The New Yorker cartoon of Readers Write articles.

Monday Morning Update 10/1/12

From DanburyWhaler: “Re: Western Connecticut Health Network. The manager we thought was being groomed to take over as CIO is gone after three months. They are laying off people left and right. The major construction budget is way over.” The hospital recently laid off 28 employees, citing economic conditions, state taxes, and general healthcare trends. The $150 million expansion is pictured above.

From Boomer: “Re: Patrick Soon-Shiong. The billionaire’s healthcare coming out event is this Wednesday, when he will announce the results of an oncology-focused application of his supercomputer / high-speed fiber / middleware / mobile platform that he has been building for years. He claims that 8,000 oncologists using his decision support tools lowered the patients receiving the wrong treatment from 32% to 0%.” He’s presenting at the Bipartisan Policy Center’s October 3 conference in Washington DC, Accelerating Electronic Information Sharing to Improve Health Care.

From At Northwestern: “Re: Epic. No commitment from Northwestern Memorial Hospital to move to Epic.” Like the original rumor saying they were making that move, this one is unverified.

From Bean Multiplier: “Re: Allscripts. I hear from a good source that the company would be willing to take a private equity deal for $15 per share.” Unverified. Shares closed Friday at $12.42, up 14% on rumors that the company is exploring a possible sale to private equity. Shares were last above $15 on April 26, the day before the company fired Chairman Phil Pead, after which three of the company’s board members quit in protest. Even now the P/E ratio is at 40, about the same as Cerner’s. I assume the P/E ratio takes into account the $200 million of repurchased shares, which would have raised earnings per share by reducing the share count rather than reflecting increased profits. Bloomberg did not cite the source of the “possible sale” rumors, which could either be an informed, unbiased source or a pump-and-dumper trying to unload some shares on the market’s reaction to the non-news.

From The PACS Designer: “Re: RIS/PACS integration. There’s been some fresh looks at how a RIS fits into the flow of information between radiology presents, and the submission for and completion of a radiology study. Since most configurations between the RIS and PACS are customized at each institution, it leaves many opportunities for a future RIS/PACS upgrade to be a more robust information source. This upgrade should provide two-way information flow so everyone can plan their activities each day more efficiently. One way to achieve the better information flow goal is to insist that the new system of a combined RIS/PACS come from the same vendor.”

From Miraculous Miler: “Re: John Landis of Cerner. Rumor is that he’s gone.” Cerner’s media relations department confirms that John Landis, SVP of ClientWorks, has left the company.

From MumpsInToronto: “Re: University Health Network, Toronto. Going to RFP. They are running QuadraMed now, which is MUMPS based. From the volume of data that will need to be converted, you can bet they will be looking at Epic.” Unverified.

McKesson announced Better Health 2020 and an investment of $1 billion in R&D in last December. Three-quarters of poll respondents said the company’s healthcare IT position is worse now than then. New poll to your right: has the use of EHRs increased Medicare fraud?

Welcome to new HIStalk Gold Sponsor Agilum Healthcare Intelligence of Franklin, TN, which describes its offerings as “Business intelligence in a box.” Modules include Service Line Costing and Profitability (margins by service line and payer, case mix trends, length of stay and volume trends, DRG mix, margin by physician, etc.); Revenue Cycle Performance (dashboards, A/R performance indicators, ageing reports, net revenue modeling, and denials by reason); Operational Performance (executive view with KPI line item indicators, facilities operations and department dashboards, daily volume dashboards and forecast, and operating ratios); and Productivity Manager (departmental dashboard, pay period reports, daily reports, overtime ratio reports, and skill mix reports). One of the most technologically astute hospitals in the world, Bumrungrad International Hospital in Thailand, recently signed up for Agilum’s business intelligence solutions to improve its operational, managerial, and financial decision making. Thanks to Agilum Healthcare Intelligence for supporting HIStalk.

I headed over to YouTube to see what I could find on Agilum Healthcare Intelligence. Above is an overview.

I had heard reports that HCA signed a big contract with Epic to replace its Meditech system, but two HCA sources told me off the record that it’s still just one HCA site piloting Epic so far. HCA is still rolling out Meditech CPOE.

Epic consulting firm Nordic Consulting announces that it has raised growth capital from SV Life Sciences, Health Enterprise Partners, and HLM Venture Partners. All three backers focus on healthcare, with the one catching my eye being SV Life Science since Bruce Cerullo is a venture partner there in addition to being the CEO of Vitalize Consulting Solutions that was sold to SAIC a year ago.

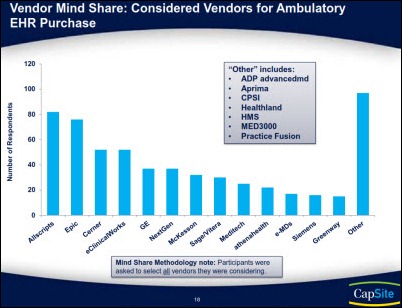

CapSite releases its 2012 Ambulatory EHR & PM Study. It finds that 40 percent of organizations are still in the market for an ambulatory EHR, with most of them planning to buy within the next two years. The practice management market offers less opportunity, with only 27 percent of responding organizations indicating their interest in buying or upgrading and just 21 percent saying they would replace their current practice management system to move to an integrated PM/EHR.

Pearson and Cerner announce RealEHRPrep, an EHR learning tool for nursing students.

The UK’s Department of Health admits that the failure of its NPfIT project means it no longer owns rights to the software developed for it by CSC using billions of dollars of public funds. The original contract called for software ownership as one of four terms that were to protect the government’s interests if the project failed, which it did, but either the contract was incorrectly drafted or the government negotiated the rights away in trying to avoid a CSC termination lawsuit. The Department of Health and vendors involved (CSC and BT) are ignoring information requests, according to the ComputerWeekly.com article.

