Move your quotes to where they should be and it's no longer politics-in-the-blog, but instead a fact that's true at…

Monday Morning Update 7/21/14

Top News

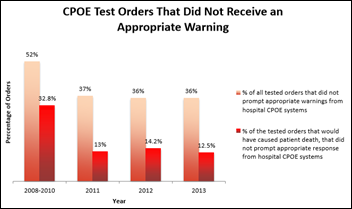

The Leapfrog Group’s just-released 2013 survey finds that 43 percent of the 1,400 responding hospitals entered at least 75 percent of medication orders in a CPOE system with clinical decision support. However, a third of the CPOE systems tested by 931 hospitals failed to failed to warn physicians of serious ordering problems.

Reader Comments

From Veteran SQ Vendor: “Re: Sunquest. I just returned from SUG and Matt Hawkins was a brilliant choice by Roper. The culture change is discernible and Hawkins is approachable, involved, listening, and leading – which have been missing for a long time. I hope it’s not too late.” Sunquest previously violated one of my key predictors of success – its top executive refused to move to its headquarters city (Tucson). The company also had some defective Misys DNA in its gene pool, put quite a few inexperienced aptitude hires in jobs they’ve failed at, runs a questionably integrated office in India (was that redundant?), and in typical lab analytical fashion thinks everything important can be measured and managed from a spreadsheet. Sunquest’s overall problem is that it’s a market leader in a saturated niche in which Epic and other vendors are nibbling away at some of the decreasingly sexy core LIS business and its lab customer has to take one for the (integrated) team, which makes it an expiration-dated cash cow unless it can figure out how to innovate again. Also, hungrier companies are going after the genomics and personalized medicine business where the company should be strong. All of that is fine as long as Roper doesn’t expect a lot of future growth for its $1.4 billion investment — you can only squeeze the existing base of cash-strapped customers so much. Matt needs to take a firm hand in re-establishing the connection between his office and the troops, try to compensate for all the private equity BS the remaining employees have had to deal with, clear out the management deadwood, articulate a position of where the company is going beyond the comfortable box in which it works, and put together a team that can handle an acquisition or two in the not-too-distant future. That’s the unsolicited advice I would give most new CEOs, and at least Sunquest doesn’t need to make reactive changes quickly since Roper seems patient.

From NP: “Re: NantHealth. SVP and former iSirona CEO Dave Dyell is the latest in the ranks of departing execs. He was working to integrate Patrick Soon-Shiong’s myriad acquisitions and deliver on the good doctor’s immense (but confused) vision for healthcare, but fell victim to Nant’s micromanagement and acquisition indigestion.” Dave verifies that he has left NantHealth, which will probably be concerning to iSirona users who don’t care about PSS’s grand plans as long as their medical device connectivity keeps working.

From Sugar Sister: “Re: vendor demos. I viewed several lately. Epic may not have a marketing department, but they must have a showmanship department given their slick show with Wisconsin jokes. Their software is also slick – it reminds me of Apple in its attention to detail. You only get a product to that level if someone in authority demands it. Athenahealth is not a cloud-based solution. ‘Cloud’ means your data can be stored anywhere and your instance could be running anywhere. Athena knows exactly which specific database server has a particular customer’s data and which server it will fail over to. That works, but investors are right to question the cloud marketing spin. Athena has so many customers that have attested to MU2 compared to other vendors because those other users haven’t upgraded their systems yet. Epic has way below 50 percent of customers running the latest production version. Athenahealth is like a Greyhound bus – if you don’t want to worry about anything but seeing patients, leave the driving to them. Epic is a Cadillac limo – a beautiful ride if you hire a driver who knows the roads.”

HIStalk Announcements and Requests

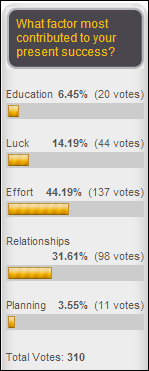

Poll respondents said their success comes from hard work and building relationships rather than education, luck, and planning. New poll to your right: do you own stock or other equity in a healthcare IT-related company?

