Giving a patient medications in the ER, having them pop positive on a test, and then withholding further medications because…

News 5/20/15

Top News

Allscripts layoffs, which HIStalk readers have been reporting for the last several weeks, finally happen, with 250 indeed being the magic number. Several readers chimed in with their opinions just as the company made the cuts. Allscripts Peon pointed out that Allscripts “continues to lie to employees and cut staffing levels. Last month, 250-300 employees were cut so leadership could ‘right size’ the company. At that time, senior leaders told remaining employees that further cuts were not anticipated or being contemplated. Last Friday (5/15), another 250 or more employees got the axe as executives again said they were ‘right sizing’ the company. Apparently Paul Black and his team have no clue what the right size is for Allscripts.” Broadway Joe added that layoffs affected DBMotion, too. In terms of “right sizing,” the layoffs represent 3.5 percent of the company’s global workforce. Spokeswoman Concetta DiFranco explained that, “As a normal course of business, we are rebalancing our teams to ensure we have the right resources allocated to the right projects." I’m wondering how “right” those 250 folks feel right about now.

Webinars

Here’s the video from Tuesday’s webinar with Imprivata, which featured tips on how to prevent phishing attacks at healthcare facilities, as well as lessons learned from Yale New Have Health System.

May 20 (Wednesday) 1:00 ET. “Principles and Priorities of Accountable Care Transformation.” Sponsored by Health Catalyst. Presenter: Marie Dunn, director of analytics, Health Catalyst. Healthcare systems must build the competencies needed to succeed under value-based payment models while remaining financially viable in the fee-for-service landscape. This webinar will outline key near-term priorities for building competency at successfully managing at-risk contracts, with a particular focus on the importance of leveraging data to drive effective decision making

May 27 (Wednesday) 1:00 ET. “Introducing Health Catalyst Academy: An Innovative Approach for Accelerating Outcomes Improvement.” Sponsored by Health Catalyst. Presenters: Tommy Prewitt, MD, director, Healthcare Delivery Institute at Horne LLP; Bryan Oshiro, MD, SVP and chief medical officer, Health Catalyst. The presenters, who are graduates of Intermountain’s Advanced Training Program, will introduce the Health Catalyst Academy’s Accelerated Practices program, a unique learning experience that provides the tools and knowledge for participants to improve quality, lower cost, accelerate improvement, and sustain gains.

Acquisitions, Funding, Business, and Stock

Welltok acquires predictive analytics company Predilytics for an undisclosed sum. The timing is interesting, given that Predilytics secured a $10 million Series C round last December. Welltok will likely incorporate the new company’s tools into its CaféWell health optimization platform.

Announcements and Implementations

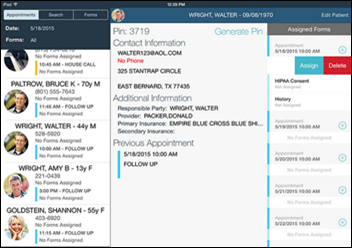

ADP AdvancedMD launches patient and administrative kiosk apps, plus corresponding electronic check-in and consent forms.

Surescripts announces the processing of 6.5 billion health data transactions last year, surpassing transaction heavyweights American Express and PayPal.

The Hilo Medical Center’s Hawaii Pacific Oncology Center implements Meditech Oncology 6.0x, making it the ninth and final clinic in the HMC network to migrate from paper to the EHR. The five-year, system-wide project also included implementation of secure patient bill pay through the East Hawaii Regional Patient Portal.

Arkansas Heart Hospital and Arkansas Urology implement Pingmd’s secure text messaging solution across 35 facilities. The app has been in use at each organization’s main facility in Little Rock for over a year.

Stoltenberg Consulting partners with Qlik to offer the visual analytics vendor’s data solutions to its clients.

HealthCare Synergy becomes the first home health EHR vendor to partner with Great Lakes Health Connect, a Michigan-based HIE that connects over 80 percent of hospital beds and 10,000 providers throughout the state.

Government and Politics

An OIG report finds the Coast Guard sorely lacking when it comes to protecting personnel medical records, citing a lack of instruction and process to periodically review health data security measures. The report also found no evidence of meetings between the Coast Guard’s privacy and HIPAA officers, and noted a lack of leadership as the main barrier to be overcome. The copious amounts of paper files pictured in the report (along with one black-and-white photo of a flooded records room) are also cause for concern.

