"A valid concern..." Oh please. Everyone picks the software they like and the origin of that software is an afterthought.…

Monday Morning Update 8/2/21

Top News

Cerner announces Q2 results: revenue up 10%, adjusted EPS $0.80 versus $0.63, exceeding analyst expectations for both.

From the earnings call:

- The company is increasing its earnings outlook for the year.

- DoD is live at 42 commands and 663 locations with 41,000 activated users. The Coast Guard’s deployment will be completed this year.

- Cerner says the results of the VA’s strategic review focused on governance, training, and readiness rather than Cerner-caused problems, consistent with the findings of an internal assessment that Cerner conducted earlier this year. It also notes that the DoD’s initial go-live resulted in similar required work in the 12 months following.

- The search for a CEO replacement for Brent Shafer continues and “has been very active.”

- The company continues to look for acquisitions that enhance Cerner’s competitive position, exceeds its cost of capital, is accretive over time, and creates shareholder value. Areas being considered cybersecurity, technology to support provider networks operating in both fee-for-service and fee-for value arrangements, and data.

- Cerner will continue selling unneeded office space that represents half of its owned property.

- The company laid off 500 employees in the quarter and eliminated 300 open positions, which will deliver $70 million in annualized savings.

- Asked by an analyst about Amazon’s HealthLake announcement, Travis Dalton said, “There’s a long history of big cap entry and big cap exit from healthcare. There’s an inherent complexity at the intersection of healthcare and IT. I see market interest in areas that we’re focused on is very validating of the growth opportunity that exists.” He added that healthcare data is dirty and requires normalization around Master Data Management.

- Cerner expects to have 80 provider organizations selling data to life sciences via its Learning Health Network by the end of the year.

Reader Comments

From Ephraim: “Re: news items. How many readers click to the announcement or story you link to?” I don’t track those clicks, but I will say that if I’ve done my job well in summarizing the news item, most readers won’t need to click over. I only run items that I consider newsworthy (which excludes probably 95% of industry PR), so I expect that many readers get the gist (the company, the person, or whatever the item relates to) without actually clicking anything. My experience with Twitter is similar – most people skim the tweet but don’t click to learn more.

From Yes Sars: “Re: COVID-19. Time to start up your COVID-19 news section again?” Maybe, if readers want me to. I thought pandemic doom scrolling was behind us given availability of an effective, safe, and free vaccine, but here we are again with overcrowded hospitals.

HIStalk Announcements and Requests

Jenn put together our HIMSS21 guide (PDF version), which includes the participation information of those of my sponsors that submitted it.

I’ve heard from maybe three tiny companies that they have decided to join Medicomp and Olive in cancelling their HIMSS21 exhibitor plans. The exhibitor count has dropped by only three in the past few days, although that might be questionably useful information unless those companies notify HIMSS and they are removed from the exhibitor list quickly. I will play Las Vegas bookmaker and place the odds at 70% that the conference will go on and will increase those odds to 95% if HIMSS doesn’t cancel it Monday. Not much else could go wrong unless Las Vegas cracks down in ways that would be hard to fathom given its historical focus on protecting tourism revenue. I assume HIMSS won’t refund attendee registration fees under any circumstances since they cover both the in-person and virtual version and the latter allows checking the box as delivered, but exhibitor fees that also include rolled-over HIMSS20 credits would be hit hard if the exhibit hall is cancelled. I would cancel my own attendance except I think readers have a strong interest in living it vicariously.

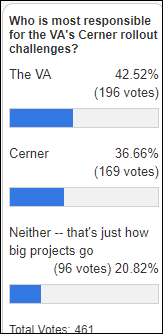

It’s a fairly even poll respondent split of who is most responsible for the VA’s Cerner rollout issues. My take: nearly all of the misfires were by the VA, which has a long history of struggling to successfully complete projects, but perhaps compounding the issue is Cerner acting as its own prime contractor. The question is whether Cerner told the VA about the training, infrastructure, budgeting, and support issues and nothing was done, or if Cerner drew a box around what it considered as its responsibility and let VA worry about the rest. Epic’s implementation approach would have put problems front and center, but that doesn’t mean that VA would be as obedient to fix them compared to a health system with hundreds of millions of dollars on the line. DoD seems to be doing pretty well with its Cerner rollouts and using Cerner’s services successfully, or at least we aren’t hearing as much about any problems.

