Merry Christmas and a Happy New Year to the HIStalk crowd. I wish you the joys of the season!

Monday Morning Update 9/30/24

Top News

Epic asks Carequality to publicly release its resolution regarding the dispute between Epic and Particle Health.

Epic filed a dispute with Carequality against Particle customers, which it says were downloading patient records for non-treatment purposes in violation of Epic’s policies. Epic blocked Particle’s access to its data, naming Particle customers such as Integritort, which it claims used EHR data to assist personal injury law firms in identifying potential class action lawsuits. Also named were Reveleer (risk adjustment) and Novellia (personal health records).

Epic asserts that Particle mischaracterized Carequality’s resolution and is urging Carequality to make those findings public. Particle says that Carequality had originally requested that the resolution remain confidential, but says it has no objection its release.

Particle filed an anti-trust lawsuit against Epic last week, accusing the company of leveraging its market dominance to block Particle’s entry into the payer platform market. Particle also lodged an information blocking complaint against Epic with HHS OIG.

HIStalk Announcements and Requests

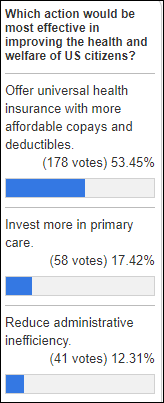

The US is the only wealthy, industrialized nation that does not provide universal health insurance / healthcare, and poll respondents say that implementing that would be the best way to improve our collective health. That wouldn’t fix our issues with industrial-manipulated food and our general appetite for unhealthy behaviors, but at least it would start with fixing the symptoms and then moving upstream to the problems. Which will never happen, of course, because someone’s pocketing profit with every one of these.

New poll to your right or here: Which party seems to have a stronger case in the Particle Health vs. Epic lawsuit? This is a first reaction kind of poll since we’ve only seen Particle’s complaint and Epic’s brief response.

Webinars

October 24 (Thursday) noon ET. “Preparing for HTI-2 Compliance: What EHR and Health IT Vendors Need to Know.” Sponsor: DrFirst. Presenters: Nick Barger, PharmD, VP of product, DrFirst; Tyler Higgins, senior director of product management, DrFirst. Failure to meet ASTP’s mandatory HTI-2 certification and compliance standards could impose financial consequences on clients. The presenters will discuss the content and timelines of this key policy update, which includes NCPDP Script upgrades, mandatory support for electronic prior authorization, and real-time prescription benefit. They will offer insight into the impact on “Base EHR” qualifications and provide practical advice on aligning development roadmaps with these changes.

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Digital musculoskeletal therapy provider Hinge Health hires investment bankers to take the company public next year. It was last valued at $6 billion in October 2021.

California-based telehealth startup Done Global, which prosecutors allege has operated as an Adderall pill mill, has reportedly moved its operations to China and shifted management to employees there to continue business as usual despite the arrest of its US executives. US-based clinicians are still issuing prescriptions, with some of them reporting minimal review of patient records. One nurse practitioner earned $43,000 in May 2024 alone by prescribing for 3,000 patients. Team members claim that the company instructed its Philippines-based customer care staff to sit in on patient appointments and shared patient information internally via WeChat, which raises concerns about potential US privacy violations. The company’s founders were arrested in June 2024 for illegal distribution of 40 million pills of Adderall, which earned them $100 million.

The investment firm owner of US-based, 12,000-employee health IT services firm AGS Health will seek a buyer for its five-year-old investment at a valuation of $780 million.

WW International (WeightWatchers) fires its CEO, who pivoted the company into digital health and GLP-1 prescribing with the $132 million acquisition of weight management telehealth provider Sequence in March 2023. Tech executive Sima Sistani took the CEO job in early 2022.

Steward Health Care CEO Ralph de la Torre, MD – who was held in contempt of Congress last week for refusing to comply with a Senate subpoena to answer questions about corporate greed and the financial struggle of Steward’s hospitals – will resign this week.

