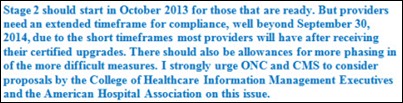

News 8/2/13

Top News

Cerner announces plans to acquire a 237-acre abandoned mall near its Innovation campus in Kansas City. A new campus on the property will eventually house up to 15,000 new Cerner employees as the company grows over the years.

Reader Comments

From Jobu: “Re: access control. Have there been recent discussions about deploying fingerprint or iris scanner recognition systems vs. multiple passwords?” I’m sure there’s a case study out there somewhere from Caragidm or Imprivata or another user access systems vendor. Feel free to point the way if you’ve seen something.

From Bluebonnet: “Re: Oregon Health & Science University patient information stored on Google Drive or Gmail. Does this not point to an organization not meeting the needs of its users to promote patient care? Given that this organization has been pretty progressive, is it not troublesome?” That question rarely gets asked: what system deficiencies created the need to store information on consumer-grade services in the first place? OHSU plastic surgery residents were keeping a spreadsheet of their service’s patients on Google Docs, which contained minimal patient information. A similar practice was discovered in the urology and kidney transplant areas. Questions: (a) was the only problem that the hospital didn’t have a business associate agreement with Google? (b) does the hospital’s system not provide a snapshot of which patients each service is covering? (c) if not, then does the hospital not provide network storage for saving copies of files, or was the problem related to mobile devices? Give the residents credit for trying to do the right thing in making sure handoffs were done and using technology to do it. It’s a tough sell to argue that ubiquitous cloud storage is fine for almost everything except PHI.

From HIS Junkie: “Re: Siemens. Looks like the CFO will take over. Is the SMS ride about to end? Less R&D for Malvern? John Glaser in trouble? We all know they been losing their client base to Epic and others for the last three years. Will they come to the same conclusion as GE – healthcare IT can’t be a winner?” Siemens issues a surprise profit warning and uncharacteristically quickly fires its CEO, replacing him with the CFO (you just can’t beat the excitement of an engineering company run by a bean counter.) The new guy says the company tried to grown too fast and needs to get back to execution (not referring to that of his predecessor). The deposed CEO, who steered the company around its global bribery scandals, will get $20 million in severance and a $20 million pension for his six years in the job.

A reader asked whether outside healthcare IT experts could help veterans and what the 90-day agenda would look like. Proud veteran, healthcare IT guy, and HIStalk/HIStalk Connect contributor Lt. Dan provided this response:

I’d scrap iEHR and spend what’s left of the money creating a patient portal that would make the soldier the acting custodian of their own electronic medical record. After every clinic visit, ED visit, or hospitalization, the entire chart from that visit is pushed to the patient portal. It has lab results, physician notes, PT/ OT, all of it, an exact carbon copy of everything entered in the chart for every visit. The portal IS the medical record, and it houses all details of any injuries or illnesses treated.

The portal follows them through their military career and grows as they need services. If they’re transferring from Ft. Bragg, NC to Ft. Stewart, GA they process out of medical at Bragg where the Bragg doctor signs off on the chart and the portal is updated to show that the soldier is transferring to a new duty station, and that Ft. Stewart is now the primary care location.

When the soldier is ready to be discharged, they have their entire military record on the portal from all bases, including medical and dental. When they get back to the civilian world and meet their new civilian PCP, they can at worst print out the medical record for them, and at best leverage some type of HL7 interface to push a medical summary (CCD) to the provider with extractable allergies, prescriptions, problems, and medical history.

If the vet needs to submit a disability claim with the VA, they grant access to their portal so VA reps can review the records immediately, rather than waiting up to 90 days for DoD to find, print, and mail them a copy.

Vets already have a portal. It’s called My HealtheVet. It looks exactly like your typical portal. A dumbed-down, patient-centric version of a medical record. It’s fine, it’s just missing much of the information clinicians will want to see if they’re taking you on as a new patient after military service, or information that a VA rep would want to see if they’re processing a disability claim.

To help vets within 90 days, I’d get the entire medical record from the first day the soldier enters the military, feeding into that patient portal so that soldiers would have custodianship of their own medical record. Then I’d enhance that portal so that vets can easily authorize access to any or all of the content within it and could transmit a CCD from it.

