B.J. Schaknowski, MBA is CEO of Symplr of Houston, TX.

Tell me about yourself and the company.

I have been the CEO of Symplr for three years. Over that time, we have tripled the size of the company. We acquired seven companies in that time, but we have seen strong organic growth because we have developed a competency around delivering value for our healthcare system customers. We are in 97 out of 100 US acute care facilities. We are earning the right to add more value as we deliver for these systems and deliver important outcomes during a time where they have financial problems and workforce shortages. Symplr turned into an important partner over that time, and we are just getting started.

How has the company integrated those acquisitions?

It’s a lot of work. It starts with a thesis and a strategy. We say no to infinitely more potential acquisitions than we ever do. For most of them, it’s not for lack of what would be otherwise a creative financial engineering, but it’s that they don’t fit our strategy. We have built a concept of non-clinical or administrative healthcare operations that are divided into four portfolio areas – provider data management; workforce management; contract and supplier management; and compliance, quality, and safety. If a potential acquisition doesn’t round out or add scale to one of those pillars, we say no.

We have a concept of a connected enterprise. We believe that interoperability and a common UI will make a healthcare worker’s day simpler, with better outcomes, less time in front of computer screens, and more time in front of patients. Acquisitions have to fit into one of those portfolio areas.

Once we identify one and get the deal done, it becomes, how do we take the best of that acquisition, incorporate it into the Symplr culture, lexicon, and core processes, or if we have better, more mature processes here at Symplr, how do we apply those to that asset to get the right level of scalable and sustainable competency for our customers going forward? It takes a lot of time. It takes a lot of hard work. Our team puts in long days and long weeks, but our systems are telling us that it’s working.

Financing and competitive challenges may force young companies to be acquired or die. How would you characterize the likely winners and losers?

There are certainly fewer processes in general. There is still access to capital, even for the smaller companies that weren’t running at much of a margin. It is wildly expensive right now, as you might imagine. Some of those companies that might have otherwise tried to stick it out for a few more years, or sell to somebody like me or another strategic, may be looking at taking on new private equity investment or new partners. They will give up more of their companies because they are not at a point where they can realize the full value.

But the good companies, the companies that have run well — which are the ones that we are interested in, that for a sustained period of time, have had good customer referenceabiliy and have thought about both profitability and growth — those are still attractive assets. It’s less about the financial profile for us. It’s more about the value that they bring to a customer. If we have a complementary or tangential solution, we call it one plus one equals three. Those are still the most interesting assets for us. They usually come from companies that have managed their overall operational portfolio and financial portfolio well.

How aggressively are health systems reducing their technology vendor count, and how has that influenced acquisitive, investor-backed companies versus a one-product startup?

It is the dominant theme relative to technology in healthcare today. COVID shone the spotlight on all the inefficiencies. Fifty or 60% of healthcare systems are using 50 to 100 applications. Think about the credentials, data security, and privacy issues on that. Think about the inability to get your data and send it to your healthcare administrator to be able to make intelligent decisions about how to run the system. At the same time, you’re trying to drop a nurse into three or four facilities, and he or she may literally feel like it’s Day 1 on another system facility that he or she walks into.

It is the driving force behind a lot of technology decisions. It is the driving force behind the evolution and escalation of the CIO as a real driving force of healthcare system — productivity, efficiency, financial outcomes, patient safety, and workforce engagement. Technology consolidation is applied to a highly fragmented patchwork quilt of systems that it took to run a healthcare system. You will see that phase in to more centralized decision-making over the next five years, how it relates to the availability of healthcare technology assets.

Companies that look like Symplr are trying to accomplish the same thing that we have. They may not have the same philosophy around integration or UX/UI, but I see a narrowing of the aperture relative to the willingness to consider a lot of small vendors versus partners who can be there at scale and deliver for you in a variety of areas. As the commercial challenges potentially mount for those companies — and there will be good ones, there are always great ideas, true innovation, and real outcomes — but they will become a little bit more scarce. The larger, the more sustainable, more successful ones that can offer more breadth and depth will continue to become more attractive. It will be interesting to see where that leaves some of the little guys.

OpenAI just killed the valuation and prospects of a few startups by enhancing ChatGPT to read PDF documents, which made those other products instantly obsolete. In digital health, how do companies stay out of Epic’s way while hoping not to be killed off by Epic as an incumbent vendor building a good-enough competing product?

