“We build the board a house of glass and pray the question’s never asked.” Oof! I wouldn't want to be…

News 2/19/25

Top News

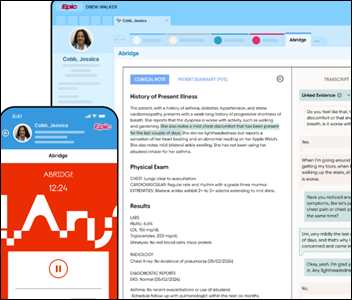

Abridge raises $250 million in a Series D funding round.

The company says that its ambient documentation product is being used by 100 health systems.

Abridge’s valuation has been reported as $2.5 billion.

Reader Comments

From Dr. Anon: “Re: Oracle Health. We keep hearing about the ‘excitement’ of Oracle shifting ‘to the cloud,’ but I’ve still not been able to get a straight answer on what will happen to all of our custom build when that occurs. And we have tons of custom build based on the old PowerForm / PowerNotes features that supports all of our regulatory reporting requirements. Unfortunately the workflow mPages and dynamic documentation features, on which the cloud implementation will be based, has yet to include key features despite a decade of Cerner / Oracle knowing what is needed.”

From Aca-Doc: “Re: work metrics for physician productivity. My prior chairman was big on metrics for bonuses. As the CMIO, I had to develop reports to show who was at 75th percentile or above on RVUs. Because we’d had problems with people submitting charges without writing a note, the metrics also incorporated a requirement that 95% of notes had to be completed within seven days of the visit. People figured out workarounds. They would sign a blank note on the day of the visit and then go back later and fill in the details. On the other hand, patient satisfaction and outcomes are not necessarily a good indicator of work effort or quality, so it’s not really fair to hold clinicians accountable for these variables over which they have no control.”

From ViveRant: “Re: ViVE. Now there’s wristband for ‘additional security.’ This is required wear in addition to the badges that now include a picture of the attendee. As when airlines started requiring picture ID, the point was to remove the thriving secondhand market for unused plane tickets. Like CES, ViVE realized that badge pictures are suboptimal since scanning thousands of people is impossible. Adding a wristband that cannot be removed without breaking is possibly easier to spot, but for most, it remains invisible and adds the frustration of unnecessary lines each morning to get a new wristband unless you like wearing a post-shower, now-sodden cloth wristband.” Being cynical, I would wonder what kind of attendee tracking the badge enables, like the RFID that HIMSS planned to use at HIMS11 (also RSNA) so that exhibitors could “derive a more accurate score of a visitor’s buying potential and send a booth alert when a key prospect approaches.” As if that wasn’t creepy enough, the tech company that HIMSS hired for that attendee tracking later incorporated facial recognition and also added a feature that HIMSS didn’t use — value-based booth pricing, so getting stuck in exhibit hall Siberia at least cost less. Also, did the ViVE wristbands have ads?

ViVE Conference Day 1 and 2 Observations from an Attendee

- 10,000 attendees (2,500 more than ViVE 2023 in Nashville), 30% are C-Suite-level. 725 provider and payer organizations represented. 5,000 scheduled meetings over the course of the conference.

- Nashville has not been spared from the latest Arctic blast. There were snow flurries falling during the (partially outdoor) opening night reception.

- The show floor feels both active and quiet; there’s definitely a lot of people and a lot of activity, yet nothing feels frenetic or chaotic. It feels like everything flows and runs smoothly.

- The layout of the show floor is different in notable ways from two years ago. There is less empty space. Every inch is used in a way that’s compact but doesn’t feel cramped.

- It feels like there are a lot more vendor booths, and they’ve cut back on some of the free space as a result. Also, the primary stages at each corner of the show floor have much less seating compared to two years ago.

- 99% of the booths seem to be taken. I’ve only seen three booths and one meeting cube on the floor plan showing as unfilled.

- AI is definitely a core focus and some of the biggest booths are heavily AI-oriented.

- Vendors I’ve noticed who have a diminished or no presence (smaller booth, much fewer attendees): Health Gorilla, Graphite Health, Moxe, eClinicalWorks, Interfaceware, Quest Diagnostics. I’m sure there are others.