Sales

- Sectra will implement its Sectra One Cloud enterprise imaging solution in all of Quebec’s public hospitals.

Announcements and Implementations

ChristianaCare President and CEO Janice Nevin, MD, MPH confirms its Cerner-to-Epic switch via a video announcement. Go-live is planned for 2026.

Government and Politics

US Rep. Matt Rosendale (R-MT) tells the technology modernization committee of the House Committee on Veterans’ Affairs that the VA should not have shut down its $624 million, Epic-powered MASS appointment scheduling system project in 2019 (which it later downgraded to a pilot project) in a “disastrous” decision to move to Cerner. He also wants the VA to explain its decision to turn off the its $278 million WellHive external provider scheduling system due to budget problems.

The VA expands its tele-emergency care pilot nationwide after finding that it avoided an ED trip for 59% of callers.

Ireland’s competition regulator opens an investigation into 1,000-employee global healthcare software vendor Clanwilliam to review the company’s EHR, referral, and text messaging business. Clanwilliam launched as Medicom in 1996 and renamed itself in 2014 after making several acquisitions.

Privacy and Security

The Atlantic warns that 23andMe’s rapid company decline should concern “anyone who has spit into one of the company’s test tubes” since the only asset it has left to sell is the genetic information of 15 million customers. The company is not bound by HIPAA and its privacy policies state clearly that it can sell customer data if merged or acquired. 23andMe’s market cap, which was nearly $5 billion three years ago, is down to $150 million and its entire board quit last week, leaving CEO Anne Wojcicki as the only remaining member.

The New York Times reports that behavioral health patients are feeling “stunned, ambushed, and traumatized” after learning that their progress notes are available to other clinicians on the patient portals of hospitals that have adopted OpenNotes data sharing.

Other

A San Francisco software engineering manager is convicted of tax evasion for offsetting his three-year income of $1.2 million with a claimed $1.1 million in medical expenses for a 2010 appendectomy that actually cost him just a few hundred dollars. DOJ didn’t say where he works, but a LinkedIn search suggests Apple.

Sponsor Updates

- EClinicalWorks works with HealthEfficient to complete Hyndman Area Health Center’s (PA) UDS+ submissions to HRSA.

- Availity publishes a new whitepaper, “From Complexity to Connectivity: The Journey of Availity’s Payer-to-Payer Data Exchange Cohort.”

- Rhapsody announces that it has been recognized as Sample Vendor in Gartner’s Hype Cycle for Real-Time Health System Technologies report in the Next-Generation EMPI category.

- Redox publishes a new report, “DIY or Outsource: EHR Integration Costs for Providers.”

- Verato will present at the Reuters Total Health Conference October 8-9 in Chicago.

- Waystar will exhibit at ACEP24 September 29-October 2 in Las Vegas.

Blog Posts

- BCA Best Practices: Strategies for Success with MEDITECH Business and Clinical Analytics (Tegria)

- Embracing AI in Healthcare: Overcoming Reluctance and Unlocking Potential (Netsmart)

- Why Secure Medical Texting Works Better for Patients (PerfectServe)

- Key Areas Where Technology Should Support Optimized Workforce Scheduling (QGenda)

- Unlocking Healthcare Innovation through Digital Health Enablement (Rhapsody)

- Nurses Corner: 5 ways to improve education views (Sonifi Health)

- Smooth Sailing: A Case Study on Medication Adherence (Surescripts)

- How to Get the Most Insights From Your Data (TruBridge)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Lots of great stuff in today. But my preeminent thought is that the IRS did well to quickly suspect that an appendectomy didnt actually cost $1m! After all recently it took CMS 13 years to notice a doc ordering $35m unnecessary lab tests!

TBF in reading the case, it took the IRS a lot more than 3 years to notice, and he had been doing it for a long time. So maybe they’re not better than CMS!

To be fair, this story actually informed me that you CAN deduct unreimbursed medical expenses that exceed 7.5% of your AGI. I did not know this!