New poll to your right or here: Would you as a patient be OK with having contact with a masked health system employee who hasn’t received COVID-19 vaccine?

Webinars

On-Demand Webinars:

“Key Differences: Value Based Care vs. Fee-For-Service.” Part 1 of a three-part series. Sponsor: Net Health. Presenters: Bill Winkenwerder, MD, chairman, CitiusTech; Josh Pickus, CEO, Net Health. Dr. Bill Winkenwerder, former assistant secretary of defense for health affairs for the US Department of Defense, shares his unique perspective on the future of value-based care (VBC) systems in the public sector and how VBC differs from fee-for-service models in the private sector. This Part 1 webinar covers which aspects of the fee-for-service health system payment model look the most different compared to fully value-based systems (clinical, back-office, analytics, etc.)

“Current Innovation and Development in Value-Based Care.” Part 2 of a three-part series. Sponsor: Net Health. Presenters: Bill Winkenwerder, MD, chairman, CitiusTech; Josh Pickus, CEO, Net Health. Dr. Bill Winkenwerder, former assistant secretary of defense for health affairs for the US Department of Defense, shares his unique perspective on the future of value-based care (VBC) systems in the public sector and how VBC differs from fee-for-service models in the private sector. This Part 2 webinar discusses what health systems should know about the transition to value-based care, including macro versus micro shifts.

“Future of Value-Based Care: Predictive Analytics, Technology, Policy.” Part 3 of a three-part series. Sponsor: Net Health. Presenters: Bill Winkenwerder, MD, chairman, CitiusTech; Josh Pickus, CEO, Net Health. Dr. Bill Winkenwerder, former assistant secretary of defense for health affairs for the US Department of Defense, shares his unique perspective on the future of value-based care (VBC) systems in the public sector and how VBC differs from fee-for-service models in the private sector. This Part 3 webinar discusses the role analytics will play in the shift to value-based care and how financial and clinical ROIs for analytics-oriented products must differ when applied to FFS and VBC models.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

WellSky will acquire Healthify, which connects providers with community-based social services organizations to address social determinants of health of patients. Terms were not disclosed. Healthify had raised $26 million, including $16 million in a Series B round in November 2019.

Handheld ultrasound and medical imaging vendor Exo raises $220 million in Series C funding.

A newspaper in Ireland says that Amwell paid $250 million for Ireland-based SilverCloud Health and $70 million for Conversa Health in the combined acquisition that was announced only at a total of $320 million. The companies had raised $26 million and $34 million respectively and have $15 million in combined annual revenue, meaning Amwell paid 21 times revenue.

Vocera announces Q2 results: revenue up 19%, adjusted EPS $0.15 versus $0.08, beating Wall Street expectations for both. From the earnings call: the company had six sales of more than $1 million in the quarter and follows its largest sale ever to Providence in Q1. VCRA shares are up 36% in the past 12 months, valuing the company at $1.4 billion.

Spok announces Q2 results: revenue flat, EPS –$0.04 versus $0.20.

Sales

- Health and Social Care Northern Ireland will implement First Databank’s Multilex to provide e-prescribing decision support within Epic.

People

Guthrie promotes Terri Counts, MHA, RN to SVP/CIO.

