Move your quotes to where they should be and it's no longer politics-in-the-blog, but instead a fact that's true at…

News 8/5/15

Top News

Cerner announces Q2 results: revenue up 32 percent, adjusted EPS $0.52 vs. $0.40, meeting earnings estimates but falling short on revenue expectations as service revenue declined and operating expenses jumped 53 percent. The company raised full-year earnings guidance but lowered full-year revenue guidance, sending CERN shares down 3.5 percent in after-market trading following the market’s close Tuesday. CERN shares are up 26 percent in the past year vs. the Nasdaq’s 17 percent.

From the Cerner earnings call:

- CFO Marc Naughton says the company is disappointed that it missed its guided revenue estimates, but is happy with its all-time high strong sales and positive outlook.

- Recurring revenue from the Siemens acquisition is tracking as expected, but fewer than expected customers committing to moving to Millennium or buying additional of the former Siemens solutions as they are “holding pat with their hand.”

- President Zane Burke says Cerner differentiates itself (presumably from Epic) on predictable costs of ownership, fixed-fee implementations, and partial or full IT department outsourcing.

- Cerner says (without naming names) that it is gaining ambulatory business at the expense of Athenahealth because it offers better service and value.

- Burke says Cerner is happy to have been chosen by the DoD as part of the Leidos bid, but doesn’t expect a material impact on sales, revenue, or profits in the near term. He adds that the DoD’s project estimate is $9 billion over 18 years, but the value of the contract awarded is less.

- Cerner says its customers “are actually very excited” about its DoD win.

- Cerner’s new campus construction will require a capital expenditure of $150 million in the fiscal year.

- CEO Neal Patterson was supposed to join the call for Q&A, but did not participate.

Reader Comments

![]()

From Captain Cupric: “Re: CHIME’s for-profit vendor-CIO matchmaking service. Isn’t that what the AHA’s AHA Solutions group does? Vendors pay hundreds of thousands of dollars (sometimes more than a million dollars) for an agreement, then pay a percentage of sales for ‘introductions’ to decision makers.” I believe that’s the case, although AHA Solutions does have some sort of vetting procedure (other than having the vendor’s check clear) before anointing their solutions as “endorsed.” It annoys me when supposedly non-profit member organizations can’t resist the lure of transforming themselves into richly rewarded pimps who arrange vendor-member liaisons in exploiting the “Ladies Drink Free” business model. The healthcare history is rich with examples (AHA, AMA, HIMSS, etc.) and CHIME seems anxious to pile onto the financial bandwagon in selling access to its provider members.

From CIO Doc: “Re: DoD EHR coverage. HIStalk had all I needed to know, from the early rumors to Dim-Sum’s webinar to critical analysis of the selection and then contract and vendor insight.” The other sites didn’t get anything wrong, they just didn’t add much value to the single-paragraph DoD contract notice (which is all they had to work with) in cranking out mindless articles and tweet-seeking missiles like (a) plucking a few random tweets or reader comments about the selection and passing them off as an insightful article representing the industry’s collective reaction; (b) running a long piece about how Epic feels about getting passed over in repurposing content from a rather sloppy Madison newspaper article; (c) asking but not answering questions in headlines; and (d) assembling random, pointless factoids together in proclaiming “X things to know” that were in fact not at all worth knowing. I don’t see much value in having writers with zero healthcare or IT experience rewording public information to seem like fresh news, hoping to attract reader eyeballs and advertiser support with stories that provide those readers with little value, but that’s just me.

From Horse Hockey: “Re: Healthcare IT News. Tooting its own horn in an odd press release. It’s odd that they brag on their unstated DoD reader numbers and even more that they issued a press release about themselves – what editor other than their own would think something like that is newsworthy?” I hesitate to comment since this reader’s email came after I had already written my media diatribe in response to the comment above, but the HIMSS-owned HITN issues a self-congratulatory news flash stating that its (unstated) readership numbers temporarily rose by an (unstated) percentage after they stopped the online presses for lightweight articles as, “CIOs ‘surprised’ at Cerner DoD win,” “Is DoD’s EHR modernization bound to fail?” and “The good, the bad, and the ugly: social media’s response to DoD Cerner EHR contract win.” I don’t read any health IT sites since I’ve yet to find anything there that wasn’t amply described elsewhere, but more power to everybody who can earn and keep readers, especially if they’re trying to do it as cheap seats observers.