Epic to Particle: “Liar, liar, pants on fire”

Error: Unable to Process

Missing ICD-10 CM code.

“…which it says were downloading patient records for non-treatment purposes in violation of Epic’s policies.”

I believe this is actually a violation of Carequality policies, not Epic policies, regarding the Treatment purpose of use stemming from the HHS definition of Treatment: ““Treatment” generally means the provision, coordination, or management of health care and related services among health care providers or by a health care provider with a third party, consultation between health care providers regarding a patient, or the referral of a patient from one health care provider to another. ” (https://www.hhs.gov/hipaa/for-professionals/privacy/guidance/disclosures-treatment-payment-health-care-operations/index.html).

Healthcare organizations, and by proxy, their EHR vendors, are required to support the Treatment Purpose of Use to be a part of the Carequality network (and as a part of complying with the 21st Century Cures Act). There are other Purposes of Use, such as Payment, Operations, Research, etc, but these are only enabled at the discretion of a specific health care organization. If you query using one of those other Purposes of Use, you may or may not get a response (and most likely will not as the vast majority of participating Carequality locations only support the required Treatment Purpose of Use)

Ironically, Particle uses the same ONC definition of Treatment Purpose of Use in a whitepaper easily available via Google and the included examples for Treatment don’t align with the use cases that they’re now citing as appropriate use. From what I’ve read, the genesis for this argument aligns with the examples they have, in their own documentation, as a Payment or Operations Purpose of Use and NOT a Treatment Purpose of Use This white paper also talks about Individual Access, but that requires the patient to authorize access to their data (by logging into an app and providing consent), which is doesn’t sound like they were doing. (https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://go.particlehealth.com/hubfs/Files/Treatment_PoU_Overview.pdf&ved=2ahUKEwiDs-O8quuIAxWmjIkEHaVTH-YQFnoECBMQAQ&usg=AOvVaw25JZKgMTJ-VhvM9PHjbvjD)

My understanding of the issue is that Epic flagged the concern to Carequality that there was potentially a misuse of the Treatment Purpose of Use because the querying endpoints (like Integritort) weren’t similarly responding to queries of their systems. If a vendor is asking for data, but not providing it, it’s highly likely that vendor isn’t providing treatment services that would qualify them to leverage that Purpose of Use.

Would it be better for the world if Epic won or lost this case?

Yes. The sunshine on the processes and real-world details of how interoperability tech is being used will benefit the industry at large either way.

Re: US Rep. Matt Rosendale’s comments on MASS in the VA

Ummm. I have to express some difference with Rep. Rosendale here.

If you accept that VistA was an old system, badly in need of modernization? Rep. Rosendale’s comments amount to little more than, “don’t touch that, something is liable to break”.

With respect, if Rep. Rosendale wants to make a positive contribution? He could say (perhaps) that MASS could/should have acted as a pilot project (the VA made it such anyways), with the goal of using it as a success foundation for implementing more of Epic. The end goal being, a complete or near-complete replacement of VistA with Epic.

This analysis is not based upon Epic’s current market position. It is instead based upon the concept of starting small, gain some wins with MASS, and tackle the very likely tangle that is VistA, one piece at a time. Thus, this approach could work with any commercial EHR in principle. MASS simply happens to be Epic-based.

Note that there are downsides to this approach too. The switch to another EHR would be very lengthy, and interfaces between VistA and the 3rd party EHR would be a major issue that whole time. The long project duration makes the whole endeavour a target. Further, there is a danger that the whole episode takes so long, that the end-goal loses relevance or focus. Sideline critiques are a bit easier than taking ownership of a massive project.

I do want to note that in Rep. Rosendale’s hearings, the overall tone and tenor was reasonable, respectful, and avoided scoring cheap points for political gain. This was a refreshing change from much of current political discourse. Rep. Rosendale gained some respect from this observer for his conduct and leadership. My comments above nothwithstanding!