- I continue to question how valuable a booth is. If you have a catchy brand or offering that’s likely to attract the attention of a wanderer, I can see it helping. If you’re meeting- and one-on-one-focused, I feel like a meeting area is a better investment.

- The Provider and Payer Connect Lounge, where vendors have scheduled meetings with provider and payer orgs, is huge this time around, with at least 170 small tables for meetings. The Investor Connect Lounge feels smaller and anecdotally, I haven’t run into nearly as many investors.

- Being a repeat ViVE attendee, I feel my organization has a much better game plan for the conference. I’m clearer on who to meet with and how to make connections happen. I’m more realistic about who actually attends and how to find them. I think vendors coming to ViVE need to understand that it is focused on doing business with investors and health system/health plan prospects. The days are heavily structured around meetings and more curated interactions with providers, payer, and investors. Some folks are here to learn or explore, but many are on a mission and will treat everything tangential to that mission as a distraction. If you are a B2B company, like a professional services org, you need to hit every aisle of booths and seek out partnerships or prospects. You have to have the right strategy to make the conference worthwhile, and for some it probably isn’t the right fit.

- Nashville is expecting one to four inches of snow starting late Tuesday night, so there is a lot of chatter about folks changing flights and abandoning town. I’m expecting Wednesday to be dead, and I’m surprised the ViVE organizers haven’t addressed the elephant in the room and given guidance on whether they’ll even keep Day 4. I feel bad for those slated to hold key meetings or to present on the final day. Though the weather’s unusual, it isn’t unheard of in Nashville in February. ViVE should really stick to March.

Sponsored Events and Resources

Instant Access Webinar: “How AI Addresses Resource Constraints Within Identity Data Management.” Sponsor: Rhapsody. Presenters: Lynn Stoltz, MS, director of product management, Rhapsody; Drew Ivan, MS, chief architect, Rhapsody; Michelle Blackmer, chief marketing officer, Rhapsody. Discover how to overcome the toughest challenge in identity data management: resource constraints. The presenters will cover how Rhapsody EMPI with Autopilot solves resource challenges like limitations in time, talent, and budget; Reduces costs and risks associated with inaccurate data; and boosts identity data accuracy through 98% decision-making precision.

HIMSS25 Guide: HIStalk sponsors can provide conference participation details by February 24 to be included in my guide.

Contact Lorre to have your resource listed.

Acquisitions, Funding, Business, and Stock

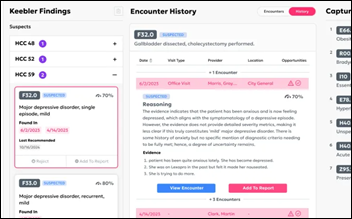

Keebler Health raises $6 million in seed funding. The Durham, NC-based company’s software performs medical records review to help providers assess and adjust risk under value-based care contracts.

I missed this from mid-January. A private equity firm acquires ComplexCare Solutions, a carve-out from Inovalon. The company offers an independent health assessment and member engagement platform.

Avandra, which operates a medical imaging data network, raises $17.75 million in funding.

Sales

- Community Hospital Corporation will deploy CarePilot’s AI scribe solution. Founder and CEO Joseph Tutera, Jr. ran unsuccessfully for governor of Kansas in 2017 at age 16, then started a business early in the pandemic buying respirator masks and COVID tests from Asia and reselling them to US customers.

- MultiCare Connected Care will use Tuva Health’s open-source technology to manage and analyze data for 375,000 patients and has taken an ownership stake in the company through its investment arm.

- Montefiore Health System selects Amazon Web Services as its cloud provider and will transition Epic to AWS.

People

Germany-based medical inhaler digital therapy vendor VisionHealth promotes Peter Shadday to CEO. He replaces founder Sabine Häussermann, PhD, who will move to chief scientific officer.

Oncology software vendor OncoHealth hires Jon Maack, MBA (Definitive Healthcare) as CEO.

Announcements and Implementations

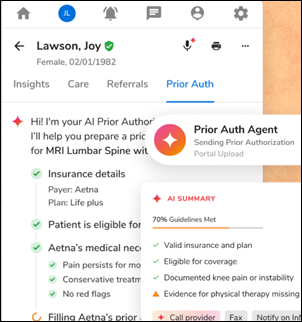

Innovaccer launches telephone-based AI voice agents for patient scheduling, protocol intake, referral, authorization, care gap closure, HCC coding, and patient access.