I’d get a team of sergeants, corporals, and privates to execute the plan. It would be done in 89 days and there would be enough money left over in the budget to spend the last day drinking beer and barbecuing.

HIStalk Announcements and Requests

![]() What you may have missed this week on HIStalk Practice: the number of physicians opting out of Medicare has tripled since 2009, according to CMS. CareCloud adds more than 150 new medical groups in the second quarter, with more than half also selecting CareCloud’s integrated EHR/PM. Dr. Gregg shares a story of a blogosphere encounter with another physician who took his office fully live on EMR in one day. Dr. Gregg offers additional insight on the doctor’s EMR platform in a subsequent post. Click over to HIStalk Practice and catch up on the latest ambulatory HIT news, sign up for e-mail updates, and check out the offerings of our sponsors. Thanks for reading.

What you may have missed this week on HIStalk Practice: the number of physicians opting out of Medicare has tripled since 2009, according to CMS. CareCloud adds more than 150 new medical groups in the second quarter, with more than half also selecting CareCloud’s integrated EHR/PM. Dr. Gregg shares a story of a blogosphere encounter with another physician who took his office fully live on EMR in one day. Dr. Gregg offers additional insight on the doctor’s EMR platform in a subsequent post. Click over to HIStalk Practice and catch up on the latest ambulatory HIT news, sign up for e-mail updates, and check out the offerings of our sponsors. Thanks for reading.

Acquisitions, Funding, Business, and Stock

Ascension Health Ventures invests in Quantros, a portfolio company of Francisco Partners.

The Advisory Board Company reports Q1 results: revenue up 18 percent, adjusted EPS $0.31 vs. $0.31. The company also announces its purchase of referral technology vendor Medical Referral Source for $11.5 million.

MedAssets reports Q2 results: revenue up 4.7 percent, adjusted EPS $0.30 vs. $0.28.

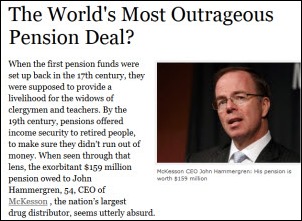

McKesson re-elects all its board members at the company’s annual meeting despite dissent from activist shareholders who wanted the company to cut CEO John Hammergren’s pay and split his chairman and CEO roles.

A Bloomberg article says, without any facts to back it up, that Quality Systems has become a Siemens and McKesson takeover target because its share price has dropped and proxy fights have pushed the company to reevaluate its strategy.

Sales

Hallmark Health System (MA) selects athenahealth’s athenaClarity to proactively manage its patient population and engage in new reimbursement contracts.

The Hospital for Sick Children in Toronto selects MetaVision’s MVperfusion solution.

People

HIT Application Solutions names Betty Jo Bomentre, MD (Vitalize Consulting Solutions) CMIO.

Healthwise SVP Karen Baker joins the board of Center for Plain Language, a nonprofit that advocates for clear communication in government and business documents.

Health Care DataWorks names Kathleen Kimmel (MedeAnalytics) chief clinical officer.

Announcements and Implementations

Cerner opens an on-site health center for 2,800 employees and covered dependents of the California-based ViaSat, a communication products company. Providers will use Cerner’s EHR and patients will have access to the Cerner Patient Portal.

Brightree changes the name of its CareAnyware EMR software to Brightree Home Health and Hospice.

NorthCrest Medical Center (TN) implements Allscripts Sunrise Clinical Manager.

PinnacleHealth (PA) goes live on Soarian Financials.

University of Arkansas for Medical Sciences had the first of three Epic go-lives Thursday, bringing up ambulatory scheduling and registration, kiosks, referring physician portal, retail pharmacy, MyChart, and professional billing in all of its clinics. A third of the clinics also went live on EMR.

The Discovery Channel aired an episode of “Today in America” highlighting PeriGen’s PeriCALM and PeriBirth on Thursday. It’s pretty good, although host and former NFL quarterback Terry Bradshaw struggles painfully to pronounce the big words as he adopts the “Serious Terry” persona instead of his usual goofy on-screen presence.

