The End of “Good Enough:” A Personal Journey to Better Healthcare IT Application Support

By Jody Buchman

Jody Buchman, MBA is SVP of continuous services at Healthcare IT Leaders.

I never imagined that my most powerful lesson in healthcare IT application support would come from a hospital bed.

During my third pregnancy, I was given only a 30% chance of carrying to term. It was a high-risk situation that kept me on bed rest. I worked remotely for Cerner from a hospital room while continuing to support clients. For the first time, I experienced the healthcare system not just as a professional, but as a patient. And in that moment, I saw the real impact of the women’s health solution we were implementing – not on a screen, but in the care I was receiving when every decision mattered.

My son Jake was born early, just four pounds. But thanks to an incredible team of clinicians and the systems that empowered them, he went home just three days later. Today, he’s a healthy high school baseball player and a daily reminder of why this work matters so deeply to me.

That experience shaped everything about the way I lead today. Lying in that hospital bed and experiencing the system not as a technologist, but as a mother, I came to understand what excellence in healthcare IT truly means. Behind every system alert and resolved ticket is a human story, a moment where things either go right … or don’t.

It’s why I’ve dedicated my career to building support organizations that are more than just reactive help desks. The traditional Managed Services model – transactional, after-the-fact, and satisfied with “good enough”- simply isn’t good enough. Not when every delay, every overlooked alert, every closed-but-not-solved ticket can directly impact care. I’ve seen the fallout firsthand: burned-out IT teams, clinicians wrestling with tools instead of treating patients, and families caught in the middle.

Healthcare doesn’t stop after hours, and neither can we.

Why the Old Way of Application Support No Longer Works

When you’ve managed global application support at scale, with thousands of customers and millions of incidents a year, you start to notice patterns. For too long, we tolerated a model that measured success by closed tickets, not real solutions.

I’ve seen the consequences: the physician who can’t get help after hours, the nurse who hesitates to open a ticket because it rarely leads to resolution, the IT manager who knows what’s broken but lacks the resources to fix it.

In healthcare, where time, accuracy, and availability are non-negotiable, that model simply doesn’t hold up.

What a Continuous Services Model Looks Like

Healthcare runs around the clock and technology continues to evolve. It’s time our application support models did, too.

What’s needed now is a continuous services approach, one that’s proactive, connected, and designed to prevent problems before they impact care.

Here’s what that means in practice:

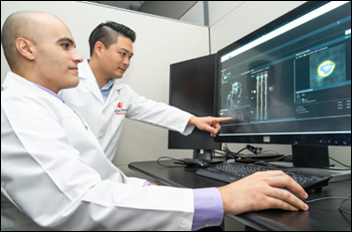

First, real-time system monitoring should be the norm. Just as clinicians monitor patient vitals, IT support teams should track system health in real time. Application performance lags, interface errors, error pop-up messages, and failed jobs should be spotted early and addressed before users ever notice.

Second, automation needs to take on more of the routine work. Routine fixes like restarting ops job, failed interface transactions, or real-time data cleansing don’t have to require manual effort or have time constraints. Smart automation can handle these tasks, freeing up IT resources for higher-value work and providing an always-on and available resource around the clock.

Third, the tools and teams supporting the system need to be connected. Too often, monitoring tools don’t talk to ticketing platforms. Analysts don’t have access to context or history. A continuous model links everything together so that support is both faster and more informed.

Fourth, expertise matters. In a continuous services model, clinical and technical support analysts are experts empowered to do more than respond to tickets. They understand clinical workflows, governance, and IT business processes to work as an extension of the IT team solving problems at the root.

Finally, the model has to scale. As organizations grow, the support structure should adapt with them. Intelligent automation makes that possible, creating a flexible operations model that evolves as needs change without drastically impacting cost.

What We Gain When Support Gets Smarter

The benefits go well beyond reducing tickets. Internal IT teams finally get room to focus on long-term projects instead of reacting to daily disruptions. Clinicians spend more time on care and less time wrestling with technology. And most importantly, patients receive care backed by systems that are reliable and responsive.

A Final Thought

After a career in healthcare IT support, I’ve learned that service excellence isn’t about heroics, it’s about making a difference. It’s about providing world-class support designed to ensure the technology is no longer a barrier for clinicians to provide quality care.

Status quo isn’t an option when lives like Jake’s are on the line. The real heroes are the nurses and caregivers. Our job is to make sure the systems behind them are just as ready and dependable.

That’s the kind of continuous support healthcare needs now. One that runs quietly in the background, and when it works well, it saves lives. And it’s entirely within reach.

There was a time when my company went through multiple rebrands. These were relatively minor shifts, but completely unnecessary. It…