Giving a patient medications in the ER, having them pop positive on a test, and then withholding further medications because…

News 5/9/14

Top News

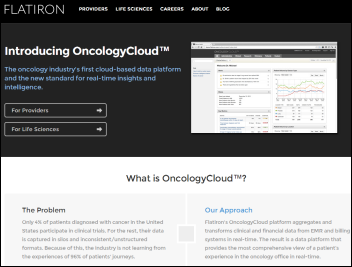

Google Ventures invests $130 million in oncology data platform vendor Flatiron Health, which will use some of the money to acquire oncology EMR vendor Altos Solutions. The two 20-somethings who founded Flatiron Health sold Google their online advertising platform for $81 million in 2010. They knew nothing about advertising or healthcare before starting their companies. Their first Flatiron oncology rollout was in 2013. It’s a lot of money, so let’s hope Google’s investment outcomes exceed their healthcare ones.

Reader Comments

From Dave Miller: “Re: UAMS. We are now live fully everywhere on Epic. It has gone really well, with just a few of the usual minor bumps (printing, security, scanning, etc.). I think this has been the best of my three Epic go-lives (University of Chicago, Carle Foundation Hospital, now UAMS). I guess you can teach an old dog new tricks. We also did enterprise speech recognition, device integration, and barcoding among other things. We went from a HIMSS Stage 4 to a Stage 7 (application in process). My lab team made me an honorary member of the Beaker team with the shirt above, maybe because I am a former med tech.” Dave is vice chancellor and CIO of University of Arkansas for Medical Sciences in Little Rock. Congratulations to the team. I told Dave he has more Epic experience than some of the consultants out there.

From Joe: “Re: IBM’s Watson. I followed your link from HIStalk and got a Chat Now window on IBM’s page. I’m curious about Watson in healthcare, so I accepted. See the transcript – I decided to open with a (perhaps obtuse) nod to Alan Turing, which I figured any good IBMer should appreciate. Touchy, touchy! Or maybe they have an algorithm that indicates anyone skirting around Turing Test references is clearly a cycle-wasting tire kicker.” I replied to Joe, “Maybe the IBM rep was indeed a Turing fan and decided to prove in the most definitive way possible that he’s not a computer!” Joe says he’ll try again, asking, “Did you kill our previous session because you ARE a computer, or you are a human trying to PROVE that you’re not a computer?”

From Trey Hermanos: “Re: athenahealth. Can somebody tell me how many providers athenahealth has on their network? An article says 37,000, but Jonathan Bush said 52,000 at a recent conference. Their implementation is a breeze compared to others, but in their quest for growth and relevance, they risk losing the 1-10 doc practices that made them what they are today, the practices that aren’t getting decent service and call-backs from their account managers. They gave their award for improved patient experience to Target’s clinics, the same corporation that compromised the identities of millions. The company doesn’t think you need to see a doctor for ‘small things,’ a view held by many despite the fact that the knowing when something is simple or not requires skill and sophisticated knowledge. A recent article called ‘Nurses are not Doctors’ said you have to know a lot to do primary care – the Target and Walgreens clinics are there to sell what’s on their shelves. There is no respect for knowledge and we spoil our patients the way we spoiled our kids to the point they have no coping skills and grow up entitled. Athenahealth must feel undervalued and not appreciated enough, sort of like primary care.”

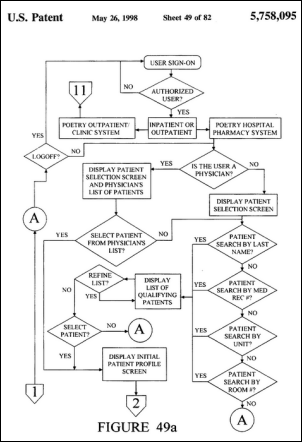

From HIT ESQ: “Re: patent troll. A company called Presqriber is filing a massive number of patent infringement cases against EHR vendors. It has no Google hits except these cases. Its patient is for an ‘Interactive Medication Ordering System.’ They appear to be the first major patent troll in a few years.” The patent is from 1998, so I bet someone bought it from a defunct vendor (“Poetry” is referenced as the system name, which had some California pharmacists and urgent care people involved and is presumably long gone) and hopes to milk vendors for go-away money. They hit all the majors in their list of 20 except one – Epic, who has a history of launching a full-scale legal counteroffensive on patent trolls. HIT ESQ also called attention to two class action lawsuits brought against Cerner for claimed labor standards violations, which although I can’t pull up the documents since I don’t have access to the PACER system, usually means a salaried employee claims they should have been paid for overtime because they were misclassified and should have been hourly.