Also in the UK, and external review finds that the rate of clinical errors increased after NHS turned over operation of its pathology laboratories to the multinational corporation Serco. The report by a non-profit watchdog also found that the money-losing JV required hospitals to chip in cash to keep it afloat, and even then the company will pull out of certain markets. Computer problems caused some of the patient-related problems: a patient received the wrong blood type after the software failed to issue a warning, an incorrect creatinine clearance calculation was highlighted as a near miss, and the company’s blood analyzers were shut down for four days after becoming infected with a computer virus.

And also in the UK, a report commissioned by Imperial College Healthcare Trust concludes that 3,000 of its cancer patients have not been seen promptly because the hospital uses 17 different computer systems, some of them requiring manual data entry. The trust says they’re looking for a single system, but the report warns them of the risks involved.

A Wall Street Journal article listing the top 50 startups says that healthcare has fallen out of VC favor based on its somewhat subjective criteria, with last year’s top-ranked Castlight Health dropping off the list entirely.

The VA was expected to award a contract for mobile device management software by Sunday, September 30, the end of its fiscal year.

Weird News Andy likes this story, in which police used fingerprints to locate the former owner of a human finger that was found inside a fish caught from an Idaho lake. When the sheriff called a wakeboarder who had lost four fingers in a towline accident in June, he immediately responded, “Let me guess – they found my fingers in a fish.” The sheriff offered to return the well-preserved digits, but the man declined, saying, “Uh, I’m good.”

Another WNA find: pathology researchers at Georgetown Lombardi Comprehensive Cancer Center (DC) develop a method of testing the susceptibility of a patient’s specific cancer cells to various chemotherapy drugs, much like the routine culture and sensitivity tests that help doctors choose an appropriate antibiotic for a given infection.

Here’s Vince’s HIS-tory on QuadraMed, Part 3, which purely coincidentally provides a history of the Quantim product line that the company just announced that it’s selling to Nuance.

- Vitera Healthcare’s VIBE user group meeting was held September 12-14 at Disney’s Grand Floridian Resort & Spa in Lake Buena Vista, FL.

- Optum announces an ICD-10 education program for hospitals.

must know more about Northwestern…

Data2breasts: RE: Patrick Soon-Shiong – That guy us amazing! He invests in the correct technology. I hope to goodness that my oncologist is one of the 8000 that was utilizing his “super computer”. I was diagnosed with Stage 1 breast cancer and even the surgeon was confident that the encapsulated tumor would keep me from having chemo. However, when they evaluated the DNA of the tumor, the results indicated that I fallen within the bell curve. Meaning of all the women my age (46) with the same or similar type of breast cancer; if nothing was done, no Tamoxifin, there was a 40% chance of recurrence. With Tamoxfin for 5 years, my chance of recurrence shrank to 20%. With Tamoxifin and chemotherapy my chance of recurrence shrank to 13%. These results were based on cancerous breast tissue. I was Stage 1. Without those results, I had a 40% chance of recurring breast cancer. My choice, double mastectomy, 4 rounds of chemo, 5 years of Tamoxfin and I placed 3rd in my age group in a triathlon 30 days after my last chemo treatment….bald!!! Data matters people!!

In response to:

From At Northwestern: “Re: Epic. No commitment from Northwestern Memorial Hospital to move to Epic.” Like the original rumor saying they were making that move, this one is unverified.

Epic is in the AEMR space at Northwestern and will be expanded. They currently have a mix of IDX and Epic, and are positioning this as an “IDX replacement” (the same way (kinda) that Cedars Sinai is positioning their AEMR (both Clinical and financial) as an “IDX replacement”). Both organizations are thought-leaders in their approaches, and both organizations are a bit hesitant to use standard starter sets and standard model workflows to accomplish their complex workflows in an orthaganol way. as an aside: Both organizations in this blurb are contemplating moving towards using Epics’ SBO process within the financial workflows, as both orgs have a high percentage of self-pay that they need to manage, and I believe would like to standardize some billing paper (statments and/or bills)

They continue to lose business and existing customers of substance.

Something else happened in NYC on this day for AllScripts – and it wasn’t good.

http://www.cherryontop.com/tag/new-york-city-health-and-hospitals-corporation/

Maybe it was this…

http://www.nyc.gov/html/hhc/downloads/pdf/board-packets/2012-09-board-of-directors.pdf

Regardng growth capital for Nordic. Seems that the play in the industry is to use so called growth capital to buy growth so that you can sell it to a larger firm , ie SAIC. So who is benefiting from the growth surely not the rank and file employees. Seems EPIC has created another market that uses pirates with gold to grab market share, hire under-qualified employees, then charge high rates. Then we sell the large company to for millions and walk away. I am tired of the revolving door of these consulting firms with so called growth capital.

THB is confusing Northwestern Memorial Hospital and Northwestern Medical Faculty Foundation which are affiliated but not related. NMFF is an Epic client while NMH is not.

Hi HIT: – I did separate it into AEMR (Ambulatory) and EMR. Their IP side is indeed Cerner and their Ambulatory side is IDX/Epic mix (there may be some IDX on the IP side, but I am unsure). Additionally when you mention affiliates, are you speaking in a governance-sense?, or in a non-PBB (Provider-Based Billing) sense? I agree that in general you are correct … maybe we are disconnected based on semantics? Anyway thank you for make the legal distinction, as we all seek Clarity (no not THAT Clarity)

You might want to check out facts before publishing information on this site. The first post about WCHN was completely inaccurate, and the one this morning is not much better.

^5 Breastcancer survivor!