Apple legacy? Seems I heard that before. Say around 1997. Jobs put out a 15 min video where a guy…

Monday Morning Update 11/8/21

Top News

From the Allscripts earnings call, following the announcement of quarterly results that beat earnings expectations but fell short on revenue:

- CEO Paul Black says that NIH has extended its contract for Sunrise for another five years.

- Veradigm revenue grew 10% year over year.

- The company admits being frustrated that Allscripts “stock is cheap” compared to companies that enjoy high multiples while operating businesses similar to Veradigm.

- The core clinical and financial solutions business has seen some shrinking, part of that intentional in focusing on higher-quality clients, but also because of the tail end of a bolus of larger academic medical centers and clients going in a different direction.

- Allscripts believes that non-US opportunities are “a more level playing field” even though those wins are hard to predict because they are mostly public sector clients with inconsistent deal times.

- The company sold 2bPrecise at a small gain in August, taking a non-controlling stake in the combined entity instead of cash.

- Allscripts expects to see managed services opportunities as clients deal with wage inflation and sending teams such as revenue cycle management to work from home, where they could just as easily be someone else’s employee.

HIStalk Announcements and Requests

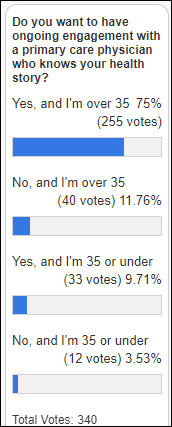

An overall 85% of poll respondents seek ongoing engagement with a PCP, with a slightly higher percentage of over-35s looking for that kind of relationship. David says he wants ongoing engagement, but not ongoing disengagement where he sees the same doctor who never remembers much about him, while Kathy fears the “too many cooks” problem because whatever doctor was available to see her changed her treatment plan.

New poll to your right or here: How do you most often communicate in one-to-one work-related meetings? I’m curious because I do interviews via a conference line where I can record the call, and sometimes surprises people who have learned to spend their entire workday on video calls with cameras on. I say use video for one-on-one calls only if the value it adds exceeds the mental strain of being on camera, and I don’t know of many examples where that’s the case unless documents are being reviewed.

Webinars

November 9 (Tuesday) noon ET. “The Next Generation of Identity Resolution in Healthcare.” Sponsor: Verato. Presenters: J.P. Lugo, solution architect, Verato; Nick Orser, solution architect, Verato. This webinar will provide an overview of person-matching in healthcare, how challenges can be overcome with Verato Referential Matching, and how person-matching technology can support Customer 360, marketing, analytics, IT, and more.

November 10 (Wednesday) 1 ET. “Too Important to Fail: How to Bring Better AI to Healthcare.” Sponsor: Intelligent Medical Objects. Presenters: Dale Sanders, chief strategy officer, IMO; Marc d. Paradis, VP of data strategy, Northwell Health. It’s relatively easy to obtain healthcare data and build an AI demo, but getting AI to perform reliably and with meaningful impact is much harder. However, strategies exist for delivering AI products to commercial markets. This fireside chat will review the status of AI in healthcare; discuss the vital importance of data quality, methodological rigor, and product focus; and explore what this means to the startup and investor world.

November 11 (Thursday) 1 ET. “Increasing OR Profitability: It May Be Easier than you Think.” Sponsor: Copient Health. Presenters: Michael Burke, co-founder and CEO, Copient Health; David Berger, MD, MHCM, CEO, University Hospital of Brooklyn at State University of New York Downstate Health Sciences University. The OR is a hospital’s biggest source of revenue and its costliest resource, yet it often sits idle because of unfilled block time even as providers with cases ready to book lack access. AI-powered emerging technologies can help fill unused OR time and provide decision support to structure workflows and optimize block allocation. This webinar explores the biggest challenges to profitability faced in the OR and the fastest, most impactful changes a hospital can make to address them.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Spok reports Q3 results: revenue down 5%, EPS –$0.13 versus $0.16

Early-stage investor Colin Keeley provides a fascinating analysis of Canada-based software giant Constellation Software and its reclusive billionaire founder Mark Leonard. The company’s Harris unit contains a long list of acquired health IT vendors, such as Amazing Charts, QuadraMed, IMDSoft, Iatric Systems, Obix Perinatal Data System, and Picis. Interesting observations:

- The company has acquired more than 500 vertical market software companies and has sold only one of those (in the early days, which Leonard regrets).

- The company was launched in 1995 with the equivalent of $33 million 2021 US dollars. Its has grown at 30% per year to a publicly traded market cap of $31 billion.

- Leonard started the company as a former venture capital operator who was frustrated that VCs were interested only in companies that have a large addressable market. He saw many businesses that were in niche spaces that generated high margins from recurring sales of mission-critical software. Constellation bought many of its companies directly from their founders.

- Acquisition criteria include a mid- to large-sized vertical market software company with consistent earnings and growth, committed management, and an offering price that has already been determined. The average acquisition price ranges from $2 to $5 million, although the company has done bigger deals and says it will continue to do so. They also prefer companies that have low capital investment requirements just in case they need to weather a business downturn.

- The company reportedly made 90 small acquisitions in 2020 alone.

- One analyst estimates that Constellation acquires at a price of just 0.8 times annual sales, which is far below market.

- Constellation leaves the management team of its acquisitions in place, supporting them with best practices and company-wide performance data.

- The company says it offers its business unit managers autonomy, the ability to scale, and an environment in which rules are few and the focus is making the pie bigger, not fighting over how to divide it.

