“We build the board a house of glass and pray the question’s never asked.” Oof! I wouldn't want to be…

News 10/30/24

Top News

Oracle Health will release a voice-powered, AI-enabled EHR in 2025.

The new system will be developed from scratch rather than being built on Cerner Millennium architecture, which will then require existing customers to migrate to the new one.

The company says that it discovered that Millennium has a “crumbling infrastructure” that was not suitable for enhancement.

Reader Comments

From TooCuteByHalf: “Re: Oracle Health’s application to become a QHIN. This is great news for interoperability … eventually. The application process takes months at the earliest, and even at that, it won’t be till at least mid 2025 before the first Oracle Health hospital goes live. TEFCA is nearly a year old, with millions of documents being shared, and the founding QHIN’s have been in the game for literally years. What took Oracle so long, and why take a victory lap in a race you’re not winning?” I’m even more interested in how Oracle Health plans to release a from-scratch EHR in the next few months that does not use Millennium’s underpinnings. It seems challenging to develop, test, document, and install a brand new EHR that will require existing customers to migrate, which is probably why no company has succeeded in rolling out a competitive inpatient EHR in decades. It’s a high-wire act to put out a huge software platform that directly affects patient care, especially given significant loss of former Cerner subject matter experts, and it wouldn’t take many clinically unfortunate missteps to send Oracle Health’s remaining customers fleeing to Epic. Meanwhile, having thrown the only available product under the bus after what seems to have been poorly executed due diligence, Oracle won’t likely make many new sales until the replacement system goes GA, not that it is selling much anyway.

From Big Dog: “Re: Epic. Is the shared version (where multiple clients are on the same instance) of Epic a reduced functional version of Epic when it’s a standalone version? Was talking to a nurse at a local hospital the other day and they recently converted from Cerner Community Works and the nurse was stating they must have purchased the cheap version as it was no better than what they had been using.“

HIStalk Announcements and Requests

This week is a first, in that both Jenn and I are away on vacation at the same time. I’ll put in enough hours to not miss anything important, but will keep it simple otherwise.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

London-based events operator Hyve acquires HLTH, whose HLTH USA conference will become its largest event by revenue. Hyve will take over HLTH USA (Las Vegas), ViVE (Nashville), and HLTH Europe (Amsterdam). Hyve says it has targeted HLTH for years as the top conference in healthcare, noting a post-pandemic trend in which the largest conferences are growing at the expense of smaller ones. Hyve will bring over 80 HLTH employees and founder Jon Weiner. Hyve was taken private by two private equity firms in June 2023.

Alpha II, which acquired RCxRules in October 2023, changes its name to Aptarro.

A study by Peterson Health Technology Institute finds that digital hypertension management tools – which include blood pressure monitoring, medication management, and behavior change – don’t provide overall health spending value even though they can be effective. It concludes that solutions that send data to care teams for medication management are most effective, while those that focus on patient behavior change deliver substandard results compared to traditional care.

Sales

- Northeast Georgia Health System chooses Optimum Healthcare IT to support execution of its cloud strategy with Amazon Web Services.

People

Lissy Hu, MD, MBA (WellSky) joins healthcare learning solutions vendor Ascend Learning as CEO.

Announcements and Implementations

Oracle Health will apply to become a Qualified Health Information Network. The company says that it will continue to support CommonWell Health Alliance as a founding member. Epic welcomed Oracle Health to TEFCA, noting that Epic already has 700 hospitals live on TEFCA as a founding member and adding, “Epic hopes that today’s Oracle Health announcement indicates that they are finally ready to take interoperability seriously—and to deliver the technology that patients and providers deserve instead of making distracting, untrue statements.”

Altera Digital Health announces GA of Paragon Denali, a cloud-native EHR that runs on Microsoft Azure and is targeted to rural, critical access, and community hospitals.

Medscape announces a free, AI-powered scribe solution that transcribes and summarizes encounters.

Emory University and Emory Healthcare will consolidate their IT operations into a single organization under Alistair Erskine, MD, MBA, who has been named to the newly created position of enterprise chief information and digital officer. He joined Emory Healthcare as chief information and digital officer in March 2023.

Inovalon announces new products for eligibility verification, network provider utilization, AI-powered record review, FHIR API connectivity for health plans, a research network, and expanded pharmacy functionality.

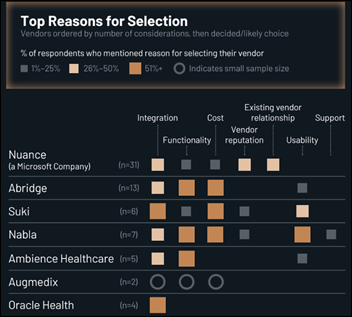

A new KLAS report on ambient speech solutions finds that Nuance is most often considered while Abridge is strong in affordability and physician acceptance,with both companies benefiting from their relationship and integration with Epic. Suki and Augmedix are often considered by Meditech users.

