Peter Neupert is corporate vice president, Health Solutions Group, of Microsoft of Redmond, WA.

I haven’t heard much about HealthVault lately. How would you characterize that product and the personal health record market in general?

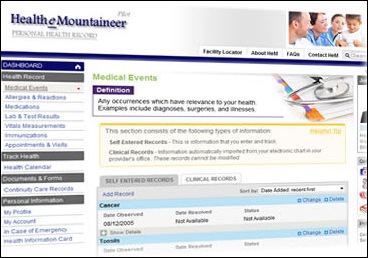

You have to remember that the personal health record market is a function of how connected is it, right? People don’t want to enter data on their own. They want to be able to connect with their physicians, or connect with their service providers. What we have been focused on is providing the plumbing to get the connections.

I think there’s been a lot of interesting or exciting activity in the last year, mostly at the policy level. When you look at Meaningful Use and Blue Button and all those things that are saying, “Hey, let’s all get together to get the plumbing going, and then we can really unleash the power of HealthVault,” which is to say that I can share the data, I can reuse the data, I can have applications take advantage of this connectedness in addition to what I want to do direct with my physician or care provider.

I think it’s been an idea that has been very, very helpful in framing the debate, in framing what the right answer is, making people understand that it was feasible and doable, and here’s what it would look like and how to make it work. So, I’m really glad that we’ve invested in it. In the last couple of years, we’ve been investing in the plumbing to make reality happen faster when people start to open the connections.

That didn’t seem obvious up front. There wasn’t disappointment that it’s taken this long?

I’m always disappointed when things take a long time because I think, in general, the health industry moves more slowly than other industries when adopting these kinds of consumer technologies or other things. But it, I think, has more to do with industry structure than anything else. We always understood that we had to do the plumbing in order to make HealthVault a consumer success.

As somebody who’s grown up through the operating systems business, you understand that you have to do an awful lot of work to bring together the physical device and the compute power and the video and the other kinds of things together, and then have an application on top of it to make it really compelling for an end user.

So, no, it wasn’t a big surprise, but that doesn’t mean that I’m not still disappointed that it’s taking many years of investment and talking to get to this stage where I actually think people have put in plans to have consumer portals that will connect HealthVault in a meaningful way.

What about the Medstory search engine? That was one of the first investments in healthcare and I haven’t really heard much about it. I think the site still says its beta, but I guess there are parts of it in Bing?

Yes, more than parts of it in Bing. You know, I’m delighted to be able to say that that acquisition got integrated into our core platform. It was one of the four channels.

You’ll remember when Bing launched, they launched with four domains that were built out. Health was one of them, all based on that technology that we acquired in Medstory. So, the fact that the Medstory site is still out there and live is more an artifact of the acquisition than what the technology has turned into inside the halls of Microsoft.

What about Global Care Solutions? It was bought to some fanfare, but now it’s going away. What was so attractive about a hospital information system with a very limited customer base in Asia to begin with? And then, what changed in two years to make it something that wasn’t that important any more?

I think the way to think about the Global Care acquisition is we have always had a vision around a plug-and-play capability and the ability to have this data aggregation platform — our Amalga UIS — and being able to have flexible solutions that sit on top of that and enable a class of workflows that are important to enterprises.

The domain knowledge and the solution focus of the Global Care acquisition were what was interesting to us. We, perhaps, mis-estimated the amount of work it would take to take some of those solutions and make them easily available on our UIS platform. From a timing point of view, it didn’t happen in the way we’d hoped.

We want to focus on UIS, focus on the value creation of workflows that fit the gaps. You know — care coordination, patient safety, things that are not in the same transactional workflow that might be in a patient administration system or an order entry system. We figure that is a better use of our investment dollars today.

What is the strategy for UIS?

I think people in the CEO chair, as they evaluate their IT strategic roadmap going forward, have to say, “What are the right characteristics of my plan that allow me the agility and flexibility to meet the changing conditions in the marketplace? Am I going to get bundled payments? Am I going to buy more hospitals? How do I get closer affiliation with physicians? What are the right IT strategies to accomplish that?” While at the same time, “I’m getting pressure to do CPOE,” however that’s defined.

My view, in conversations with CEOs and CIOs, is that a one-size-fits-all is not the best strategic roadmap and not the most flexible one. Amalga UIS is a cornerstone piece of middleware that allows you to get more value out of your existing departmental systems or EMR system — depending upon where you are in that implementation — and gives you the flexibility to acquire; to create new workflows that deliver value; to deal with new payment models that deliver value; to take some risk because of some of the capabilities; to be more predictive; and is an important component of your future strategic roadmap. That’s the role for Amalga.