I hit an internal buzzword-and-hype limit the other day after reading too many overwrought press releases. I was thinking that if a hospital report writer wrote a cool list of diabetic patients who hadn’t been seen in six months, a vendor’s marketing team would be announce it as, “Cloud-based business intelligence and population health management analytics, powered by a comprehensive, scalable patient engagement and clinician workflow platform whose real-time alerts and actionable insights support the Triple Aim of improving patient experience, advancing health, and reducing costs.”

Listening: new Finnish operatic metal from Amberian Dawn, with new singer Capri and without (thankfully) the background grunting often found in so-called “Beauty and the Beast” female-led Northern European metal. I explain the genre thusly: ABBA backed by Black Sabbath.

BOSS Award Winner – Amy Thomas

Our first Beacon of Selfless Service award winner is Amy Thomas, interface architect at Edward Elmhurst Healthcare, Naperville, IL. VP/CIO Bobbie Byrne commends Amy for leading a conversion of 120 physicians from NextGen to Epic, using NextGen CCDs from three separate database instances as summary documents and writing extracts to copy patient demographics, future appointments (which Bobbie says “sounds easy but is really hard”), lab and rad results, progress notes, immunization histories, and vital signs. Amy did this while supporting live hospital interfaces and working on ICD-10 and population health management projects. Congratulations to Amy.

You are welcome to nominate a non-management individual for BOSS Award recognition.

Acquisitions, Funding, Business, and Stock

From the athenahealth earnings call:

- Athenanet added 2,500 providers in the quarter, raising the total to 55,000.

- Half of the company’s transaction volume is still paper-based.

- The Epocrates acquisition has created new leads, but its revenue is dropping and the premium version is struggling because it’s too hard for subscribers to renew online. According to Jonathan Bush, “We’re hammered pretty hard by Epocrates which had a very big miss … Epocrates is about half what we thought we would get by now.”

- The company has high hopes for the upcoming Epocrates secure messaging functionality

- Bush says that hospitals have 40 percent unused capacity that could be used to offset their cost of fixed assets. The company has partnered with Accenture to help hospitals open up that capacity with the goal of selling athenaCoordinator Enterprise, which now has three customers.

- Bush says it failed last year in its goal of having its account managers bring in 1,000 new leads, saying, “We knocked out a good, solid 78 leads during 2013, so we had to retrain and reorient our account management teams.”

- Asked about promises to inpatient prospects about athenaCoordinator, Bush said, “Nobody wants to be the first guy on athena’s inpatient thing and nobody wants to be the last guy to drop a quarter billion dollars on Epic, so they’re sitting and trying to figure out which wolf to feed when they come out of their tepee. I pity them. It’s a hard decision.”

- Asked about the company’s More Disruption Please program, Bush described it as, “The leading edge, the exciting new bubbling up from the primordial venture capital ooze is of generation of companies that are performing on the cloud across many clients in a single instance, activities that used to sit in a hospital information system. So suddenly entrepreneurs are saying, ‘These giant enterprise software companies, these single-instance software companies, actually won’t make it and they are old and there’s going to be an opportunity to sell into the nurses and the pharmacists and the inventory management people at the hospital.’ So you’re seeing a collection of cloud-based athena architecture, but more like a Salesforce business model, a monthly user rent type business model community of apps that represent in total kind of 80 percent of the surface area of a complete hospital information system in API connected independent little cool apps.’”

- On fitness tracking and related personal health apps, Bush said that 91 percent of people aren’t patients until some event happens, calling it “100 million conscientious objectors” who care about their weight, body, love life, and people they’re are caring for. He adds that athena looks forward to connecting to Apple’s Health “despite Apple’s decline” and “the quickly rising Samsung stuff.”

- Bush says that people are recognizing that Obamacare is “a huge rise in deductibles” and the company will focus on helping its users get the “love and money in equal measure” from their customers.