From Informatics Please: “Re: Tampa General Hospital. Has extended their instance of Epic to the University of South Florida in a large ambulatory Epic Connect project involving 850 physicians and 2,800 users.” Unverified, but the source is sound.

From RingRing-Tom Brady: “Re: question for clinical readers. What about a vendor prompts them to want more in going to the vendor’s website or picking up the phone? I’m interviewing and am amazed at how much faith sales and marketing people place in their CRM and automated marketing platforms to drive sales. Is email outreach and social media really making an impact or is it just lazy selling? Does it matter how many touches you hit a prospect with, or do they just hit delete? Does an old-school ‘let me tell you how I can help solve your problem’ work?” I’ll let readers weigh in, but I’ll say this: I often find that clueless sales and marketing people who measure vanity but irrelevant metrics such as ad clicks to be employed by equally clueless and unsuccessful vendors. I’ll also opine that any company that relies on Twitter and Facebook to drive sales might as well lock up and go home since most heavy users of social media (both vendors and providers) are junior employees rather than decision-making executives. I would wager that most healthcare IT sales come from word of mouth or existing personal relationships, not a flashier HIMSS booth or insultingly boilerplated emails.

HIStalk Announcements and Requests

Welcome new HIStalk Platinum Sponsor VitalHealth Software. The company, co-founded by Mayo Clinic and Noaber Foundation in 2006, offers cloud-based solutions that include chronic disease care management, patient questionnaires, an integrated digital interventions portal, a next-generation heath IT application development environment for deploying cloud-based EHR solutions, and a Mayo-designed EHR for specialty practices. The company is a certified supplier of ICHOM, which defines global outcomes standards for issues that matter most to patients. The company’s global eHealth solutions are used by 100 healthcare networks in the US, Argentina, China, Spain, and several other countries, with a project in China, for example, providing cost-effective telemedicine services with shared medical records, risk profiles, and patient access to their medical records by smartphone. Thanks to VitalHealth Software for supporting HIStalk.

I found this YouTube video describing the use of VitalHealth Software’s QuestLink questionnaire platform for patient-reported outcomes.

I was about to eat an apple this morning and polished it on my shirt, leading me to ponder, why do I do that? The apple has passed through a lot of unwashed hands on its way from orchard to me, so anything short of washing it or peeling it isn’t going to accomplish much (not to mention that polishing it will deposit cloth particles and whatever’s on my shirt on the peel I’m about to eat). It’s almost as mystifying as why many men (not me) pointlessly spit in a public restroom urinal before using it.

Listening: Vaults, a London-based synth pop trio that nobody seems to know anything about — their website says nothing about them and they aren’t even on Wikipedia or Amazon. Their melodic, slow, bass-heavy music is fronted by a siren-like singer. Trying to find them turned up “In Vaults,” a new album of Chicago-based, female-led prog rock from District 97. The band played an amazing live version of “Starless” that features King Crimson’s vocalist/bass player John Wetton, who sang the original version of that King Crimson musical epitaph to itself on the group’s 1974 final album “Red” and who delivered an engaged performance here, unlike most of his 1970s-era music peers who just prop themselves up on stage like sagging, lip-syncing Disney audio-animatrons.

I’m happy to report that most of the HIStalapalooza sponsorship spots have been claimed, meaning the odds have improved that I won’t go broke in throwing the industry a free party next February. Still available are the all-access CEO Rock Star package and one I’m calling HIStalkacabana, although we’ll still consider the needs of smaller companies who want to be involved (we’ve customized some packages already). Contact Lorre. Thanks for the companies that have stepped up – it’s going to be a great evening as always.

Webinars

None scheduled in the next two weeks. Previous webinars are on the YouTube channel. Contact Lorre for webinar services including discounts for signing up by Labor Day.

