Neither of those sound like good news for Oracle Health. After the lofty proclamations of the last couple years. still…

News 6/3/15

Top News

Partners HealthCare (MA) goes live on Epic at a cost of $1.2 billion, double its original $600 million estimate, making the project the single largest investment the health system has ever made. The Boston Globe article quotes a Tufts professor and Health Policy Commission member as saying, “We will ultimately all pay for it. Will we get dividends back in terms of better care and greater efficiencies? We don’t know yet.”

Reader Comments

From Around St. Louis: “Re: SLU Hospital. The university is buying their hospital back and conjoining with SSM to run it. SLU Hospital was the only Tenet hospital with Epic – all others are on Cerner.” The 356-bed hospital wasn’t happy that buyer Tenet, which paid $300 million for the hospital, failed to establish a regional network. The city will lose $6 million in annual tax revenue that for-profit Tenet was paying that SSM won’t, although the mayor’s office say it’s happy with the hospital providing “quality healthcare, jobs, and expansion,” thus neatly illustrating that it’s tough to control healthcare costs when everybody likes the huge employment it creates at public expense.

HIStalk Announcements and Requests

Mr. K sent a photo of students with the Bluetooth speaker we provided to his Wisconsin PE class via DonorsChoose, which apparently was a great student motivator for our $178 donation. Mrs. F’s Ohio first graders are using their STEM kits in summer school sessions where they learn “while they think they are playing,” she reports. Meanwhile, companies donating $1,000 or more to our DonorsChoose project get mentioned and double their impact via matching funds provided by an anonymous HIT vendor executive – contact me.

I was thinking about complaints that providers don’t make EHR data available to patients vs. the tiny percentage of patients who actually request it. Someone should perform a study to determine the level of demand and the reasons people aren’t requesting their information. I haven’t seen anything to suggest that providers are denying those requests, so targeting them as the villain doesn’t make sense. Proponents should be taking their case to the public, not to providers and EHR vendors. I’ve never requested my own information or changed providers just because I couldn’t get it easily – have you?

I was also thinking that among all the unrealistic expectations placed on health IT to improve health, a big one is caused by consumers who think a huge problem is misdiagnosis. That’s a minor issue compared to lack of consistent, evidence-based treatment of easily diagnosed conditions in which the patient accepts full responsibility for their outcome. Improving outcomes and cost for obvious conditions such as COPD, diabetes, and heart disease unfortunately isn’t as sexy as uncovering a gene for an obscure disease or using Watson to suggest treatments. The transition to a public health mindset is slow and patients don’t like hearing that the answer to their problems is willpower, moderation, and acceptance rather than a decisive, inconvenience-free prescription or procedure.

Webinars

June 9 (Tuesday) 11:30 ET. “Successful HIEs DO Exist: Best Practices for Care Coordination.” Sponsored by Medicity. Presenters: Dan Paoletti, CEO, Ohio Health Information Partnership; Brian Ahier, director of standards and government affairs, Medicity. Not all HIEs are dead – some, like Ohio’s CliniSync HIE, are evolving and forging a new path to successful care coordination. Brian Ahier will explain how HIEs can help providers move to value-based care models, emphasizing Meaningful Use Stage 3 and FHIR. Dan Paoletti will provide best practices in describing CliniSync’s journey to success in serving 6,000 primary care physicians, 141 hospitals, and and 290 long-term and post-acute care facilities. Attendees will learn how to use a phased approach, establish client champions, help providers meet MU Stage 2, create a provider email directory, deliver care coordination tools, and drive continued ROI.

Acquisitions, Funding, Business, and Stock

Post-hospital care coordination systems vendor Careport Health closes $3.8 million in financing.

McKesson sells its Care Management business, which offers case and disease management services to payers, to investors who will rename it AxisPoint Health.

Premier acquires CommunityFocus, a community health needs assessment management solution jointly developed by UNC-Charlotte and Premier that will be incorporated into PremierConnect.

Sales

Kingsbrook Jewish Medical Center (NY) will use CipherHealth’s Echo to provide secure, online audio recordings of verbal discharge instructions to visually impaired patients.

Kentucky Medical Services Foundation chooses MedAptus Enroll for managing provider credentialing.

People

Payor platform vendor Healthx names Sean Downs (Enclarity) as CEO.

Government and Politics

Vermont Governor Peter Shumlin says a successful software upgrade to the state’s troubled health insurance exchange system this week will reduce the time required for “change in circumstance” updates, but adds that consumers will still need personal staff help until more changes are made in the fall and that warns that it will take time to catch up on the 10,000 changes that have been backlogged. Optum met the May 31 deadline for applying the update but must clear the backlog by October 1 to keep the state from considering shutting down the exchange and moving to Healthcare.gov.

Privacy and Security

Cottage Healthcare System’s (CA) cybersecurity insurer demands that the hospital repay $4.1 million it provided in settlement costs following a 32,500-patient data breach in 2013, saying the health system lied on its application in saying that it was applying patches, performing annual audits, and verifying the security capabilities of its outsourcers. The hospital failed to update the default FTP settings of servers, allowing patient information to display on Google searches.

Other

County-operated 439-bed Riverside County Regional Medical Center (CA) requests $53 million to convert to Loma Linda University Health’s Epic system, which I believe would replace Siemens Soarian for inpatient and NextGen for ambulatory.