Above is the one-year performance of athenahealth (blue) vs. the Nasdaq (red), which it trails after a nearly 50 percent ATHN haircut in a two-month period starting in March 2014.

Your money would also have been better off invested in an Nasdaq index fund (red) a year ago than in Allscripts (blue), but at least MDRX shares are moving back up over the past month.

GE Healthcare’s Q2 results: revenue down 0.7 percent, net profit $730 million vs. $726 million.

Sales

New York City Health & Hospitals Corporation chooses Constellation Software’s QuadraMed Affinity QCPR. I assume this is just a renewal since they’ve been running Affinity and then QCPR since the early 1990s. Toronto-based Constellation Software, which sells all kinds of unusual vertical market software, acquired QuadraMed from Francisco Partners in June 2013. It put QuadraMed under its Harris Operating Group, which sells public utility and public safety software. Its other healthcare IT company is ERP software vendor MediSolution.

Other

I missed this from a couple of weeks ago: the private equity fund of former National Coordinator David Brailer, MD, PhD has flopped and its biggest investor, California Public Employees’ Retirement System, reportedly wants to cash out its investment. CalPERS pledged to invest $700 million in Brailer’s Health Evolution Partners seven years ago after he promised returns of 20-30 percent despite his zero experience in private equity and the marginal success of the one company he formed and sold, CareScience. Instead, their money is dead with a 2.6 percent annual return and the only company HEP has sold was for a loss. CalPERS also put $200 million in a money-losing HEP “fund of funds” focused on healthcare. Some of CalPERS’ board members questioned in 2012 the decision to put hundreds of millions of dollars into no-experience company that didn’t actually invest their money until 18 months later. CalPERS also paid $5 million for a 15 percent equity interest in HEP and paid it $52 million in fees in its first five years. Despite Brailer’s stated investment focus in healthcare IT, HEP shows no active investments in healthcare IT companies among its seven portfolio positions. Calpers was initially HEP’s only investor and the company has declined to say if it has obtained others.

A Stanford biophysicist develops an easily shipped microscope made of folding paper that’s as powerful as a desktop instrument yet can be produced for $1. The Gates Foundation-supported FoldScope project hopes to get the devices to third-world countries for faster diagnosis of infectious disease. It’s one of few TED talks in which the audience breaks out into applause at several points and gives a standing ovation at the end.

Weird News Andy notes that 20-bed Three Rivers Hospital, a Critical Access Hospital in Brewster, WA, has been evacuated due to the 169,000-acre Carlton Complex wildfire that has destroyed 100 homes and shut down power to most of the Methow Valley.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

Re Sugar Sister:I don’t think you actually understand what cloud computing even means. Basic Wikipedia definition:Cloud computing is the delivery of computing as a service rather than a product, whereby shared resources, software, and information are provided to computers and other devices as a utility (like the electricity grid) over a network (typically the Internet).

where data is stored is a small component of that equation. By your definition none of the generally accepted “cloud” companies are cloud based since they store and backup data as you describe. Furthermore, Athena is accessible from anywhere and on multiple platforms. Your computing device doesn’t have to do anything other than access the web using IE, Chrome, or Safari.

oh, and epic is much more like an exotic Italian car where basic service requires removal of the engine at a cost equivalent to buying a cheaper, more practical and efficient car.

Kudos to Leapfrog for unmasking a truth that endangers patients.

One of the critical deficiencies of the CPOE and CDS devices is their failure to detect absurdity. Another is the monotonous repetition of reminders that are not clinically relevant, popping up on every order. For instance, there are reminders for dvt prophylaxis in patients in shock from GI bleeding.

There was discussion at the FDASIA work shop on the failure of these devices to detect absurdity. The panelists and FDASIA representatives seemed shocked.

I am shocked to find that there is gambling going in there!

Hey What’s up??

On 10-3-12 Mr. H reports that Epic wins the NYHHC contract:

http://histalk2.com/2012/10/02/news-10312/

Now you report that Constellation (QuadraMed-CPR) gets the contract???

