Today's post contains the phoenixes rising from the ashes of the post COVID telehealth era. There's two things that destroy…

News 6/9/21

Top News

Scotland-based RCM vendor Craneware will acquire Sentry Data Systems, a Florida-based hospital pharmacy procurement, revenue cycle, and compliance solutions business, for $400 million.

Sentry offers software and services that support health system 340B drug purchasing programs.

Reader Comments

From Little Wing: “Re: software. I’m looking for a company that develops AI-based applications that a local government could use to track and report on the treatment and care for abused children in the social services program.” Readers, suggest a company from your experience and I’ll forward the information.

HIStalk Announcements and Requests

Welcome to new HIStalk Platinum Sponsor Azara Healthcare. The Burlington, MA-based company is the leading provider of data-driven analytics, quality measurement, and reporting for the Community Health and physician practice market. Azara solutions empower more than 1,000 Community Health Centers, physician practices, Primary Care Associations, Health Center Controlled Networks, and clinically integrated networks in 36 states to improve the quality and efficiency of care for more than 25 million Americans through actionable data. Specific products include data reporting and analytics; care management; patient outreach; MIPS and APMs management and reporting; patient registry and population health; and the FHIRstation interoperability platform. Recent company news includes its merger with the population health division of SPH Analytics and its #1 Black Book ranking in end-to-end population health vendors, best-of-breed provider technology. Thanks to Azara Healthcare for supporting HIStalk.

I’m required to occasionally purge inactive email subscribers from the HIStalk Updates list. You might want to enter your email address again just to make sure you didn’t fall off the list inappropriately (you won’t get duplicate emails regardless). Signing up for no-spam email updates is the secret weapon of more than a few industry leaders who are driven to be the first to know.

Webinars

June 24 (Thursday) 2 ET: “Peer-to-Peer Panel: Creating a Better Healthcare Experience in the Post-Pandemic Era.” Sponsor: Avtex. Presenters: Mike Pietig, VP of healthcare, Avtex; Matt Durski, director of healthcare patient and member experience, Avtex; Patrick Tuttle, COO, Delta Dental of Kansas; Chad Thorpe, care ambassador, DispatchHealth. The live panel will review the findings of a May 2021 survey about which factors are most important to patients and members who are interacting with healthcare organizations. The panel will provide actionable strategies to improve patient and member engagement and retention, recover revenue, and implement solutions that reduce friction across multiple channels to prioritize care and outreach.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

At-home testing company LetsGetChecked raises $150 million in a Series D funding round, increasing its total to $260 million.

San Francisco-based primary and urgent care company Carbon Health marks its first foray into chronic condition management with the acquisition of digital diabetes clinic Steady Health. Carbon Health hopes to have 1,500 clinics across the country within the next four years. It operates 70 clinics in 13 states and offers virtual care in select locations.

Membership-based primary care company One Medical will acquire Iora Health, which offers similar services for seniors, for $2.1 billion. Iora Health co-founder and CEO Rushika Fernandopulle, MD will become One Medical’s chief innovation officer.

Mendel will use an $18 million Series A funding round to further scale technology that uses AI to make sense of unstructured health data from health records and medical literature. The startup markets its services to healthcare organizations that are looking for analytics-ready data.

Sales

- Gillette Children’s Specialty Healthcare (MN) will implement Infor’s CloudSuite Healthcare software with assistance from Bails & Associates.

- Twin County Regional Healthcare (VA) will offer telecardiology services from Access Physicians, a division of SOC Telemed.

- Together Women’s Health (MI) selects Emerge’s ChartGenie, ChartScout, and ChartPop data conversion and integration tools to help two of its member practices transition to Athenahealth.

- UMass Memorial Health will power its new Hospital at Home program with Current Health’s remote care management technology.

- South Texas Physician Alliance selects LeadingReach for referral management and care coordination.

People

Erich Huang MD, PhD (Duke Health) joins Onduo as chief scientific and innovation officer.

HealthTrust promotes Michael Seestedt to CIO.

CitiusTech names Bhaskar Sambasivan (Eversana) president.

Hospital supply chain, analytics, and interoperability solutions vendor SCWorx promotes Tim Hannibal to CEO.

Conversational AI vendor Orbita hires Patty Riskind, MBA (Qualtrics) as CEO.