Acquisitions, Funding, Business, and Stock

Activist investor Starboard Value, which holds an 8.7 percent stake in MedAssets, calls for the company to replace some of its board members, questioning its acquisition track record and undervalued share price. MedAssets also files SEC disclosure that Tenet will not renew its group purchasing contract with the company, costing MedAssets $44 million in annual revenue or about six percent of its total, but Tenet will continue using its revenue cycle technology products under a separate agreement. MedAssets reiterated that it is continuing to pursue a “value creation plan” and the loss of the Tenet contract may cause “expense reductions, restructuring charges, and/or investments in products or services to help drive long-term growth.” Above is the one-year share price chart of MDAS (blue, up 1 percent) vs. the Nasdaq (red, up 17.3 percent). The company’s market cap is $1.3 billion, helped along by the prospect of Starboard Value taking control from present management.

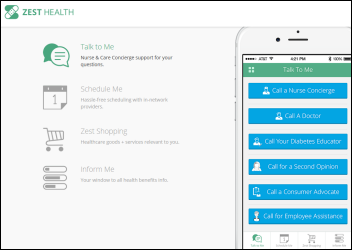

Preventative care and disease management platform startup Zest Health, co-founded by former Allscripts executives Glen Tullman and Lee Shapiro, raises $6 million in Series A funding, with an unstated amount of the money coming from the Tullman-Shapiro-led 7wireVentures.

Aetna announces Q2 results: revenue up 4 percent, EPS $2.05 vs. $1.69, falling short of revenue expectations but beating on earnings. AET shares rose 46 percent in the past year, with CEO Mark Bertolini holding $83 million worth.

CVS Health announces Q2 results: revenue up 7.4 percent, EPS $1.12 vs. $1.06, beating earnings expectations but reporting a front-of-store sales drop of 7.8 percent following the company’s decision to stop selling tobacco products last fall.

The Advisory Board Company reports Q2 results: revenue up 30 percent, adjusted EPS $0.40 vs. $0.30. The company also announces a new healthcare marketing product, Audience RX.

Allscripts reports Q2 results: revenue flat, adjusted EPS $0.12 vs. $0.09. GAAP numbers showed the company losing $3.2 million in the quarter. From the Allscripts earnings call:

- CEO Paul Black is happy with the company’s sales, revenue, profitability, gross margin, and recurring revenue.

- The company added 180 new customers in the quarter.

- The company signed one net-new Sunrise client, a 50-bed hospital.

- Allscripts will work with NantHealth on API integration between their respective systems and in integrating genomic data.

I reported a reader’s rumor on July 29 that said a company (whose name I omitted) would divest several hospitals and its consulting company. I omitted some of the details since they involved the publicly traded Community Health Systems, which announces exactly what the reader reported – it will spin off 38 of its rural hospitals and Quorum Health Resources. CYH share price has risen 60 percent in the past year, valuing the company at $7 billion and the holdings of CEO Wayne Smith at $61 million.

Premier acquires supply chain and performance services vendor CeCity for $400 million. The company offers PQRS reporting, an educational platform, clinical data registries, and a performance and population health management system. CEO Lloyd Myers, a pharmacist, founded the Pittsburgh-based company in 1996.

Meditech’s Q2 report shows total revenue down 16 percent and product revenue down a startling 42 percent as the company moves from $23.4 million net income to just over $17 million quarter over quarter, reporting EPS of $0.46 vs. $0.63. Six-month net income dropped from $85.4 million to $37 million. Sales dropped nearly $26 million as maintenance fees made up more of the company’s total revenue, with that big sales drop seeming to prove the market perception that Meditech is no longer a significant challenger as Cerner and Epic make it a two-horse health system EHR race as they move down the food chain into smaller and acquired hospitals.

Sales

Delaware Valley ACO chooses Wellcentive’s value-based care solution.

Presbyterian Healthcare Services (NM) will deploy Zynx Health’s Knowledge Analyzer to standardize its clinical decision support using evidence-based intelligence.

University Health System (TX) chooses Spok for enterprise clinical communications.

Baptist Health South Florida chooses Cerner Millennium and HealtheIntent for all of its locations, apparently replacing Soarian clinicals but keeping Soarian financials in favor of Cerner’s own offering.

Spartanburg Regional Healthcare System chooses HCTec Partners for Epic 2015 implementation consulting.