Is it a big enough product to be worth Microsoft’s time?

Yes.

Do you see it extending in some other way with other technologies? That rumor’s out there about mobile device integration with some other vendors, some workflow pieces. Is this just a centerpiece or is it going to stand alone?

I didn’t mean to be flip, but our strategy isn’t a product-specific strategy. Our strategy is how do we deliver value through technology to help users? Those users are integrated delivery networks, academic delivery networks, life sciences companies, and others. There are many components along the stack for Microsoft that allow them to meet the mission critical and business critical needs that they have.

Amalga’s a great component of that. HealthVault’s a component. Those two things get connected. We connect to SharePoint, we connect to SQL. We’ll connect to, yes, mobile applications.

The question is what’s the right framework and component architecture that really allows you to do what people wanted to do for forever? Whether they talk about it as interoperability or they’re talking about SOA, or they talk about it in some other sort of interchange mechanism, we’re bringing it to life and bringing it to life in a way that people can get value out of it today.

We believe in the extension model that says, “Hey, you’re not going to get dead-ended in a particular vendor perspective.” Ours is — any data that you get in, you can get out. We’ll make it easy to get out. We’ll make it easy to reuse. We’ll make it easy for you to get the BI components that you need to still use the tools you use when you do BI and you don’t have to change everything.

I think it’s a very compelling strategy. Yes, it’s going to extend in all different kinds of ways both up the stack, if you will, in terms of specialized uses or applications, and in a breadth way, and perhaps even in a depth way when you look at how do you add new sensor class information or real-time streaming information or other types of data sources?

The great thing about health is there’s a huge amount of economics. Data really matters. Big data really matters when you think about where imaging and discovery is going. There’s going to be a huge amount of computation, and it needs to be delivered in a mobile way and in different scalable ways — for the individual, for the population of a doctor, for the population of a county, for the population of a country. We need to be able to scale along that dimension as well. We think we have the right infrastructure and architecture to be able to do that.

What about the Sentillion acquisition?

We’re really excited with bringing Sentillion on board — making the connection with their customers, maintaining their momentum and their customer satisfaction, and beginning to build the integration into our environment and our Amalga products to where we have 1+1=3. So we’re pretty excited about that.

What do you think about the proposed Allscripts acquisition of Eclipsys given that you have relationships with both companies and in New York Presbyterian, in which you share a customer?

We share lots of customers with Eclipsys. I’m less knowledgeable about which of all of our customers are also using Allscripts.

I think the vision of the Allscripts and Eclipsys guys is a good vision of how do we bring together, in a modern architecture, inpatient and outpatients and a lot of things they have hanging off the sides that not everybody knows? I think any time you merge different code bases, you have both the opportunity and a challenge to make that easy for customers and seamless. We hope to be part of helping them to accomplish that.

From a competitive framework, when you look at what’s happening in the US marketplace, it seems to be that’s what customers are looking more and more for — how do you bring these inpatient and outpatient environments together for better patient coordination and different workflows? It was hard for either of them to get to alone, and it’s really going to be about how do they go out and execute and make the promise at the marketing level, at the customer level, a reality at the technology level? Which is true of all acquisitions, right? That is always the hard part.

New York Presbyterian, I think you signed some agreements with them for both HealthVault and Amalga. Do you see that relationship changing once their two other products are under a single banner, or do you think you’ll be involved in whatever it takes to tie those products more tightly together?

I’m really excited about our relationship with New York Presbyterian. If you talk to Steve Corwin or Aurelia Boyer, I think they would say the same thing.

I don’t think the change in the vendor relationship will impact us one iota. They have a very complicated environment. They have some Epic, they have some Allscripts, they have a lot of Eclipsys, they have lots of GE, they have some Siemens scheduling. I mean they have a lot of stuff in there. Amalga is playing an integrative role, as is HealthVault playing an integrative role.

New York Presbyterian is one of our flagship thinkers in terms of how do they use these components that they’ve now invested in to meet their strategic goals as a business, both for their internal employees and providing better tools for them; and as a customer-facing, how do they leverage the connected care environment for their own competitive positioning?

We are working on their strategic roadmap. I’m very optimistic that we will continue to do more with New York Presbyterian in establishing better ways to leverage technology for them, and for their customers, using the foundational components of HealthVault and Amalga.

What do you think the lessons learned are from the problems that Connecting for Health is having in the UK?

How much time do we have? [laughs]

I’m kind of an engineering kind of guy. When you looked at the problem 4-5 years ago, the concept of a large, centrally planned, standards-driven paradigm for a large integration care delivery like NHS is always interesting on paper, but at the architectural level, I think they made some mistakes.

