Traditionally Professional Courtesy is something that physicians gave each other - but we had to be careful with it when…

News 5/5/17

Top News

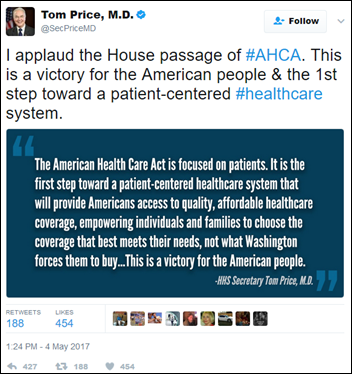

The House votes 217 to 213 to repeal the Affordable Care Act, sending the American Health Care Act to the Senate. President Trump said afterward in a White House victory celebration, “We’re going to get this passed through the Senate. I feel so confident,” adding a promise that premiums and deductibles will go down.

No Democrats voted “yes,” while 20 Republications voted “no.” Two more “no” votes would have killed the bill. The House allocated 40 minutes for discussion before the vote.

The voting was held just before the House leaves for an 11-day recess. Congressional Budget Office scoring of cost and the change in the number of uninsured has not been completed.

Just about every medical and consumer group urged rejecting the American Health Care Act, which would:

- End Medicaid as an open-ended entitlement.

- Give the wealthiest Americans a $300 billion tax break over 10 years.

- Allow insurers to charge older citizens five times the premium rate of younger ones (increasing it from three times).

- Allow states to eliminate the requirement that insurance companies issue policies without considering pre-existing conditions.

- Eliminate the requirement that individuals buy insurance.

- Remove the penalties for large employers who don’t want to provide insurance to their employees.

- A change added to the bill in a last-minute amendment would allow states to remove the out-of-pocket maximums now required of employer-provided insurance.

The expected millions of people who would lose insurance under the proposal would leave hospitals at risk for providing their emergency care without payment since the Affordable Care Act reduced hospital Medicare payments on the assumption that more of their patients would be insured.

The Senate’s debate on the bill will begin in June.

Reader Comments

From LongInTheTooth: “Re: Australia’s Telstra Health. You mentioned them as being shortlisted for an EMR tender in Northern Territory. After making over a dozen health IT acquisitions in the last few years, they have decided to trim down and focus solely on the Australian market. New Managing Director Mary Foley is trying to turn around a larger-than-required health vertical without a coherent strategy and has just announced a massive reorg which includes layoffs. Last week they sold their Arcus EMR business in Asia to private buyers. Their CTO Roy Shubhabrata (ex-Epic, GE Healthcare, Microsoft) couldn’t save the sinking ship. Another acquisition, Dr. Foster in the UK, is up for sale as well.” Telstra Health is a business unit of Telstra, the biggest telecommunications and media company in Australia.

From Polite Patrician: “Re: Epic’s App Orchard. The site seems to be free of legal disclaimers. I’m wondering how the submission and approval process works.” I’ve heard concerns that Epic asks a lot of questions about submitted apps and could theoretically use that information to guide its own product development. Epic could also reject apps in claiming without proof that they encroach upon planned future Epic functionality. It seems farfetched to me that Epic would use App Orchard submissions to glean product enhancement ideas or that it would deny applications without a good reason, but at least some small companies seem to worry about that possibility. I’m interested in hearing (anonymously) from anyone who has experience in working with Epic on App Orchard since we’re otherwise just sitting around wringing our hands without facts.

From Old Relay Dev: “Re: McKesson. Sweeping layoffs in NewCo/Change starting last night.” Unverified. An anonymous post on TheLayoff.com quotes a claimed internal email indicating that 394 employees were let go along and 89 open positions were closed, predicting that another RIF will follow in June.

HIStalk Announcements and Requests

HIStalk readers funded the DonorsChoose project of Mrs. F in Virginia, who asked for headphones for her kindergarten class. She reports, “During our group rotations, when students are not working with one of the teachers, then they are on the computer using a program that they sign into so that reading, word recognition, and spelling are at the student’s level. The headphones allow only the student who is on the computer to hear the program without distracting the groups the teachers are working with. The students on the computer are also not distracted by what the teacher is teaching. These headphones allow my classroom to run smoothly. The donors who help make my room complete are angels.”

This week on HIStalk Practice: Compulink develops all-in-one HIS solution for ASCs. MDLive CEO hints at the important role telepsychiatry will play in its future business model. NCQA develops Oncology Medical Home recognition program. Charlotte Eye Ear Nose & Throat rolls out Epic. Practice Velocity announces ownership changes. Change Healthcare helps Saltzer Medical Group transition to independence. Kerri Wing, RN of IHealth Innovations outlines the IPPS proposed rule’s peace offering to physicians.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre for information on webinar services.

