HIStalk Interviews Beth Wrobel, CEO, HealthLinc

Beth Wrobel is CEO of HealthLinc of Valparaiso, IN.

Describe what HealthLinc does.

We are a Federally Qualified Health Center. The federal government realized that there was a need to build a national infrastructure for the underserved, which up until now was the uninsured, Medicaid, and Medicare, although that’s changing.

HealthLinc was one of those free clinics back in the 1990s. In early 2000, we applied to become a Federally Qualified Health Center. We get a little bit of state funding and some federal funding, but most of our funding comes from patient fees — Medicaid, Medicare, or a sliding fee basis.

We treat the whole body. We have medical, dental, and behavioral health on site. At one of our sites, we have optometry. We have on-site pharmacies. Truly we’re a one-stop shop for those who are underserved.

We’ve seen a huge change as people get $5,000 or $10,000 deductibles. In my mind, those are becoming our underserved. At least in Indiana, we’ve been able to get a lot of the uninsured to get services through what they call the Healthy Indiana plan. We’re not supposed to call it Medicaid expansion, but it really is our Medicaid expansion. We’re a healthcare provider that treats the whole body.

What lessons have you learned in managing health and not just healthcare episodes?

It goes down to data. A lot of times the healthcare system sees bits and pieces of that body and they don’t communicate. The number one thing that we have learned even internally is to see that person as a whole body.

I like to tease when we talk about optometry, behavioral health, and dental that we put the neck back on the body. The human body is intertwined. If you treat one part of it but don’t look at the other, you could be hurting that person’s outcome. At HealthLinc and with Federally Qualified Health Centers, we look at every part of that and help them.

The other part that is different for us is we never start with, "The patient will…" You can say until you’re blue in the face, "The patient will go get their meds. They’ll exercise." We have people that help them set goals and help them understand that. Treating the whole body and communication are the two things we do best.

What technology do you use?

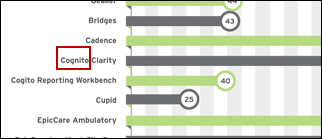

We have a practice management system that talks to our electronic health record. That’s from Greenway. They have three platforms, but the one we use is called Intergy. We use it for optometry. We use it for behavioral health. It’s very flexible. We just switched to a new dental program, MediaDent, so that it talks to it.

Our medical providers can see what’s happened over on the dental side, optometry side, or behavioral health side and vice versa. It’s very common during flu shot season, which we’re just starting in, for dentists to say because it pops up in their side, "You haven’t had your flu shot. I can call someone if you want to get your flu shot right now." That’s just not heard of. It takes the IT infrastructure to be able to leverage that and to be able to do what we do.

How are you using your technology to reach out to patients?

About a year ago we got a call from The Guideline Advantage, which is a consortium of the American Cancer Society, the American Heart Association, and the American Diabetes Association. They had received a grant from the GE Foundation to work with Forward Health Group, a software company, to do population health.

That patient can look great in our electronic health record, but you can’t see what that population is going through. What are you doing? Are there things that we could be doing on a population-wide basis through this Guideline Advantage and Forward Health Group software that would improve not only that patient, but all the diabetics or all the hypertensive patients? That’s our next step in improving our patients’ health.

We’ve also found — I like to joke about this — that once we put in the PopulationManager of Forward Health Group, we were able to see data that wasn’t put in correctly. When we started looking at the population of a site and the BMI of patients in that site, we saw someone that had a 30,000 BMI, which is pretty much impossible [laughs]. It wasn’t me — that was the good news, there’s somebody worse than I am. We were able to start to clean up our data. We’re starting to do a lot more interfaces that go right in to the system and see that the medical assistant typed in the number wrong. Instead of maybe a weight of 130, they might have done 13,000. That doesn’t always come through, but it did in PopulationManager.

Our providers want to give the best care. but sometimes they don’t know what they don’t know. By looking at PopulationManager and seeing that maybe Dr. Smith — we don’t have a Dr. Smith, so I’m going to use that name — his hypertensives are not under control. We can go in there and see why. Is it the population? Is there some additional training? Something that he didn’t know? Is he using the wrong drugs?

We code everything green, yellow, and red. Green is the good — meeting your goals. Yellow is kind of, “You’re almost there.” And red. They all want to be green. When you start to show them a population, it motivates them. It gives them a better picture than what they have when they look at just each patient. That’s making a huge difference, having the TGA people working with us with Forward Health Group.

