Healthcare data sucks - that song turned my Friday to Friyay!!! Gave me the much needed boost to get through…

News 5/1/24

Top News

Walmart Health announces that it will close its clinics and virtual care service, noting that it can no longer sustain a business model that is beset by rising costs and declining reimbursements. The company had previously said that it would open 22 additional health centers this year.

Walmart Health grew to 51 locations in five states during its five-year run, implementing Epic across its clinics in 2022. The concept was piloted in Dallas, GA in 2019, where it offered $40 visits and physicals from standalone offices. Walmart simultaneously ran Care Clinics from inside its stores in three states. Walmart acquired multi-specialty telehealth provider MeMD in mid-2021 and renamed the business to Walmart Health Virtual Care a year later.

The retail giant will continue to focus on the development of its pharmacy and vision offerings, of which there are, respectively, 4,600 and 3,000 in-store sites.

The company launched Walmart Health Care Research Institute in October 2022 to pair members of underrepresented communities with clinical trials, which included digital tools for research participants to manage their health records and insurance information. Walmart says that business will continue.

Reader Comments

From Wiggles: “Re: Walmart Health Centers. We’ve been patients since it opened. It was convenient, offered easy access, and was super affordable. I guess it was too good to be true. My only frustration with the numerous times they cancelled appointments because they didn’t have available clinicians.” The upside is that physicians might be realizing that they can (or could) control delivery since giants like Walmart can’t scale with them, much less without them. Healthcare still requires doctors who might be in short supply, who don’t enjoy offering care-by-wire encounters, or who don’t find that wearing a Walmart-logoed white coat carries the prestige they expected. This is the chance for doctors to wrest control back from the suits in a medical form of a rollback special.

From Spindrift: “Re: Walmart Health. They must have spent a fortune implementing Epic for the short time they used it.” Agreed.

HIStalk Announcements and Requests

Today I learned that Larry Ellison’s son David is founder and CEO of Skydance Media, which makes the “Mission: Impossible” and “Star Trek” films and is negotiating a multi-billion dollar merger with Paramount Pictures. David’s wife is Larry’s connection to Nashville – she’s a country singer (who I could find next to nothing about, which I assume that she’s still hoping to break out) who has a house there.

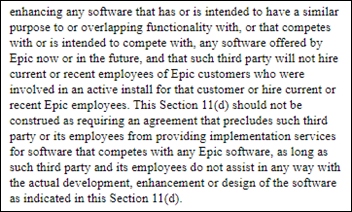

I’m thinking of all the ways that Epic could theoretically limit the career options of its employees even if non-compete agreements are banned. I found the above language in the Epic contract of Ardent Health, which was filed with the SEC and which I think I recall is Epic standard contract boilerplate. Lawyers, is this legal, or just unlikely to be found illegal because affected employees don’t have the time or money to challenge it?

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

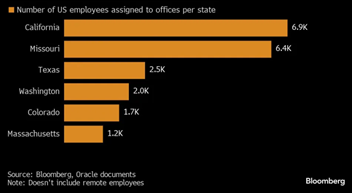

Oracle Chairman and CTO Larry Ellison’s headquarters relocation declaration likely won’t impact most of the company’s US employees, given that the majority — including Ellison, who spends most of his time on his Hawaiian island of Lanai — are remote. Seven thousand are still based in the company’s original home state of California, while 6,400 largely former Cerner employees reside in Missouri. Just 2,500 call the company’s current Austin, TX, headquarters home.

HCA reports Q1 results: revenue up 11%, EPS $5.93 versus $4.85, beating analyst expectations for both. HCA shares are up 23% in the past 12 months versus the S&P 500’s 12% gain, valuing the company at $82 billion.

Streamline Health reports Q4 results: revenue down 19%, EPS –$0.02 versus –$0.04. Shares dropped on the news, valuing the company at $17 million, down 82% in the past 12 months.