Acquisitions, Funding, Business, and Stock

![]()

Private equity firm Thoma Bravo will buy Lexmark’s enterprise software business — which includes Kofax, ReadSoft, and Perceptive Software – and will then sell the Perceptive business (image capture, vendor-neutral archive, and a universal viewer) to its portfolio company Hyland Software. The Kofax and ReadSoft businesses will be rolled into a new Thoma Bravo company under the Kofax name. Lexmark acquired Perceptive Software for $280 million in 2010, bought competitor Kofax in 2015, and then sold itself to a China-based investor consortium for $3.6 billion in 2016.

Allscripts announces Q1 results: revenue up 20 percent, adjusted EPS $0.13 vs. $0.13 as GAAP earnings swung to a loss, meeting earnings and revenue expectations. Shares were unchanged early in after-hours trading and are down 9 percent in the past year.

Germany-based CompuGroup Medical reports Q1 results: revenue up 5 percent, EPS $0.27 vs. $0.22. Share price has risen 20 percent in the past three months.

Analytics vendor Inovalon reports Q1 results: revenue up 5 percent, adjusted EPS $0.07 vs. $0.05. Share price is down 22 percent in the past year, valuing the company at $1.8 billion.

EHR prescription drug coupon vendor OptimizeRX reports Q1 results: revenue up 22 percent, EPS -$0.03 vs. –$0.01. OTC-listed shares are down 29 percent in the past year, valuing the company at $22 million.

Analytics vendor Koan Health buys ZirMed’s value-based care analytics business.

China-based insurer Ping An launches a $1 billion investment fund that will focus on overseas financial and healthcare technology. The company’s health Internet subsidiary, which offers free online doctor consultations, raised $500 million in a Series A round last year,valuing it at $3 billion.

People

Patient engagement technology vendor Conversa Health hires Chris Edwards (Validic) as chief marketing and experience officer and Becky James (WebMD Health Services) as VP of operations.

Phil Spinelli (Visiant Health) joins Ingenious Med as SVP/chief revenue officer.

Kyruus hires Scott Andrews (Athenahealth) as SVP of delivery.

AdvancedMD hires Greg Ayers (inContact) as CFO.

Announcements and Implementations

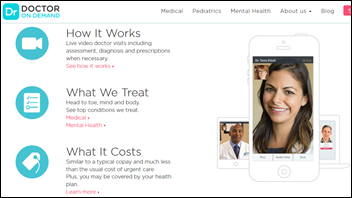

Video visit vendor Doctor On Demand integrates its system with those of lab companies Quest and LabCorp, allowing its doctors to order lab tests and for its patients to choose a lab based on insurance coverage, availability, and location. The company — co-founded by TV psychologist Dr. Phil and his TV producer son – has raised $87 million in three funding rounds, although the largest and most recent was nearly two years ago. Among its investors are Athenahealth’s Jonathan Bush and Virgin’s Sir Richard Branson. It offers medical sessions for $49 along with ongoing psychology and psychiatry counseling.

In Australia, Pulse+IT reports that a Victoria-wide implementation of Epic did not receive funding in the state’s new budget.

Surescripts extends its real-time medication history service to long-term and post-acute care facilities.

Government and Politics

The CEO of insurer Molina Healthcare – the son of the company’s founder who, along with his CFO brother, was fired Tuesday despite improved quarterly results – says his criticism of the Republican repeal-and-replace movement may have cost him his job. He says, “People are afraid of the administration. Why take an aggressive stance if you think you have nothing to gain, or if you think you have something to lose?” He adds, “The most troubling development has been the attempt to get votes from the Freedom Caucus by allowing states to get rid of the ban on pre-existing conditions … The Trump administration is destabilizing [the marketplaces]. Health plans need to plan ahead. He can pull the rug out from the health plans at any minute.” Molina shares rose 25 percent on the news as investors speculated that the company is now an acquisition target, having jumped 41 percent in the past year and 152 percent in five years.

Privacy and Security

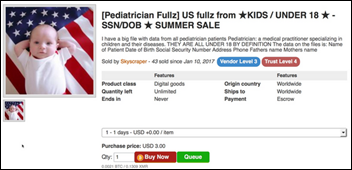

DataBreaches.net reports that an anonymous hacker is running a “summer sale” on his or her inventory of 500,000 recently stolen patient records from pediatric practices, offered at $3 per child. The site verified the validity of a sample of the records even though no cumulative breaches of that magnitude have been reported. The hacker, “Skyscraper,” says he or she simply searches for “patients,” adding that, “For some stupid reason, entire databases show up” and clarifying that the searches don’t involve the known weaknesses of IoT-connected devices or FTP servers. Asked what practices should do to protect themselves, the hacker says they need to pay for their software: “You wouldn’t believe how many of those offices run on cracked / downloaded software and outdated 2015 versions.”