People

Hebrew SeniorLife (MA) names Peter Ingram (MetroChicago HIE) as CIO.

Diana Nole (Carestream Health) will join Wolters Kluwer Health as CEO.

Ingenious Med names Todd Charest (Cogent Healthcare) as chief innovation and product officer.

SRG Technology, which offers population health management technology it developed with Massachusetts General Hospital, hires Adrian Zai, MD, PhD, MPH (MGH) as CMIO.

Greenway Health names David Wirta (Vista Consulting Group) to the newly created position of chief revenue officer.

Announcements and Implementations

NTT Data acquires global exclusive rights to products from it business partner InteHealth, which include a cloud-based HIE and portals for patients and physicians. The LinkedIn profile of former InteHealth VP Frank Nash (now senior director at NTT Data) says NTT Data acquired the assets of InteHealth on June 1, 2015 and the company is now part of NTT’s Healthcare Convergence Group.

London-based EY (the former Ernst & Young) consolidates its health consulting offerings in a barrage of obfuscatory buzzwords, promising to “collaborate with clients on improving efficiencies, catalyzing new digital health technologies, and helping to ensure wellness and prevention.” The company promotes Jacques Mulder to Global Health Sector Leader, a title that begs to be uttered in a Darth Vader voice.

Government and Politics

The Senate’s HELP committee is scheduled to discuss Karen DeSalvo’s nomination for HHS assistant secretary of health on Thursday, August 6. This is probably the Senate’s first step in confirming President Obama’s May 2015 nomination of DeSalvo for the HHS promotion, which would leave ONC searching for its next National Coordinator. She won’t get much if any opposition.

Privacy and Security

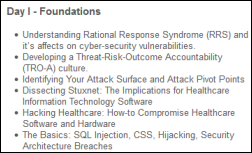

Sensato and Divurgent will offer a three-day workshop titled “Designing Secure Healthcare Systems” October 27-29, 2015 in Long Branch, NJ. It would be fun to attend a hacker’s conference – I bet they are constantly trying to pry into each other’s Wi-Fi connections to earn happy hour bragging rights before the World of Warcraft all-nighter.

Indiana-based NoMoreClipboard vendor Medical Informatics Engineering says the medical information of 3.9 million people was exposed its May 2015 breach by unknown hackers. The long list of affected health organizations include Concentra, Franciscan St. Francis Health Indianapolis, and Rochester Medical Group. The company’s former president says it took in $18 million in 2014 revenue from 2,500 commercial clients, all of which could go right down the tubes after this massive breach. MIE’s other claim to fame is that it invented the phony Extormity and SEEDIE sites that made fun of EHRs a few years back, an attempt to gain the company publicity that unfortunately fell far short of the exposure it’s getting from spilling the data of millions of people into the hackersphere.

Innovation and Research

The FDA approves Spritam, the first drug to be manufactured by 3D printing. Manufacturer Aprecia holds an exclusive worldwide license for MIT-developed 3DP (powder-liquid three- dimensional printing) technology, which can deliver a high-dose drug in a quickly dissolved tablet. Spritam is a new formulation of the existing epilepsy drug levetiracetam (Keppra).

Other

In England, Papworth Hospital NHS Foundation Trust backs out of its commitment to implement Epic following an investigation into the Epic implementation of Cambridge University Hospitals NHS Foundation Trust, with which Papworth jointly chose Epic in the spring of 2013. Papworth’s board concluded last week that Epic won’t deliver optimal value and says it will consider other vendors to provide “a cost-effective ICT system which meets our patients’ needs.” I like that they’re thinking value, as they obviously do in working from building that looks like a slightly decrepit hotel rather than the obscenely glitzy edifice complex palaces commonly found in even financially teetering US hospitals.

Athenahealth posts a video of CEO Jonathan Bush interviewing oncologist, author, and Affordable Care Act contributor Ezekiel Emanuel, MD, PhD. Emanuel says excess hospital bed capacity, low margins, and the fact that nobody really wants to be hospitalized will cause 1,000 hospitals to close as their bond market drives up, while the survivors will shift into other care venues. He’s against health system consolidation, which focuses on controlling the market, vs. more care-focused integration. He says most hospital executives have no idea what it costs to perform a given procedure or service, so any claims that they lose money on Medicare or Medicaid patients aren’t fact-based. Emanuel says EHR information can drive quality and price transparency. He thinks video visits are the wave of the future.

