Monday Morning Update 7/31/23

Top News

Surescripts settles Federal Trade Commission charges from 2019 that accused the company of anti-competitive practices in the electronic prescribing and eligibility markets.

FTC claimed that Surescripts maintained a 95% market share in both business lines by using “loyalty contracts” in which customers who did not use Surescripts exclusively would pay higher prices, preventing competitors from gaining enough business to become a viable competitor.

FTC also said that Surescripts executives used what they called “nuclear missiles” threats in 2014 against Allscripts, which was considering using Surescripts competitor Emdeon. FTC also claimed that Surescripts inserted a clause in its value-added reseller contract with McKesson’s RelayHealth that locked it out of the routing market for six years.

The company says that FTC’s case was based on significant factual errors.

The FTC’s proposed order would prohibit Surescripts from engaging in exclusionary conduct and from executing or enforcing non-compete agreements with current and former employees.

Reader Comments

From Hospital CIO: “Re: HIMSS. Got an invitation at 10:21 this past Friday morning for a noon Teams call from HIMSS (wonder what that could be about?) Most annoying is that they don’t know about BCC and blasted 600 email addresses to everybody. Probably time to tweak my mail filters.” Did they talk about the sale of the annual conference? Industry reaction has been minimal, so either folks are waiting to hear what HIMSS has to say or don’t really care.

From Mike Teavee: “Re: HIMSS. If they have not filed federal tax forms, is is possible that they have changed their incorporation or non-profit status?” I don’t know, but they also stopped filing Illinois corporate reports in 2020 along with the required IRS forms, at least under their original name as searched on the IRS and Illinois websites where their previous reports appear. It is curious that those reports stopped in the disastrous HIMSS year of 2020. I can’t find anyone listed on the HIMSS website or LinkedIn who serves as CFO, following the departure of the CFO and then the interim who followed. I would be interested in hearing from in-the-know readers since the current HIMSS regime doesn’t usually respond to my inquiries.

Selling the HIMSS Conference

HIMSS hasn’t said anything about the surprising note in Informa’s six-month financial report on Thursday in which the B2B media and events company says that it has obtained the exclusive right to buy the HIMSS Global Health Conference and Exhibition. Thoughts:

- The “announcement of exclusivity” to buy the conference falls short of announcing an actual acquisition. Still, that mention from a huge, publicly traded company in its financial report suggests its confidence that the deal will go through.

- The acquisition, at least as described minimally by Informa, involves only the HIMSS annual conference, not the other conferences HIMSS runs, its membership business, or any of its other offerings.

- HIMSS hasn’t filed an IRS Form 990 for FY 2021 or 2022. The last full-year Form 990 before the 2020 conference’s cancellation showed conference revenue of $40 million, plus what is likely to have been considerably more from tie-in advertising and corporate sponsorships, so the conference was probably directly or indirectly generating close to half of the organization’s $112 million in annual revenue.

- Informa says is paid around nine times earnings for its four 2023 acquisitions, including the HIMSS conference (note that including this note suggests that the acquisition price has already been set). That might suggest a HIMSS selling price of around $150 million to $250 million based on pre-2020 conference margins, although the numbers since 2020 are less robust. That is my speculation since I haven’t seen its financial forms.

- The sale would leave HIMSS as a membership organization that operates other conferences (such as those outside the US, assuming Informa doesn’t acquire those), its HIMSS Media arm that generates about $13 million in revenue, and a maturity model consulting firm. All might see reduced revenue when tie-ins to the annual conference are eliminated.

- HIMSS has struggled with the last-minute cancellation of the 2020 conference and dissatisfaction with related refunds and communication. Competition from the HLTH and ViVE conferences, the latter of which involves CHIME and its strong CIO participation, is a threat.

- The HIMSS name is on both the organization and the conference, so any separation of ways would need to iron that out, along with any ongoing involvement that HIMSS might have in the conference.

HIStalk Announcements and Requests

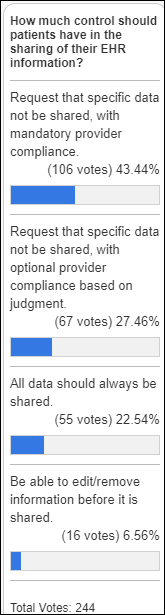

Most poll respondents think that patients should be able to ask providers to not share some of their EHR data elements, with most of those preferring that provider compliance with those wishes be mandatory. Readers provided some thoughtful comments about the issue, which is more complex than it might seem.

New poll to your right or here: How would HIMSS selling its annual conference affect the organization’s industry relevance?

Thanks to the following companies that recently supported HIStalk. Click a logo for more information.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Fairview Health Services and Sanford Health call off their planned merger, their second attempt in 10 years.

Sales

- Memorial Sloan Kettering Cancer Center chooses Visage Imaging’s enterprise imaging system.

Announcements and Implementations

Salesforce, Oracle Health, and Epic will likely bid to provide Ireland’s proposed patient record system, whose cost could exceed $2 billion over 10 years.

Sponsor Updates

- EClinicalWorks population health tools help HealthTexas Medical Group achieve a five-star customer rating.

- Meditech announces that EVP and COO Helen Waters has been named an advisor to The Scottsdale Institute.

- The Health is Hard Podcast features Nuance Chief Strategy Officer Peter Durlach.

- Nordic releases a new Designing for Health Podcast, “Interview with Dr. A Jay Holmgren.”

- West Monroe employees help with The Journey School’s Intro to Software Engineering Workshop.

- Wolters Kluwer Health and Unbound Medicine release an updated mobile version of Lippincott’s Nursing Drug Handbook.

Blog Posts

- Why UpToDate stands out for infectious disease specialists (Wolters Kluwer Health)

- How Mile Bluff Medical Center thrives as an independent rural healthcare system (Meditech)

- Tissue Analytics, Partners Capture Spotlight at Leading Healthcare Technology Conference (Net Health)

- The Pan-Canadian Interoperability Roadmap: Does it get us where we need to go? (Nordic)

- Four Questions with Optimum CareerPath Analysts (Optimum Healthcare IT)

- From Staffing to Billing: Is Your Pharmacy Ready to Expand its Clinical Services? (OmniSys)

- Bridging the Health Literacy Gap: Improve HCP & Patient Conversations (OptimizeRx)

- How to Enhance Locum Tenens Workflows (PerfectServe)

- Improve Transitional Care Management with Workflow Automation (PMD)

- Interpretable AI in Healthcare: Designing Data Solutions to Build Clinician Trust and Deliver Personalized Care (Ronin)

- The link between the quadruple aim and improved clinical communications (Spok)

- Connecting Beyond Loneliness: Online Opportunities for Older Adults to Foster Meaningful Connections (Trualta)

- ONC Proposed Rule HTI-1 Offers a TEFCA Carrot (Zen Healthcare IT)

- Patient Safety: Embracing Care Plans to Support IHI’s Initiative (Zynx Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Giving a patient medications in the ER, having them pop positive on a test, and then withholding further medications because…