You have to be really careful about where you pick your lanes. With Symplr and some of the other larger operational software companies, there will always be a little bit of coop-etition. But you need to understand where any of the large players are headed and then understand how you can be complementary.

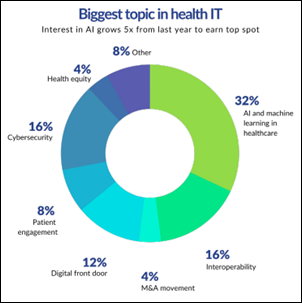

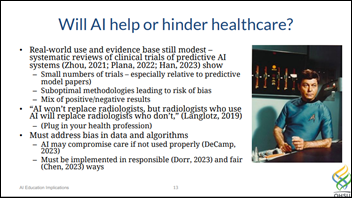

We have our own AI ML strategy, which is a funny thing since AI is not new. The consumability of AI relative to ChatGPT and some of the other formats that have been released recently has been the game-changer. But as you think about their ability to meaningfully come in to do the non-value added workflows, that is super interesting. OCR is 20-plus years old and isn’t new or novel. We would never create a business around that. It’s understanding your swim lanes and having technological innovation and process differentiation that allows you to collaborate and live alongside, hopefully at incremental value, and very rarely overlap.

Health systems are reporting poor financials even though they have near-monopoly markets, charge high prices, and should theoretically be improving efficiency at scale via acquisition. What technology business opportunities does that create?

At the end of the day, if you are a services business and you don’t have enough people to fulfill demand, you are going to have financial troubles. We have a 45% nursing shortage and another 25% saying they will retire in the next five or 10 years. That’s problematic. When you can’t actually get the patient throughput to fulfill the demand you have, even if you are somewhat monopolistic in a market, that’s bad math that doesn’t take an MIT PhD to figure out.

The real question is, how do you leverage technology? This is what Symplr does. Everyone else is oriented around the patient, while we are oriented around the healthcare worker. We’re trying to make them more productive. That means more efficiency, more productivity, and less time in front of a computer screen, yet better outcomes and more time in front of the patient. Seeing more patients, having better patient safety, having better patient quality visits and engagement when they are actually in the system through leveraging technology. That’s where we see the differentiation.

There is still extraordinary waste inside healthcare systems, particularly those that have been run in a highly fragmented or decentralized way. We see in our contract and supplier and spend management portfolio the opportunity for hundreds of millions, if not billions, of dollars of improved savings just by leveraging better technology, which obviously that system can then redeploy return to shareholders or whatever it looks to do. Getting back to the fundamentals of what a healthcare worker is supposed to do and how to manage the bottom line through technology are the two obvious areas.

How are health systems addressing clinician labor challenges?

It’s putting the same level of emphasis around healthcare worker processes and workflow that they have had around patient throughput and patient workflows for all these years.

If you look at the amount of time that a nursing leader, for example, had previously spent in front of a screen scheduling nurses or doing patient safety audits, all of these things could be done in a simpler way, where they are served to served to him or her. Cut that time by two-thirds to 75% and then you get 45 minutes back in an hour to spend on patient care or mentoring younger nurses, which is from what we’ve seen is the key to improving healthcare. It’s all about time. Healthcare is all about giving them more time and then giving them the optimal workflows to get through the day, to see the right patients and give them the right outcomes.

That’s where more progressive systems are focused. How do we empower rather than constrain our nurses, our physicians, and our respiratory therapists? And down the line, to be in the moment more and less in front of that computer screen being forced to follow a set of antiquated workflows or processes.

What are the biggest changes you expect to see in digital health over the next handful of years?

It’s not a sexy answer, but a return to basics and doing it at system-wide level. Where you used to have 47 different facilities inside of one system running as 47 different organizations, as you begin to see them consolidate into a standard way, a best practice way, a gold standard way, you’ll see that beginning to improve not only patient outcomes, but healthcare worker outcomes. That’s what this is about. The focus on the healthcare worker — their engagement, minimizing burnout, making sure that they have the right tools to do their job successfully and effectively, and making sure they aren’t wasting their time on red tape administrative workflows. It’s a return to some of those things, leveraging technology, be it workflow technology or a little bit of AI/ML, to augment and make them more productive. If we get back to the basics and leverage technology to do so, you’ll see a step function improvement in the outcomes that healthcare systems deliver, and that will be to the benefit of every constituent in the healthcare ecosystem.

Amazing that the takeaway is that its easier to buy a gun than to get credentialed as a physician is…