Announcements and Implementations

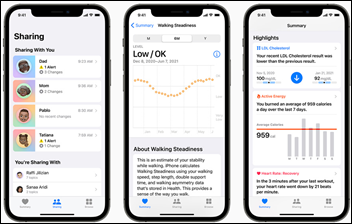

Apple adds new health-related functionality to IOS 15, including the ability to share health and wellness data from its Health app, new trending tools for health measures and goals, a Walking Steadiness measure, improved lab results display, and the option to store immunization and test results directly in the Health app. Apple Watch adds a measure of respiratory rate during sleep and a new Mindfulness app. Cerner announced that it will support the enhancements in the fall.

Wolters Kluwer Health releases telehealth-specific Health Language value sets for use in claims processing, care coordination, and benefits systems.

Jvion develops a Behavioral Health Vulnerability Map to help providers better address conditions that contribute to mental illness.

Augusta Health works with care and social services coordination software vendor Unite Us to develop Unite Virginia, a tech-enabled care coordination network for healthcare and social services providers.

Seven hospitals in Ontario will go live on a shared Epic system in December.

MUSC Health (SC) implements Etiometry’s clinical decision support software in its cardiovascular ICU, with an eye to also installing it in the OR.

KLAS distills its information on each of the four major health system EHR vendors into individual “Complete Look” reports, which conclude:

- Allscripts — C- in product, C- in loyalty, 18% of customers report deep interoperability as adoption of DbMotion wanes. Sunrise has 4% of US hospital beds. Sunrise is an integrated, highly customizable platform, but Sunrise Ambulatory Care and Sunrise Financial Manager are not widely used. For transformational technology, significant interface maintenance is required since each system has its own database.

- Cerner — C in product, C+ in loyalty, 28% of customers report deep interoperability as customers benefit from its CommonWell connection. Millennium has 25% of US hospital beds. Cerner offers a broad Millennium suite that reduces third-party integration and is proven in both large and small organizations, but patient accounting is a weakness and the company’s less-prescriptive implementations lead to variability in customer success.

- Epic — B+ in product, A in loyalty, 63% of customers report deep interoperability with Care Everywhere and its connection to Carequality. Epic has 42% of US hospital beds. The company’s fully integrated suite has topped all software suites for 11 years running, is proven in big health systems, and offers a widely used patient portal and population health management solution, although it has a high upfront cost and some modules require in-house expertise to build.

- Meditech — B+ in product, A- in loyalty, 10% of customers report deep interoperability as most customers use point-to-point interfaces or HIEs, although its CommonWell connection is used by some early adopters. Expanse has 4% of US hospital beds. Meditech offers consistent development on Expanse, integrated offerings, and affordability that has made it the leading product for community hospitals, but Expanse costs more than the company’s legacy solutions and larger health systems have been historically hesitant to choose it.

Other

Teladoc sues Avail – which offers an audio-visual platform that supports surgery collaboration, consultation, and education – for infringing on three of its patents.

Amazon offers Prime customers a six-month supply of some common prescription medications for $6 with free two-day delivery.

Two universities – one a non-profit, the other a for-profit – are vying to give Montana its first medical school. Colorado-based Rocky Vista University College of Osteopathic Medicine wants to open a satellite college in Billings, while Benefis Health System (MT) CMIO Paul Dolan, MD, MMM is leading an effort to bring a non-profit medical school operated by Touro College and University to Great Falls. The US has eight for-profit medical schools opened or announced, all of which are in the West and all but one of which offer osteopathic rather than allopathic training.

Sponsor Updates

- CHIME releases a new episode of its Leader to Leader podcast featuring Dr. First President Cameron Deemer.

- CarePort develops Quality Score, a scoring system that summarizes the quality of care delivered by skilled nursing facilities for short-stay patients.

