Health IT Market Review 2/8/24

Christopher McCord, MBA, CFA is managing director of Healthcare Growth Partners , an investment banking and strategic advisory firm in Houston, TX. I follow the company’s reports and invited Chris to contribute a summary of their latest analysis.

We’ve been ardent followers of HIStalk since our inception in 2005, hanging on to every post of insightful and in-depth reporting on the health IT landscape. We can’t stress enough its value as a resource for anyone wanting to stay informed about the latest trends and developments in the industry.

To that end, we’re excited to share some highlights from our latest “Health IT Market Review.” This report delves into key areas like mergers and acquisitions, investment flows, and market valuations, offering data-driven insights gleaned from our own experience and research. We believe it’s a valuable resource for anyone looking to understand the current state of the health IT market and its future trajectory.

Key Takeaways

- M&A activity rebounds. Deal volume surpasses pre-pandemic levels, up 50% in Q4 2023 as compared to Q4 2022 and trending up in January, but valuations remain below historical norms, ~25% lower than the pre-COVID average and 57% off their COVID peak (based on multiples of revenue).

- Investment declines. Investment in health IT continues to decline, falling to $743 million in January 2024, levels not seen since 2017.

- Public market struggles. The number of public health IT companies has contracted from 68 to 53, and 13 are at risk of de-listing due to non-compliance.

- Future outlook. Despite the challenges faced in 2023, positive signals abound, mostly fueled by anticipated decreases in inflation and interest rates.

First, we’ll attempt to describe how we, the collective health IT enthusiasts, got here in a few sentences.

The past decade in health IT was shaped by a potent cocktail of regulatory and economic forces. Starting with the American Recovery and Reinvestment Act’s HITECH Act, which incentivized Electronic Medical Record (EMR) adoption, and followed by the Affordable Care Act, significant regulations fueled an initial boom. The 21st Century Cures Act later evolved Meaningful Use into a more dynamic data platform, now laying the groundwork for AI integration.

Simultaneously, a decade of near-zero interest rates and quantitative easing inflated the US money supply, creating an environment where a generation of professionals became accustomed to expansionary policy and rising valuations. The COVID-19 pandemic further amplified these trends, dramatically validating the investment thesis in digital health across sectors like telehealth, mental health, and drug discovery.

The pandemic’s vivid demonstration of health informatics’ value undoubtedly contributed to a period of heightened investor confidence in the sector. It’s no wonder investors felt invincible.

The current market presents a dynamic interplay of forces, largely a byproduct of the complex macroeconomic and interest rate environment. While health IT M&A activity has witnessed a surprising resurgence, now exceeding pre-pandemic levels in terms of volume (but not value), new investments still show a declining trend. Valuations remain below pre-COVID levels, but are rebounding after hitting a floor in the first half of 2023.

Where does it go from here? The following charts and commentary delve into this critical unknown, leveraging data and experience gleaned from our own journey, to help you piece together your own market mosaic.

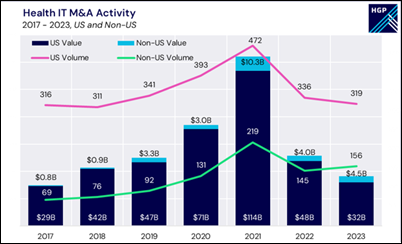

After hitting a Q4 2022 nadir, 2023 US health IT M&A and buyout volume rebounded to levels higher than pre-COVID. The last quarter of 2023, with 84 transactions, marked a 50% surge compared to Q4 2022. The upward trend was maintained in January, with 30 US health IT transactions during the month, annualizing to 360 deals versus 319 in 2023.

While M&A volume has rebounded, M&A deal value sits at the lowest levels since 2017. This is attributed to a confluence of factors: rising capital costs, broader macroeconomic concerns, a tech-specific valuation reset, and a more cautious approach by investors – all concerns that are showing signs of dissipating.

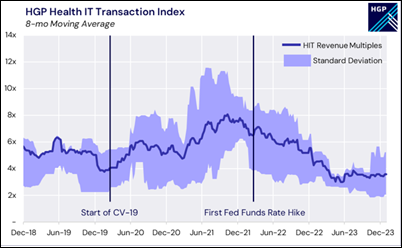

The following is what we think is the most important piece of data – valuation trends of health IT M&A and buyout transactions. The HGP Health IT Transaction Index sits at 3.6x revenue, a 22% discount from its pre-pandemic 4.6x average and a 55% discount from the peak of 8.1x seen during the COVID hype cycle. Despite the valuation gap, there are positive signals in both the data and macroeconomic picture. Notably, the standard deviation of transaction valuations has widened over recent months, meaning that more transactions are trading at both higher and lower multiples than the average, which is a promising signal that the average has room to move up.

The recent wider band of valuations reflects healthier market activity and perhaps and revival of traditional SaaS transactions, while the lower band generally represents the sale of distressed assets and divestitures of prior acquisitions. For those unfamiliar with valuation multiples, we’ve added an explanation at the end of this piece.

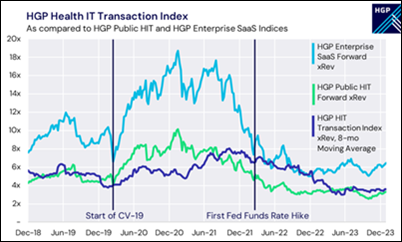

Enterprise SaaS (multi-industry, not pure health IT) currently trades at a discount to pre-COVID averages, trending down from 8.8x to 6.5x forward revenue. The current 26% discount is even more staggering compared to its COVID peak of 18.8x, representing a 66% discount. The overarching question weighing on the market is whether valuations will revert to the mean and the definition of that mean. Low interest rates raised valuations, high interest rates lowered them, and the general expectation is that valuations will find the reversion to the mean as interest rates return to the FOMC’s “Neutral Rate”, generally defined as 3-3.5% (compared to February 2024’s 5.25-5.5% rate).

