Giving a patient medications in the ER, having them pop positive on a test, and then withholding further medications because…

News 7/22/22

Top News

The VA postpones this week’s planned Oracle Cerner go-live in Boise, ID due to system stability issues that the VA says make it unsuitable for larger-facility use. The VA has no other go-lives scheduled for 2022.

The Spokane paper obtained a document from Mann-Grandstaff VA Medical Center that lists 180 incidents of system degradation and downtime since September 2021, a far larger number than the VA has acknowledged.

Meanwhile, VA officials tell Congress that its implementation will cost $51 billion over the next 30 years, including maintenance and staffing, but it does not expect the $16 billion Cerner contract to run over budget unless the 10-year implementation timeline is extended.

HIStalk Announcements and Requests

Several COVID-careful relatives and friends have come down with the virus in the past week, some of whom have had it multiple times and all of whom were vaccinated. I think the term “pandemic” no longer applies (COVID-19 is now arguably endemic) and the coronavirus is no longer “novel” (most of us have been vaccinated, had COVID-19, or both, which has dramatically dropped hospitalization and death rates). A New York Times viewpoint predicts that by the end of 2022, 80% of the total infection count since 2020 will have happened in 2022 as new variants are popping up every few weeks. Experts predict 100,000 to 300,000 COVID-19 deaths in the US each year indefinitely as higher case counts overcome lower death rates. COVID has killed just over 1 million Americans.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Amazon will buy publicly traded primary care clinic chain One Medical for nearly $4 billion in cash, a 77% premium to ONEM’s closing share price Wednesday. The company has member-only clinics in 16 cities throughout the US. One Medical acquired Medicare-focused provider Iora Health in June 2021 for $2.1 billion. Before the acquisition announcement, One Medical shares were down 63% in the previous 12 months versus the Nasdaq’s 18% loss. Bloomberg reported on July 5 that One Medical was considering its options after CVS Health reportedly expressed interest but ultimately passed.

A CB Insights Q2 report on digital health says that the COVID-era funding boom is receding to 2019 levels, dropping 32% quarter over quarter following a 36% drop in Q1. IPO activity is nearly non-existent and SPAC exits are rare. Funding in the health IT category remained at 2021 levels, however. Telehealth cooled dramatically and digital startups that focus on reproductive health face privacy and security challenges following the Roe v. Wade decision.

Remote patient monitoring system vendor Verustat acquires One Healthcare Solution, which sells software for chronic care management, annual wellness visits, and medication reconciliation.

A recapitalization of Internet Brands values the company at $12 billion. Its health brands include WebMD, Medscape, EDoctors, and Henry Schein One.

Tech-powered online pharmacy Capsule reportedly lays off 13% of its employees.

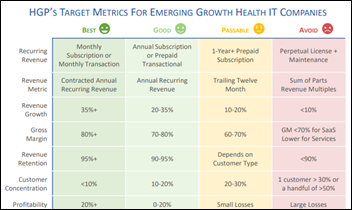

The twice-yearly health IT investment market review of Healthcare Growth Partners – the only company whose reports I study carefully — notes that an entire generation that was raised on cheap capital and climbing valuations is watching the market come to a screeching halt. It observes that while valuations are falling, they have climbed steadily since early 2018. Points:

- Valuations remain strong for high-quality companies, although investor criteria for “quality” have stiffened and emphasis has shifted from growth to profit.

- Fewer investors are buying, but available capital from premium buyers has kept valuations high.

- The cost of private debt is increasing, as lenders become cautious and raise their quality standards.

- The industry will consolidate as smaller companies that lose access to capital are acquired by incumbent competitors.

- HCP believes that multiples are nearing a bottom, but a return to post-COVID levels is unrealistic and sellers need to deal with a market that looks more like 2018-19.

- Winning sectors are likely to be supply chain management, spend analytics, contract and vendor management, lead generation, and revenue enhancement.

Sales

- MemorialCare Miller Children’s & Women’s Hospital Long Beach will implement Health Catalyst’s Twistle patient, family, and caregiver communication system in pediatric cardiology.

- Denver community mental health provider WellPower selects Augintel’s NLP solution to extract information from provider case notes.

- Prime Healthcare adds three hospitals to the surgical care team collaboration and coordination solution of RelayOne.

People

Matthew Lungren, MD, MPH (Amazon Web Services) joins Nuance/Microsoft as CMIO.

Announcements and Implementations

Apple publishes a report on its healthcare accomplishments and ambitions. Notes:

- The company’s health efforts are focused on the personal health journey of users (data storage, fitness and health features, support for third-party apps) and medical collaboration (research enrollment, making patient data available to providers, promoting health lifestyles via Apple Watch, and supporting public health and government).

- The release this fall of IOS 16 and WatchOS 9 will offer features covering 17 areas of health and fitness . These are activity, heart health, sleep, respiratory, mobility, hearing, mindfulness, education, COVID-19, handwashing, safety, women’s health, medications, research, health sharing, data visualization and insights, health records, and third-party apps.

- The Health IPhone app can store 150 types of health data and tens of thousands of App Store apps use the HealthKit API.

- The company’s work with Stanford to develop the Apple Heart Study helped it develop capabilities to allow researchers to develop medical studies at unprecedented scale.

- Healthcare systems are using Apple technology to strengthen the physician-patient relationship and to enable care from everywhere.

- Providers and insurers are integrating Apple Watch into their wellness programs.

Google Health develops a tool that can reduce the effort and cost of training machine learning systems on chest X-rays. The system, CXR Foundation, converts X-ray images to a numeric representation that allows models to be developed using smaller datasets and less computing power but with no loss of predictive quality. Another benefit is that it works with smaller datasets and allows building a solid model that accommodates underrepresented populations and rare medical conditions.