Privacy and Security

The IEEE Cybersecurity Initiative releases “Building Code for Medical Device Software Security,” a 23-page set of guidelines that aims to help companies “establish a secure baseline for software development and production practices of medical devices.”

Innovation and Research

New York-Presbyterian Hospital launches InnovateNYP, a 10-week technology competition in which contestants will develop working prototypes that improve patient engagement or provider collaboration. Entries are due July 24, with a top prize of $15,000.

A study of over 300,000 free-text machine-readable documents in the Stanford Health Care EHR finds that text-mining tools can be used to detect unplanned care episodes documented in clinician notes or in coded encounter data. Researchers believe their methods could be used for quality improvement efforts in which “events of interest occur outside of a network that allows for patient data sharing.”

MD Anderson Cancer Center at Cooper (NJ) and behavioral health technology company Polaris Health Directions will launch a breast cancer behavioral health pilot project incorporating the Apple Watch. Wearable data on treatment side effects, sleep patterns, activity levels, and mood will be combined with patient EHR and population health data from within the Cooper health system to provide researchers with greater insight into engagement, feedback, and intervention.

Technology

![]()

Flatiron Health will incorporate National Comprehensive Cancer Network Chemotherapy Order Templates into its OncoEMR, beginning with breast, colon, and non-small cell lung cancers. The EHR will also link to NCCN’s website to provide oncologists with additional resources.

Fruit Street Health taps Validic to integrate wearable devices and applications into its telehealth software, PHR, and video-conferencing platform.

Proxsys partners with mobile technology developer Catavolt to create a bedside discharge delivery app for tablets. The new app will be deployed throughout the Proxsys Rx Integrated Outpatient Pharmacy Provider network.

People

Jonathan Scholl (Texas Health Resources) joins Leidos as health and engineering sector president.

Hai Tran (BioScrip) joins Specialists on Call as CFO.

Recondo Technology appoints Eldon Richards (PatientPoint) CTO and Perry Sweet (Allscripts) as chief client officer.

Mark Reed, MD (Seattle Children’s Hospital) joins JWA Consulting, a part of Truven Health Analytics, as medical director.

Other

This article highlights the decade-long collaboration between physicians at the Uganda Cancer Institute and Fred Hutchinson Cancer Research Center (Seattle). The two organizations are preparing to open a new research, training, and outpatient facility in Uganda. It will be the first comprehensive cancer center jointly built by U.S. and African cancer institutions in sub-Saharan Africa.

HIMSS issues a call for members of its new Health Business Solutions Technology Task Force. The group will facilitate discussion between health IT vendors and end-users, review legislative and administrative initiatives, and educate policymakers on aligning regulatory requirements with business needs.

Sponsor Updates

- ADP AdvancedMD explains “What the Meaningful Use deadline means for your practice” in a new blog.

- The San Antonio Express-News covers AirStrip’s expansion into home health.

- AirWatch recaps its first annual employee hackathon in a new blog.

- AtHoc recaps its annual user conference in its latest blog.

- Besler Consulting explains “The Role of Discharge Disposition in Preventing Hospital Readmissions” in a new blog.

- Bottomline Technologies and Cornerstone Advisors Group will exhibit at the MUSE conference May 26-29 in Nashville, TN.

- CapsuleTech offers a new blog entitled, “Are you aware that your patient’s ventilator has just disconnected?”

- Caradigm outlines “How Population Health Enriches the Patient Record” in a new blog.

- CareTech Solutions offers a new video explaining the benefits of cloud services in today’s healthcare environment.

- Clinical Architecture recaps its HIMSS15 fundraising efforts for the Music Empowers Foundation, Illinois Tornado Relief Effort, and St. Joseph the Worker School

- CommVault adds several new cloud solutions to its line of enterprise products.

- Connance’s Patient-Pay optimization solution receives HFMA Peer Review designation.

- CoverMyMeds Vice President of Customer Relations Michelle Brown discusses how to scale up a company’s culture during a Startup Week event in Columbus, OH.

- Culbert Healthcare Solutions offers a new blog on “Improving Population Health using Epic’s Healthy Planet.”

- Divurgent offers a new white paper entitled, “Population Health: Laying the Foundation of Healthcare’s Next Generation of Care.”

- Medecision offers a new blog entitled, “From Patients to People: Leveraging Analytics to Improve Population Health.”

- Burwood Group posts a new blog entitled, “ED Caregivers, Tech – Let’s Get Together.”