HIStalk Announcements and Requests

Highlights from HIStalk Practice this week include: A report finds that higher payer doesn’t necessarily equal higher job satisfaction. Another says the physician industry generates $26 billion in sales revenue and supports $15 billion in wages and benefits. Northwestern Memorial Physicians Group and Northwestern Medical Group merge to form the second-largest physician group in Chicago. A trio of ophthalmologists turns to crowdsourcing to fund their digital physician on-call answering system. A study uncovers the fact that hospital prices and privately insured patient spending increase when hospitals acquire physician practices. A physician pleads with Forbes editors to get RAC bounty hunters off his back. Arizona Care Network and Northeast Medical Group launch separate ACO initiatives with payers. Don’t write athenahealth’s eulogy just yet –several company partners make product announcements.

This week on HIStalk Connect: Google continues its move into healthcare, as it grows its team of A-list genetic scientists working on its Calico moonshot project. Google also led the massive $130 million Series B funding round of oncology data analytics startup Flatiron Health. In other non-Google related news, PatientsLikeMe CEO Jamie Heywood discusses the details of its recent Genetech deal.

Listening: new from Brody Dalle, the former (female) lead singer of The Distillers.

Want to get in touch? I created a new contact form that covers everything I could think of. Submissions go straight to my inbox (which is usually overloaded, so keep expectations modest.) There’s a link at the top of this page, too.

Acquisitions, Funding, Business, and Stock

Castlight Health reports Q1 results in its first report as a publicly traded company: revenue up 339 percent, adjusted EPS -$0.72 vs. –$1.19, beating on revenue but missing earnings estimates by a mile. The company, whose market capitalization is around $900 million, had revenue of $8.4 million and lost $24 million in the quarter. Shares have dropped nearly 75 percent since CSLT’s March IPO, which some analysts called at that time “the most overpriced IPO of the century.” Castlight Health was founded in 2008 by Todd Park (White House CTO and athenahealth co-founder), Bryan Roberts (Venrock), and Giovanni Colella, MD (RelayHealth). Shares that rocketed to $40 on IPO day are now worth around $10 less than two months later.

Allscripts reports Q1 results: revenue down slightly, adjusted EPS $0.07 vs. $0.09, missing expectations on revenue.

Nuance reports Q2 results: revenue up 5.5 percent, adjusted EPS $0.28 vs. $0.34, beating expectations on both.

The Advisory Board Company reports Q4 results: revenue up 15 percent, adjusted EPS $0.34 vs. $0.34, beating expectations on both.

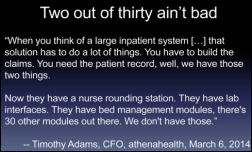

Hedge fund manager David Einhorn sent athenahealth’s stock price reeling this week when he said his firm has shorted the company’s shares because athenahealth is a faux cloud vendor whose real business is unsexy business process outsourcing that doesn’t deserve high share valuation. He didn’t just blurt it out – his slides from the investor conference presentation summarize his analysis:

- The company has failed to meet its 30 percent organic growth target for 2013, analysts have cut revenue expectations for the next two years, and earnings estimates keep going down.

- He says ATHN and some of the friendly analysts who cover it use a lot of buzzwords in describing what the company does, hoping to make it sound cooler and deserving of high share price, instead of what it is – an efficient business process outsourcer similar to lower-margin companies like MedAssets and Accretive Health.

- The valuation numbers of Morgan Stanley, which also happens to be ATHN’s largest shareholder, are shaky (although that company might also question Einhorn’s negative analysis since he, too, is providing supposedly unbiased information that could move ATHN share price in a personally beneficial direction.)

- Einhorn questions Morgan Stanley’s assumption that athenahealth’s inpatient business will jump from 0 to 40 percent of its revenues and that it will launch an inpatient revenue management service that will bring in $2.5 billion a year.

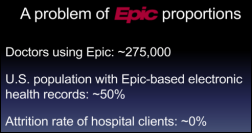

- The report says Epic is unbeatable in hospitals and will expand into other markets, including gaining ground with hospital-acquired small practices that might otherwise be athenahealth prospects.

- He says that HITECH is winding down and practices that wanted EHRs have already bought them, with Kareo, eClinicalWorks, and CareCloud offering lower-priced RCM and EHR products as athenahealth competition.

- Capitation would hurt athenahealth, he says, because providers would be paid upfront and wouldn’t need its help.

