Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…

News 12/11/24

Top News

CVC Capital Partners will likely acquire German health IT company CompuGroup Medical in a take-private deal valued at $1.2 billion. The acquisition is expected to close in the first half of 2025.

CGM acquired EMDs in 2020 in a $240 million deal that included the assets of Aprima Medical Software, which EMDs had acquired the year before. CGM, which has a US office in Austin, also acquired certain European assets of Cerner’s portfolio around the same time for $236 million.

Reader Comments

From Independent Primary Care: “Re: CareMax. Has laid off 530 employees since filing for bankruptcy in November. I think it’s safe to say that the Medicare Gold Rush has ended with the implosion of VillageMD, Walmart Health, Cano Health, Clinical Care Medical Centers, and now CareMex. Who’s next? Amazon’s One Medical, CVS’s Oak Street, or Optum?” CareMax, which is a Medicare Advantage delivery system, hopes to sell its management services organization and care centers to Revere Medical, the private equity-backed recent acquirer of Steward Health Care’s physician group. CMAX shares, which began trading in 2021 via a SPAC merger, are approaching worthlessness. The sustainability of MA value-based care is uncertain due to high labor costs, unexpectedly high demand for services, competition among publicly traded companies, and more complicated payment rules that are tied to quality ratings. The MA business isn’t making anyone happy, as those plans cost taxpayers a lot more money than traditional Medicare, companies use questionable diagnostic and documentation practices to exploit the system, and sicker patients who encounter MA denials or restrictions can move their high costs to traditional Medicare when it benefits them.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Oracle reports Q2 results: revenue up 9%, EPS $1.10 versus $0.89, missing Wall Street expectations for both and sending shares moderately down. The company’s healthcare business wasn’t mentioned except as a use case for its AI agents.

Walgreens is reportedly considering selling itself to private equity firm Sycamore Partners in a take-private transaction. The drugstore operator is struggling with lower prescription payments and front-of-store competition with Walmart and online retailers such as Amazon. It took a $6 billion charge this year for the declining value of its investment in primary care operator VillageMD, its only significant non-drugstore business. Sycamore invests in dying mall retail businesses such as Hot Topic, Belk, and Lane Bryant and, like most PE firms, has a history of loading its acquisitions with debt and pulling out billions of dollars from the already-struggling businesses.

![]()

The US Patent and Trademark Office grants TeamBuilder a patent for its predictive staff scheduling technology that incorporates patient volume, workflow, and employee availability and characteristics.

Healthcare workflow AI startup Evidently raises $15 million in a Series A funding round.

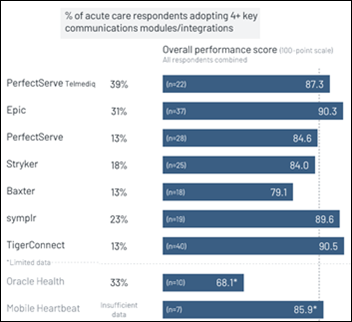

A new KLAS report on clinical communications technologies finds that PerfectServe Telmediq is the most broadly adopted and has the most users live on physician scheduling, while users of TigerConnect and Symplr report simple deployments and easy adoption. End user training and integration are the biggest implementation obstacles.

Sales

- Syracuse Area Health (NE) will launch telenephrology services using technology from Teledigm Health.

- Sanford Health (SD) selects Availity’s Essentials Pro RCM software.

People

Wolters Kluwer names Mark Sherwood, MBA (Microsoft) EVP/CIO.

Lori Jones (Agiliti) joins Aptarro as chief growth officer.

C3HIE promotes Jim Hoag, MA, MBA to interim CEO. He takes over from Phil Beckett, who will join Texas Health Services Authority as CEO.

RhythmX AI names Andrei Zudin, PhD (Carequality) head of interoperability and security.

Tyler Turner (Optum) joins Edifecs as RVP of payer sales.

Announcements and Implementations

Broward Health (FL) goes live on Epic.

Privacy and Security

HealthAlliance (NY) will pay a $550,000 fine for its failure to prevent a cyberattack in July 2023 that exposed the information of 243,000 patients. The organization had been made aware of a system vulnerability by one of its vendors, but failed to implement a patch because of technical issues.