Oracle and Microsoft announce Oracle Database Service for Microsoft Azure, which allows customers to run applications across the cloud offerings of both companies.

Frederick Health (MD) goes live on Meditech Expanse Genomics in that includes First Databank’s embedded pharmacogenomic decision support, sending orders, and receiving inbound patient-matched results in full PDF form.

Government and Politics

The Justice Department seizes $500,000 from the cryptocurrency accounts of North Korean hackers, which includes ransom paid by hospitals that DOJ returned. A Kansas hospital paid $100,000 to regain access to its systems following a ransomware attack, while a Colorado provider paid $120,000. The incidents drove the federal government’s July 6 cybersecurity threat warning about North Korea-based ransomware hackers who are targeting healthcare and public health organizations.

Privacy and Security

An Atlas VPN review finds that three-fourths of Q1 malware attacks exploited Microsoft Office vulnerabilities, often because users had not applied security updates. Browser exploits are becoming rare because they keep themselves updated automatically.

Other

I’ve read some insightful comments about Amazon’s acquisition of One Medical, which I’ll summarize:

- Health systems have bought up primary care practices as a loss leader, with their real interest being forcing their owned PCPs to refer their high-profit inpatient procedure work to the health system’s acute care hospitals.

- Telehealth companies can disrupt that process only so much in the absence of offering the in-office services that patients regularly need.

- Amazon is gaining a national physical presence with the acquisition. It also gains a respected healthcare name.

- Amazon’s PCPs can focus on meeting consumer needs rather than making in-organization referrals.

- The company could also charge for its procedure gatekeeper services or bid the procedure work selectively.

- Amazon CEO Andy Jassy said in November 2021 that the company will be a “significant disruptor” with its Amazon Care virtual primary care business. Its goal was to be a one-stop shop for health-related transactions via three health arms – Amazon Care (virtual medical advice), Amazon Diagnostics (at-home testing), and Amazon Pharmacy (the former PillPack). Amazon also offers the Alexa Together caregiver support / remote patient monitoring service that runs on Echo devices.

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

As to your observation on the motivation of health system buying primary care practices to force referrals to the system, this is a continuing and concerning trend. Revenue and profit growth, not quality care, access and affordability appear to be the objectives.

We oppose single payor, government regulated care, and the AHA/AMA throw lots of lobbying dollars to ensure it doesn’t happen, but the state of US healthcare continues to deteriorate.

Who are these “we” who oppose single payer? And who apparently conflate single payer with “government regulated care”…

Revenue is vanity…Profit is sanity.

I don’t blame hospitals for using this approach. It is a game of survival at this point. Many CEOs know it is only a matter of time until their organization is absorbed by a large behemoth — the end game is preservation until retirement.

At this point, only a few have the energy to do the necessary work involved with M&A or transforming to an IDN. Although they won’t admit it, many also have no idea where to start to transform their organization.

In 10 years, we will be left with a few major players: HCA, Kaiser, Intermountain (more acquisitions to come), etc.

Of course, there will always be a place for others who specialize (Mayo, Cleveland Clinic) or have geographical circumstances that dictate their independence (rurals).

There are only so many options for growth: buy, buy, buy for leverage in negotiations, build a war chest of investment income that can keep the organization going during hard times, start a VC fund (public will cry about it).

Our healthcare system is in a state of constant, accelerating, disruptive change. This Amazon deal is a blip on the radar in the grand scheme of things. United Healthcare is years ahead…

I see the same dynamic in my organization. Most leaders don’t really want to put the time and effort into actually transformation. While the organization talks about “transformation,” most of what I see in terms of action is avoiding the core reality that the hospital financial model is collapsing with the continued migration of surgical volume to ambulatory care. Instead of proactive decisions about the size of acute care required, most of the time is spent looking for efficiencies in the back office, while they wait out the clock for an attractive merger opportunity.

One Medical does partner with regional CIN’s – I’m assuming to offer coordinated access to facilities and specialty services to their offerings so it seems there may be a preferred referral pattern – not a closed network, but still steering patients.

And when will Apple figure out not all of us live and die by phones? Why can’t I use Apple Health on an iPad? Old eyes and more real estate would be really nice.

Congratulations to One Medical! After years of losing money, (-$90M in Q1-2022, -$254M in 2021, -$89M in 2020, -$53M in 2019), and then buying Iora Health who also couldn’t make money, and being investigated by Congress for their COVID vaccine rollout, its great to see them rewarded!

One Medical patients can’t wait for their free Prime Membership and Subscribe and Save on their vitamins and supplements.

As far as I can tell over the past few years, One Medical has focused on securing agreements with IDNs and big health systems that amount to profit sharing on referrals into the system. One medical is a premium brand with a big convenience factor but I’d don’t think they’ve done much differently in their relationship with health systems. Iora was different but nothing much came of that acquisition so far.

Like I said when Amazon announced the telehealth initiative, I think there is a difference between selling consumer goods/groceries/subscriptions or being a cloud supplier vs providing and selling employee benefits. I’m a software developer and I don’t care what cloud my employer uses even though I deal with it everyday. But if there is a meeting about medical benefits, there is no way I’m missing it, even if it is just for the drama that always happens. And right now I think of One Medical as that perk Google offers employees (Google is 10% ish of One Medicals revenue?). Does your retail chain want to buy benefits from Amazon? I think no. Does Google even want to continue their relationship with One Medical? My bet is no. Meanwhile Amazon will alienate more staff at One Medical who have many other employment options – already the staffing is noticeably worse than a few years ago.