How would you describe your relationship with traditional health systems and how does the technology fit?

I used to always say we were their safety net, because the Medicaid and Medicare population and the uninsured weren’t the patients that they really wanted. We still have great partnerships. At HealthLinc, we’re pretty well spread across about 100 miles of northern Indiana, across the top of the state, and probably another 80 miles down.

We work with five hospital systems. With some FQHCs I’ve heard of competition, but we work with them more. But I could see as we start seeing these more of these commercial insurances come to us, there is the potential of that.

I have heard stories – again, I’ve never been able to document it — that the primary care aspect of a hospital system is the loss leader. They make money on everything else. My dream someday is to get a hospital system that says, "You guys are really, really good at primary care. You’re a patient-centered medical home. You have the infrastructure and everything. We’ll let you be that primary care infrastructure. You’re going to send labs and things like that to us."

From a community financial standpoint, that makes more sense to me. Of course, that’s me talking and not a hospital CEO. But looking at those relationships and what we can do to improve the health of the community, because we have been doing this infrastructure where we treat the whole body for a while now, it’s hard to catch up with that, but we’re there. So far, so good. We aren’t seen as a competition, but I could see where that could happen down the line.

FQHCs are required to have strong patient representation on their boards, which isn’t common with health systems. How does the patient perspective influence how your operation is conducted?

Patients of the clinic are 51 percent of our board. That makes a huge difference. I’ll give you an example. Before we had optometry, we had an eye doctor who would see our patients. It was in another town. There were transportation issues and things got in the way. Every time they had a no-show, they would call up. For $35, you got an eye exam and glasses. She would fund-raise on her own to pay for the glasses.

I brought that up to the board. I said, "I’m really struggling. I’m afraid we’re going to lose this doctor. Any ideas?" One of the patients on our board said, "Why don’t you charge them the $35 up front and make them sign and if they didn’t go, they lose it?" Not that $35 is much money for someone with means, but for them, it meant a lot. Once we implemented that, the no-show rate dropped drastically. We got our own optometrist. We were able to keep that eye doctor.

Social determinants of health are becoming very prevalent now. Are you close to a grocery store? Do you have transportation? Do you have babysitting services? You can’t come to your appointment because you have to drag six kids, but Medicaid only pays for you to bring one kid in transportation? Those kind of things. They can really help us with that, too. It’s a win-win because we understand more of what it is for our patients. But everybody has those social determinants sometimes, whether you have money or not. That’s an aspect that isn’t there in primary care.

We’re open until 8:00 four nights a week, 6:00 on Friday, and open on Saturday. A lot of primary care hospital-run systems are not open that late. They want you to go to urgent care. Urgent care can take care of your urgent needs, but they’re not going to take care of your diabetes or hypertension and do your well checks.

In one of our sites that we were able to build about two years ago, we started seeing more commercial insurance patients. They’re at work and they can’t get to the doctor, but we’re open until 8:00, so they can come to us. Again, they have money. They could go anywhere. They have insurance. But because of our hours, they like to come to us. It’s bringing in what that patient needs.

Do patients who could go anywhere consider your services to be at least equivalent?

When they get through the door and they see the one-stop shop, they are like, "Oh my gosh, this is great." A newspaper editor came and we went, "Wow, I’ve never seen something this nice." We treat them with respect. We treat everybody with respect. That comes through very quickly to people.

It’s been a journey. At one time, we wouldn’t take commercial insurance. We started before the marketplace, but a lot of our patients were over 200 percent of poverty, which is $24,000 a year, approximately. When the marketplace came, they were able to get some insurance, but they stayed with us because they liked it. They felt like they were getting good care. Our hours were convenient. We treated them well. That’s important. If you feel comfortable where you’re going to your doctor, that helps with keeping you in good health, or if you’re sick, improving your health.

Where do you see the healthcare system in 10 years?

My crystal ball is broken, but I guess what I can say is that we’ve got to do something. We cannot continue for these costs to go out of control.

What I’d like to see is that every system has population health, that patients can get the healthcare wherever they want, whether it’s going to the doctor or doing telehealth. Until we get to the point where we can control the cost and use these population health programs like Forward Health Group and through the TGA, we’re not going to do that. My dream is that we will see the costs go down and that our health improves.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…