- Practice Unite offers a new blog entitled, “[Checklist] Evaluating Mobile Patient Engagement Apps.”

- SyTrue offers a new visual blog focusing on industry response to its Radiology NLP offering.

- Microsoft blogs about its experience demonstrating nVoq’s SayIt speech-recognition solution on Surface Pro 3 tablets at HIMSS.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

Gee, so many layoffs, so close to college graduation. Just sayin….

Who is Concetta Di Franco? I have never heard of her. I had to look her up! Just a PR person. lay her off, hire another engineer in in the US.

Allscripts layoffs:

Well, its not like nobody saw this coming. If employees were caught off guard, perhaps they should pay closer attention to their employers performance.

Besides, corporations are under no obligation to hire or employ persons they don’t need. When a company under performs, people lose jobs, usually its the rank and file. What? you think executives will fire themselves?

Hopefully these folks will find a better fit for their talents and contributions from companies that place higher value on people and have healthier bottom lines.

There is always a market for talent. Just sayin.

Gee, so close to the Military decision….If I were spending that kind of money I would hesitate going with a vendor “rebalancing” with a big lay off like this

Unfortunately the resulting company that is Allscripts today fate was sealed years ago starting with the Mysis Healthcare merger. The deal was structured so the resulting “Allscripts” was so heavily leveraged that its fate was already sealed. Historically Allscripts has not been know as being the leader in technology, it assembled all of its solutions by way of merger or acquisition. It was the leader in putting deals together and having great deal makers. Very little of what is Allscripts is really their intellectual property.

Several years ago when Glen was still the CEO an outside firm was commissioned to review the current state of the Allscripts solutions prior to the Eclipsys merger. In the end the report recommended that Touchworks or Enterprise EHR be scrapped and an entirely new solution built and they build an unified Inpatient/Ambulatory solution . The report was sound in its approach, due diligence and recommendation of moving to a single platform that was built on a single database verses Enterprise which is really two databases, one for clinical data and one for revenue cycle as they were joined and authored by different companies. Instead the idea of merging Eclipsys was born as at that time one of its founders Terry Macaleer was a Senior VP with Allscripts help smooth things out and all the main players would have huge pay days again. But that was about the time Glen was lobbing the hill for HITECH and we all know what came next. In Allscripts eye it was about sales, that is what fueled the MyWay fiasco.

The merger with Eclipsys made sense as it was a fast way to put compete with the other major players, Cerner, and Epic who had complete unified solutions for Ambulatory and Inpatient and Revenue Cycle. But they ran into the same technology issues of not having a unified solution. They have tried to talk their way around and are now building a unified solution for the future. But its to late. Allscrpts has been on a catch up game for the last 5 years, that trend will not change. The big purchase phase is now over, and what you have now are one offs and they are not in the game. It really comes down to being a two or three vendor market, Cerner, Epic and Meditech for enterprises with GE, McKesson,and Siemens gone. On the low end you will have similar offerings but only among 3 – 5 firms will survive. The healthcare IT market is maturing like others before it.

Over time you’ll see Allscripts sell off pieces such as dbMotion or what is left of it, the Claims Clearing House and some of the underlying technology. Alternatively another company could purchase it all and take what it wants and scrape the rest. But if you hold Allscripts stock I’d be looking for peaks to sell it over the next 12 – 18 months. My belief is Allscripts will not see 2018 as the company it is today. Paul Black and his leadership are priming the company to be sold or scrapped. Cut costs, manage bottom line performance, don’t set high expectations for Wall Street. All tell tell signs. Everyone who is left that does not have a “Employment Contract” should be polishing their resume and hitting the bricks. The clock as started. Best of luck to all.

Allscripts has a Record 2015 Q1 bookings and a 3 BILLION DOLLAR backlog. High visible reoccurring subscription revenue with terms of 5 to 10 years at all time high–oh my, sounds real scary?!?

MU has come and gone, as Hater #3 (Monty Hall) points out the large land grab is over. If you’re a vendor and not right sizing/rebalancing/laying off (whatever you want to call it) to prepare for what’s next then…..then you’re just obtuse. I’d be more concerned if you work for a vendor and that wasn’t the case–you better be lean and mean going into ICD10, bundled payments, telemedicine, (insert buzzword).