University of California regents sue several doctors and pharmacies, claiming that they defrauded the student health insurance of $12 million over six months by running Facebook ads offering students $550 to participate in phony clinical trials for a pain cream and recruited other students as sales reps for a drug “startup” at a campus job fair. The 500 respondents to both solicitations were required to provide their student health plan numbers, which the lawsuit claims were used to bill prescriptions for custom compounded, Ben Gay-like creams that cost the student health insurance up to $5,300 per tube. The prescribers did not examine the students, who were unaware that they were being billed for the creams. One podiatrist wrote 600 prescriptions for the creams in a single day, costing the system $1.7 million.

Other

Ever-increasing patient cost-sharing has hurt the collection rates of medical practices, according to a Health Affairs article co-authored by Athenahealth’s Jonathan Bush that studied the company’s practice data. Patients paid around 90 percent of balances that were less than $200, but once they owed more than that amount, the figure dropped to 67 percent. The article also notes that collection rates are lower for specialists (because they charge more) and that practices must wait weeks to receive an EOB from the insurance carrier to find out what the patient owes, greatly reducing the chances of getting paid once the patient has left the office.

An article in The Economist says that data rather than oil is the world’s most valuable resource, suggesting an antitrust evaluation of the companies that are profiting massively from it (Google, Amazon, Apple, Facebook, and Microsoft). It notes that access to consumer data gives those big companies an early warning (“a God’s eye view”) of potentially competitive upstarts that they can either copy or buy, highlighting Facebook’s $22 billion acquisition of 60-employee, zero-revenue WhatsApp in 2014. The article suggests that antitrust regulators look not only at company size when evaluating the consumer impact on a proposed merger, but also the extent of the data assets of the companies. It also proposes that companies be forced to let consumers know what information about them they hold and how much money they make from it; that governments open up their own data vaults; and that countries require at least some industries (as is being done with banks in Europe) to share their customer data with third parties.

A Wall Street Journal article examines whether public outcry over a company’s $89,000 drug (previously sold for $1,200) forced that company to sell the drug to yet another company and effectively put itself out of business. Marathon Pharmaceuticals bought a old UK muscular dystrophy drug, paid $370,000 to buy study data from universities, researchers, and the Muscular Dystrophy Association that it used to earn FDA approval, then set an $89,000 per year US price. The CEO’s previous company bought another rare disease drug and upped the price from $289 per vial to $1,950, a formula it repeated in buying “under priced” drugs from big companies and increasing US prices by an average of 500 percent. He made $60 million when he sold the company for $900 million. He expected to sell the current company, Marathon Pharmaceuticals, for several billion dollars before the pricing backlash, but even though he fell short, the company received $140 million in cash and stock, 20 percent of future sales revenue, and a potential $50 million payout, all thanks to 20,000 young boys afflicted with Duchenne muscular dystrophy.

A survey of 800+ health IT workers (two-thirds of them consultants, most of them working on Epic) finds that 86 percent of them feel optimistic about their career opportunities and nearly half say they make $100,000 or more per year. The most important factors in deciding whether to accept a contract are pay, company reputation, and the expense reimbursement model, with the least-important factor being the ability to work from home. Interestingly, two-thirds of consultants would consider a full-time role, which represents a huge jump over surveys from previous years, although salary expectations seem to be a barrier given the tiny number of respondents who say they’re willing to take a pay cut.

Wilkes Regional Medical Center (NC) will convert from McKesson Paragon to Epic as its lease is turned over to Wake Forest Baptist Medical Center on July 2, when it will be renamed to a name that will surely almost never be used in its entirety, Wake Forest Baptist Health – Wilkes Medical Center.

An interesting study finds that parents who Google the symptoms of their child are much more likely to question their pediatrician and seek a second opinion because they don’t understand the differential diagnosis process the doctor used. The author suggests that physicians explain how they arrived at their diagnosis during the office visit to avoid treatment delays caused by patient second guessing.

Vending machines are offering $4 HIV test kits as part of a government pilot project in China, where people often don’t undergo testing because homosexuality — and with it, HIV and AIDS — are taboo subjects and hospitals reportedly regularly turn away HIV/AIDS patients even though the law forbids such discrimination.