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

“There are no menus or drop-down screens, and doctors can pull up the information they need by asking questions with their voices”

I know I am neither a visionary nor a doctor, but personally – ew, as well as yikes. What could possibly go wrong?

So, will the DoD and VA be the guinea pigs for the new Virtual Resident EHR written by bots? Or do they get to build their future on the “crumbling infrastructure”?

When you say your current product is bad and the new product will fix it, your sales team has a problem. Clients don’t want to commit to the new product until it’s feature ready, but they don’t want to buy the “crumbling” old product either.

Current hospital systems won’t buy Cerner because of RevCycle concerns. Oracle isn’t investing in fixing that. They are investing in this ambulatory EHR. What’s the target market? It’s the same market targeted by athenahealth, ECW, and various specialty EHRs. Those vendors are already miles ahead of Cerner on this.

Has Oracle completely given up on new sales?

Yeah, this seems like a pipe dream. They’re going to have a 100% new EHR from the ground up, with “AI” and “Voice Enabled” and it’s going to be FDA approved in 2025? Remember, medical software is considered a medical device by the FDA. This doesn’t seem likely that Oracle already has FDA approval, unless they can somehow inherit it from their Cerner purchase, but that was for Millennium, not for this new fancy EHR.

All of that aside, let’s say Oracle has their legal ducks in a row. Who in their right mind is going to pioneer what is bound to be an expensive piece of software with tons of bugs? No one ever got fired for buying IBM and no one ever got fired for buying Epic.

Oracle has a lot to prove IMHO.

Oracle doesn’t need FDA approval. Most EHRs are excluded from the definition of a medical device by the 21st Century Cures Act. FDA purview typically only comes into play for radiation oncology EHRs since the FDA has oversight of all radiation-emitting devices and the systems that tie into radiation treatment.

Oracle will need to get ASTP certification for the new EHR to ensure the customers who adopt it don’t lose points under Promoting Interoperability and see their CMS payments decreased.

Oracle is flirting with the Osborne Effect!

https://en.wikipedia.org/wiki/Osborne_effect

I wouldn’t do that; seems like a bad idea.

Oracle hasn’t completed its move to Nashville yet, so they still have access to lots of cannabis, facilitating delusions that they can build a fully featured EHR in a year.

This is the beginning of the end of Cerner/Oracle in the EMR market. They will literally fall by the wayside faster than you can say Sunrise Clinical Manager. Physician adoption of AI will continue to wane as the challenges continue to pop up with patient safety issues, let alone moving to a full EMR completely dependent on AI.

Hah, I love SCM.

Category 5 software, (bespoken) that doesn’t have an ambulatory option. If you have seen an instance of Sunrise you have seen exactly one instance of Sunrise.

And that is where Epic beat them in the market: Epic only has two Epics — Duke and all the rest — and they learned their lesson about customizing with implementation of the Duke solution

It is instructive to see how Oracle moved Peoplesoft and JD Edwards users onto its e-business suite platform in the 2010s. There will be bold pronouncements, with tenuous relationship to reality in the early years. But what will emerge at the end (in ~5 years) will be a full-featured platform with a modern user experience and industry-standard backend.

I worry about the “Epic can do no wrong” mindset of the majority of users on this website. It is a terrible piece of software – awful user experience, a backend that no one understands (still on a technology called MUMPS), and its monopoly position either eliminating or heavily reducing innovation activity around EHR, information management and sharing.

The healthcare community, while being justifiably cautious of Oracle’s aggressive plans, should be cheering on the move to modern systems. Epic has missed two platform refresh cycles. When the community complains about the slow rate of change and innovation in healthcare, not enough attention is paid to how much that drag is due to Epic.

Epic left Mumps 2 or 3 decades ago, they are primarily on Intersystems Cache and SQL. Cache has proven to be a bullet proof data base, yet does have some shortcomings, hence the SQL component.

If there is anything I learned in 40 years in the HIS/EMR world is that hospitals may jump at new medical technologies but they are extremely cautious in installing new IT technologies.

Oracle has one overwhelming challenge in front of it and I am sure they are grossly under estimating the time and investment required The real question is do they have the patience and money that it will need. Not likely for a public company..

While I agree that simply saying Epic is based on MUMPS, is misleading, so is saying “It’s not MUMPS, it’s Cache/Iris.” It’s the same technology under the covers, but it has been updated and modernized to support multi-paradigms (Object Oriented, Functional, etc.) you can even run Cache/IRIS in a relational database model if you want to. All that being said, Epic’s middleware is all MUMPS/M code.