The US Patient & Trademark Office awards EDCO Group a patent for its Solarity medical record scanning and indexing process that identifies a scanned document type by its recognizable content rather than by a printed bar code.

PatientOrderSets.com announces the integration of its order set tools with Cerner Millennium.

Government and Politics

VA Undersecretary of Health Robert Petzel, MD says that while one million veterans currently use some type of VA telehealth offering, he hopes to boost the number to more than four million.

Above is Farzad Mostashari, MD responding to questions at the Senate Finance Committee hearing on healthcare IT this week, courtesy of Brian Ahier.

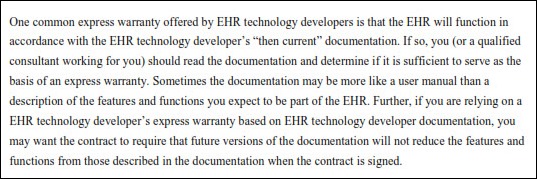

ONC releases its user guide to EHR contract terms.

Innovation and Research

Researchers find that providers who use EHR clinical decision support predictive tools at the point of care are less likely to order antibiotics for respiratory tract infections.

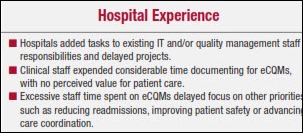

The American Hospital Association says even EHR-experienced hospitals are struggling to implement electronic clinical quality measures, recommending: (a) slow the transition by reducing and then improving the measures; (b) make EHRs and eCQM tools more flexible; (c) improve EHR and eCQM standards to meet Meaningful Use expectations; (d) test eCQMs to make sure they are reliable and valid before rolling them out nationally; and (e) provide more tools and guidance for the transition.

Other

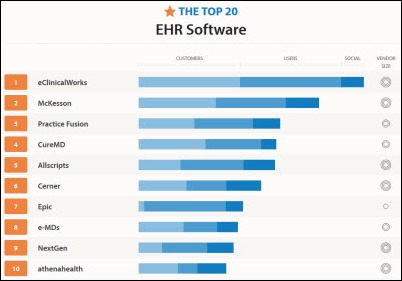

![]() A Capterra infographic lists the 20 most popular ambulatory EHRs based on number of customers, number of users, and social media presence. The accuracy of the information is suspect given that Epic is listed as having one to 50 employees rather than its actual 6,500. Potential buyers should note that “most popular” is not the same thing as “most likely to succeed” in a given practice, where the vendor’s prolific Tweeting and Facebook likes may provide little consolation.

A Capterra infographic lists the 20 most popular ambulatory EHRs based on number of customers, number of users, and social media presence. The accuracy of the information is suspect given that Epic is listed as having one to 50 employees rather than its actual 6,500. Potential buyers should note that “most popular” is not the same thing as “most likely to succeed” in a given practice, where the vendor’s prolific Tweeting and Facebook likes may provide little consolation.

Consumer advocates in Florida oppose a proposal that would boost allowed charges for providing copies of medical records to $1.00 per page rather than $1.00 per page for the first 25 pages and then $0.25 per page afterward. Lobbyists for release of information provider HealthPort technologies filed the request, surely seeing dollar signs at the prospect of nearly quadrupling revenue given the size of the average chart.

Dialysis patients of Boston Medical Center (MA) were exposed to hepatitis B earlier this year because nurses weren’t allowed to use the hospital’s EMR, the state health department has concluded. Contracted dialysis nurses from DaVita weren’t given access to the EMR that would have flagged an infected dialysis patient, leading them to improperly sterilize equipment and expose 13 patients to the disease. The state said the hospital should give EMR access to non-employed nurses who are delivering patient care.

Healthcare employers cut 6,843 jobs in July, the highest monthly total since November 2009. Hospital finances have been hurt by sequestration, Medicare payment cuts, and lower utilization as patients move to high-deductible insurance policies.

The CEO of WakeMed Health & Hospitals (NC) warns employees of possible cost-cutting and layoffs as the health system’s accumulated losses hit $15 million before the September fiscal year end. The hospital is spending $100 million implementing Epic and expects a $23 million reduction in payments next year.

The bond ratings agency for Johns Hopkins Health System gives it kudos for its system integration, including installing Epic system-wide.

