me and to a tee they said Eclipsys new release is what they want with more content, but that AllScripts is well off the mark for a go-forward Ambulatory solutoin. Hopefully Eclipsys will continue to build out thier solution instead of some hokey integration story that Allscripts is touting to make up for their lack of an acute care offering. Does anyone else know anything about this?

There are many Allscripts/Eclipsys clients. Everyone knows that “integration” is a buzzword and that it will be years before true integration exists. I am employed by one of these companies and the merger makes logical sense from a strategic standpoint. I hope this does not weaken the momentum Eclipsys has gained with its 5.5 release, which has been getting rave reviews. Allscripts is often-times portrayed as a troubled company so it will be interesting to see how that impacts the changes happening at Eclipsys.

It sounds like the balance of power goes back to Chicago with Glen Tullman rather than down in Raleigh with Misys. I like it.

Another interesting tidbit about Eclipsys/Allscripts merger:

Allscripts was working on integration with dbMotion: http://www.dbmotion.com/webSite/Modules/News/NewsItem.aspx?ntype=2&pid=246&id=166

Eclipsys was working on integration with Amalga: http://www.healthdatamanagement.com/news/integration_analytics_intelligence_hospital-39868-1.html

It will be interesting to see whether dbMotion or Amalga loses here.

Listening to webcast, it’s blatantly apparent that this deal is nothing but an upside for Allscripts. They can tap Eclipsys’ market share, which is double the opportunity for them than it is for Eclipsys. What does Eclipsys get? A chance to solidify it’s ambulatory market, which has been pathetic.

Allscripts BOUGHT Eclipsys, that should be clarified, and will hold 55 percent stake, ECL 37 percent and Misys the rest.

After the webcast and reviewing all news/press releases, it’s still unclear to me what the go forward focus will be for ambulatory: Allscripts’ products, PeakPractice, or a smorgasbord. I’ve been assured that PeakPractice is part of the solution by high-placed friends, but the lack of direct address by the bigs or PR peeps has me curious.

As the ancient Chinese wise man said, “We’ll see.”

PS – re: Winston Z – With all the talk about Microsoft during the webcast, I’m betting dbMotion may be worried.

I do not get it. Allscripts brought a Philadelphia program to its knees but contractual obligations kept the hospital from disclosing it to other would be purchasers of Allscripts systems. Sunrise has become known as “Sunset”, for the outcomes it produced at another hospital in Pennsylvania. Will the merger of the two compound the ineffectiveness? Wonderin if Phil will play basketball with Glen and Barack O in the White House. Any information, Winston?

Winston,

Adding to the complicated story on the HIE front is that Eclipsys has had a long-standing partnership with Medicity who sells their Meditrust product through the Eclipsys channel for private HIEs.

When I met with Lee Shapiro of AllScripts at HIMSS, he flat-out stated that dbMotion was their go to market private HIE offering. Been getting some feedback from market that dbMotion is a bit too pricy for many of AllScripts customers. Could AllScripts adopt Eclipsys’s existing partnership with Medicity, maybe expand with the Novo grid solution a lower cost alternative? Have to wait and see.

We would like to hear from current Eclipsys customers or prospects for a follow-up posting. Do you think this is good news? The company’s main product lines are Sunrise for hospital inpatients, EPSI for budgeting, PeakPractice for practice EMR, along with some revenue cycle and integration offerings. How will Allscripts manage those along with the several PM/EMR products it already sells? Sunrise was already struggling to get new business against Epic — does this help or hurt? What are the biggest potential benefits and concerns? E-mail me.

Mr. HISTalk,

I would be extremely interested in those responses.

Consolidation is a reality, and anytime competitive strengthening occurs, it’s good for the market.

Glenn Tullman has a track record of success, Eclipsys needed this. Their customers will benefit from a stronger combined entity.

My prediction is, DbMotion loses here, bet the farm.

Referencing the Allscripts and Eclipsys HIE strategy…to add to the further confusion, Allscripts introduced the Misys Open Source Solutions (“MOSS”) HIE platform in Hartford and the customer chose MOSS over the much higher cost dbMotion. The MOSS solution is going live now in Hartford and being considered for the state-wide HIE. And Misys plc still retains a 10% stake in Allscripts. Will be interesting to see what the REAL community HIE strategy for the combined entity will be. Stay tuned.

1. In a large meeting with clients and agree with this “Eclipsys, it’s like we are married and you have cheated on us so many times, we no longer believe you”. Phil repeatedly said he would build and not buy or be bought- today just shows so many lies again.

2. Patients and organizations money need to go to patients and providers and insurance- mergers like this drain the HCOs into huge interface projects. Single database vendors like Epic get it.

3. New company name on the street- ‘total cluster f–k’

I would like to know which one is more likely to survive: the formerly Bond or the formerly iMedica.

Makes no sense to keep both…. or does it?

“Eclipsys, you have over 20 million a year from a client and what did that go to? No enterprise revenue cycle product, 50 million for Bond and Medinotes? Now the investment goes towards 5 plus ambulatory and HIE products? Merger has WAY too many products for the same markets- Ambulatory alone has Mysis, allscripts touchworks, allscripts professional, Eclipsys sunrise amb, Eclipsys peak (bond clinician), and Medinotes.”. Forest Gump take away- RUN, RUN, RUN

Gregg – Smorgasbord. My bet is that Sunset Ambulatory and MyWay get sunsetted in the end. Allscripts has Peak Practice for the small practices while keeping Professional & Enterprise for the big clients. Allscripts did waste some R&D funds on trying to update the source from Aprima to bring MyWay up-to-speed this year especially on the coding/billing side. In the end, it is still a pig with lipstick on it. If you really want MyWay, you are better off with Aprima (iMedica).

