Look, I want to support the author's message, but something is holding me back. Mr. Devarakonda hasn't said anything that…

News 3/9/22

Top News

Epic announces Garden Plot, an Epic version for independent medical groups that is offered directly from Epic instead requiring a Community Connect agreement with a health system.

Epic provides the system in a software-as-a-service model that includes hosting, support, updates, and integrated third-party products.

Integrated products that are included in the offering are from Availity, Biscom, Change Healthcare, Healthwise, Intelligent Medical Objects, Iron Bridge, Lyniate, OSG Billing Services, Solarity, Sphere, Surescripts, and Wolters Kluwer.

HIStalk Announcements and Requests

I’m fast-roping into HIMSS22, arriving Monday evening and heading out early Thursday. Two days in the exhibit hall is it for me, the shortest time I’ve ever stuck around. The asterisked HIMSS21 almost convinced me to skip this year’s version entirely, but I’m like a migratory bird that can’t stay home.

I appreciate the many folks who have connected with me on LinkedIn in the past few days, some of them adding nice comments about how long and/or enjoyably they have been reading HIStalk. My only viewpoint of HIStalk is as an empty screen demanding to be filled from my frequently occupied chair, so hearing from actual humans boosts me. For those who ponder the advantages of connecting (can’t we just be ROI-free online pals?), it’s a short list:

- I’ll see your postings.

- LinkedIn will notify me when you change jobs and I will list your new gig in my “People” section if it meets my criteria, even in the absence of a an official announcement.

- You’ll be connected to thousands of like-minded people, although I confess that I don’t really use LinkedIn beyond superficially and thus I don’t really know what benefits that offers.

- You can send me messages via LinkedIn.

- You’ll make me feel more relevant, which makes me more confidently snarky if you consider that to be an HIStalk feature rather than a bug.

Speaking of LinkedIn, I keep seeing cookie-cutter messages from people who have joined Chief, so I had to look up what that’s about. I wish I had thought of its business model, which combines vanity, networking, and employer-paid expensive dues:

- It’s an investor-funded private network for C-suite females who have at least 15 years of career experience.

- The company has raised $40 million from investors.

- Annual dues are $5,000 to $9,000, usually paid for by the member’s employer.

- Chief says it has thousands of members and thousands more on the waitlist.

- It offers meetups, mentorship connections, online discussion groups, and physical clubhouses in four cities.

ViVE attendees seem to be having a ball, with most of the Twitter photo evidence being beaming party photos. Despite the fact that I’m a certified curmudgeon with a mild case of FOMO, I am glad to see people happily interacting face to face after the long COVID drought. Hopefully healthcare cost, quality, and patient experience will get at least passing attention among the glossy good times and startup salivation. I’ll also say this for the conference timing and location — it has sucked all the air out of the HIMSS22 room, made direct comparisons inevitable, and possibly consumed much of the energy of the overlapping attendees and exhibitors who will do it all over again upstate next week. I thought it was a mistake to schedule ViVE so close to HIMSS (although not as disastrous as the initial HLTH conference right after HIMSS18 in Las Vegas), but HLTH and CHIME might have been thinking more strategically.

Meanwhile, ViVE announces that its next iteration will be March 26-29, 2023 in Nashville, ending 19 days before HIMSS23 in Chicago. I hadn’t paid attention to the HIMSS23 location — HIMSS banned its home town from future conferences twice, once because of nasty exhibit hall Teamsters and once for hotels giving RSNA attendees better rates. I assume HIMSS will save some much-needed cash with the Chicago home court advantage, with a slight negative being the chance of a blizzard like at the HIMSS09 opening reception there.

Welcome to new HIStalk Platinum Sponsor Optum. Optum is a leading information and technology-enabled health services business dedicated to helping make the health system work better for everyone. With more than 190,000 people worldwide, Optum delivers intelligent, integrated solutions that help to modernize the health system and improve overall population health. Optum is part of UnitedHealth Group (NYSE:UNH). Thanks to Optum for supporting HIStalk.

Here’s a recent YouTube video that describes Optum’s provider careers.