- He predicts a worst-case share price of $14 vs. then-current $127 (now $107), saying ATHN is like the 2004-era WebMD.

Meanwhile, Jonathan Bush said Thursday that Einhorn doesn’t understand the company, which he then compared to Uber, Airbnb, and Amazon. He added, “The right price of athena is … completely out of my pay grade,” but told also CNBC that he’s sure ATHN is a $1,000 stock and then said, “Who cares about net income?”

Streamline Health will acquire the assets of cost and spend management solutions vendor CentraMed.

Cedars-Sinai Health System (CA) and MemorialCare Health System (CA) form Summation Health Ventures, a healthcare IT development fund that will seek startups not only for potential return, but their capability to create technology that the hospitals can use.

Sales

Lake Taylor Transitional Care Hospital (VA) will implement HCS Interactant for its LTACH and SNF service lines.

Announcements and Implementations

An engineer who helped develop ride service Uber launches Pager, which allows Manhattan residents to request an off-hours telephone consultation or house call from participating doctors. Telephone calls cost $50 (of which Pager skims $10), while house calls run $300 and the company keeps $50. Like Uber, Pager is thinking about surge pricing, raising charges when demand is high. It has only 20 doctors participating during its launch testing period. He should have chosen a less-generic name: Uber was always easy to find, but I couldn’t locate anything on Pager despite extensive Googling.

Policy documentation software vendor PolicyMedical will integrate with the Access electronic forms system.

Hybrent announces a medical supply ordering application for clinical staff.

Mandi Bishop, Nick Kypreos, and Lauren Still put together Team FloriDUH to create open source data visualization tools. They’ve been invited to compete at Health Datapalooza in Washington, DC June 1-3 and have formed a non-profit foundation to distribute tools they build. They are hoping to raise $10,000 in a Medstartr project that starts Friday, May 9 to cover travel costs and extend their product offerings.

Government and Politics

HHS Secretary Kathleen Sebelius, who I assumed was long gone but apparently isn’t, leads a thinly veiled cheer for the Affordable Care Act in touting its supposed benefits as analyzed from HHS’s databases: a tiny reduction in readmissions and a nine percent drop in hospital-acquired conditions in 2011-2012 and a claimed 15,000 lives and $4 billion in healthcare spending saved. President Obama’s nominee to replace Sebelius, Sylvia Burwell (above), faced her first Senate confirmation hearing Thursday and received near-universal compliments, even from Republicans.

New York-Presbyterian Hospital and Columbia University will pay $4.8 million to settle charges related a 2010 privacy breach in which the medical information of 6,800 patients was exposed when a CU physician-programmer tried to deactivate a personally owned server he had connected to NYP’s network, opening up the patient information it contained to the Internet. The error was discovered, as it always is, by someone Googling individuals and turning up inpatient clinical information. Neither organization had checked the server’s security, conducted a risk analysis of all systems, or developed policies and procedures for database access. It’s the largest HIPAA fine ever.

Health Information Technology Exchange of Connecticut will be shut down since the HIE has spent its federal grants without accomplishing a whole lot.

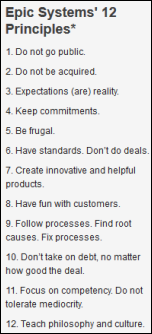

A former Epic intern and employee who worked directly for Judy Faulkner for a time writes about his experience in a Madison online publication. He says Judy isn’t reclusive, just more interested in tending to her company and its customers than gabbing with reporters. He anguishes over whether the company spends too much on fancy buildings. He says Epic is good place to work because it quickly jettisons underperforming employees, but wonders if it shouldn’t hire more experienced people even if Judy’s long-held belief is that she can turn a new college grad into an “Epic person” in three years while experienced hires would take twice as long.

Weird News Andy reacts to this story by saying, “Mmmmm, bacon.” Scientists question the 1950s study that claimed saturated fats cause heart disease, saying the researcher chose specific countries that would prove his point, used small sample sizes, and studied one country during Lent when nobody was eating meat or cheese. The Wall Street Journal essay by the author of a pro-saturated fats book says that funding by Crisco’s manufacturer, Procter & Gamble, made the American Heart Association a national force and the group later spearheaded a move to vegetable oil for a “healthy heart” even though proof was lacking.

Sponsor Updates

- Alan Worsham (Sutter Health) and Joe Schmidt (Emory University School of Medicine) join Culbert Healthcare Solutions as practice directors.