Sales

- SSM Health St. Mary’s Hospital (MO) will use Inbound Health’s hospital-at-home services, including virtual care, as part of its new Recovery Care at Home program.

- Ochsner Health (LA) selects self-service triage, care navigation, and capacity optimization software from Clearstep.

- Akron Children’s Hospital will implement Health Catalyst’s population health and analytics solutions.

- Houston Methodist will implement EVideon’s Vibe Health smart room technology at its West Hospital and Cypress Hospital, which will open next year.

People

Penn Medicine promotes Mitchell Schnall, MD, PhD, to SVP of data and technology solutions.

Announcements and Implementations

Hackensack University Medical Center (NJ) implements AvaSure’s TeleSitter virtual care technology.

Researchers find that using AI to analyze the high-risk ECGs of hospitalized patients was associated with a 31% drop in all-cause mortality, the first randomized clinical trial to show that AI saves lives.

Government and Politics

Noting that, “There is no Plan B,” Deputy VA Secretary Tanya Bradsher says that the department is committed to rolling out Oracle Health. She made that promise during her second visit to the Mann-Grandstaff Medical Center in Spokane, WA, which went live on the software in 2020. Resuming implementations at VA facilities will depend upon the readiness of the system and each medical center, which will be determined by analysis of a “readiness scorecard,” according to VA EHR Modernization program lead Neil Evans, MD. Restarts will likely begin in 2025 and go-lives a year later.

Privacy and Security

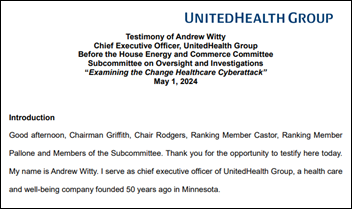

UnitedHealth Group CEO Andrew Witty confirms via written testimony that hackers used stolen credentials to remotely access a Change Healthcare Citrix portal, which did not have multifactor authentication. The criminals spent nine days nosing around Change systems before initiating the ransomware attack. Witty, who will present his testimony to a US House Committee May 1, adds that paying the ransom was “one of the hardest decisions I’ve ever had to make.”

Other

In Ohio, Montgomery County officials will work with the Greater Dayton Area Hospital Association, Montgomery County Behavioral Task Force, and area providers to develop a behavioral health services referral portal. The project will be funded in part with nearly $2 million received by the county as part of an opioid settlement earlier this year.

Notes from Oracle’s Larry Ellison from his healthcare fireside chat last week:

- Ellison says that hospital pathology departments can’t detect mutated bacteria or viruses, so the next version of Millennium’s pathology module will focus on gene sequencing to support global outbreak surveillance.

- He notes that Oracle is “by far the largest provider of automation systems to hospitals and clinics throughout the world,” with virtually every NHS hospital as clients as well as those in the Middle East, Saudi Arabia, UAE, Kenya, Rwanda, Indonesia, and Japan.

- Ellison was surprised that real-world evidence of drug effectiveness isn’t used for quick approval by FDA for specific conditions, so drug companies spend 10 years and millions of dollars to run another clinical trial, concluding that “classical clinical trials [aren’t] the only way you discover things work” and proposing the idea that “a clinical trial should never end” in reviewing data on the first 5,000 patients and then ignoring data from the next 50 million.

- He adds that Cerner goes beyond the EHR into life sciences.

- Ellison talked up autonomous digital infrastructure for cybersecurity, with Oracle’s first customers for it being the CIA, NSA, and Britain’s MI6.

- Passwords will be eliminated from all Oracle systems by the end of the year.

- Ellison says that buying Cerner wasn’t just about automating hospitals, but also the hospital-payer interface, noting that high healthcare costs threaten democracy in Europe, with half of the UK’s budget being consumed by healthcare.

- He says that Oracle Health needs to get involved with medical devices, FDA oversight, hospital workforce management with emphasis on the “gig economy” where nurses and doctors aren’t hospital employees, and hospital inventory management.

