I've figured it out. At first I was confused but now all is clear. You see, we ARE running the…

News 2/3/21

Top News

HIMSS confirms that HIMSS21 remains on schedule for August 9-13 in Las Vegas, but announces that it will also include a virtual component.

HIMSS will determine later — based on vaccination rates, infection rates, and federal guidelines – whether it will need to cancel in-person activities in Las Vegas.

The next HIMSS21 update will be published on February 19, which will include announcement of the date on which registration will open.

Reader Comments

From Just_a_CIO: “Re: HIMSS and CHIME. Getting a divorce, as quietly announced a while ago but in a more formal letter from CHIME this week. This likely further dooms HIMSS to the boat show only role and maybe gives CHIME a chance to get back to its roots with a more educational / peer-to-peer event. Vendors will always play a role since someone needs to pay to put these things on, but it seems CHIME has a better shot at striking the right balance as a smaller, more focused conference. What do you think?” CHIME confirms that it won’t be participating in HIMSS21, as the organizations “have decided to explore different directions in how we serve and grow our memberships.” CHIME will offer broadcast events in April and June and presumably others to follow, and had already announced that the Fall Forum in October will also offer a hybrid model. Here are my random thoughts as the reader requested:

- Certainly CHIME is better scaled to survive on the proceeds of running a smaller conference, although it was beginning to show signs of HIMSS-like dollar sign eyes. It’s a good time to refocus.

- Nearly all member organizations walk an ethical tightrope in deciding how hard to milk the willingness of sellers to pay for exposure to buyers in the “ladies drink free” model. Perhaps it’s a bit cleaner for CHIME since vendors can’t be members.

- I often question why hospital executives can’t perform their job duties without heading off to luxury resorts for networking and education. I’ve only ever worked in healthcare, so I don’t know if it’s common for C-level executives in other industries to rely on ideas from peers in other companies, to expect their vendors to educate them, or to wander back and forth between customer and vendor jobs.

- I’ve always been uncomfortable with cocooning CIOs off in their own track at the HIMSS conference. All events should be open to all attendees except for those that require extra payment (well, I don’t really like those either, but I digress). Exhibitors need to come to terms with the idea that most of the people who visit booths don’t have titles that suggest decision-maker, yet they have every right to be welcomed and in fact often actually do have influence beyond their job titles.

- I’m not really fooling myself that I yearn for a quieter, more educational conference even though I don’t go to the parties. Boat show or not, you’ll usually find me in the exhibit hall, where the collective energy, fun, noise, and elbows-flying capitalism is more interesting than most of the educational sessions, which often end up being run by the same vendors anyway.

- Now that I’ve said a lot without really saying anything, I’ll ask CHIME members, HIMSS members, vendors, and whoever cares – what do you like or not like about CHIME’s break from the HIMSS conference?

From Masshopper: “Re: VPay. Have heard that Optum is acquiring the company, adding to its healthcare payments and clearinghouse capabilities that it gained with the purchase of Change Healthcare last month.” I haven’t heard anything.

From Toothpick It: “Re: Olive’s new PR. What exactly is ‘AI cybernetics?’” I don’t think the term “cybernetics” is used much these days, but it involves feedback loops, which one could argue that in the absence of connections to physical devices like an artificial pancreas or something, simply means computer programming or scripting. Olive’s latest announcement says its product is being used by 675 US hospitals to deliver $100 million in efficiencies (that’s around $150,000 per hospital). It tripled headcount to 550 “Olivians” in the past year and will double it again in 2021 in a distributed work model it calls “The Grid.” You have to think that some science fiction nerds are involved.

Webinars

February 24 (Wednesday) 1 ET. “Maximizing the Value of Digital Initiatives with Enterprise Provider Data Management.” Sponsor: Phynd Technologies. Presenters: Tom White, founder and CEO, Phynd Technologies; Adam Cherrington, research director, KLAS Research. Health systems can derive great business value and competitive advantage by centrally managing their provider data. A clear roadmap and management solution can solve problems with fragmented data, workflows, and patient experiences and support operational efficiency and delivery of a remarkable patient experience. The presenters will describe common pitfalls in managing enterprise information and digital strategy in silos, how to align stakeholders to maximize the value of digital initiatives, and how leading health systems are using best-of-breed strategies to evolve provider data management.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Private equity firm Abry Partners acquires healthcare cloud and managed services vendor CloudWave through a majority investment.