- InterSystems TrakCare gains the largest share of non-US hospitals and is named a clear leader by KLAS.

- Perceptive Software’s Larry Sitka will speak on breast tomosynthesis and John Hamdor will present on image-enabled EMR management at the SIIM14 conference.

- Tampa General Hospital (FL) is live on Wolters Kluwer UpToDate Anywhere integrated into Epic.

- Extension Healthcare releases a two-part white paper to aid hospitals with compliance with clinical alarm safety.

- Capsule Tech celebrates National Nurses Week by posting celebrations and nurse-focused activities on the company’s blog.

- Merge’s Mark Bronkalla explains the service model of PACS shifting to enterprise IT in a recent blog posting.

- Gwinnett Medical Center and Connance will co-present at the Healthcare Business Insights’ Spring Member Retreat on “How Revenue Cycle Can Change Patient Loyalty.”

- ICSA Labs certifies 29 vendors in April, including HIStalk sponsors Iatric Systems, Quest Diagnostics, and Orion Health.

- Netsmart advocates for behavioral health providers on Capitol Hill.

- Visage Imaging offers a NVIDIA case study in connection with a video detailing the architecture of the Visage 7 Enterprise Imaging Platform.

- Aspen Advisors Founder and Managing Principal Dan Herman and principal Jody Cervank discuss IT’s impact on operations, clinicians, cost and productivity at a regional VHA COO/CFO Joint Affinity Group.

- Ashish Shah and Brian Ahier of Medicity discuss the landscape and future direction of data exchange networks in a recent article.

- Carolinas HealthCare System shares how Medicity was instrumental in its HIE CareConnect success.

EPtalk by Dr. Jayne

We hosted a site visit at the office yesterday. It’s been a long time since we’ve done one and I had somewhat forgotten what an adventure they can be. We’ve been a reference site for our ambulatory vendor for years, but because of everything going on with upgrades, Meaningful Use, and ICD-10 preparation, we had taken a break.

We’re old pros at site visits since we were early adopters of EHR and had put our ambulatory physician practices through an accelerated implementation that was not only rapid, but successful. We had only been live for a few months before the vendor started asking us to host site visits. Initially I was naïve enough to think it was simply because we had done a great job. Only later (after I swiped our vendor contract from an unattended filing cabinet) did I learn that our CFO had leveraged potential site visits against discounts on our initial software purchase. I’m glad he was confident in our potential abilities!

Our formula for site visits is pretty standard. Our local vendor exec and the prospect’s vendor exec bring the entourage to our corporate headquarters. We start with a presentation on the history of the physician group and our ambulatory project. We share some fairly detailed information about our methodology, decision making, and implementation processes and then talk about results we’ve achieved over the years.

Although most of the groups that visit us ask to go to the practices and shadow physicians, we have a strict policy of not allowing it. We make that clear when the site visit is scheduled. The disruption to patient care is aggravating to our physicians, and if I was a patient, I wouldn’t want a bunch of visitors looking over my doctor’s shoulder and asking questions about the software.

Instead, we invite some members of our clinical advisory board to join the group for lunch. Most of them will have their laptops or tablets with them, which allows for hands-on discussion of workflow or how they handle challenges. Not all of them are serious fans of EHR, but they usually provide a balanced perspective.

Although members of the vendor sales team are usually present, they’ve learned to just sit back and let it unfold. There have been a couple of account reps that tried to jump in and camouflage deficiencies in the product, but being on the receiving end of our evil eye usually shuts them up. We’re completely open about what the clinical and billing systems will (and won’t) do. Most of the reps have learned that prospects appreciate that level of candor.

We’ve had some visitors that were squeamish about having the vendor in attendance. When that’s the case, we’re happy to kick the vendor people across the street for coffee. Other visitors have tried to beat up on the vendor with them in the room in the hopes of increasing their negotiating power by making the product seem deficient.

My favorite site visit was a couple of years ago. The revenue cycle director and I are good friends and have done so many talks together that we decided to mix it up and do each other’s parts in the presentation. I’m not sure the prospect fully understood the humor of what was going on, but the sales execs could barely keep straight faces as I chatted about denial management and my billing colleague started talking about clinical quality.

Even though we’re somewhat contractually obligated to host site visits, our vendor has never asked us to hide anything or to portray anything other than our real experience. They’ve been respectful when we simply have too much on our plate and understanding when we refuse to do them because we’re waiting for delivery of code that’s been delayed and we want to make a point. We actually have fun doing them since we get to tell our story and we’re proud of what we’ve accomplished in an industry that’s still in its relative infancy.