Recent transactions signal that investors see opportunity at these valuations. For those looking for points of reference for health IT valuations, Thoma Bravo’s acquisition of Everbridge, a critical event and communications vendor, is a legitimate comp. On February 5, Thoma Bravo announced a $1.5 billion go-private of Everbridge. The purchase price implies a 3.2x and 15x multiple of forward (2024) revenue and EBITDA, respectively, for a company with a <5% growth rate, 73% gross margins, and a 22% EBITDA margin, noting that the business traded for over 20x revenue during the post-COVID euphoria and posted growth rates 30-40% at that time. While today’s investors may be valuing profitability more over growth, this valuation would indicate that growth matters.

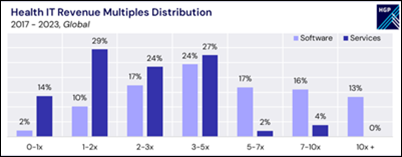

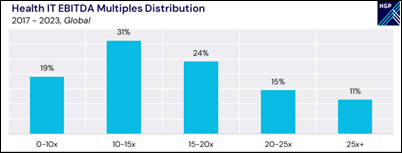

Going deeper into valuation, HGP keeps tabs on the distribution of revenue and EBITDA multiples for M&A and buyout transactions, summarized in the following charts since 2017. Notably, while the COVID period represents 25% of the period (which we define as Q3 2020 – Q1 2022), this period represents 37% of transaction multiples, a reflection of the outsized share of transaction activity that occurred during this time. HGP believes the exclusion of the COVID period best represents valuations in the current market environment, which is described in more detail in our full report.

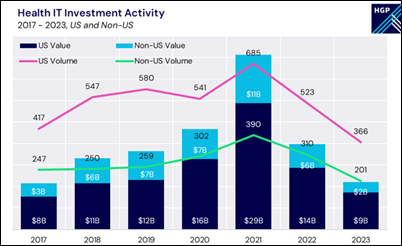

Investment in health IT continues to slide, falling to levels not seen since 2017. Activity fell further in January 2024, with $743 million ($8.9 billion annualized) invested in 21 companies (252 annualized) in the US. The median investment round declined from $20 million in 2021 to $11.5 million in 2023, still above a pre-COVID average of ~$8 million.

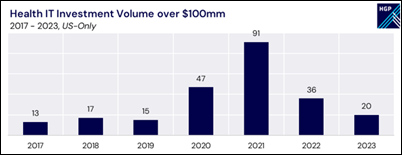

Not surprisingly, the COVID cycle saw the rise and fall of $100 million+ investment rounds. Despite the decline, the number of mega-rounds is higher today than pre-COVID, likely a result of larger private equity funds that were raised during the COVID cycle.

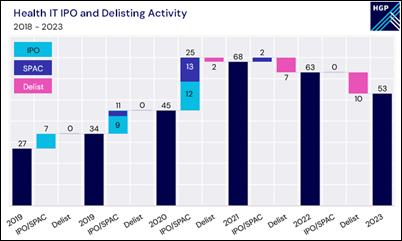

The health IT public market scene has undergone major transformations since the end of the almost three-year drought of health IT IPOs that ended in 2019. Following a surge of activity that was supercharged by the rise in SPAC popularity in 2021, the market reversed course, almost inversely mirroring the 2019-2021 flurry of new entrants with seven de-listed companies in 2022 and 10 in 2023. Of the remaining 53 constituents, 13 trade below or dangerously near $1, risking de-listing due to noncompliance.

We believe many emerged from this year stronger and nimbler, and many are encumbered by challenging capital structures because of recent market dislocations. Inflation and interest rates are projected to fall, and valuations may benefit from money supply to risk assets. Private equity dry powder sits at all-time highs at $2.5 trillion globally, and money market funds are sitting on a record $6 trillion in assets. These funds will likely be drawn down as rates fall, stimulating demand and supporting valuations for both private and public equities, with further stimulation as the credit markets get back into swing. Despite stubborn inflation, a presidential election year, and uncertain geopolitical backdrop, the economic and overall picture in the US is more positive and stronger than this time last year, injecting a much-needed dose of confidence into the market for the year ahead.

About Valuation Multiples

Compared to complex discounted cash flow methods, the most common way to value a business relies on revenue and EBITDA multiples. These multiples offer a standardized way to compare companies based on their financial performance. They’re valuable for comparing businesses, assessing potential investments, understanding industry trends, and negotiating deals. Investors compare companies to multiples derived from market data of publicly traded companies and similar recent acquisitions in the same industry.

These “multiples” are essentially valuation benchmarks. They’re applied to a company’s revenue or EBITDA to estimate its value. While popular for its simplicity and market data reliance, this method requires finding truly comparable companies, which can be challenging due to differences in size, maturity, and market position. Additionally, several factors beyond these multiples, like revenue models, growth potential and customer retention, can influence valuation. By analyzing these factors and their impact on multiples, investors can gain valuable insights into a company’s relative value and make more informed decisions.

Give ophthalmology a break. There aren’t many specialties that can do most of their diagnosis with physical examination in the…