Researchers find that hospitals that score well on clinical quality metrics often have quality-focused boards of directors.

Computer systems at the fantastically named Credit Valley Hospital in Ontario, Canada go down for a day and a half following flooding that took out its telecommunications systems. As is always the case, the hospital claims patient care was not impacted in moving back to paper, which if you take at face value raises the question of why they bothered installing those systems in the first place.

Sponsor Updates

- Peer60 names Nuance as the leading provider of medical image-sharing offerings with its PowerShare Network.

- ADP AdvancedMD offers “5 ways to enhance your current ICD-10 transition plan.”

- Aprima will hold its user conference August 7-9 in Dallas.

- Aventura, Capsule Tech, CareSync, and Culbert Healthcare Solutions will exhibit at the Allscripts Client Experience August 5-7 in Boston.

- Billian’s HealthData offers “Traversing the Path to Patient Data Access.”

- Caradigm posts “Moving Healthcare Analytics from Measurement into Management.”

- Jaffer Traish, director of Epic consulting with Culbert Healthcare Solutions, publishes a letter to the editor of the Boston Globe titled “Celebrating strides being made in electronic health records.”

- CitiusTech wins the “2015 Best Companies to Work For” award from the Great Place to Work Institute for the fourth consecutive year.

- ClinicalArchitecture offers “Semantically Enabled Medication Reconciliation.”

- The Detroit News features Clockwise.md in a profile of the Henry Ford QuickCare Clinic.

- CoverMyMeds offers “Prior Authorization, Step Therapy and Quantity Limit … What’s the Difference?”

- Cumberland Consulting Group is named by the Nashville Business Journal as one of the 25 fastest growing private companies for 2015.

- Innovista Health CIO David McCormick explains how the organization’s partnership with Medecision helped move the network towards value-based care.

- Burwood Group is named one of Chicago’s “101 Best & Brightest Companies to Work For in 2015.”

- Recondo Technology will exhibit at the HFMA Region 10 Conference August 10 in Colorado Springs, CO.

- Practice Unite offers “6 Ways Secure Texting & Mobile Patient Engagement Apps Improve Patient Experience.”

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us or send news tips online.

Interesting calculation to determine how much Epic Kool-Aid is downed before a sizeable percentage of folks, at any given site, begin to question the value, notably as compared to Cerner, Meditech, Allscripts. #Epicblacklash

What did Neil Patterson have to do that was more important the shareholder call? Really?

First, Zane Burke’s comments on Cerner’s earnings call, “Cerner differentiates itself (presumably from Epic) on predictable costs of ownership, fixed-fee implementations, and partial or full IT department outsourcing.” Strangely, he seems to miss pointing out the key competitive advantage which won Cerner the DOD deal: INTEROPERABILITY. Second, I find it odd that Burke says “Cerner is happy to have been chosen by the DoD as part of the Leidos bid, but doesn’t expect a material impact on sales, revenue, or profits in the near term”. It would seem that in the face of Cerner’s numerous competitive losses to Epic they might be, in fact, thrilled to have been chosen by the DOD and would at the same time reference exactly what moved them to the first place position. In terms of revenue, something south of $9B over 18 years (what, perhaps half a billion dollars a year?) might have some material imact on Cerner’s revenue. When I read this release I am sure that Cerner has some clear advantages over Epic and equally sure that they are not clear at all about how to communicate these advantages. Epic, while posing as an organization *not* focused on sales, is outselling Cerner – winning all the (or now most) of the major deals out there. In my opinion, Cerner should be kissing the ground right now that they won the DOD deal and they should be able to clearly communicate to their clients, prospective clients, and their investors exactly what their key advantages are that won them the deal.

“I don’t see much value in having writers with zero healthcare or IT experience rewording public information to seem like fresh news, hoping to attract reader eyeballs and advertiser support with stories that provide those readers with little value, but that’s just me.”

FYI – and I can speak for (mostly) all industry road warriors, stakeholders, and providers here: It’s NOT just you, Mr H.