Weird News Andy says 50-times-faster brain surgery is fine as long as it isn’t done half-fast. University of Utah develops a robotic, CT-mapped surgical drill that may reduce surgery time from two hours to 2.5 minutes, although it hasn’t actually been tested on humans.

Sponsor Updates

- Impact Advisors delivers 200 backpacks filled with craft supplies and games to patients of Florida Hospital for Children.

- EClinicalWorks will exhibit at the 2017 ASCA Annual Meeting May 3-6 in Oxon Hill, MD.

- Nuance recaps recent hospital sales of its computer-assisted physician document system and publishes a new report titled “CAPD 2017: Improve physician documentation at the point of care.”

- Evariant will host its third annual Converge User Conference May 7 in Austin.

- ECG Management Consultants will present at the 2017 ASCA Annual Meeting May 4 in Oxon Hill, MD.

- An Emory University research study finds cost savings for CABG surgery, supported by Glytec’s Glucommander for personalized insulin dosing.

- The HCI Group publishes “Selecting the Right Interface Engine – Top 5 Considerations.”

- Healthcare Growth Partners supports the sale of Clockwise.MD to DocuTap.

- Imprivata will exhibit at the Canada Collaboration Forum May 8-10 in Whistler, British Columbia.

- Influence Health releases a new whitepaper, “Healthcare Consumer Experience in 2017.”

- InterSystems will exhibit at the Blue Cross Blue Shield National Summit May 9-12 in Orlando.

- Kyruus publishes “Health System Call Center Experience Report: Are Top Health Systems & Hospitals Answering the Call to Provide a Better Patient Experience?”

- Liaison Technologies begins accepting applications for its new Data-Inspired Future Scholarship.

- NVoq will exhibit at the MGMA NE conference May 10-12 in North Falmouth, MA.

- Experian Health will present at HFMA Eastern Michigan May 12 in Livonia.

- Wellsoft will exhibit at the Rural Health Conference May 9-12 in San Diego.

Blog Posts

- How to Increase Your Revenue by Closing Care Gaps (ECG Management Consultants)

- Beyond Clinical Care – How to Define “Customer Experience” (Evariant)

- Are You Maximizing Your Clinical Documentation Improvement? (Optimum Healthcare IT)

- Implementing a New Compensation Plan: 5 Ways to Get Physician Buy-In (Hayes Management Consulting)

- Why Sugar Isn’t Sweet for the Healthcare Industry (Healthgrades)

- PHI and Meditech’s Data Repository (Iatric Systems)

- MEDITECH Solutions Bring Real Results to Southern Africa Healthcare (Meditech)

- How Gundersen Health System is securing its EMR without impacting clinical access (Imprivata)

- A Healthcare Marketer’s Consumer Experience Wish List (Influence Health)

- I Know it When I See It: Coordinated Care (InterSystems)

- The Evolving Role of Digitization in Healthcare (Conduent Health)

- Solving the Problem of Dirty Orders (Liaison Technologies)

- Landing Top Information Security Talent: How Healthcare Organizations Can Stand Out to CISOs (Fortified Health Security)

- Rethinking healthcare data: it is a technology ecosystem (LifeImage)

- Meditech Solutions Bring Real Results to Southern Africa Healthcare (Meditech)

- The Power of 3: From the Three Musketeers to Our 2017 Patient Payment Check-Up Survey (Navicure)

- Meditech 6.1x Implementation Phases Part 4: Build (Parallon Technology)

- My nursing path to Infor (Infor)

- Healthcare Security Roundtable: An Interview with CloudWave and Fortified Health Security Experts (CloudWave)

- Who Let the Trump Out? (Reaction Data)

- No Logo: When Your Brand Gets in the Way of Your Vision (Salesforce)

- Will Ambulatory Surgery Centers Become More “Hospital-Like?” (The SSI Group)

- The Difference Indifference Can Make (Solutionreach)

- Thank You, Lab Professionals, For All You Do! (Sunquest Information Systems)

- Spring Fever Hits IT – Disaster Recovery to the Rescue (TierPoint)

- From Meaningful Use to Meaningful Insight. (Voalte)

- Leverage SMS Messaging for Fiesta-Worthy Communication (West Corp.)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates. Send news or rumors.

Contact us.

Important to note, those “Contract hourly” numbers are bill rates. The consultants get paid a fraction of that, sometimes only 50%. And a portion of it could be used to cover travel expenses (flights, rental car, hotel, food, etc.) if the consulting company does not bill expenses directly to the client in addition to the bill rate.