Move your quotes to where they should be and it's no longer politics-in-the-blog, but instead a fact that's true at…

News 7/29/16

Top News

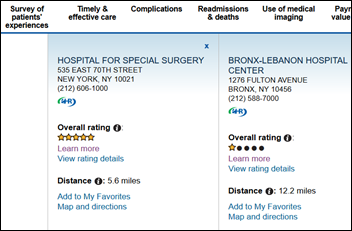

CMS adds star ratings to its Hospital Compare website, which also offers a data download option. Of the 78 New York City hospitals listed, one (Hospital for Specialty Surgery) earned five stars, while 29 hospitals have a one-star rating.

University of Miami Health System, which earned one star, predictably argues that the methodology is flawed and that its patients are sicker, complaining that academic medical centers and safety net hospitals are treated unfairly by the rating system.

Two hospital systems that made US News & World Report’s “Best Hospitals” list earned only two stars from CMS – UPMC and Barnes-Jewish Hospital. Both point out that scores vary among their similarly run hospitals, in their minds proving that ratings are skewed by patient demographics of the hospital’s geographic area.

Reader Comments

From Gordie Gecko: “Re: NantHealth. Check out its progressive tanking in the market. Patrick Soon-Shiong is trying to announce new deals, but one success doesn’t mean he’ll always be successful. People on the inside still don’t know what the future is.” NantHealth went public a couple of months ago with a first-day closing share price of $18.59, but shares have since dropped 45 percent to around $10. Allscripts bought 15 million shares right after the IPO, so the company is down around $50 million in just a few weeks. NantHealth hasn’t filed its first earnings report yet, but its IPO documents showed an annual loss of $72 million on $58 million in revenue.

HIStalk Announcements and Requests

We funded the DonorsChoose grant request of Mr. D in Pennsylvania, who asked for three iPad Minis and cases. He reports that his students are using them to work on math and reading skills, to log their science activities, and to do research for their social studies assignments.

This week on HIStalk Practice: Cerner VP of Population Health Services Mike Heckman explains the role healthcare tech plays in managing on-site clinics for employers. Practice Fusion CMO & VP of Informatics Richard Loomis, MD shares interoperability advancement plans. Zoom+ VP defends the company’s executive exodus. AristaMD closes an $11 million Series A. Athens Orthopedic Clinic alerts patients to The Dark Overlord’s hack. Medstreaming acquires Physician Billing Partners. Epic, Allscripts, EClinicalWorks lead the vendor way in EP MU attestations. American Well CTO Jon Freshman outlines the ways in which vendors must differentiate themselves if they want to survive telemedicine’s bubble.

Webinars

August 10 (Wednesday) 1:30 ET. “Taming the Beast: CDS Knowledge Management.” Sponsored by LogicStream Health. Presenters: Luis Saldana, MD, MBA, CMIO, Texas Health Resources (THR); Maxine Ketchum, clinical decision support analyst, THR; Kanan Garg, senior applications analyst, THR; Patrick Yoder, CEO, LogicStream health. This presentation will review THR’s systematic process for managing clinical decision support assets, including identifying broken alerts, addressing technical and clinical issues, modifying order sets, and retiring tools that have outlived their usefulness. Attendees will learn how THR uses a robust knowledge management platform to better understand how clinicians are interacting with their clinical content to maintain their order sets and reduce the number of alerts fired.

Contact Lorre for webinar services. Past webinars are on our HIStalk webinars YouTube channel.

Acquisitions, Funding, Business, and Stock

McKesson announces Q1 results: revenue up 5 percent adjusted EPS $3.50 vs. $3.14, falling short on revenue expectations but beating on profit. Revenue for the Technology Solutions business was down 2 percent, but still generated a profit of $179 million. Shareholders again voted down a proposal that would have limited executive golden parachutes, which in CEO John Hammergren’s case, involves several hundred million dollars if the company changes hands. This is probably the last time I’ll report MCK’s earnings since they are scurrying quickly away from healthcare IT.

AristaMD, which offers a referral management system, raises $11 million.

Consumer health site Sharecare, founded in 2010 by Dr. Oz and WebMD founder Jeff Arnold, acquires the population health business of publicly traded Healthways. The business and its 1,700 employees will remain in Franklin, TN. Healthways announced in 2015 that it was exploring strategic alternatives.

Oracle will buy ERP vendor NetSuite for $9.3 billion. Oracle Chairman Larry Ellison already owned nearly half of NetSuite’s shares, having funded the company when it was founded by a former Oracle executive.

Leidos announces Q2 results: revenue up 2 percent, adjusted EPS $0.68 vs. $0.77, meeting revenue expectations but falling short on earnings.

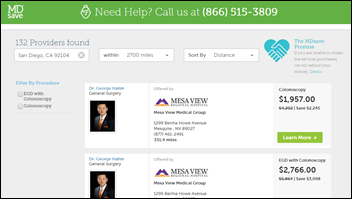

Cambia Health Solutions makes a strategic investment of unspecified amount in medical procedure buying site MDsave. I tried the four-year-old site and found that few providers offer services on it – searching for a flu shot in Cleveland turned up a handful of doctors in Tennessee and Virginia and seeking a bargain-priced colonoscopy in San Diego showed the closest willing provider at 331 miles away in Nevada.