As for the HIE aspect, that is the harder part of this to guess what plays ot. Allscripts has several parternships with various HIE vendors but dbMotion is their contracted partner. If a client doesn’t want dbMotion, they have to have a seperate agreement.

More interesting to see what happens with the Eclipsys relationships with Medicity & Microsoft. Less clear on what happens there.

“The acquisition of Sunquest will consolidate Misys’s position as a leading provider of healthcare systems, extending Misys’s presence into the acute care market with a strong position to exploit the expected growth in clinical systems. The combination of our leading position in physician systems and Sunquest’s strengths in the clinical environment will have broad capabilities to meet US healthcare providers’ increasing requirements for systems which improve efficiency and enhance patient care.”

Kevin Lomax, Chairman Misys PLC, June 25, 2001

Hmmmm…..how did that work out

Predictions:

1.) Eclipsys 5.5 will still be delivered. Consistent to Eclipsys form, expect there to be significant defects. We’re going to be waiting longer than even usual for SP 1 because development effort will be directed to stitching together Allscripts and Sunrise.

2.) Allscripts rocks in terms of Sales and Marketing. I would expect that most of the Sales force at Eclipsys turns. The good news is customer focus should increase.

3.) Eclipsys has been building partnerships with about 6 large integrators. Pro Services will be reduced or eliminated to build up cash for development work. If you don’t have third parties, time to integrate some.

4.) The products will probably exist in separate databases. Who cares if they are both on SQL Server if they are running on different schemas…

5.) Interfacing will be done through HL7 and this will be yet another set of “best of breed” modules connected into eLink attempting to look like 1 application; however, functioning for the user as distinct and separate.

6.) Forget about new functionality from SCM 6. All the focus will be on merging these systems together through mid-2012.

7.) Support will probably stay with Eclipsys because they have built a very cheap model using offshore resources.

8.) Who knows on the B.I. and HIE fronts… Both organizations have significant different strategies and partnerships.

I too remember the promises from EUN last year about continuing to “build our own future”…

The market has spoken: MDRX down 9.66%; ECLP up 2%

The market is saying: it does not expect buyers for their devices and I concur with: do not buy their devices unless you want to participate in the downdraft of medical care. Call the Philadelphia hospital and speak to the doctors there.

Talked to these two companies’ HIE partners and put together a post on the implications of this merger to their respective HIE initiatives which you’ll find at:

http://chilmarkresearch.com/2010/06/09/allscriptseclipsys-who-looses/

Welcome one and all’s comments.

Suzy – Devices? You have to be kidding me… Please stop posting until you have something meaningful to say.

RE: Allscripts/Eclipsys – This will be an interesting development with the purchase/merger. All great points brought up about their competing strategies with HIE and other crossovers in the Ambulatory sector (not sure if there really was a strong product there for Eclipsys). I know it’s all speculation now, but where do you think the two companies sit with employee fallout?

Not to happy is right on the nose with the new company name! Both companies have been “cobbled” together like HBOC did in the 1980’s and they couldn’t deliver squat then. Neither one of these organizations are delivering too well except to their talking head customers and Eclipsys case only to those that are outsourced so that they get the “A” team. There is going to be a ton of sunsetting on the product side and huge defections by those who feed the fire on the revenue side. Hopefully customers will be smarter and not buy into this marketing hype/crap. Not to be a told you so, but I believe that I posted back in Sept/Oct 2009 that Phil Pead’s vision was nill and he was in it strictly for the mighty buck just like every other position he has held. I have trouble believing that customers are so naive to believe anything that comes out of that “Bloke’s” trap. The only saving grace for HBOC was McKesson and that still hasn’t turned out too good and the only hope for both Allscripts and Eclipsys customer will be that Microsoft will come in and “save” the day.

Great to see quality leadership and products come together in Healthcare. The Allscripts Merger with Eclipsys brings together two very well run organizations with exceptional product offerings. Both organizations have continued to develop, deliver and support exceptional solutions. As with any software solution there are some challenges, put any other vendor under the microscope and you will see those problems too. This merger seems to be looking towards the future and the good that these two companies can do together. There is very limited to no overlapping solutions. This is nothing like the HBOC/McKesson days when you bought your competitor for market share, this is a strong merger that brings together the best solutions. Integrate or Interface, no kidding it will be interfacing at first, so what, the data still flows, the clinical staff get a good workflow and that is a win for the patient. A temporary down turn in the stock price, take a look at the Allscripts track record and continued growth and by the way significant hiring they have been doing during a down economy. As someone who is more on the side lines of healthcare today, having worked through the HBOC days, time with Eclipsys, this move makes great sense to move healthcare in a better direction.

GT Quote – “…the fastest transformation in healthcare..”

Guidance – growth at 8-10% – something seems amiss. I would think the company would grow at 15-20% if it was truly winning market share. The reality is Management is all about sell, sell, sell while the customer base is leaving rapidly. It will be interesting to watch the next few earnings reports.