- Ellison blurted out that “we’re moving this campus, which will ultimately be our world headquarters, we’re moving that to Nashville.” He then laughed that “I shouldn’t have said that,” and then said “what might ultimately be our world headquarters.” He added, “This is where I’d love to go to work. This is the center of the industry we’re most concerned about, which is the healthcare industry.”

A former Cigna medical director says that her bosses pushed her to speed up her review of cases that nurses had flagged for coverage denial, saying that she wasn’t given enough time to review the literature or review the patient’s medical records. She said that peers simply copied and pasted the company’s denial language, which company insiders called “click and close,” even though the company’s Philippines-based review nurses often make mistakes that would have led to inappropriate denial of coverage.

Sponsor Updates

- TruBridge will host its national client conference through May 2 in Las Vegas.

- Black Book shares findings from its latest user satisfaction survey regarding specialty RCM firms.

- AdvancedMD welcomes new integration partners Jopari Solutions, TriumpHealth, DMEconnected, and EirSystems.

- Aga Khan University Hospital in Pakistan goes live on Agfa HealthCare’s Enterprise Imaging Platform.

- Ascom Americas will exhibit at Avaya Engage May 13 in Denver.

- The DGTL Voices Podcast features AvaSure Chief Clinical Officer Lisbeth Votruba.

Blog Posts

- How to Bridge the Gap Between Epic and Your IT Ecosystem (CereCore)

- Aligning People, Process, and Technology to Improve Healthcare Experiences (Tegria)

- Leveraging technology to humanize healthcare (Altera Digital Health)

- Key strategies to build a data analytics infrastructure (Arcadia)

- Certification of TREs and SDEs – What Comes Next? (Aridhia Informatics)

- Navigating Governance: Review the Current State of Patient Communications (Artera)

- Steps Every Healthcare Organization Can Take to Ensure an OCR-Compliant Risk Analysis (Clearwater)

- Navigating Regulations in Healthcare: Cyberattacks and AI Governance (Consensus Cloud Solutions)

- Analyzing the Challenges of Pharmaceutical Supply Shortages (Dimensional Insight)

- Scaling Your Practice for Success (EClinicalWorks)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

There just isn’t sufficient money in primary care.

Walmart Health just threw in the towel.

Walgreens and VillageMD are getting killed.

OneMedical bought Iora Health, who never figured out how to make a profit.

Amazon bought OneMedical, who never figured out how to make a profit.

All of those independent primary care offices either sold to their local hospital or to Private Equity.

Hospitals view primary care as a loss leader, but at least they control the referrals.

And Private Equity just leeches out money, while driving their providers to early retirement through understaffing and cuts.

Is anyone making a profit in primary care?

Agree, I was a hospital CFO many many years ago and even back then we viewed primary care and pediatrics as ‘loss leaders’. Amazing that Walmart with all it’s powerful marketing talent couldn’t see that. Maybe they should have given away a free rotisserie chicken with each visit. Then after eating it the customer would have to come back for antiacids and/or another visit.

This comment and the one above are a great example of what’s wrong with the perverse incentives in the American healthcare system. The fact that primary care, where clinicians have an opportunity to keep people healthy before conditions worsen, is a “loss leader”. Our private system demands operational profitability. And no one has actually figured out how to make money off of keeping people healthy. So primary care suffers and overall national healthcare spending goes up.

I don’t really see what’s wrong with having a ‘loss leader’ in any industry, business or social service. Car dealers do it, house renovators do it, travel agencies, HVAC services,,etc. The core strategy is to get people to come in, diagnosis a potential problem and then deliver more services. If primary care is not a loss leader and you had to pay full freight nobody would get screened.

Walmart’s problem is that the full cost of this loss leader (as Inal points out) could not be recovered by selling a cart full of toys or groceries. Note that Walmart will still supply (in many cases for free) vaccines and other simpler services. Why because when I get my covid shot at Walmart I usually buy $50+ of other goods.