DrFirst enhances its IPrescribe electronic prescribing app with a feature that lets providers call patients from their personal phones while displaying their practice’s name as the caller ID.

Healthcare accreditor URAC announces plans to release a healthcare AI accreditation program later this year and seeks advisory committee members to help develop standards.

DirectTrust opens a 60-day public comment period for draft criteria for its new Identity Provider and UDAP Identity Provider programs.

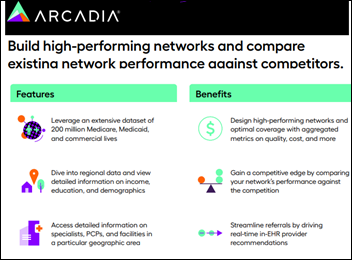

Arcadia launches new solutions for modeling care networks, managing value-based care contracts, identifying care gaps, and developing AI models to identify disease progression and risk.

Symplr announces an AWS-powered platform that integrates 28 applications in a unified user experience.

MultiPlan changes it name to Claritev and announces its intentions to broaden its product lines beyond reducing payments for out-of-network provider claims.

Clarigent Health, a Cincinnati Children’s startup that developed an AI-driven tool for schools to analyze counseling session recordings for suicide risk, shuts down. The company had received $1 million in NIH funding, but a 2023 newspaper investigation found no evidence supporting its claims and raised accuracy concerns due to the AI being trained on recordings from a majority-white population.

Government and Politics

HHS appoints Clark Minor, a software executive at Palantir, as CIO. The intelligence data firm won a contested $415 million NHS contract in 2023, drawing criticism over sole-source awarding and full NHS data access. HHS, a Palantir client, has paid the company $300 million over four years.

Stat reports that FDA has laid off many AI and digital health employees who were involved in AI regulation.

A new Ohio law forces hospitals to comply with the widely ignored federal price transparency rule by prohibiting non-compliant hospitals from collecting patient medical debt.

Sponsor Updates

- Cordea Consulting introduces its Innovation Lab video series.

- Clinical Architecture joins the CHIME Foundation to collaborate on healthcare IT innovation.

- Optimum Healthcare IT achieves Amazon Web Services Healthcare Competency status.

- CloudWave will present at the North Carolina Healthcare Association Winter Meeting February 20 in Raleigh.

Blog Posts

- AI and healthcare: What clinicians need to know (Wolters Kluwer Health)

- How Cybersecurity Ambassador Programs Strengthen Your First Line of Defense (CereCore)

- Navigating the Current State of AI and Automation in Revenue Cycle Management (AGS Health)

- Looking toward the future of healthcare: Altera leaders’ predictions for 2025 and beyond (Altera Digital Health)

- Seven Habits of Client-Focused Companies (Clearsense)

- Powering Pharmacogenomics: Clinical Architecture’s Role in Advancing Personalized Medicine in the NHS (Clinical Architecture)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Follow on X, Bluesky, and LinkedIn.

Contact us.

ViVE observations are spot on!

Agreed with the ViVE comments. It did feel less ‘luxury and trendy’ compared to previous ViVEs (the food wasn’t as nice, no free salons, no big name performer), and the increase in booths and less seating at the stages made it feel a little more like a regular conference. Big players had no booths (Microsoft, Epic). But as your Attendee noted, if you’ve pre-packed your schedule with meetings and your primary goal is B2B and networking, it’s the way to go versus a gargantuan HIMSS. (Plus I overheard at least a dozen different job interviews going on in the lobbies and lunch/meet up areas, so that’s clearly some people’s objectives too…)

In addition, because of the focus on all the new, shiny, AI-driven edge cases, even though some panels were about rural health and patient inequity, they still ended up saying “we’re piloting at [insert very well known hospitals and AMCs that have gigantic budgets].” I wish these cool new companies would remember that the big cities are not the only place people go to for their healthcare.

At lunch, I chatted to someone new to healthcare and he was so visibly frustrated that his ‘easy startup’ is (shockingly) going to be very very very hard to actually launch. Healthcare is a complicated beast.