You never know how visitors are going to behave in a site visit until they start talking. This one was one of those doozies.

It was a bit of an unusual visit to start with. The visitors were already live on our vendor’s platform, but had “paused” their implementation. They were coming to us to see an example of a success story and to hopefully learn ways to improve when they restarted their project. They are a high-value client, so a vendor VP and some other execs came along for the ride. Although they had provided us the back story beforehand, it was interesting to watch the visiting CMIO explain that his initiative was essentially a failure / money pit without actually admitting as much.

We set the stage with our group’s profile, which was similar to theirs when we started our project. We went through our financials, success metrics, clinical quality indicators, and then jumped into the discussion of our implementation methodology and physician adoption strategy. No matter what platform you’re on, the latter two are critical in my book. Implement faster than your organization can handle or slower than it needs and you have a mess. Fail to think about physician adoption and you have the same mess, but exponentially larger and more painful.

Barely two slides into our EHR implementation presentation, the visiting CMIO started interrupting. Every time I would talk about how we did something, he would jump in with a counterargument about why that wasn’t a good idea. I would talk about how we implemented our pilot practices in phases and he would explain that in his master’s coursework, they had discussed that phased implementations are a mistake. I’d talk about how we brought laboratory and document interfaces live with the billing system (months before EHR) to pre-populate charts and he’d argue with me about medico-legal risk. I would say the sky was blue and he would try to tell me it was brown.

I thought I was holding it together pretty well in the face of his bad attitude, but I had to work to not laugh at my co-workers, who kept darting their eyes around to see how people were reacting to his bluster. I spotted a sidebar conversation that I knew was probably an attempt to guess how long I was going to let him continue his boorish behavior. The sales execs were increasingly agitated and tried to redirect him without being adversarial, but no one from his hospital tried to intervene.

Finally, I reached my breaking point. You can make fun of some of our user engagement strategies. You can think we’re goofy at times with how we do team building and change management. But don’t diminish the product of thousands of hours of hard work by our staff and end users, especially when you’ve got your own project on hold and your vendor is flying you around the country trying to help salvage your implementation. And definitely don’t try to tell us our strategy “can’t possibly be effective” when we have brought hundreds of physicians live successfully with no real revenue impact to them.

I gave him my best “steely-eyed missile man” look – the same one I give medical students when they appear particularly unprepared and which has been honed by years of craziness in the ER. I simply said I guessed we didn’t have anything to really teach them and handed the presentation controller to my revenue cycle colleague.

She’s usually the master of the poker face, but this time her expression said it all. I thought I heard a couple of people suck in their breath, but they were drowned out by the sound of the vendor VP choking on his breath mint.

To her credit, my colleague rapidly advanced through the rest of my slides and dove right into the wonders of the central business office without missing a beat. I caught a couple of smirks among our site visit guests, so I’m encouraged that there is hope for them even though their boss is clearly a jerk. The CMIO seemed to be trying to figure out what had just happened and started sputtering and trying to backtrack, but my colleague pressed ahead. I’m betting our vendor won’t be inviting him to any other client sites any time soon. I’m hoping our next guests leave their confrontational physicians at home.

Are you a reference site? Have any good stories? How do you deal with adversarial visitors? Email me.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis, Lorre.

More news: HIStalk Practice, HIStalk Connect.

You should stop knocking ATHN, you sound more like a Verona prostitute with each post.

RE: Einhorn’s blast of ATHN, this is an “opportunity”, as Jonathan Bush suggested on CNBC, to clarify Athena Health’s unique position in the market. This needs to be done clearly and coherently with strong data to drive confidence in the company’s stock price. I am especially curious to hear Bush’s response to Einhorn’s comment: “Capitation would hurt athenahealth, he says, because providers would be paid upfront and wouldn’t need its help. “

ATHN refers to PROVIDERS when giving the 52,000 number – differentiating from MD’s. If the person is billable – they are counted in the number….MD’s would be a lower number.

Most public HIT stocks will be vulnerable (including Athena) over the next few yrs as mkt is entering a slow-down. Believe Athena’s attempt to enter acute care/clinical space will not be successful. If folks are basing valuation on that opportunity, they will be sorely disappointed.

And as for those patent trolls, why doesn’t some org like EHRA have pooled resources and just beat the beejeezus out of them? Is Epic the only one with the guts to stand-up to these jokers?

…or maybe epic is the only company that hasn’t purchased any of it’s IP and can be certain that it was all internally generated without any outside IP.