Hillrom purchases EarlySense’s contact-free, continuous-monitoring technology for $30 million. EarlySense CEO Matt Johnson says the company will now focus on its remote monitoring technology for the post-acute market. Hillrom announced several weeks ago that it will acquire Bardy Diagnostics for $375 million.

Zyter acquires population health software vendor Casenet from Centene, which had acquired the company in 2012.

Healthcare Growth Partners lists the transactions it closed in 2020. On the sell side: Firstsource acquired Patient Matters, Coronis Health acquired PMG, Intraprise Health acquired HIPAA One, Intelerad acquired Digisonics, Provation acquired EPreop, and EverCommerce acquired AlertMD. On the buy side, Ontellus acquired Intertel, Symplr acquired Wolters Kluser ComplyTrack, and Symplr acquired The Patient Safety Company.

Sales

- In England, Manchester University NHS Foundation Trust signs a $170 million, 15-year contract with Siemens Healthineers for the planning, installation, and maintenance of 222 pieces of imaging equipment.

- MedStar Health and Intermountain Healthcare sign legacy PACS replacement contracts with Visage Imaging, which will deploy its product via Google Cloud.

People

Premier CEO Susan DeVore will retire effective May 1, 2021. She will be replaced by President Mike Alkire.

Praveen Chopra (George Washington University Medical Faculty Associates) joins Gundersen Health System (WI) as CIO.

Announcements and Implementations

Jackson Memorial Hospital (FL) implements Everbridge’s COVID-19 Shield: Vaccine Distribution software.

Divurgent develops a virtual patient support solution to help healthcare facilities handle call volumes related to COVID-19 vaccination scheduling.

Visage Imaging parent Pro Medicus Limited earns FDA clearance for its first AI algorithm, which assesses breast density from mammography studies.

Healthcare Triangle and CareTech Solutions partner to offer Meditech customers their cloud-based disaster recovery / backup solutions and secure hosting, respectively.

Allscripts-owned Veradigm signs a three-year deal giving ConnectiveRx exclusive rights to deliver electronic prescription coupons on Allscripts EHRs and Veradigm’s e-prescribing network.

COVID-19

The federal government says it will start delivering vaccine directly to 6,500 chain pharmacy stores starting next week to provide more vaccination sites. Walgreens, CVS, and Rite Aid are among the 21 chains involved.

Beaumont Health System (MI) temporarily shuts down its COVID-19 vaccine scheduling system after a user finds and shares an Epic loophole that allowed 2,700 ineligible patients to schedule appointments that were ultimately cancelled.

MIT Technology Review covers the many shortcomings of CDC’s $44 million VAMS vaccine management system — built by Deloitte under a no-bid contact — that South Carolina’s health department head “says has become a cuss word.” Nearly all states are passing on the free system and either building their own or paying for commercial systems, and people who are trying to use it to sign up for shots are so frequently unsuccessful that vaccine doses are going unused. The authors note that while it might seem questionable that Deloitte was given the no-bid contract despite a history of similar failures, CGI Federal has earned $5.6 billion in federal IT work since being fired for the Healthcare.gov debacle.

North Carolina upgrades its CVMS vaccine management system that one county health director says is a bigger problem than vaccine shortages. Clinics have found that it takes eight hours of data entry to record each one-hour administration of 200 vaccine doses, and that any data entry errors must be corrected at the state level.

Some California county and local health officials question the decision last week by Governor Gavin Newsom to turn COVID-19 vaccination over to Blue Shield of California, which was given an emergency, no-bid contract. Those officials note that Blue Shield has no history with a similarly sized project, the organization is a Newsom political donor, and it has minimal relationships with underserved communities. Blue Shield’s bar for success is low given that county efforts that have resulted in confusing appointment systems, shifting vaccine eligibility rules, long lines, and faulty data collection that has left the state unable to say exactly how many doses have been administered. Kaiser Permanente will run its own program for 9 million members and assist Blue Shield, but says slow vaccine shipments mean that at the current rate of vaccine deliveries, it will take four years to give just its own members their first doses.

Studies of Russia’s Sputnik COVID-19 vaccine find that it is 92% effective, with zero severe cases or deaths in the active group. Phase III results suggest that most of that effectiveness may occur after the first dose, with researchers now investigating a single-dose regimen. Mexico has already signed a contract for Sputnik and is expected to issue emergency use authorization almost immediately. The Russian government says that going through the US regulatory process isn’t a priority.

Four hundred Cerner employees will help administer COVID-19 vaccines at company headquarters later this week as part of the Operation Safe coalition in North Kansas City, MO. The coalition, which includes local hospitals and governments, hopes to vaccinate up to 4,500 people every other week.

