Weekender 8/14/20

Weekly News Recap

- MDLive announces plans to go public early next year.

- Health Catalyst announces its acquisition of Vitalware for $120 million.

- Epic reverses its mandatory return to campus policy, approving working from home through at least the end of the year.

- Waystar will acquire ESolutions, valuing the company at $1.3 billion.

- Craneware raises $100 million for acquisitions.

- Providence Services Group acquires Navin Haffty.

- VA OIG recommends that the VA work on increasing its use of VA Direct and improve oversight of its VHIE community coordinators.

Best Reader Comments

The most surprising aspect of the Teladoc-Livongo deal is how investors and healthcare analysts don’t seem to understand the telehealth market. The walk-in or urgent care telehealth visit has a razor thin margin for telehealth companies. Almost 100% of the $50 fee charged to consumers goes to pay the physician labor or pay for the ads. The market is national, so any telehealth agenecy can join if they are willing to spend the ad dollars or offer slightly cheaper visits for a brief period as telehealth is uniquely price shoppable. On the other hand, your average physician is used to being protected from national competition by having a very local, captive market and they have many options when it comes to keeping their income above say 120 grand a year. Plus consumers prefer in person visits if the cost and convenience are the same, so providers always can fall back to that. It is very hard to reduce provider labor cost. So the telehealth agency gets squeezed between a price sensitive consumer, a provider who demands the bulk of the revenue from consumer, and the cost of ads which are raised by investors repeatedly dumping their money into new telehealth companies driving up demand on the ads displayed when people search video doctor. So every telehealth company that has lasted more than a few years has some strategy that gets them out of the urgent care market. (detroitvseverybody)

[Teladoc acquiring Livongo for $18.5 billion] reminds me of the post-deregulation period in the airline business, 1980s into the 1990s, when airlines fetched this kind of insane money from all over. I was there for that and it didn’t end well. (Deetelecare)

Providence Services Group now owns two MEDITECH focused service organizations while Providence is in process of migrating multiple MEDITECH hospitals to Epic. Plus, Providence is large Epic client. So basically MEDITECH helps fund a large Epic client since NHA and Engage are two of its partners. (Chris Hill)

Watercooler Talk Tidbits

Readers funded the Donors Choose teacher grant request of Ms. G in Ohio, who asked for white boards for her high school class in urban Cleveland. She reported in late February, “I cannot express how much these white boards have helped my students in class. We use them every day in order for them to practice different concepts in class. These white boards allow for my students to have immediate feedback in class and work through concepts even faster. They have taken pride in their work and have grown so much since having these white boards available in class. Thank you so much for allowing my students the opportunity to use these white boards every day in class.”

A COVID-19 hospital in India lists its challenges: relatives keep barging in rooms to bring isolated patients meals, air conditioners don’t work in the sweltering heat and humidity, new patients are housed with those known to be infected, families sit curbside with the bodies of family members waiting for funeral home pickup, and armed guards protect the hospital administrator.

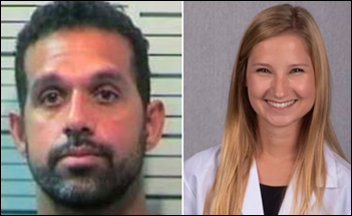

An Alabama neurosurgeon crashes his $200,000 sports care while doing 138 miles per hour in a 45 zone, killing his 24-year-old medical school passenger. He’s charged with manslaughter. Police say the doctor was intoxicated and suffered only minor injuries.

Chicago chose a politically connected company to develop a temporary 2,750-bed COVID-19 hospital in the McCormick Place convention center at a cost of $66 million, passing on another company that offered to do the work without fees. Federal taxpayers will foot 75% of the bill for the hospital, which saw just 38 patients. Wielding influence in the selection was the private company that oversees Navy Pier, which is run by political allies of former mayor Richard Daley.

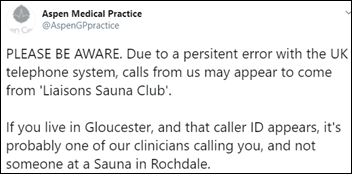

A medical practice in England discovers why patients aren’t answering its phone calls – a phone system error caused its Caller ID to show the name of a massage parlor.

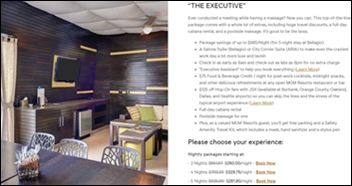

Can’t wait for Las Vegas at HIMSS21? MGM hotels is offering “Viva Las Office,” a work-from-Vegas package that includes discounted flights, rooms in the Bellagio or Aria hotels, and a personal concierge. Big cheeses can blow their company’s cash with “The Executive” package, which includes a luxe suite, $75 food and beverage credit, a discount on JSX semi-private jet travel, a day’s cabana rental, a poolside massage, and a mask and hand sanitizer. Plus you can study COVID-19 in person since 95% of new Nevada cases originated in the city, comping visitors from all over the country with yet another situation that happens in Vegas but doesn’t stay there.

In Case You Missed It

- News 8/14/20

- EPtalk by Dr. Jayne 8/13/20

- News 8/12/20

- Curbside Consult with Dr. Jayne 8/10/20

- Monday Morning Update 8/10/20

Get Involved

- Sponsor

- Report a news item or rumor (anonymous or not)

- Sign up for email updates

- Connect on LinkedIn

- Contact Mr. H

It's nice when Epic takes on patent trolls and other bad actors in the industry. They do great when they…