In fact, it is precisely why your site has any real value to us at all. Maybe that sentence is your de facto mission statement, maybe not. Either way, keep it up.

Re: Epic and NHS pull back…

Here we go again, it seems EVERY vendor that has taken on the Brits health system gets burned at least once and probably more.

Can anyone name a US firm that has done a complete NHS facility install and survived. From my personal experience (in the last century of course) the NHS contracts are suicide missions and any vendor that signs one is headed for big, big trouble.

@Seriously, do you seriously think that Cerner takes 100% of that contract out of the 30+ vendors involved in the winning bid?

Re: FrankP – I spent a good bit of time in the UK, engaged on the Southern Cluster EMR roll out which was Cerner. Many of the Go-Live’s went pretty well to be honest. However, I think one of the biggest issues is that both Cerner and Epic are used to the US way of healthcare, especially in the Reg/Sch space, whereas in the UK, the waitlist process really throws a kink into how Cerner and Epic both work. Another thing to consider is that with how the UK EMR deals are structured, Cerner and Epic are playing second fiddle to companies like BT and Fujitsu. Fujitsu was a NIGHTMARE to work with. Not a single change to the system could have been made, even in a critical situation, without going through miles of red-tape. I think if the Trusts were allowed to work directly with the vendors and eliminate the mandated middle men, the implementations would have gone better. Not saying Cerner or Epic is perfect, but a lot of the issues are not their fault with the UK

Re: Seriously – The reason Cerner says the DoD won’t impact revenue is because it actually won’t. Cerner is only getting a rumored 10% give or take a few points. So in the long run, thats about $400M over 10 years, not exactly earth shattering when you break it down to yearly revenue (about $40M per year). As for Epic outselling Cerner, that is just not true. Cerner has actually taken to more of an Epic approach lately, where their deals have been kept more quite while Epic has had to shout at the roof tops their new deals. Lets see, Cerner deals in the last few months that should be public knowledge: University of South Alabama, CAMC in West Virginia, Baptist South Florida, IASIS in TN, ITWorks with CHI in Denver, a new system in Austria (Global Client) and several others I could name. Cerner isn’t producing record bookings and revenue year after year if they are getting beat by Epic as bad as people think. You know, for a company that says it has no Marketing Organization, Epic seems to do a very good job of Marketing lately….

Re. FrankP. Actually, if you look at what Allscripts are doing in the UK, it’s been quite successful. Take a British guy who knows the NHS, knows the government, knows the culture, but who has also spent over a decade in the states selling; put him in place as Managing Director of UK, and ta-da(!) you have steady growth and happy customers. Allscripts has now got a number of successful sites over there and a strong team, and although they aren’t yelling from the rafters about it, they’re just getting down to business and selling to what the market needs/wants.

the nuances I caught from the Cerner earnings call re: DOD was that the first years will be dedicated to the pilot in the PNW, and that payment terms would be sized to that specific rollout. obviously if that’s successful we could see the deal become material.

Lose DOD, NHS putting the brakes, name in the mud bc they won’t integrate with anyone. I think it’s safe to say Epic is on its downward trajectory. Did they seriously think they can be the next big thing with 50 yr old MUMPS database hahah.

If I hospitals bond rating gets lowered, I say the CFO gets fired. No better indicator that the CFO is not performing.

This is just other vendor spreading Fear, Uncertainty, and Doubt (FUD). I’d advise other vendors to deliver value to their clients like Epic and compete on delivery versus trying to spread rumors and lies. Other vendors have issues like disappearing blood orders, mismatched orders, or disappearing orders. Epic’s ultra reliable MUMPS db delivers. I’d advise other vendors to do the same.

@Epic-tipping, if you want to argue that a SQL-based platform is better than a non-SQL-based platform like Caché, then ok. But calling Epic out on the age if their platform seems kind of B.S. given that Oracle was created at about the same time in the mid-late 70s. See their own timeline as a reference: http://oracle.com.edgesuite.net/timeline/oracle/. SQL Server has a similar genealogy, as I recall.

Of course the Oracle of today has advanced well beyond that original system, but so has Caché. Both Epic and Cerner are doing fine running on platforms that were born in the early days of database technology.