Nine top New York health officials have quit as Governor Andrew Cuomo addresses vaccination delays by taking control away from state and local public health officials and giving it to large health systems in declaring that he doesn’t trust government scientific experts. Those workers say Cuomo blindsided them with policy decisions and ignored their plans that had required years of preparation, instead relying on long-time advisors, consultants, and a lobbyist from Northwell Health to make decisions. A former New York City health official and epidemiologist says the government lost control of vaccination pacing early by giving most of its doses to hospitals, which they say lack the skills, experience, and perspective to manage a public health initiative.

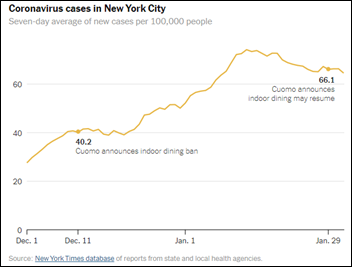

Meanwhile, Governor Cuomo says he may reopen indoor restaurant dining on Valentine’s Day even though per-capita case counts are 64% higher than when he halted indoor dining in December. The New York Times says that the graphs he used to illustrate a recent drop in test positivity rates are misleadingly optimistic in several ways.

In England, World War II veteran Captain Sir Tom Moore, who raised dozens of millions of dollars for NHS last year by walking through his garden to observe his 100th birthday, dies of COVID-19.

Other

The New York Times finds that major health systems are declining to bill Medicaid for treatment of auto accident injuries and are instead placing liens on the accident settlements of patients for the full, undiscounted list prices of services rendered. Medicaid would have paid $2,500 for one patient’s treatment, but the hospital used a lien to go after $13,000. Hospitals are asking patients to sign waivers agreeing to not bill insurance, telling them their insurer shouldn’t have to pay for an accident someone else caused, failing to mention that signing means the patient themselves will pay the full price out of any settlement they receive. HFMA, in an apparent “if it’s not illegal it must be ethical” view, says it is reasonable for hospitals to seek payment from whoever will pay the most.

Best in KLAS

KLAS announces “Best in KLAS Software & Services 2021,” which includes a change in which products in niche categories are awarded full “Best in KLAS” distinction rather than the previous “Category Leader.” Some of the winners are:

- Epic, Galen Healthcare Solutions, and The Chartis Group are named as notable performers.

- IBM Watson Health Merge PACS is named most-improved software product, while Athenahealth’s AthenaPractice EMR is tagged as most-improved physician practice product.

- The top three highest-ranked software suites are Epic, Meditech Expanse, and Cerner.

- Epic, Athenahealth, and NextGen Healthcare take the top three spots among physician practice vendors.

- The top three IT services firms are Galen Healthcare, Prominence, and S&P Consultants.

- Chartis Group, Accenture, and Guidehouse earned the top three spots in healthcare management consulting.

Some of the individual category winners:

Inpatient Clinical Care

- Large-hospital acute care EMR: Epic

- Small-hospital acute care EMR: Meditech Expanse.

- Clinical decision support (care plans and order sets): Zynx Health.

- Interoperability platform: InterSystems HealthShare

Ambulatory and Post-Acute Care

- Large-practice ambulatory EMR: Epic

- Medium-sized practice ambulatory EMR: NextGen Healthcare

- Large-practice practice management: Epic

- Medium-sized practice management: NextGen Healthcare

- Small practice ambulatory PM/EHR: Kareo

- Ambulatory specialty EHR: PCC (pediatrics)

- Ambulatory care RCM services: R1 RCM

- Behavioral health: Cerner

- Claims and clearinghouse: Waystar

- Small home health EHR: Meditech

- Large home health EHR: MatrixCare

- Long-term care: PointClickCare

- Patient intake management: Phreesia

Financial, Revenue Cycle, and HIM

- Business decision support: Strata Decision Technology

- Charge master management: Vitalware by Health Catalyst

- Claims management: Quadax

- Clinical documentation improvement: ChartWise

- Computer-assisted coding: Dolbey Fusion

- ERP: Workday

AI/data science solutions: Epic - Business intelligence and analytics: Dimensional Insight