In England, the BBC finds that Royal Berkshire Hospital has paid $25 million to 200 consultants over five years to help it bring up Cerner Millennium. The article says the total cost is $42 million so far, it’s still not working right, the annual cost is $10 million, and IT is now one of the biggest departments in the hospital.

Sponsor Updates

- Joseph Eberle of CTG Health Solutions presents a case study on using data analytics to improve outcomes for chronic kidney disease patients at this week’s National Forum on Data & Analytics.

- Impact Advisors’ Senior Advisor Janice Wurz co-authors an article with Henry Ford Health CTO John Hendricks on planning and designing strategic technologies for clinical BI.

- Allscripts adds integration with Spaulding webECG, allowing the app to be launched from within Allscripts Enterprise EHR to support physician orders and provide access to ECG reports.

- 3M Health Information Systems introduces Patient-focused Episodes software, which considers the costs and outcomes of longitudinal care.

- Quest Diagnostics works with Greater Houston Healthconnect to make lab results available to providers.

- Ingenious Med offers a white paper, “Transition from ICD-9 to ICD-10: Managing the Process.”

- Andre L’Heureux and and Kevin Entricken of Wolters Kluwer participate in a roundtable on the genome approach to investing.

- INHS recognizes 18 of its customers that were named Most Wired.

- API Healthcare reports that it expanded its market reach to include behavioral health and rehabilitation centers in the second quarter.

- Truven Health Analytics will add animated videos from Health Nuts Media to its Micromedex Patient Connect Suite.

- Holon’s Scott McCall discusses the importance of good communication skills for HIE implementation team.

- INHS client St. Elizabeth Hospital (WA) earns HIMSS Analytics’ Stage 7 recognition for EHR adoption.

- Health Catalyst SVP Dale Sanders lists five indispensable information systems needed for ACO success.

- RazorInsights will showcase its ONE Enterprise HIS solution during the Illinois Rural Health Association Educational Conference Aug. 22-23.

- Five Medicity clients are serving as HIO ambassadors to a Chinese delegation gathering best practices for organizing, administering, and sustaining an HIO.

EPtalk by Dr. Jayne

The American Academy of Family Physicians has a new Web page covering the Medicaid-Medicare parity payments specified in the Affordable Care Act. Included is a checklist with the steps providers must follow to obtain the payments.

Clinical Decision Support update time: The US Preventive Services Taskforce publishes a draft recommendation for annual screening of high risk smokers by CT scan. Although it’s still a draft and insurers are not paying yet, it’s a good excuse to review the steps needed to configure new screening guidelines in your EHR.

I was intrigued by a blurb about Cisco’s “Video-enabled virtual patient observation” offering. Essentially it’s remote monitoring of patients who would normally require a “sitter” to ensure they don’t fall out of bed, remove IVs and other tubes, or otherwise cause self-harm. I wanted to find out more about it, but couldn’t without filling out a 17-field questionnaire including budget and timeline information. Based on my recent experiences from the patient perspective, I’d lobby that no technology can replace the presence of a family member at the bedside. For those who can’t have someone there 24×7 or for hospitals that have a shortage, it might be an interesting option.

Researchers at Temple University in Philadelphia are conducting a two-year study looking at virtual speech therapy. Patients will be pushed to spontaneously generate speech rather than practicing scripted conversations.

There have been several additions to the HealthIT.gov site recently, including a document on key terms used in EHR contracts. Based on some of the questions I receive from our affiliated providers, it should be required reading for anyone thinking about purchasing an EHR or going live on a hospital’s platform as part of an alignment strategy or Accountable Care Organization. It’s not a bad read on legal terms in general, especially for providers in the habit of signing documents without reading them.

Bianca Biller alerted me to the proposed cuts to the 2014 Medicare physician fee schedule. Highlights include the (now usual) 24.4 percent cut due to the SGR formula, implementation of value-based modifiers, changes to the Physician Quality Reporting System, and limitations on nearly 200 services where the physician fee schedule non-facility payment is more than the total payment for the same service in a facility setting.

It’s been a rough couple of weeks in the trenches, so I’m going to recharge my magic wand with a long weekend somewhere sunny. If I were a fairy godmother, this is what I would feel like about now. Here’s to sunscreen and fruity drinks.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…