What do you think eClinical ,NextGen, Athena, Greenway/Vitera, GE, Cerner/Siemens, Epic etc. are doing?? You think Cerner is going to keep there Siemens workforce? you think EPic will keep hiring implementation/professional analyst as there deals wind down to a handful a year? Do you think they are selling large enterprise deals every month, selling massive hospital contracts, hiring 100s of ppl every quarter. No, they are doing the same thing–right sizing for what’s to come. Yes, there’s the one-offs that Epic/Cerner/Allscripts are winning. Some vendors have a convenience of being under the veil of a privately held company to keep their house private.

My guess is haters 1 thru 3 above are competing vendors looking for any avenue to compete even if it means hate hate hate on a blog read by 10k ppl.

Lastly, comments about Indian support are borderline bigotry/racist. so its ok for Indians to build majority of your software that you us eon a day to day basis, but not support it? You think Cerner, epic, etc. don’t have thousands of Indian based engineers and support analyst. We’re in a global economy! Economic globalization, or the lack there of, is one of the greatest threats to our national GDP. In the long term you have to drive efficiency or the invisible hand will force you to. Using the global marketplace is one the most proven ways to do so.

Oh, I wont even start on Aprima.

HISTalk living up to its National Enquirer moniker. That’s not an insult Mr. H, love your blog, but lets be real–gossip is one of the main reasons your blog is read :)!

Allscripts has a Record 2015 Q1 bookings and a 3 BILLION DOLLAR backlog. Highly visible and predictable reoccurring subscription revenue with terms of 5 to 10 years at all time high–oh my, sounds real scary?!?

MU has come and gone, as Hater #3 (Monty Hall) points out the large land grab is over. If you’re a vendor and not right sizing/rebalancing/laying off (whatever you want to call it) to prepare for what’s next then…..then you’re just obtuse. I’d be more concerned if you work for a vendor and that wasn’t the case–you better be lean and mean going into ICD10, bundled payments, telemedicine, (insert buzzword).

What do you think eClinical ,NextGen, Athena, Greenway/Vitera, GE, Cerner/Siemens, Epic etc. are doing?? You think Cerner is going to keep there Siemens workforce? you think EPic will keep hiring implementation/professional analyst as there deals wind down to a handful a year? Do you think they are selling large enterprise deals every month, selling massive hospital contracts, hiring 100s of ppl every quarter. No, they are doing the same thing–right sizing for what’s to come. Yes, there’s the one-offs that Epic/Cerner/Allscripts are winning. Some vendors have a convenience of being under the veil of a privately held company to keep their house private.

My guess is haters 1 thru 3 above are competing vendors looking for any avenue to compete even if it means hate hate hate on a blog read by 10k ppl.

Lastly, comments about Indian support are borderline bigotry/racist. so its ok for Indians to build majority of your software that you us eon a day to day basis, but not support it? You think Cerner, epic, etc. don’t have thousands of Indian based engineers and support analyst. We’re in a global economy! Economic globalization, or the lack there of, is one of the greatest threats to our national GDP. In the long term you have to drive efficiency or the invisible hand will force you to. Using the global marketplace is one the most proven ways to do so.

Oh, I wont even start on Aprima.

HISTalk living up to its National Enquirer moniker. That’s not an insult Mr. H, love your blog!

Several sources have indicated, that many that were impacted,

were +20 years in service, most of whom had come over from Medic,

when it was bought out by Misys.

High level technical staff, many who were the top level support,

in several groups, are now gone.

It appears that no thought(none should be surprised),

went into those that were terminated.

There is no morale left there, it has been gone for a very long time,

and the ones left, are just holding on, and hoping for severance,

when their time comes.

The goal is 100 percent India, everything going to India.

Supporting Haters going to hate. Cerner just completed a voluntary seperation for longer term Cerner and ex-Siemens associates. There numbers exceeded the 250 at Allscripts. That might of been a better path for MDRX.

The end of MU1 and 2 has changed the landscape a bit. The whitespace is in Pop Health and Global. Not saying Allscripts doesn’t have growth issues, but every vendor has it challenges right now.

Always a tough decision to reduce jobs. I wish all effected well.

This is not the forum to have a chip on your shoulder as so eloquently displayed by Haters got to Hate displays. So much so they had to post the same comment twice. I hope it calmed you down. I love how you point out Allscripts record bookings for the 1st quarter of 2015, but the majority of those bookings are from professional services, support, subscription licenses fees, and or other recurring revenue, not net new business. The 3 Billion backlog you highlight can be attributed to Allscripts inability to deliver timely implementations or enhancements contractually obligated to earn and book the revenue. In very simple terms the backlog you want to point out as being so great is really no more than non-realized revenue that while on the books is not money in the bank. Not my opinion, but GAP.

