There was a time when my company went through multiple rebrands. These were relatively minor shifts, but completely unnecessary. It…

Monday Morning Update 11/13/23

Top News

Doximity reports Q2 results: revenue up 11%, adjusted EPS $0.22 versus $0.17, beating Wall Street expectations for both and sending shares sharply up.

DOCS shares are down 32% in the past 12 months versus the SP& 500’s 12% gain, valuing the company at $4.4 billion.

The company laid off 10% of its employees and reduced revenue guidance in August 2023.

Reader Comments

From Quite the Tenses: “Re: NextGen Healthcare. Thoma Bravo closed on its acquisition and immediately announced a 20% RIF in a town hall meeting. Details to be shared next week.” Unverified, but reported by multiple readers. TB paid $1.8 billion to take NextGen private. The company’s Mirth integration product line didn’t get a lot of airtime in the announcements even though it launched a cloud-based version a few months ago, so I’m wondering how that fits into the new owner’s expectations.

From Big Night: “Re: Amazon One Medical. Why do you call it concierge medicine?” Your $99 per year gets you no medical services except for telehealth visits, and should you show up in one of the company’s limited number of physical locations, either you or your insurance will be paying full price. One Medical’s annual fee was $199, so the only thing new is the $100 discount through Prime. The price is low for concierge medicine, but greater than the $0 memberships that most primary care practices charge. The company also offers Amazon Clinic, which is a marketplace for the telehealth services of paying advertisers. Everybody’s getting overly excited about Amazon’s monetizing of its $4 billion acquisition of One Medical early this year, but it could be a minimally seismic event like when it bought Whole Foods.

HIStalk Announcements and Requests

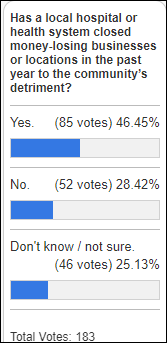

Poll respondents confirm that it is common for health systems to shut down community-needed services that aren’t profitable.

New poll to your right or here: Which position seems to be losing popularity or influence the most in health systems?

I appreciate the comments of Kat McDavitt and Lisa Bari of the Health Tech Talk Show, who recapped my Olive implosion summary and described HIStalk as “still the reigning number 1 health tech hotsheet. Despite the 1998 UI.” That appearance-shaming assessment is accurate and I am pleased in an “all cattle, no hat” sort of way. I like to think of HIStalk’s quirks as being the velvet rope that industry leaders happily sidestep to join their peers in consuming what’s inside, while others flee for prettier, shorter content with all the abbreviations spelled out.

My polls are mostly for entertainment and to generate timely reaction, but vendors who wrap advertising around a poll they have conducted should include this information to support validity and thus newsworthiness:

- The way you chose and invited respondents and whether random sampling was involved.

- The sample size and response rate.

- The method of delivery.

- A sample survey instrument so it can be reviewed for bias, quality of wording, and verification that the lofty conclusion is supported by the actual questions.

Webinars

November 16 (Thursday) 1 ET. “How Scheduling Helped Streamline Memorial Hermann’s Communication.” Sponsor: PerfectServe. Presenter: Amee Amin, MD, hospitalist, Memorial Hermann-Texas Medical Center. Dr. Amin will discuss the challenges she experienced in creating schedules for her team of hospitalists, and how an optimized solution transformed her workflow. Attendees will learn now TMC gleans crucial data and analytics from their scheduling system, the impact of real-time schedules being pushed out to other applications, and how Lightning Bolt’s optimized, auto-generated schedules improve provider satisfaction and work-life balance.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Value-based care and population health management company Cano Health reports Q3 results: revenue up 19%, EPS –$91.87 versus $0.23, sending shares sharply down as investors question its ability to stay in business. The company’s market cap is down to $32 million. It went public via a SPAC merger in November 2020 at a $4.4 billion valuation.

Elucid, whose AI-powered imaging analysis system assess cardiovascular diseases, raises $80 million in a Series C funding round.

People

Flatiron Health promotes Nathan Hubbard, MBA to chief business officer.

Courney Starnes, MBA (Saint Luke’s Health System) joins Kaleida Health as SVP/CIO.

CommonSpirit Health promotes Jamie Trigg, MSITM to system VP of primary EHR systems.

CHIME names Shafiq Rab, MD of Tufts Medicine as its 2024 John E. Gall, Jr. CIO of the Year.

Announcements and Implementations

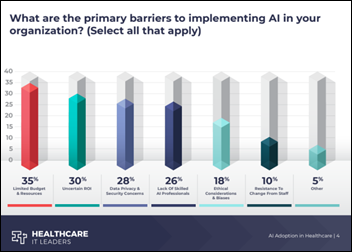

A Healthcare IT Leaders survey of CHIME members finds that while AI adoption is in its early stages, two-thirds plan to implement or pilot projects with 12 to 24 months. Half expect AI to help alleviate worker shortages, while nearly all involve clinicians in their AI decisions.