Other

Informatics researchers propose adapting the Clinical Laboratory Improvement Amendments (CLIA) model — which allows labs to develop and modify FDA-approved tests without further review — to regulate healthcare AI. The framework could include local oversight, risk stratification, assurance of appropriate staff training, validation of developer claims using local data, a recalibration schedule, ongoing quality control, and a certification program for AI-competent organizations.

Sponsor Updates

- Cardamom Health moves to new offices in downtown Madison, WI.

- The Norwegian healthcare region Helse Nord RHF will expand its use of Sectra’s enterprise imaging solution to include digital pathology.

- Agfa HealthCare recaps its team’s experience at RSNA with daily updates.

- Arcadia publishes a new report, “The current state of healthcare analytics platforms.”

- Availity promotes Sujin Park to senior marketing operations manager.

- Capital Rx releases a new episode of The Astonishing Healthcare Podcast, “What’s Hot In and Around the Pharmacy Supply Chain, with RSM’s Tom Evegan.”

- Cardamom Health moves to new and expanded office space in downtown Madison, WI.

- CTG publishes a new whitepaper, “Optimizing the Epic Journey: Workflow Alignment as the Cornerstone of EHR Success.”

- Divurgent publishes a new success story, “Integrating Project Portfolio and IT Operations Management at the Child Mind Institute (CMI).”

Blog Posts

- Succeeding in Value-based Care: Part 2 (Tegria)

- Flipping the script: Why nurses stay (Altera Digital Health)

- VA Hospital Fall Prevention: A Pathway to Zero Falls (AvaSure)

- Navigating the HIPAA Privacy Rule for Reproductive Healthcare: Compliance Essentials Before the December 2024 Deadline (Clearwater)

- Physician CIO Advice: Scaling Health IT in Rural America (CereCore)

- Speeding Access to Specialty Meds in Oncology: How Electronic Prior Authorizations Make It Possible (DrFirst)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Follow on X, Bluesky, and LinkedIn.

Contact us.

Mr. H, maybe you missed these Oracle updates in the misty murky vapor…

Larry E, waffling on the previously promised wholesale bulk rewrite of the crumbling infrastructure:

“So, it will be fully in OCI and SaaS, but it will not be — the new — we are rewriting — we’re replacing Millennium a piece at a time, not a big lift and shift, but we are upgrading and modernizing Millennium a piece at a time, and different pieces will be available starting next year.”

And Safra C, on the far more important topic than when the vaporware will be ready:

“I think — yeah. So, let me just tell you, I think for the year — for the full fiscal year, Cerner will be sort of negative 1 to 2 points, but that will be it. It’ll end this fiscal year. And from then on, it will be a gross story. So, it will no longer be a drag on the — on Oracle growth. OK?”

I think those comments were from the year-ago Q2 2024 earnings call. Q2 2025’s call from Monday didn’t mention anything health related other than, “Oracle’s AI agents automate drug design, image and genomic analysis for cancer diagnostics, audio updates to electronic health records for patient care, satellite image analysis to predict and improve agricultural output, fraud and money laundering detection, dual factor biometric computer logins, and real-time video weapons detection in schools.”

Haha, my mistake. I should have known since Cerner presumably no longer is a drag on growth?

I doubt much has changed with the former Cerner except that Safra stopped ripping the business after Oracle ended breaking out its financials. Maybe most notable is that even Larry didn’t have any cheerleading to offer about Oracle Health, so either there wasn’t much to say or he has lost interest.

Neither of those sound like good news for Oracle Health. After the lofty proclamations of the last couple years. still nothing to show means that “rewriting the whole codebase” is proving harder than thought. Not that any of us are surprised. And if Larry indeed *has* lost interest, that may well be the start of the death knell for the former Cerner, as it has seemed that he was its sole cheerleader.

There was a recent report pointing to increased Medicare costs when patients returned to traditional Medicare, of course assuming that they had been denied necessary care under MA rather than having the care better managed at a better price point. It has become popular, fueled by hospitals and somewhat by docs, to attack MA and advocate return to loosely if at all managed traditional Medicare. I’d like to see the data, outcome and cost, fairly compared across the two vehicles.

My wife and I have been UHC MA members for over 10 years and have never been denied care or had authorization delayed, and we have presented numerous opportunities .

With the US spending far more than the rest of the industrialized world with poorer outcomes, per the Commonwealth Fund studies, it is disappointing to see the resistance to value-based care with sketchiy data in support, including by Mr HISTalk.