Blog Posts

- “What About My Ovaries?” Part 3 – Outside Facility & Disconnected EMR (Access)

- AI in medical imaging – Interoperability will unleash the power (Agfa HealthCare)

- Hurricane Season 2021 Forecast Calls for a New Kind of Emergency Response (Audacious Inquiry)

- Real-time insights to optimize patient outcomes in home health (CarePort)

- Epic Hyperspace Printing Tips that Reduce Cost and Maintenance (CereCore)

- PDMP Changes 2021 – The Requirements Shaping Healthcare Today and Tomorrow (ChartLogic)

- Is There a Perfect Workflow for Medicare Annual Wellness Visits (ChartSpan)

- Time to Overhaul the Cumbersome Prior Authorization Process (Culbert Healthcare Solutions)

- Improving Patient Safety Series: Reducing Reportable Safety Events (EClinicalWorks)

- Healthcare Transparency: Pandemic cool down turns up regulatory heat (Experian Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Jvion’s Behavioral Health Map looks incredibly cool, but examining my area reveals a lot of dubious findings. I suppose I’m a little relieved that their data access isn’t THAT good. Feels like a little less granularity might be a more accurate and more honest approach.

Regarding the social services software, you’re looking for off the shelf software, yet there are only five or ten orgs in the country that would ever buy that software. It doesn’t exist. You could issue an RFP and listen to salespeople lie to you, then wait for the features to get actually implemented, then work with the bugs in that implementation since you’re the only impacted customer, then get frustrated and issue another RFP.

I don’t have a solution but here’s my suggestion. Inter agency collaboration. There are similar agencies to yours who probably have a similar problem. Some are probably better funded software wise, some may have partly solved the problem. They may even use the same case tracking software that you do. Hit em up. See what SQL queries, reports and models they have. If they have something good, see if you can work on it with them. If they have a problem that you have a solution for, share it. Take the money you were going to give the vendor and invest it in your own people and the new network you built. If you don’t have the expertise in house, there are hard working excellent people who got too frustrated with the bureaucracy of their government job and started their own consultancy. You’ll know them by the reputation they have within your network.

Source: friends with a few of those one man/woman consultancies and data scientists in state gov and healthcare industry

Hmmm. I like your idea here. There’s just one problem though.

The lure of COTS is strong (Commercial Off-The Shelf). You don’t hear this term much anymore but it was all the rage in the late 90’s. And COTS was a reaction against in-house developed systems. COTS was the major strategy deployed to solve the Y2K problem, for instance.

Fundamentally, the principle behind COTS is sound. You are leveraging the work of others (a vendor) and getting a reasonably quick result for a known investment.

Even though you’ve tried to embed work re-use in your concept, I’m not sure there’s enough effort leveraging going on, to make it worthwhile.

Using someone else’s work, outside of an organizational boundary also raises other issues. Namely, of ownership, control, direction, priority setting, and so on. While there are plausible answers to all of these, many organizations don’t want to be bothered.

I’ll even submit a few ideas. You could become a:

1). Ad-hoc idea sharing collective. Risks falling apart later though;

2). FOSS-type foundation or corporation;

3). Wholly-owned subsidiary;

4). Independent spin-off corporation;

5). Maybe some type of shared Co-Op entity?

The thing is, most forms of success in our world means a monetary reward. The money attracts attention and motivates the principles involved, to claim that money. Lawyers get involved. Corporate management demands to know “why weren’t we informed”, and all the rest.

Recall, the Winklevoss twins tried to claim part ownership of Facebook. That lawsuit went on for years. And that’s just one example.

It’s true that software projects often go off the rails because people can’t get coordinated. These orgs have more experience with legal contracts and organizing than they do evaluating software needs and writing code.

My other suggestion is about the feature requests and bug reports that come in after this type of software is in production. Try to get a coop set up with a local engineering school where someone technical but short on time supervises a bright college student to do some development.

I guess that I would want to know how this AI is supposed to work and what the end goal was for the software. What is the problem that this solution is supposed to solve? If that was understood then you could look at other markets for the product and that would allow the solution to potentially be viable as a product. Without knowing what problem needs to be resolved it is difficult to identify what data you would point your AI at? And, why does it need to be AI? Is there some deep insights that are drawn from large data pools?

My suggestion would be to start with a problem statement and work backwards towards the requirements — you would have to do that for an RFP anyways so you might as well start from that space. From there you might partner with some of the larger universities to develop the program — but beware that they really don’t have a great track record for producing production software — although they may find it a good class project. UW, OHSU are two schools that might find it interesting if you produced a problem statement

Re: social services software — I am sure they don’t have an off-the-shelf solution for the problem you’re trying to solve, but I have a friend who works at NIC and their specialty is developing software for local and state government, including custom solutions. You might check them out: https://www.egov.com/what-we-do/