Are some parts of MUMPS/M archaic? For sure, but Epic has decades of experience with M Technology and they go out of their way to make Epic as configurable as possible without adding new M routines.

I completely agree that Oracle has a herculean task ahead of them and, like you, I doubt they have the desire to miss quarterly profit margins long enough to get traction in HealthCare, (that’s the reason every time Apple and MS dip their toes in, they decide it’s too much and cut the division). Microsoft finally got smart and Partnered with Epic.

I also foresee the arrogance of axing Millennium instead of addressing it’s short-comings (i.e. RevCycle) is going to cost them more than developing a new EHR from scratch.

I have been forced to use several Oracle products, (Finance, ERP, and HR), I have yet to find one that isn’t: buggy, unintuitive, supported, implemented or documented worth 2 cents.

On top of that, their purchase of Cerner was full of promises that have yet to be kept. In my mind it was a grab at a government cash cow and nothing more. On top of that, if they think that they can dump all their clinical people and somehow build a better EHR I think they are delusional. I would love to see something on the market that wasn’t Epic but it isn’t going to be Amazon or Oracle that does it.

So, let’s ask a basic question: They will stop supporting the Cerner solution, what happens to the DoD and VA implementations? We have enough trouble with the VA solution as it is — will they decide that they will sell Uncle Sam their “new Oracle Cloud based solution”?

Their strategy seems to be buy the competitor, destroy the competitor, insert inferior product as the replacement.

I appreciate your points about Epic and the downvotes are probably exactly who you are talking about. The experience of using Epic is terrible, development moves at a plodding pace, and the company is a monopoly. It behooves health IT professionals to recognize that and work against that. HIT won’t, because Epic butters their career bread. I cashed Epic’s checks for a few years myself, and it pays to be on the winning team. Now I compete against the company, and it’s tough, however necessary I think it is.

That all points to how hard Oracle is going to fail here. They don’t have a good understanding of the market, and the market is already extremely unfavorable. I want them to succeed, so that we have an Epic alternative. They won’t, and we should make plans accordingly, as HIT pros, patients, and citizens.

When Oracle purchased PeopleSoft, it was to get rid of a competitor in favor of promoting their own inferior HR system. They kept PeopleSoft around but cut investment and support.

I suspect the purchase of Cerner was not based on poor due diligence, and instead a repeat of this playbook. I believe the long term plan was to create a new EHR that they could sell to existing Cerner customers, with continuous SaaS updates. All while cutting investment in Millennium to a degree where customers have no choice but to transition. Where they miscalculated was the complexity of building a new EHR, including the regulatory and revenue cycle requirements. The mindset is that they have tackled the finance industry, so healthcare will be a piece of cake. I have low confidence they will succeed.

One of the most common thoughts you’ll see on HIT forums is the idea that all EHRs are outdated and things would be so much better if they were rebuilt from the ground up on “modern” tech stacks. From what I understand Epic spent the last decade updating huge portions of the codebase to transition it to a more modern Web framework and upgrade (almost?) all customers onto the new platform (Hyperdrive vs. Hyperspace). Meanwhile you have this Oracle strategy of declaring Millennium a crumbling house and pivoting to something completely new.

We’re basically seeing two extremely different strategies to deliver on that idea of ‘outdated’ tech and it will be interesting to compare their outcomes. So far, the sales energy seems to only be going one direction.

Go to your existing CAH customer base getting them to sign 7-10 year extensions and then ship all our support overseas within 6 months, say goodbye to all of your tenured staff, and then stand on the rooftops to say the platform these organizations just invested in is crumbling like a house and they’ll be forced to move systems? Well done.

In summer of 2022, didn’t Oracle say they were going to rewrite their pharmacy module in 6 to 9 months? Did this ever come to fruition?

And in September 2023, Ellison said they were “get(ting) the existing system hardened” and his company is “basically rewriting” its core software asset Millenium “a piece at a time.” Have any pieces been released?

And now, in October 2024, Oracle Health is promising a completely new EHR, delivering it to early adopters in 2025.

I cannot wait for their groundbreaking/disrupting announcements in 2025.

“If at first, you don’t succeed? Try, try again! Then give up. There’s no point in being a damn fool about it.”

– Attributed to Mel Brooks (maybe, honestly I don’t remember who said this)

Any EMR takes 10-15 years to mature into something commercially viable. Most never make it. Oracle certainly has the gravitas to pull this off, but it ain’t happening in 2025 and my money says it won’t be viable in 2035 either.