- Large-hospital patient accounting and management: Epic

- Small-hospital patient accounting and management: Meditech Expanse

- Patient financial engagement: Patientco

- Quality management: Nuance Quality Solutions

- Robotic process automation: Databound

- Nurse and staff scheduling: Schedule360

- Physician scheduling: QGenda

- Front-end speech recognition: Nuance Dragon Medical One

- Talent management: Workday

- Time and attendance: API Healthcare

Value-Based Care

- CRM: Salesforce

- Digital rounding: GetWellNetwork

- Interactive patient systems: PCare

- Patient outreach: Well Health

- Patient portal: Epic MyChart

- Population health management: Innovaccer

- Remote patient monitoring: Health Recovery Solutions

- Videoconferencing: Microsoft Teams

- Virtual care, non-EHR: Caregility

Security and Privacy

- Access management: Identity Automation

- Clinical communications: Telmediq by PerfectServe

- Security and privacy consulting: Impact Advisors

- Security and privacy managed services: CynergisTek

Services and Consulting

- Application hosting: Epic

- Clinical optimization: Chartis Group

- Eligibility enrollment: Change Healthcare

- Financial improvement consulting: Chartis Group

- Go-live support: Engage

- Healthcare management consulting: Chartis Group

- Health IT advisory: Huntzinger Management Group

- Large implementation leadership: Engage

- Small implementation leadership: S&P Consultants

- Staffing: Galen Healthcare

- Outsourced coding; AGS Health

- Revenue cycle optimization: Softek

- Revenue cycle outsourcing: Ensemble Health Partners

- Transcription services: AQuity

- Value-based care consulting: ECG Management Consulting

- Value-based care managed services: Arcadia

Sponsor Updates

- Diana Nole, EVP and GM of Nuance’s Healthcare division, joins the Exactech Board of Directors.

- Harris Healthcare migrates its Harris Flex EHR to the InterSystems Iris for Health data platform.

- Healthcare Triangle offers customers its cloud-based disaster recovery and backup services along with Meditech-certified secure production hosting of EHR and enterprise applications from CareTech Solutions.

- TMC names Alcatel-Lucent Enterprise’s Rainbow cloud-based communication platform a 2021 Remote Work Pioneer.

- Artifact Health publishes a case study, “OU Health standardizes physician query workflow and achieves positive results.”

- Change Healthcare publishes a new e-book, “Poised to Transform: AI in the Revenue Cycle – a Signature Research Study.”

- The Chartis Group promotes Ben Perry to principal in its Strategy Practice.

- Engage and Navin Haffty announce they have aligned sales forces to improve the client experience.

- Swiss Re will leverage Diameter Health’s Fusion data-refinement technology to improve the speed and quality of their life insurance underwriting.

Blog Posts

- Driving Positive Outcomes with Virtual Care (AdvancedMD)

- Great Partner Management – The Keys to the Kingdom (Ascom)

- Leaning into Telemedicine: 5 Ways to Enable More Effective Virtual Visits (CereCore)

- Top 4 Tips for Transitioning to a New EHR (ChartLogic)

- Healthcare 2021: Regulatory trends to watch (EClinicalWorks)

- CEO’s Corner: It’s not a Debate, Healthcare is Broken (Emerge)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

The only interesting part of the Best in Klas reports are the under 75 physician practice/emr categories where there is actually some market competition. The rest of the report is basically the same every year. on that note, congrats to nextgen on either improving your products and services, losing the customers that disliked you, or a bit of both.

Wondering how much value the HIT provider community gives KLAS these days? I can see KLAS gets a decent bit of coverage here on HIStalk, but having heard so many colleagues from both the provider and vendor community share how much KLAS is influenced by vendor spend and how they play the system, I have my doubts on how helpful truly KLAS is. Anyone aware if Black Book is any better?

It is often difficult to understand Black Book ratings are they are often not reflective of the market, but likely vendor spend.

Similar to comments re CHIME and vendor relationships it is challenging for firms such as KLAS, Black Book, IDC, Forrester and the like to remain completely vendor neutral. There is most often a “pay to play” component and of course those that pay the most often get better coverage and ratings.

How can KLAS call itself objective in ranking vendors when it is now presentng Webinars with these very same vendors wjhom they will be ranking? Seems like just a slight a conflict of interest to me…

Sponsor: Phynd Technologies. Presenters: Tom White, founder and CEO, Phynd Technologies; Adam Cherrington, research director, KLAS Research. Health systems can derive great business value and competitive advantage by centrally managing their provider data.

RE: the accident/Medicaid issue. Unclear from her or the NYT article how the hospital charges figure into the claim and payment in the first place. Are they added on top of lost wages/ damage/pain & suffering money? If some of the payment is based on submitted hospital charges, should the patient pocket that?