Other

MIT Technology Review notes that AI tools that were supposed to help hospitals diagnose or triage COVID-19 patients didn’t accomplish anything, though a few turned out to be harmful. Significant problems included the use of quickly published and low quality data, researchers using data whose provenance wasn’t considered, and showing falsely accurate results by testing systems on the same data they were trained on. One system was trained on chest scans that the researcher didn’t know were limited to children, and instead of the system learning to recognize COVID versus non-COVID patients, it simply learned to recognize that the image was that of a child. Another issue is that researchers can’t make a name for themselves by validating or improving existing models, so they create new models that incorporate all the mistakes that were made by previous researchers.

Epic will require all of its US-based employees to be fully vaccinated by October 1. The company says that nearly 97% of its Verona-based staff already meet that requirement. Epic will require masks for meetings if the room occupancy is 75% or more or if any attendee voices a preference that masks be worn.

Ozarks Healthcare (MO) posts a video of CMIO Priscilla Frase, MD describing how some patients are wearing disguises and pleading anonymity when coming in for COVID-19 vaccine over concerns about the negative reaction of their friends, family, and co-workers.

Sponsor Updates

- The AI in Action Podcast features OptimizeRx VP of Data and Products Adam Almozlino.

- Spok announces that all 20 adult hospitals and all 10 children’s hospitals named to US News & World Report’s 2021-22 Best Hospitals Honor Roll use Spok’s secure healthcare communication solutions.

- Health Catalyst CFO Bryan Hunt will present during the Canaccord Genuity Growth Stock Conference August 11.

- CareSignal is included in a CHCF case study of engagement results at Axis Community Health.

Blog Posts

- Solving the issues Part 3: Purpose-built workflow – Moving beyond the worklist (Nuance)

- Creating Opportunities in Huma Services: Two Insiders’ View (Netsmart)

- Closing Gaps in Care: 3 Simple Methods for Providers (PatientBond)

- How Organizations in the Retail, Healthcare, and Financial Services Industries are Pioneering Customer Experience (Avtex)

- Providers Take Note: Huron Perth Embraces Electronic Documentation Tools and Processes (PatientKeeper)

- Emergency Departments, Substance Use Disorders, and Federal Laws (PatientPing)

- 4 Revenue Cycle Transformations to Watch in 2021-2022 (Pivot Point Consulting)

- Epic User Settings Deep Dive (ReMedi Health Solutions)

- Advice from one of the world’s largest digital pathology implementations (Sectra)

- 2022 PFS Proposed Rule Part 3: APP, Advanced APM and MSSP Proposal (Impact Advisors)

- 10 Lessons Learned after over a Million Telemedicine Consults (SOC Telemed)

- What to know about automated compliance tools (Spirion)

- Becoming great: 5 common characteristics of the best hospitals (Spok)

- Patient video education has a new dynamic duo: The Wellness Network joins Krames in WebMD’s push to deepen patient engagement services (Krames)

- The Cost of an EHR Downtime (Summit Healthcare)

- 5 ways to optimize call abandonment rate (Talkdesk)

- The Next Mile: A Blueprint for Addressing Vaccine Hesitancy (Upfront Healthcare)

- Celebrating Sys Admins for Daily Contributions That Elevate Healthcare (Vocera)

- 5 success strategies every Federally Qualified Health Center needs to know (Waystar)

- 5 Things Bad Rehab Therapy Clinic Managers Say (WebPT)

- Well ChatAssist AI: AI-Enabled Conversations for Healthcare (Well Health)

- 4 ways payers are using clinical data to address COVID-19 challenges (Wolters Kluwer Health)

- Addressing Social Determinants of Health through Functional Design and Human Touch (VitalTech)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

RE: “Time to start up your COVID-19 news section again?”

Given that so many hospitals and health systems are starting to mandate Covid vaccinations as a requirement for continued employment, I am curious how this is playing out for your readers. In my neck of the woods, I think most of the organizations are on board with this now. They are also anticipating some loss of employees.

My personal feeling is that maybe these unvaccinated staff are in the wrong line of work if they still don’t understand that this is a public health emergency and personal rights need to take a back seat to personal responsibility for achieving the greater good.

“Time to start up your COVID-19 news section again?”

Yes. Yes, you should.