- Constellation believes that growing companies create inefficiency by adding layers of management. They prefer that the original manager keep most of the business but then spin off a new business unit under a groomed protégé who can start with a blank slate and focus on customers.

- All employees are given an explicit career path in which they first learn their particular vertical market, then transition into a leader of people who can run their own business unit. Leonard says, “Become a master Craftsman in the art of managing your VMS business. It is the most satisfying job in Constellation and will generate more than enough wealth for you to live very comfortably and provide for your family. For those whose ambition exceeds their good sense, we have a role that we call a Player/Coach. A Player/Coach continues to run their BU, but ambition drives them to acquire a sizable business, usually in another geography or another vertical “

- The company’s bonus plan requires long-term investment in its shares, which has created several hundred employee millionaires.

Sales

- CyncHealth selects Nuance PowerShare for accessing and sharing diagnostic imaging and reports and to alert ED physicians of prior studies.

- Advanced Pain Care (TX) chooses Athenahealth.

People

The White House nominates Kurt DelBene, MS, MBA (Microsoft) as VA assistant secretary and CIO.

Jeffrey Brown, PhD (Harvard Medical School) joins TriNetX as chief science officer.

Walmart reportedly hires David Carmouche, MD (Ochsner Health) as SVP of its Omnichannel Care Solutions business that includes services that range from primary care to digital medicine and telehealth.

Announcements and Implementations

Nuance collaborates with Collective Medical to launch Nuance PowerShare Image Aware, which alerts ED physicians of prior radiology studies.

Redox announces a solution that enables payers to meet the CMS Interoperability and Patient Access final rule requirements.

Other

The Physician Network Advantage files a lawsuit against Santé Health Systems (CA) and related entities, which the EHR support company says failed to pay $1.5 million for Epic support. Santé says its agreement with PNA called for payment only as funded by grant funding and it notified PNA in September 2020 that the funding would be ending.

The National Nurses Union says its members are “horrified” at Kaiser Permanente’s pilot project for remote patient monitoring, saying it undermines the role of nurses, places the burden of work on family members, leaves patients far away from other services they usually need, and is intended to boost Kaiser’s profits by lowering costs while being paid by CMS at in-hospital rates under COVID-19 waivers for telemedicine.

Sponsor Updates

- The highest-rated HIStalk Sponsor vendors according to the FeaturedCustomers Fall 2021 Hospital Communications Software Customer Success Report include Market Leaders Change Healthcare, Imprivata, Spok, and Vocera; and Top Performers Halo Health and PerfectServe.

- Wolters Kluwer Health VP & GM Vikram Savkar joins The International Association for Scientific, Technical, and Medical Publishers’ Board of Directors.

- HCI Group publishes a new remote patient monitoring case study featuring Integris Health.

- RCxRules partners with AAPC to deliver an end-to-end physician risk adjustment coding managed service.

- OptimizeRx publishes a new report, “Multiple Sclerosis: Understanding Treatment Barriers and Market Fragmentation.”

- PerfectServe publishes a new customer success story, “Ridgeview Rehab Specialties department reduces no-show rate by 12.6% with automated text messages to patients.”

- Surescripts announces that its Real-Time Prescription Benefit has 550,000 prescriber users and processed 300 million real-time prescription benefit checks in the first nine months of 2021.

- Premier wins an NC Tech Awards winner for the innovative use of technology in the Analytics and Big Data category.

- The Outcomes Rocket Podcast features RxRevu CEO Kyle Kiser, “Enabling Lower-Cost Prescribing at the Point-of-Care.”

- TransformativeMed names Jason Larson (Care.ai) VP of sales.

Blog Posts

- Integris Health’s Rapid Response Remote Patient Monitoring (RPM) Program Built on ‘HealthNxt’ Recognized at CHIME21 (HCI Group)

- ICYMI: Elements of Effective Crisis Management (Netsmart)

- Unpopular opinion: Social distancing is the best thing to happen to EHR training (Nordic)

- Can AI Improve Patient Safety? (Symplr)

- How Providers Are Using Data to Determine Drugs’ Appropriate Use (Premier)

- Celebrating 10k PowerShare sites: 10 ways patients and providers are sharing without boundaries (Nuance)

- Fifteen Years: Guarding Data then, now, always (Spirion)

- Healthcare organizations must reimagine the patient experience to thrive (Talkdesk)

- System Change is at the Heart of Well-Being (Vocera)

- Post-Discharge Programs Vital to Good Patient Outcomes (Well Health)

- How to Overcome the Challenges of Integrating EMS Systems (Zen Healthcare IT)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

RE: Nurses Union Upset with Kaiser. Ask the patients if they prefer recovering in the comforts of their own home versus in a hospital bed. I doubt Kaiser is forcing anyone to do this. Demand for this type of thing is strong.

I don’t think anyone would begrudge patients recovering in the comfort of their own home, if it’s safe and people there can provide needed observation and care, 24 x 7 if necessary.

There’s an historical lack of understanding – and undervaluing – of RN role, processes, critical thinking) by CFOs and HIT vendors. CFOs for decades took the easy road in downsizing RN staff to optimize profits. Current industry leading EMRs have improved buy were poorly designed for nursing. MU saw RNs as data collectors for MDs, and task masters.

Kaiser RNs appear to be speaking about higher risk and/or higher acuity patients whose care is not replicable by home lay caretakers with monitors sending numbers to call centers. We know vital sign changes are late indicators, and technology reliability is always an issue. Reduction in RN labor budgets may be gain for CFOs but could be a nightmare – and deadly – for patients if taken to extremes.