Whatever happened to Google? Wasn’t Google also touted as having a ‘disruptive and innovative’ healthcare service?

“it can no longer sustain a business model that is beset by rising costs and declining reimbursements”

Too bad Walmart couldn’t play more with the business model. They should have tried not taking insurance for their visits, but instead charging a fair price that would pay the clinician/space. Then they would have benefited from having an underserved population (and perhaps a population that doesn’t have time to fool with getting in to see their own PCP) and benefit from the pharmacy sales.

I wish someone would be brave enough to disrupt our Insurance model and start offering bare bones healthcare.

What’s a fair price for a 15 minute visit? Let’s say you pay a clinician 200k a year, they see patients in 15 minute increments, they are with a patient 75% of their 8 hour day, they work 40 hours a week with two weeks of vacation. That’s 35 dollars straight to the doc for your 15 minute visit. Now pay for the staffs health insurance, the malpractice, the rent, lawyers, accountants, the administration, the marketing, etc. It’s really hard to get the cash pay price under 150 dollars for 15 minutes.

Business model innovation cannot get around the fact that a doctors time is really expensive compared to the wage earned by the lowest quintile of labor. If you want to solve this at the market level, you’ve got to increase the supply of doctors. Otherwise there has to be some more direct government intervention.

I love the idea of bare bones healthcare at a low cost. There’s a few places that you see that happening. If you live certain places in the US, you can drive across an international border and get your medical care for a quarter of the price. Within the US, you see online services offering five minute visits targeted to specific issues for about 40 dollars. The patients probably looked up their symptoms on the internet and were targeted by ads for the service. Note that both of these are essentially increasing the supply of doctors, either directly by including foreign doctors or indirectly by higher utilization of doctors time.

The practitioners hanging out their direct primary care shingle seem to be making the cash-for-primary-care-access equation work, I think by drastic cuts to the number of employees who are not the practitioner.

But this doesn’t point the way to Wal-Mart style retail clinics.

If anything, it points to way to “Uber for family medicine”.

I suspect the way they make it work is the same way gyms make it work. Most subscribers do not use the service. Most DPC contracts I’ve seen also don’t let you “overuse” the service or else they start billing insurance. Overuse in this case being defined as managing your chronic condition. It’s a good point that DPC is cash based, though IMO it ends up being more closer to something like concierge medicine than a low quality, affordable option.

Direct Primary Care should be called Concierge Lite. Patients pay $80/mo, totaling $1000 per year (yet still need health insurance). It works for the rich, or preys on the desperate. Great pay and lifestyle for the physician, but is not a solution to our primary care problem.

Underfunding primary care has been disastrous for our country, probably the single biggest cause of our PCP shortage, which contributes to poorer health outcomes and health inequity, and ultimately higher costs.

However, overfunding primary care also has pitfalls. Imagine Walgreens, CVS, Best Buy, and Amazon using their deep pockets to fight against Private Equity, all trying to slurp up that easy Primary Care money.

The solution is to reward quality at the PCP level. Incentivize high quality care, cost savings, and meaningful interventions. Promote health and prevention.

Really sad about Walmart Health shutting down. Marcus Osborne, former VP of Walmart Health, did a few podcast interviews before they launced that were really interesting. About 2/3 of Americans visit a Walmart in person every month, and if you remove a few metro areas like LA, SF, NYC the percentage is much higher. So basically there’s no other private entity that had the ability to impact care access better than Walmart. I understand that WMT shareholders don’t invest in the company because they’re interested in supporting a charity, I just wish the offering had a path to profitability.

Re: Skydance Media

Seeing as Hollywood has difficulty producing any new content, and relies upon franchises?

I predict the following movie, Coming Soon!

“Star Mission, Impossible Trek: Ghost Venom Recall, With A Vengeance!”