At the operational level, I think they made some challenging things in terms of how, really, was it going to work? It was just a little bit ahead of its time, if you will, in terms of what it was trying to accomplish, and probably off focus with the means by which they were trying to accomplish it.

The goals of a national patient repository — they’ve largely accomplished the goals for a large DICOM repository and making that part of the workflow better. But in other parts on the enterprise side for the hospital and the integration with the primary care trusts hasn’t really happened, so the technology challenges that they have remain. Not dissimilar to the technology challenges that we have in the United States when it comes to data interchange, patient record interchange, the ability to do really good registries — patient-centered registries as opposed to disease-specific registries.

As the combined payers and providers in this country, they’re motivated to focus on improved chronic care management, and the technology infrastructure they built for Connecting for Health didn’t really help them accomplish that goal. They’re now looking at, how do we do that?

I don’t know if you’ve stayed up to speed on the policy conversations that are coming out of the NHS, but I find it fascinating that they not only are trying to devolve the technology implementation plans, they’re trying to devolve the whole approach to how they think about planning for care and empower different stakeholders in that and have it be more decentralized — decentralized in a sense that it’s really important to them to empower the consumer, the patient.

They’re thinking about how can they create a marketplace for services where the patient consumer is a key component of the voting, if you will, with their dollars or with their actions? And, they’re devolving it to the general practitioner in terms of what are the right care endpoints at the right point in time in working with consumers?

They are thinking radically about re-architecting their delivery system. What the right technology is to help do that in a more decentralized approach is definitely in the future because that is more likely to lead to successful experimentation and adoption.

I’m pretty excited about what the NHS is trying to do. I think it’s a big shift and change. It will be interesting to see how they manage that big shift and change going forward.

It’s a pretty expensive lesson so far to realize they were on the wrong track. Are we prepared to not make the same mistakes here?

I think there are two things. One, it’s not clear how much money they’ve actually spent. I know they spent some. I know they got some value out of what they spent, and I know they froze some spending in other dimensions. But actual dollars spent, it’s not the reported number. At least that’s what I’m told by leaders over there.

I think the lessons that the United States is going to go through is really about will incentivizing EMR adoption through the construct of Medicare and Meaningful Use lead to better outcomes in and of itself, or is it just a component of a series of changes that are required to lead to better outcomes?

In my Senate testimony over a year ago, before they passed the HITECH Act, I argued — or tried to articulate — that technology’s not an end in itself. It’s a means to another end. What technology is appropriate is partly a function of what goals are you trying to accomplish? When people talk about EMRs, they imbue an EMR with all kinds of things that are sometimes true and sometimes not true in what today’s EMR systems do. Or, in how they are implemented in today’s institutions.

I think we need a more precise conversation about the role of technology: the role of reimbursement systems, the role of how we adopt technology given what goals we’re trying to go after to, perhaps, learn the right lessons.

I sit on the Institute of Medicine roundtable that’s talking about a learning healthcare delivery system. George Halvorson, at the time of the policy debate, the health reform debate, made a pretty clear and compelling statement that we ought to focus,as President Kennedy said, “We want to go to the moon,” that the right way to focus our health policy debate is say, “Hey, we want to improve the number of people with H1BC under control by 80%, or have 80% of them be under control.” That’s the single, best way to manage the cost curve.

Then you say, “What technologies do I need, and how much do I spend to make that happen?” Which is different than saying, “Hey, let’s everybody incentivize to have EMRs.” So, I think there’s a lot to be learned on focusing on the health outcomes and the system outcomes we want, and then to look at the technologies that are most appropriate to deliver those outcomes.

And also, to recognize that we have a lot of data in the source systems already, you know? Lab data’s digital. Medical data’s digital. Even in the small primary care systems they’re digital at some point of the process. Being able to capture, aggregate, and identify would allow you to get more value for your technology spent, perhaps. We’ve been pretty consistent about that and we still believe that. I think we’re not a lone voice in that perspective.

In terms of global health, if you went to another country with problems similar to ours — whether it’s infant mortality or chronic disease — probably the last thing you’d want to throw billions of dollars at is to make hospitals more efficient inside the four walls. You’d address health issues, not healthcare delivery issues. Are we throwing too much money at too little of the problem?

The private companies — hospitals, CEOs, IDNs — they’re looking at it and saying they understand that they need to go beyond the EMR and that they need to go beyond their four walls. That they see the future of payment reform, meaning they have to figure out how to get paid for not doing things. And so they’re already acting as if a change to payment systems really happens.

Now they’re not doing it with 100% of their investments, but they are all investing in that’s where the future’s going to be. I don’t exactly know what I need to do, but I need to be investing in.