They are currently being sued by the health authority in Australia and the list goes on. This on top of the investors suite that was settled last year associated with the overvaluation of the new combined company. I also like how Hater got to Hate does not address any of the issues I raise in my initial post. Facts are facts.

That said, to your question if I am with a competing vendor the answer is No!, Far from it. I’ve been in this healthcare IT rat race for almost 3 decades. Not to divulge my identity as like Mr. HIsTalk, Inga and others my business depends on relationships and our firm has close relationships with all the large vendors and multiple clients on all of their competing solutions. I’m not one for gossip, what I’m not putting up in my comments are what I was told or heard first hand direct from leadership at Allscripts, dbMotion, and Mysis now and in the past. As our firm is not publicly traded and I hold no Allscripts stock today, I’m not bound by any restraints of providing these insights.

You need to stand back and take a hard and serious look at what your advocating and applauding. I agree with your stance that all companies need to continually look at their staffing needs and right size as needed. The reality is very few Allscripts clients are really happy. Sales are few and far between and right now the solutions in place don’t compete well with the competitors solutions. This isn’t me saying this stuff, its the market and prospects saying it. I get wanting to be the good soldier and cheering on Allscripts because you drank their cool-aid but the reality is as I stated in my earlier post its days are numbered.

Seriously, posted twice is your gottcha statement haha?

Once again you’re wrong, Q1 bookings were a mix of net-new sales, dbMotion, patient portal, a couple new Sunrise acute accounts and overall expansion in to what is one of the largest install bases in North Americawith one of the largest HIT reoccurring revenue streams in North America.

Again, you failed to understand my point. There is no real net-new activity across the nation or vendors in what we historically have called EMR. What do you think vendors who don’t have an install base like Allscripts, no HIE, no patient portal, no analytics, and no acute system are doing right now???…not a whole lot. Wait until Cerner and Epic get into the world of the 1 doc practices, watch their margins shrivel or go upside down on those projects. Dr. Jayne can probably attest to that.

You speculate and some case flat out you’re either lying or just don’t know you’re lying–you can decide which is worse.

This is HIT–why are you surprised with legal eagle rumbles? There’s a laundry list of Cerner, Epic, Meditech etc. legal battles with their clients. Google any publicly traded company–you’ll find some kind of lawsuit out there. Again, privately held companies have the luxury of not having to file such news. Implementations are so complex that they tend to settle on a go-live definition through their legal avenues. SA Australia is not being suing Allscripts. Do you have a court filing, docket #…any proof? To be suing someone you must have a public court filing–can you supply this? Yes, execs/legal are speaking to getting to the bottom of a very complex implementation. Again, your comments are flimsy at best and so bias at most.

You don’t get to post anonymously and then turn around and self-label what you type/write as “insight”. You need facts, proof and credibility to earn that label–none of which I see in any of your post.

Inciting speech without substance or fact…….where I grew up, that’s a telltale sign of a Hater :)!!

Say what you will about Allscripts doing layoffs. Business is clearly not going well for them. Not a secret. Maybe they’re calling it “restructuring”. Etcetera.

I’ll at least give them points for coming clean about the fact that it’s happening, and that people are losing their jobs based on decisions their management is making. Even though it does not reflect well on their management that they are in the straits they are in, there is something to be said for the integrity of owning up to moves like these and especially so when the chips are down.

Skip back a few years, and contrast that with the behavior of another major player in the industry. Back when the recession really started to get going in 2009, Epic forced hundreds of people to resign. They were on the cusp of Meaningful Use, HITECH, and all kinds of government support that they didn’t have up to that point, and they knew it. Lavish spending on the buildings slowed not a bit, and they asked huge numbers of people to leave the company without a single public nod to the fact that they were doing so. They barely acknowledged it to their rank-and-file employees.

I left Epic a few years back, largely in disgust at the cultural shift that allowed that to happen. It was all done with the excuse that they had to eliminate mediocrity. While that’s a worthy purpose, accountability was never a huge problem at Epic, and for every layoff Epic did of someone that was not a stellar performer there were usually equal numbers of layoffs that were more questionable. Funny thing how “eliminating mediocrity” also had an ancillary benefit of tossing aside employees that might have also just been higher on the payscale. I felt very uneasy about the part I was forced to play in particularly questionable cases, some that stank of politics more than performance.