LabCorp will acquire prenatal genetic testing company Sequenom for $302 million in cash.

Struggling would-be health insurance disruptor Oscar will cut its New York provider base in half for 2017, trimming its network from 77 to 31 hospitals as it raises rates significantly. I predict Oscar will be gone within 24 months, with one of its big insurance competitors spending very little to buy the smoking wreckage.

Sales

I mentioned that Covenant Health (TN) has chosen Cerner, and based on information I found on the Web, I concluded that the health system is a Meditech customer. I was wrong – while Cumberland Medical Center does indeed run Meditech as I had found, the rest of Covenant does not. Covenant bought CMC in 2014.

People

Dorothy Fisher, MD (Sentara Quality Care Network) joins Forward Health Group as chief clinical officer.

HBI Solutions hires Alan Eisman (Information Builders) as SVP of sales and business development.

Accretive Health names Doug Berkson (Berkson Consulting) as SVP.

Government and Politics

A state report finds that Oregon hospitals boosted their aggregate profit by 54 percent in 2015 because of the Affordable Care Act’s Medicaid expansion, which turned their charity care into revenue-generating work whose cost was mostly footed by federal taxpayers.

Privacy and Security

Fertility app vendor Glow urges users to change their passwords after it finds a problem with the “connect a partner” feature that could expose the user’s data to third parties.

Other

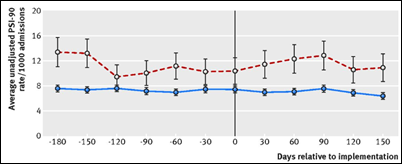

A review of the rates of mortality, readmissions, and adverse events in 17 hospitals immediately before and after their 2011-2012 EHR go-live finds no significant negative impact. That’s not really surprising since common go-live problems (late meds, missed charting entries, staff confusion) aren’t going to kill patients even though they make their encounter less pleasant.

A JAMIA article defines the work required for informatics research to support precision medicine:

- Implement electronic consent and specimen tracking.

- Develop data standards to support integration and exchange.

- Develop ways to discover and translate clinically relevant biomarkers.

- Use rules and technology to ensure the quality of large datasets to make sure they will continue to be useful in the future.

- Create a precision medicine knowledge base.

- Extend EHRs with APIs that can integrate external data and that will support the development of third-party workflow and data visualization tools.

- Engage consumers outside of provider settings with user-friendly data collection tools.

Greater Madison Chamber of Commerce launches its HealthTech Capitol program and website, which “is working to establish Greater Madison as the world-class leader for health technology.” It lists 18 companies as members, with annual dues running $260 to $1,010 depending on membership level and company headcount.

ZDoggMD reflects on his medical career in his latest video, set to the tune of by Lukas Graham’s “7 Years.” EHRs get an unflattering mention.

Sponsor Updates

- Crossings Healthcare Solutions publishes its Q2 newsletter.

- Catalyze delivers HITRUST CSF certified compliant cloud solutions for Amazon Web Services workloads.

- Besler Consulting releases a new podcast, “Auditing and monitoring for compliant physician documentation and coding.”

- Boston Software Systems releases a new podcast, “Mass Updates to Your Meditech System.”

- CompuGroup Medical will exhibit at the AACC Scientific Meeting & Clinical Lab Expo July 31-August 4 in Philadelphia.

- Extension Healthcare will exhibit at the 2016 Defense Health Information Technology Symposium August 2-4 in Orlando.

- The HCI Group is again listed on the Jacksonville Business Journal’s list of “50 Fastest Growing Private Companies.”

- Healthgrades announces the 2016 Women’s Care Award recipients.

- Healthwise is certified as a Great Place to Work.

- Santa Rosa Consulting launches a Transition Management Office service.

Blog Posts

- Self-service analytics: Empower your team to make data-driven decisions [podcast] (Nordic)

- Meaningful Use Updates: 90-Day Reporting Period and More (Impact Advisors)

- 10 Ways To Prevent Delays in Delivery of Time-Sensitive Secure Text Messages (Spok)

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.Send news or rumors.

Contact us.

Re: NantHealth and Allscripts

The investment is far worse than that. Allscripts did not buy 15 million share right after the IPO (though they did add to their stake at $14 at the IPO). They invested $200 MM at a $2 billion valuation (http://www.latimes.com/business/la-fi-soon-shiong-company-nanthealth-moves-closer-to-ipo-20150629-story.html). Nant Health IPO’d less than that and is currently worth $1.15 B according to Google Finance. On just the $200 MM, Allscripts is down $85 million. Keep in mind Allscripts BOUGHT MORE at $14 and at a $1.7 billion valuation which makes them down even more than $85 million.

Venture investments are inherently risky and it seems fair to point out that one of the Nant companies made a $100 MM investment in Allscripts. The other interesting aspect is the JV with Netsmart that Allscripts announced results in GAAP loses for Allscripts based on their pro-formas. Paul Black could be pulling off masterful financial wizardry or he could be doing one final push to line his own pockets. History predicts the latter. Time will tell.

DISCLOSURE: I am currently short Allscript’s stock.