Webinars

April 6 (Wednesday) 1 ET. “19 Massive Best Practices We’ve Learned from 4 Million Telehealth Visits.” Sponsor: Mend. Presenter: Matt McBride, MBA, founder, president, and CEO, Mend. Virtual visits have graduated from a quickly implemented technical novelty to a key healthcare strategy. The challenge now is to define how telehealth can work seamlessly with in-person visits. This webinar will address patient satisfaction, reducing no-show rates to single digits, and using technology to make telehealth easy to use and accessible for all patients. The presenter will share best practices that have been gleaned from millions of telehealth visits and how they have been incorporated into a leading telemedicine and AI-powered patient engagement platform.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Harris acquires Israel-based insurance software vendor 2Team Computers.

Former Livongo executives launch Homeward Health with a $20 million investment from General Catalyst. The startup aims to provide Medicare Advantage plan members in rural communities with primary and specialty care using local teams that provide in-person and virtual services and in-home remote patient monitoring. It is initially focusing its evidence- and value-based care model on cardiology.

Health data exchange company Consensus Cloud Solutions acquires Summit Healthcare, a health IT vendor specializing in data integration, care continuity, and workflow automation. This marks the first acquisition for Consensus, which became an independent business after parent company J2 Global split into two publicly traded companies last year.

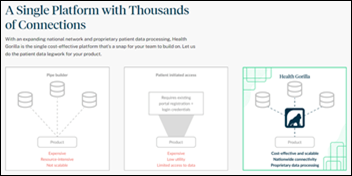

Healthcare API developer Health Gorilla raises $50 million in a Series C funding round, bringing its total raised to $80 million.

Pro Medicus co-founder and CEO Sam Hupert says that the Australian medical imaging software vendor, parent company of Visage Imaging, won’t bid for government work because of “too many gates and hoops” in the procurement process, which is led by “bureaucrats, with clinicians very much in the background. How would a bureaucrat know what makes a good clinical desktop for a radiologist?” The company recently expanded into Europe and has contracts with seven US hospitals, which provide the bulk of its revenue. Hupert and his co-founder Anthony Hall each hold nearly $1 billion worth of shares.

Sales

- The Social Security Administration’s Disability Determination Services will use Veradigm EChart Courier software from Allscripts to automate medical records retrieval.

- Johns Hopkins HealthCare Solutions will offer Glooko’s remote patient monitoring capabilities to diabetic patients who are enrolled in its Blossom diabetes management program.

- Integris Health (OK) selects population health analytics and data integration from Loopback Analytics to enhance its specialty pharmacy program.

- Northwell Health (NY) signs a 10-year agreement with Clinithink for its NLP-enabled Clix RCM technology.

- The US Defense Health Agency chooses MediQuant’s DataArk for archiving military health records as DoD transitions to Cerner.

People

ChartSpan promotes Christine Hawkins, MBA to CEO.

Stanford Health (CA) promotes Nigam Shah, PhD to the newly formed role of chief data scientist.

EHealth Technologies names Dan Torrens (ConnectiveRx) as CEO.

Virtual patient monitoring vendor AvaSure hires Adam McMullin, MBA (FDS) as CEO.

Health System Informatics promotes Stephanie Hojan to president.

Mitre hires Stephen Ondra, MD (Cygnus-AI) as chief medical adviser.

UnitedHealth Group promotes Cara Griffin to VP of marketing.

Announcements and Implementations

CloudWave announces GA of OpSus Vault, a cloud-based data storage service that is designed to protect backups from cybersecurity threats.

Tift Regional Medical Center (GA) integrates Wolters Kluwer Health’s POC Advisor sepsis monitoring software with Cerner.

Mount Desert Island Hospital and Health Centers in Maine implements Cerner.

Tausight announces a real-time detection platform to detect, track, and analyze PHI activity.

Allscripts renames its Application Store to Allscripts App Expo and opens it to all active developers with a certified solution.

Olive announces increased investment in interoperability and intelligence capabilities in its platform.

Other

I missed this a couple of weeks ago. Several states and CMS investigate Center for Covid Control, whose 242 locations tested 400,000 samples for COVID-19 using untrained workers who ignored the manufacturer’s instructions, stored and labeled specimens improperly, faked results, and told insured patients not to list their coverage on the form (they were billing the federal government for testing uninsured patients). Some patients received negative results before they were actually tested. Its associated lab – whose mailing address is a UPS store and which apparently is owned by the same couple — billed the federal government for $120 million worth of testing for uninsured people, posting “free COVID testing” signs in decrepit empty storefronts and at pop-up sites. Owners Akbar Ali Syed (35) and his wife Aleya Siyak (29) put the company together quickly in 2020 after operating a wedding photo business, a doughnut shop, and an axe-throwing lounge. They bought a $1.36 million mansion, a $3.7 million Ferrari, and several Lamborghinis. I suspect the already ample amount of healthcare fraud has been increased dramatically by the government’s frantic attempts to manage the pandemic using poorly vetted contractors and vendors.