So I’ll simply conclude by saying shame on you Allscripts. Shame on you for failing to manage your business in a manner that kept your employees properly employed. Thank you, though, for showing enough courage in a tough moment like this to admit what you did.

Monty Hall, I agree with a lot, if not most, of what you are saying. Having been a customer for 15 years or more, and around when the first acquisitions (Channel Health) were made from Rich Tarrant of IDX, Allscripts has certainly grown by acquiring other products and figuring out (at least initially) innovative ways of integrating them together. I do question that the report (of which I am familiar) recommended scrapping the TouchWorks/Enterprise EHR, but rather the bastardized combination of the TouchWorks/Enterprise EHR and the A4 Practice Management solution (renamed TouchWorks PM or Enterprise PM, depending on the timeline). Two completely different databases, with differing user interfaces and in reality two different audiences – the TW EHR was aimed at large IDNs/Academic/health system clients while the A4 PM product was really only suitable for less than 100 physicians. I still feel sorry for the poor salesfolk that were charged with trying to sell that combined product (EHR/PM) to customers like Novant, who could never use a product like A4PM to manage the revenue cycle of their thousands of physicians.

It was around the time that Allscripts decided to break it’s relationship with the GE/IDX Flowcast platform when Glen found a love/hate relationship with India and began to move product development off-shore. I remember trying to contact him on several occasions only to have him answer the phone from China or India… Clients were told it was a necessary step to ramp up the code development – US developers would write specs during the day and Indian coders would code it overnight, returning completed modules to be tested the next day back in the US. All good in theory but it never worked that way. Allscripts desperately needed the rewrite that the off-shore arrangement promised, but never delivered. Instead, customers had to wait months for solid code to find its way back to the US and then what was delivered was sub-par (specifically version 11.0 of the Note module, and more and more outsourcing of the A4 PM product). And it has been a struggle ever since…

Fast forward to today and it’s easy to see where so many mistakes have been made on Allscripts part: too much focus on just the ambulatory market; too much emphasis on off-shoring development – then support – then engineering; too much focus on growing by ill-advised acquisition and picking products that were only about adding to the “180,000 physicians served” tagline with no clear market strategy for any of the products they bought; and, perhaps fatally, too little effort placed on providing a single solution that actually solved a problem or answered a need in the market. Allscripts had a huge share of the market by default with it’s relationship with GE/IDX in the early-mid 2000’s… they squandered their lead and let Epic and Cerner beat them. Now they have a bloated staff, a code-base that looks like spaghetti, and a leader who seems to be more concerned with how his stock is doing (or selling off his stock!) than how many of his customers are kicking his systems to the curb.

Monty, you are right, all of the tell-tale signs of a company going up for sale or simply going under are starting to show. God help the customers who hang around to the end…

Let me throw another two cents of random thoughts in. Backlog is great when it’s backlog that you can eventually bill. Backlog for software and services that will never be implemented by the customer are of no value. When your services revenue is T&M like much of Allscripts services revenue is the only way to increase the margin on that work is to reduce the cost. The way to reduce the cost is eliminate your highest priced resources, simple as that. As for Allscripts coming clean about the layoffs, the first was not acknowledged at the time it occurred (end of Q1), it was merely mentioned in the earnings call in May. Human beings, colleagues go from “associates, our most important asset” to a line item in the quarterly financials. It’s all explained in the packet….

Ockham, if you would truly hesitate going with a vendor who was “rebalancing,” then I guess you’d have similar reservations about the Epic-IBM bid? After all, one of the worst-kept secrets in business is the massive nationwide layoff going on at IBM. http://www.bloomberg.com/news/articles/2015-05-19/iowa-spent-50-million-to-lure-ibm-then-the-firings-started

In addition to epic and IBM laying off, cerner just cut 400 ppl this year.

Do I think [Epic] is hiring 100s of people every quarter? I know they are. My numbers aren’t exact but they have/are adding 2k to their workforce over the +/- 1 year (most recently in Rev Cycle management). I have heard this from their trainers and a few months ago saw the expansion for myself.

I suspect the layoffs from revenue cycle back in the day (and some were in 2008) were heavier. There were and are more internal politics in that area at Epics. And companies will layoff one month, and three months later start hiring again, after getting rid of salaries or up and comers.