When I look outside the US, I think the politics really matter. When you look at what China’s doing, they’re trying to move more of their care delivery out of the hospitals. They’ve got lots of motivation to do that because their hospitals are overwhelmed and overcrowded and they still have a high length of stay. They’ve put in a lot of infrastructure to move people out, but their hospitals are really very different than our hospitals. They are big clinics in addition to being big, acute care delivery stuff.

When I look at what’s going on in Germany, they’re really struggling to figure out what promise … what’s their social compact? What promise can they do, and how do they think about primary care versus secondary care? And again, you have the private delivery system actually innovating more — both from a financial and a technology point of view — than the public system.

I would say that NHS, as we already talked about a little bit, is also very much looking at their investment level. I think what you see people saying both with dollars and with decision makers trying to put more into a “prevention regime” than in a “make me more efficient” inside the “once I’m already sick” regime. That’s where you have these combined payment systems where they have more incentive to really focus on doing that.

But yes, I see lots of stuff all around the world where people … there’s just no really good business model for prevention. It’s a hard problem.

Form factor passes for innovation in healthcare, such as having cool iPad and iPhone apps. That’s where Microsoft seems to be at a considerable disadvantage to Apple and probably Google as well. How do you get involved in that, or do you want to be involved in a market where it’s less about what the application versus just having it untethered?

I would disagree with your premise to start with. Not to say that there isn’t adoption of lots of cool stuff, and so when an iPad comes out or an iPhone comes out, you see a lot of adoption in healthcare. My observation would be, however, healthcare gets less value out of those kinds of investments than other technologies and that it’s a lot of noise. It’s not really where people are spending the money, or the things that they’re making mission critical.

We look at innovation as really enabling transformation in reengineering. The “wow” stuff doesn’t enable that kind of transformation in reengineering. I’m happy to focus on less cool stuff from an end user point of view, but if I can deliver ten times the power and actually get data sharing to really work at one-tenth the cost with some of the stuff that we’re doing, I think I’ll win a lot of business and delight a lot of physicians when the speed is faster; delight a lot of nurses when I make their job easy because they don’t have to go look for information, it’s all in one spot; and win in the trenches as opposed to winning on the “in” gadget or popularity group. I think that takes a deep understanding of what problems you’re trying to solve, what jobs are really important, and how the flow and diversity and heterogeneity of data meet in order to be able to do that.

I think Microsoft is way better situated than either Apple or Google to solve the hard problems. I think if you look at our investments in HealthVault and understanding the ecosystem, and building a set of applications, and keeping pace with the changing conversation around privacy and security and app sharing and all that other kind of stuff, that we have demonstrated the level of understanding and our willingness to continue to make incremental investments to make it a reality. So, I’m happy to compete with popularity, a brand, versus reality of technology all day long. We’ll win in the long run. We may not win in the short run.

What technologies do you see that are innovative and potentially influential that have not yet really taken hold in the market?

I don’t claim to be an expert. You know, there are all kinds of really cool stuff going on. I think if I’m a CIO today or a CEO today, I think the one thing I might be asking myself as I look at a five-year time horizon is, “How do I think about cloud computing? How do I think about really changing the cost environment and the serviceability environment of my application stack at a time when budgets are getting pressured?”

And yet, I’m going to have more data. I’m going to have more applications. I’m going to have more users. I’m going to have more everything, but I’ve got to do it with less dollars. What is the strategy that will allow me, as an enterprise, to really make that a reality and still give me the flexibility to meet my changing business needs? If I want to really cuddle up with a payer or take, at risk, a large percentage of the population and I need information systems to manage that, how do I fit that into my declining footprint? Do I get some leverage out of being able to do predictive analytics in the cloud? Or, how do I think about being able to contribute to solving cancer with a large population and connecting and sharing that kind of stuff in the cloud?

Those would be the kinds of innovations that I would want to have on my horizon before I go sink a bunch more money in physical hardware or a data center or some other thing that may have a short shelf life. And, it certainly doesn’t help my P&L.

I see lots of really interesting stuff going on there. I’m not sure that its stuff that the CMO gets that excited about, but one that probably folks should be thinking about.

Any concluding thoughts?

You know, I think we’ve had a great conversation. We’re excited to be part of the health IT community. We think we, as a player that has both the consumer and enterprise offering — and perhaps a slightly different approach at trying to solve the problem — to help remind people to think beyond the EMR. We’re really excited to be part of the community and look forward to making our customers and our lives better by the smart application of technology to the hard problems in health.

It's nice when Epic takes on patent trolls and other bad actors in the industry. They do great when they…