Sponsor Updates

- Clearsense sponsors a pre-ViVE2022 golf tournament that has raised $42,000 for the CHIME Opioid Task Force.

- AGS Health and Clearwater achieve Cybersecurity Transparent certification through a voluntary risk assessment process and program from Censinet and KLAS.

- Baker Tilly will exhibit at the 34th Annual Roth Conference March 13-15 in Dana Point, CA.

- Bluestream Health helps long-time partner MedStar Health deliver more than 1.5 million telehealth encounters during the pandemic.

- Ellkay partners with Astrata to help health plans improve quality measurement.

- Current Health expands its support for chronic care management by adding new features to its platform, including access to more integrated, third-party devices; a single platform across all populations; and new communication tools.

- Lumeon appoints former Partners, Cerner, and Siemens executive John Glaser to its board.

Blog Posts

- ViVE 2022 – Our obligation to caregivers and patients (Cerner)

- Healthcare IT Service Desk: Automation Strategies (CereCore)

- Common Prior Authorization Hurdles and How to Overcome Them (CoverMyMeds)

- Take the Worry Out of Healthcare Cloud Migration with CTG’s Cloud Solutions (CTG)

- International Women’s Day: Gender Equity in Healthcare (Optimum Healthcare IT)

- 3 Ways That Healow Pay Helped a Growing Primary Care Practice (EClinicalWorks)

- 6 strategies on how to increase outpatient revenue (Experian Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

The Chief business model isn’t “new.” Men’s organizations like this have existed for centuries. The only thing that’s new about Chief is that it’s women-centric. I like the thought that experienced women might help each other network and climb the ladder, just like men have done on the golf course. If you think Chief is expensive, you should check out Country Club dues.

I find it striking that you think this is a vanity project, as opposed to a response to the status quo. It’s also interesting to me that you posted this criticism of a women’s organization on International Women’s Day.

Not a criticism, just an observation that LinkedIn is suddenly full of messages from people who are announcing getting in to an investor-backed professional group. Maybe they scaled up selection in conjunction with International Women’s Day. Good for company and members alike if they serve a market need.

When is international men’s day?

5 seconds of Google told me it’s November 19.

Also, just about the entire rest of the year if we’re being honest with ourselves.

True, but it’s a scam when the country clubs do it too. Country clubs are less about the services they provide and more about who they provide it to. Thus members get to see and be seen by the “right” people. You pay for that access, and overpaying is proof that you too are a “right” person.

“Chief says it has thousands of members and thousands more on the waitlist.” A waitlist? So Chief is waiting to be paid thousands of dollars per member?!

Two words: Artificial scarcity.

There is no other reason I can think of to do this.

Vanity must be a driver if people feel the need to brag about being “accepted” on social media.

Very curious to see where Epic lands with pricing for GardenPlot, will be interesting to see how they compare to eCW, Athena, and Nextgen which are really the only three vendors playing in the large independent space currently.

Hasn’t Epic tried to make this product before? For hospitals it was called like Land Rover or something. The problem is Epics organization isn’t set up for this. They can bang their head on it all they want, it seems like they’re mostly getting headache.

Aren’t they also cannibalizing their own customers? Part of the value add for a major health system purchasing Epic is the increased footprint growth you get from extending your system out to all your local onsie twosie docs. Now those same docs won’t need to sign potentially lucrative community connect agreements with you and bind themselves to your organization, but can get it directly from the mothership. I wonder how new Epic clients itching to extend thier system, feel about this announcement. Granted, it may not matter anyway. What choice do big health systems have these days.

Frankly I’d rather Epic do more to help independents remain independent (but with fluid chart exchange through Care Everywhere). AFAIK Consolidation in the healthcare industry has not produced measurable benefits for health outcomes or patient costs, but it has certainly helped with profits for the large systems.

Indeed. My guess is large independents want an EHR that is a simple, cost efficient billing machine. They don’t want to take on a lot of overhead and their providers want a UI that they can use very quickly.