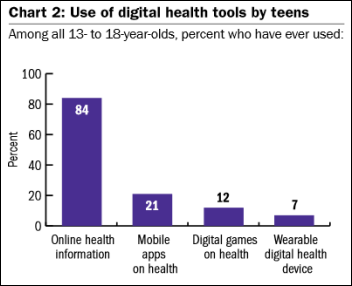

A Northwestern University study finds that 84 percent of teens have looked up health information online (mostly by Googling a topic and clicking on the first link presented) and 21 percent have download health-related mobile apps, although two-thirds of them say they didn’t change their behaviors based on health information or tools. Three-fourths of teens were at least moderately satisfied with the information they found, but a significant percentage also ran across negative information such as how to manufacture drugs, play drinking games, or create eating disorders. Only seven percent had ever used a fitness tracker.

A New York Times analysis finds that hospitals are jacking up their list prices (paid only by uninsured and out-of-network patients) at double the rate of inflation, while their Medicare payments remain flat.

A study finds that 8.2 percent of ED patients returned within three days, with a third of them choosing a different ED and the second visit often costing a lot more than the first. The highest revisit rate involved skin infections that probably shouldn’t have required an ED visit in the first place, but of course most doctors in private practice work banker’s hours in rarely being available without an appointment and nearly never between 5 p.m. and 8 a.m., leaving the ED as the only medical “open now” sign on for well more than half the day unless you count urgent care clinics that actually expect patients to pay upfront instead of if and when they get around to it.

Your cutting edge, contemporary, and fresh HIMSS16 presentation proposal is due June 15, a mere 8.5 months before you’ll actually present it.

AOL founder Steve Case, now an investor, says healthcare is one of the big economic sectors that will be disrupted by startups, for which he advises perseverance, partnerships, and policy. On the other hand, Steve’s one hit was dumping AOL on the clueless and Internet-terrified Time Warner in a disastrous and scandal-driven 2001 dot-bomb merger, with his follow-up Revolution Health sinking without a trace and his current healthcare IT investments being companies I’ve never heard of. He spoke at HIMSS08 back when it still looked like he might disrupt healthcare.

Weird News Andy flipped over this story that he titles “spatuvula.” A woman tries to clear her allergy-swollen throat using a foot-long kitchen spatula handle, removal of which (and part of her esophagus)required emergency surgery. WNA loves the bonus story at the end that describes a doctor removing a fish from a boy’s throat on camera, leading WNA to question whether he was paid scale.

Sponsor Updates

- Valence Health is named as one of Chicago’s fastest-growing companies with its 50 percent annual growth rate and 800 employees.

- Cumberland Consulting Group’s Annamarie Lee will present “Navigate Complexities of Contracting and Government Compliance” at CBI’s Medicaid and Government Pricing Congress this week in Orlando.

- Health Catalyst is named as one of the best places for millennials to work.

- Forward Health Group CEO Michael Barbouche is interviewed by a Madison newspaper.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

Wow for $1.2 billion Partner’s could have made a run at buying a controlling stake in Allscripts (current market cap $2.57 billion)….

I’ve never had to request my whole chart, but just getting an xray interpretation I needed was kind of a pain (had to physically go into the office and fill out a form). I don’t feel they were trying to keep it from me, but it would be much easier if more were online. My office is near the HIM office at our clinic and every day I’m directing someone there, often for things that are not online, but could be printed from there if they were.

There will NEVER be a payback of the $1.2 Billion dollars. To think so is delusional because I’ll guarantee that doesn’t cover all the costs incurred.

As Anonymous described, the issue isn’t that providers don’t make the EHR or portions of the EHR available to patients, Mr. HIStalk, it’s that most providers don’t make the EHR or portions EASILY available to patients, such as through a secure patient portal.

I am pretty sure that Siemens bid for Partners came in around 300 MM. So Partners decided that Epic was 900 million dollars better.

Sort of a red herring there with the AllScripts comment.

If they were to have bought AllScripts (which remember they used to own a million shares of Eclipsys) then what?

Then they could:

1. Starting paying the salaries of all the AllScripts people plus their own developers?

2. Then they could have found extra investment to actually fund the R&D at AllScripts to create an actual integrated product?

3. Then invest in creating a scalable platform so they could use the system across all of Partners?

4. Then they’d still have to fund an implementation of said new products at some future point in time?

5. Then they’d have to pay to train the same number of people?

Common – get real. Epic didn’t make the 1.2B and you likely know it. Epic’s part of that is tiny in comparison to what the organization counts in their TCO. And, they have a chunk of that TCO money burning every day with inplace support and maintenance.

My example was used to demonstrate the magnitude of the expense. Buying almost half of a publicly traded EHR company is a HUGE investment.

I do want to address your other points though as some seem off base to me.

1. Starting paying the salaries of all the AllScripts people plus their own developers? – Allscripts with their current cash flow pays their employees so buying half of Allscripts shouldn’t change that.

2. Then they could have found extra investment to actually fund the R&D at AllScripts to create an actual integrated product? – They could direct existing Allscripts spend, but too your point it would require additional capital.

3. Then invest in creating a scalable platform so they could use the system across all of Partners? – In fairness to Allscripts on this one, Sunrise is probably scalable just not fully integrated today.

4. Then they’d still have to fund an implementation of said new products at some future point in time? – The issue I have with this is if we’re saying “wow Epic costs a lot” because of the $1.2 billion you can’t turn around and say “well that’s not Epic’s cost it’s implementation of an EHR”. EHRs cost a lot to roll-out and Judy understands the importance of a good roll-out so their are specific requirements in place to ensure this happens. To get apples-to-apples the implementation plans for the two EHRs would need to be similar.

5. Then they’d have to pay to train the same number of people? Again, then this isn’t the cost of Epic, but the cost of any new EHR. I also don’t believe the Epic is some how deficient and requires additional training above any other similar EHR.