Did Epic lose a big one and Mr. H miss the boat??

HIS Junkie: i love how you took the time to look up the old news but failed to recognize that the contract is for QCPR Meaningful Use Eligible Professional software

RE: Marketing Jargon

Too funny. And accurate, sadly.

To clarify, NYC HHC is going with Epic. They still are running Quadramed in the interim, so Mr. H is correct- it’s just renewing the contract until the conversion is complete.

Wow…talk about misleading marketing baloney! You read the Constellation PR and it sounds like it’s a brand new NYHHC contract. Kinda tells you maybe that vendor is full of hot air and can’t be trusted!

Re: you don’t know cloud — Cloud can mean a lot of things but usually it’s just marketing hype. Usually, it just refers to remote hosting/ASP, which SMS/Siemens has been doing for decades (their data center in Malvern is pretty impressive…too bad they haven’t developed any worthwhile software since Siemens acquired them).

Regarding your comparison of Epic to an Italian car…You sound like a bitter competitor who’s never touched an Epic install. Epic’s functionality and quality never ceases to amaze me. With the amount of easy customization possible, you can be agile and not have to “take out the whole engine”.

The definition of cloud means nothing because we have watered it down so that everyone can say that they have one. I admittedly don’t know anything about athenahealth, but what are the actual savings by being in athena’s cloud? Is it actually more efficient or is it just allowing the health system to focus on its core competency and not manage its EHR infrastructure, which is probably not that helpful for large customers, but probably quite helpful for small ones.

@Anonymous Athena clients can benefit from pushing updates & enhancements to their software across their entire customer base in one fell swoop. Conversely, folks with Epic or Cerner, in a client-server model has to update customers one at a time, which isn’t as efficient.

Athena benefits from having a customer base that primarily doesn’t has the capacity to stand-up their own IT departments and therefore meets little resistance in this approach . I have a pretty good feeling that if they were to try and get into the large hospital market, which also requires an inpatient solution, they would get quite a bit of pushback from the established hospital IT departments.

“Re: Sunquest. I just returned from SUG and Matt Hawkins was a brilliant choice by Roper. The culture change is discernible and Hawkins is approachable, involved, listening, and leading – which have been missing for a long time. I hope it’s not too late.”

Previously, Sunquest products seemed secondary to larger corporate strategies, leaving the core products to linger while dabbling in new products with mixed success. Kind of like a colony and governor – no real vested interest in sustainable success.

Lately, leadership seems to have shifted for the better. More family, less colony. The new CEO Matt Hawkins is making a statement loudly and quickly: commitment. Moving his family to Tucson – smart move. Engaging users and staff – perfect.

Culture is the backbone of any business – Mr. Hawkins seems to get that. The summer meeting was energizing and engaging for staff and users alike. Interaction with all levels of the company and users of all kinds will only add more structure to that backbone. Questions: will there be action, and will it be swift enough?

Let’s hope Mr. Hawkins can keep the energy going, hire, listen to, and retain the right people, move product changes more quickly, and rebuild Sunquest to a point that there is no question: Sunquest is here stay.

“Culture is the backbone of any business – Mr. Hawkins seems to get that. ”

I think I just threw up in my mouth. MH did a really good job of fooling people in Tampa in thinking that initially, but less than a year later he was publicly criticizing employees on conference calls. Great corporate culture.

Sure there’s a chance MH has learned from his ways. But there’s also a reason so many people left that company in Tampa. Don’t be surprised if in six months he’s pointing the finger at everyone but himself.

Worst leadership skills of anyone in a high level position that I have ever worked for, and I’ve worked for some bad ones.

You can’t change the culture of Sunquest. The bottom line is #1, and #2 on the top two reasons for doing business. From nickel and diming customers to substantially increasing costs mid year to the outrageous 8% increase in maintenance if you don’t have a cap on it. Inept leadership driving away good talent, loss of market share and the lack of direction plague this company. Beaker may not be a great alternative, but I would rather go with a company I know is investing in the product than one that is just trying to hold on.