“We build the board a house of glass and pray the question’s never asked.” Oof! I wouldn't want to be…

News 6/16/23

Top News

Oracle conducts another round of layoffs in the former Cerner business, according to employee reports on Reddit and LinkedIn. Federal business groups, specifically teams involved in the VA’s now-paused implementation, were most often mentioned.

The company also reportedly rescinded some job offers.

Oracle CEO Safra Catz said of the Cerner business in this week’s earnings call, “You will be seeing some more significant changes, and we have legal entity combination imminently and that actually gives us a lot more flexibility regarding the way we operate the business. We are just at the very beginning of it. Their margins are nowhere close to the way we run our company.“

Oracle has reportedly laid off 3,000 of Cerner’s 28,000 employees in the year since the $28 billion acquisition.

Meanwhile, the stock market likes what it heard this week and has pushed ORCL shares to record highs, valuing the company at $342 billion and the wallet of CTO and Chairman Larry Ellison at nearly $150 billion. Shares rose another 3.5% on Thursday.

Webinars

June 22 (Thursday) 2 ET. “The End of COVID Public Health Emergency is Here. Is Your Rev Cycle Ready?” Sponsor: Waystar. Presenter: Vanessa L. Moldovan, commercial enablement + insights program manager, Waystar. This webinar will describe the proactive steps that are needed to avoid increased rejections and denials. It will cover regulatory waivers and flexibilities, major shifts in telehealth, changes to reimbursement, and the impact of the end of the PHE on Medicaid coverage.

July 12 (Wednesday) 2 ET. “101: National Network Data Exchanges.” Sponsor: Particle Health. Presenter: Troy Bannister, founder and CEO, Particle Health. It’s highly likely that your most recent medical records were indexed by a national Health Information Network (HIN). Network participants can submit basic demographic information into an API and receive full, longitudinal medical records sourced from HINs. Records come in a parsed, standardized format, on demand, with a success rate above 90%. There’s so much more to learn and discover, which is why Troy Bannister is going to provide a 101 on all things HIN. You will learn what HINs are, see how the major HINS compare, and learn how networks will evolve due to TEFCA.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Nasdaq gives Veradigm another extension to submit its annual and quarterly reports, with the company expecting to file Form 10-K on September 18, 2023 rather than June 14. The former Allscripts announced at the end of February that audits internal had uncovered revenue recognition problems that would force a 15-day delay in filing its report that was due March 1. The company then announced on March 22 that it had fallen out of Nasdaq compliance by failing to file its 10-K by the revised date. It was given another 60 days to file the report. Nasdaq issued a delisting notice for MDRX shares on May 18 for failing to file its reports on time. MDRX shares have lost 35% since January 1 versus the Nasdaq’s 30% gain, valuing the company at $1.3 billion.

Nasdaq retracts its delisting warning for shares of Healthcare Triangle, determining that it made a mistake in calculating the company’s per-share value following its May 26 reverse stock split.

Healthcare staffing company Aya Health acquires Flexwise Health, whose software forecasts hospital staffing needs.

BurstIQ acquires the business intelligence solution of Olive AI.

Sales

- Health risk management firm Captive Health will offer its covered members KeyCare’s virtual care services, accessed from MyChart and Captive Health’s mobile app.

Announcements and Implementations

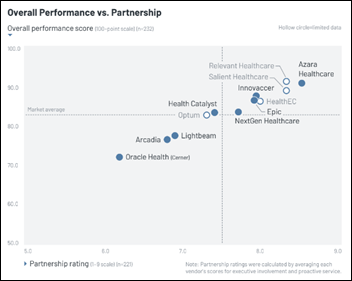

A new KLAS report on population health management technology vendors finds that Epic and Innovaccer stand out, and along with Arcadia, are most often considered. Customers give high partnership marks to Azara Healthcare, Relevant Healthcare, and Salient Healthcare.

Government and Politics

Human Rights Watch calls for the US government to protect Americans from aggressive billing and debt collection by non-profit hospitals, which the organization says is interfering with their other human rights such as housing, food, and education. It concludes that the US model of giving tax breaks to privately operated hospitals and hoping they will reciprocate by delivering charity care isn’t working, making the US a big outlier in medical debt. The report says the government should require hospitals to provide as much charity care as they receive in tax subsidies, for the IRS to set national standards for hospital financial assistance, and for the Consumer Financial Protection Bureau to require debt collectors to make sure that patients have been screened for financial assistance eligibility before pressing them for payment.

Sponsor Updates

- Team Ellkay raises over $35,000 for the Alpine Learning Group during its annual Go the Distance for Autism cycling event.

- Vyne Medical publishes a new case study, “How to Establish Proof of Patient Authorizations to Overturn Denials.”

- A new report from Forester recognizes InterSystems as a strong performer among top data management and analytics vendors.

- Redox publishes a new report, “Uncovering hidden data roadblocks of cloud and AI adoption in healthcare.”

- Black Book lists the top-ranked payer technologies category leaders exhibiting at AHIP this week. HIStalk sponsors include Wolters Kluwer Health (member and consumer education solutions) and Optum (end-to-end payer RCM outsourcing, payer analytics outsourcing).

- Wolters Kluwer Health and Laerdal Medical launch VRClinicals for Nursing to enhance nurse training with realistic, multi-patient scenarios using virtual reality.

- Konza National Network’s interoperability platform earns certified status by HITRUST for information security.

- Direct Recruiters parent company Starfish Partners acquires Global People and cybersecurity-focused NinjaJobs.

- Fortified Health Security names Katarzyna Parzonka conference and event coordinator.

- Healthwise wins six Digital Health Awards.

- Loyal names Matt Gove (Summit Health/CityMD) senior advisor.

Blog Posts

- How to Maintain a Thriving Healthcare System Despite Inflating Costs (Vyne Medical)

- How Analytics Can Transform Interoperability (Dimensional Insight)

- The Hidden Benefits of Staff Augmentation in Healthcare (Divurgent)

- EClinicalWorks Day is Back – and Coming to Your Area (EClinicalWorks)

- Doctor’s Urgent Care Sees Immediate Improvement to Revenue Potential by Switching EMR (Experity)

- EHR Implementation: How to Achieve Successful Change Management (HealthTech Resources)

- Proceed with caution: Why code crosswalks are built to fail (Intelligent Medical Objects)

- Unique Challenges of Healthcare Application Testing: Why It Is So Different (Keysight)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

It’s surprising to me that Cerner would have been so bloated and mismanaged these rounds of layoffs would have a net positive effect on anything but short term cost reduction. Even if most of the layoffs came from the paused VA project, that’s a lot of knowledge loss over the last year.

Cerner certainly weren’t making any large scale sales before the Oracle acquisition. If I were in a procurement process, I would have serious reservations about their implementation and support capabilities in this environment.

1) The Cerner / VA relationship seems over. You can’t keep it together once layoffs start. Talent leaves, and no one will join.

2) Defense Health Agency nears completion on its Cerner implementations in CONUS. Why DHA could do it and VA couldn’t a questions I’ve never heard asked much less answered.

3) I’ve got a Chicago bias but every big system here seems to use Epic. Residents becoming Epic savvy and that tells me Epic’s ascendant because that’s what the coming generation of Docs learned. So has Epic wondered what happens when their EHR becomes akin to a Utility and the Feds begin to treat it that way?

“We are just at the very beginning of it. Their margins are nowhere close to the way we run our company.“”

Is that a BIG smile I see ion Judy’s face??