In Canada, McGill University Health Centre goes back to paper and cancels appointments as its Telus Health Oacis clinical system crashes following a software update.

An AI system is used for the first time to autonomously negotiate a non-disclosure agreement between to companies with no human involvement, which took just a few minutes.

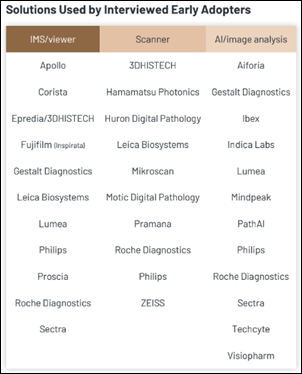

A new KLAS report finds that digital pathology is used in only 5% of US cases, but early users anticipate benefits such as better patient care, increased efficiency for pathologists, faster image access, reduced storage and delivery costs, and new opportunities for reference labs to attract hospital clients. They also foresee digital pathology paving the way for AI-assisted diagnostics, case screening, and improved quality assurance. The majority of these early adopters, typically having 30 or more pathologists, are progressively implementing digital pathology, initially focusing on applications that simplify pathologists’ tasks.

Privacy and Security

Tri-City Medical Center (CA) diverts ambulances following an unspecified cyberattack that is rumored to involve ransomware.

Other

The Verona paper summarizes its annual update from Epic:

- The company added 1,500 employees in 2023.

- Epic will open three new office buildings in 2024 that will provide 1,100 spaces.

- A sixth campus will be opened within two years.

- Software releases for 2023 focused on physician burnout and nurse staffing shortages, which included work with generative AI.

- The company trains 850 people on campus each week.

Sponsor Updates

- MRO sponsors a Stuffed Animal for Charity event at the recent HFMA Region 9 conference, benefiting Our Lady of the Lake Children’s Hospital and Ochsner.

- HIStalk sponsors exhibiting at RSNA 2023, which will take place November 26-30, include Agfa HealthCare, Elsevier, Nuance, QGenda, Rhapsody, Sectra, Visage Imaging, and Wolters Kluwer Health.

- Methodist Le Bonheur Healthcare adopts Optimum Healthcare IT’s IT Service Management.

- Wolters Kluwer Health launches Lippincott Partnership for Nursing Education and Testing, which offers a full curriculum suite of educational products and services for prelicensure nursing programs.

Blog Posts

- 3 strategies Cerner EHR-based organizations are using to improve patient access to healthcare (Notable)

- Intelligent patient experiences, part 3: How quickly can your patients get answers and advice? (Nuance)

- Apollo’s Curse: When AI Predicts and Doctors Resist (Nordic)

- Capturing the right data to power better healthcare (Wolters Kluwer Health)

- Nurses of Note 2023: The RN Case Manager (PerfectServe)

- Why Healthcare Organizations Should Prioritize Centralized On-Call Scheduling (QGenda)

- Shaping the Future of IT Contracting in Healthcare: A Tale of Two Organizations (Revuud)

- RSNA 2023 spotlight: Sectra empowers improved work-life balance for radiologists (Sectra)

- Congress Eyes Policies to Bolster Pharmacists as Care Providers (Surescripts)

- The Evolution of the CMIO Role in Hospitals & Health Systems (Symplr)

- Visage Soars with CloudPACS at RSNA 2023 (Visage Imaging)

- California’s Path to Better Healthcare: Understanding the CA Data Exchange Framework (DxF) (Zen Healthcare IT)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

“it could be a minimally seismic event like when it bought Whole Foods.”

AMZN’s acquisition of WF had a pretty significant impact on the employees, from what I’ve heard from people working there. Degraded employee experience is going to inevitably lead to a degraded consumer experience.

It’s an interesting example of Amazon jumping in big, but accomplishing little. The only change I’ve see at Whole Foods is the supposed discount I receive as a Prime member — which is so limited and minimal that it’s not worth whipping out the app to let them scan me — and to set up Amazon return desks for online orders. It didn’t signal a bold return to bricks and mortar, a massive move to self check-out as some of Amazon’s early experiments suggested, a vastly improved online experience, or using Amazon’s buying power to offer better prices than $10 chicken breast. Big companies usually fall short when they believe that their secret sauce will automatically earn them a share of massive healthcare spending.

Re: NextGen Healthcare. Thoma Bravo closed on its acquisition and immediately announced a 20% RIF in a town hall meeting. Details to be shared next week

I see a ton of activity on LinkedIn in the past few days due to the layoffs