I would guess there is a high deferential in charting speed going from Allscripts to Epic vs going from Athena or Nextgen to Epic. As an independent practice provider, you don’t chart that much faster in Epic than you do in Athena. As an affiliated practice, providers chart so slow in Allscripts or even Cerner compared to Epic. That’s in part because those EHRs have tacked on features in an incoherent way that drags down the UI and also because the health systems have been empowered to jam so many process hurdles into the providers workflow. While if you run Ecw, you tend to install it with the minimum amount of extra clicks and leave it alone so as to not waste provider’s time.

With Epic you get a laundry list of options for someone to sort through. Then you also have to hire people to tend to the software in the labor intensive ways that Epic doesn’t want to take on. Epic actually can’t take them on, because their labor structure is pay above market rate to Boy Scout type college grads until they get bored and leave. But that labor intensive work is boring and low margin and there’s a huge amount of it. You can’t dump it all on a smart college grad and reliably get it done. Theyll train for three months, do 9 months of work and then walk at the end of the first year instead of the second or third. You need to make a process for it, keep a good eye on that process, get an adult hiring pipeline set up, get some good line managers that won’t peeve off the employees, keep pay reasonable but efficient, and let your people disconnect from their 9-5 job so they can enjoy their real life. That’s the total opposite of Epics culture.

On a side note, I’ve watched some long time users chart in the green screen Meditech. They’re so fast. They don’t lift their hands off the keyboard and they have the exact timing of when Meditech loads the next screen. I think of them every time I’m working on some feature that I know is going to get engrained in business users hands. If I can get it to no clicks then they’ll be able to work as fast as I can load the next screen, so it better be fast.

Yes – but you’re conflating 2 different things.

Garden Plot was announced at a UGM a couple of years ago. You’re thinking of “All Terrain” which was an “install methodology” for new customers – that language has mostly been dropped.

Is Garden Plot similar to the software suite that Epic had been pursuing with that partnership with Philips back in the aughts? My recollection was that the partnership ended, but I imagine it created some level of foundation for Garden Plot

It reminds me more of Sonnet but it uses Epic’s hosting capabilities. Hosting by Epic did not exist back then. My understanding was that the Philips partnership was targeted at Europe and integration with Philips’ Medical Equipment.

Oh that Philips Epic deal takes me back. The orig agreement was for all outside of US and all sub-200 bed hospitals in the US. But Judy saw those Dutch yokels coming a mile off. The terms gave basically all the control and all the revenue to Epic and when the grown ups back in Amsterdam looked at what their HIT folks had signed up for they discovered that there was no way they could make any money of it. I think they paid the break up fee which was 8 figures and the first one wasn’t 1 or 2…. and now nearly 20 years later Epic is in lots of foreign markets and building a scaled down version itself.

I’ve heard a lot of these just so stories that Epic tells itself. Like Epic won everything, they’re making the real money from things, they’re smarter than the other “yokels”, etc. It’s like how people talk about that time their high school basketball team almost went to state. Community pride is a good thing, but mixing that same sort of pride with a corporation is another. It’s weird to see and I’m not sure it’s long term healthy.

@Ianal Maybe those Dutchies aren’t yokels but I was in an outside group working for Philips corporate at the time and there was no doubt that Philips IT didn’t understand what they were signing up for…

Replying to the subthread I started and updating my pen name, since it was more about how I was feeling at the time of writing.

My curiosity about the Philips partnership came from a recollection it involved making software available to organizations that used devices by Philips. This would’ve made it possible to reach smaller organizations that were much harder to reach back then. A lot of vendors have all been working to reach those smaller sites in various ways. Epic has been moving the needle a lot in the intervening years in entering that market. As Mr. H alludes to, though, that’s largely been in sync with the trend of the big systems absorbing yet more smaller practices.

Decades ago, before my career in IT, I’d worked with smaller physician offices that never would have been able to afford today’s big systems. If Garden Plot allows those kinds of offices to afford one of those vendors and stay independent, I think it’s exactly what the industry needs to keep independent practices. Though it’s undoubtedly a largely new product, you also read stories about other companies where an earlier project that didn’t go as first envisioned lays some tracks for something big later (think about Apple, and Lisa feeding into the Macintosh). I think it’s interesting if there’s a similar arc with Garden Plot.