The New Yorker cartoon of Readers Write articles.

News 2/28/24

Top News

Veradigm will acquire healthcare AI company ScienceIO for $140 million.

Additionally, Veradigm reports that it will not be able to meet Nasdaq compliance deadlines for filing annual and quarterly reports from 2022 and 2023. It expects to receive a delisting notice and to be subsequently dropped from Nasdaq trading. Veradigm’s Board of Directors has put together a stockholder rights plan as it prepares for the possibility of acquisition offers.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

B.well Connected Health raises $40 million in a Series C funding round, bringing the consumer-focused health data aggregator’s total raised to $88 million since launching in 2015.

R1 RCM shares spike on the news that majority shareholder New Mountain Capital has offered to acquire it in a deal valued at $5.8 billion. Meanwhile, the company reports break-even Q4 earnings per share and a 7.8% increase in Q4 revenue, falling short of analyst expectations for both.

Providence Health plans to more than double its workforce in India to increase capacity for its own off-shore management operations and to expand its technology services to other hospitals. Providence seems to have gotten out of the RCM business with the sale late last year of its Acclara RCM business to R1 RCM for $675 million.

People

Former Concord Hospital CIO Aaron Wootton joins Huntzinger Management Group as chief digital officer.

Announcements and Implementations

Censinet announces GA of new Risk Register software, designed to help healthcare organizations identify cyber risk exposures in real time across the enterprise; and Connect Copilot software, which automates cybersecurity risk assessment questionnaires.

OSF HealthCare (IL) implements Curbside Health’s clinical decision support software.

VerifiNow develops PatientVerifi to help virtual healthcare providers securely and accurately confirm patient identities.

Somerset Hospital (PA) will implement Epic through its affiliation with UPMC Health. The hospital expects to go live in late 2025 or 2026.

Imprivata announces GA of its Biometric Patient Identity technology.

Government and Politics

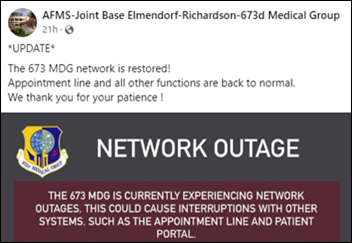

Several Defense Health Agency hospitals in Japan and Alaska have reported intermittent MHS Genesis outages lasting for several hours on Tuesday. Military pharmacies have also been affected by the cyberattack on Change Healthcare, causing them to notify patients that prescriptions will be triaged and filled using manual procedures until the disruption is resolved.

Privacy and Security

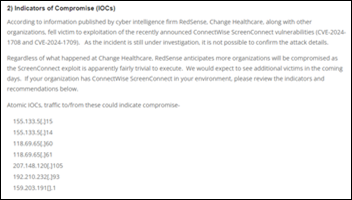

The Health-Information Sharing and Analysis Center publishes a Threat Bulletin on the Change Healthcare cyberattack that includes details on its possible connection to recent ConnectWise ScreenConnect vulnerabilities and suggested mitigation steps. The BlackCat ransomware group has claimed responsibility for the February 21 attack.

Change Healthcare parent company UnitedHealth Group says 90% of the nation’s pharmacies have set up electronic workarounds to handle prescription processing while they wait for Change’s systems to come back online.

Sponsor Updates

- Consensus Cloud Solutions celebrates two years of being listed on the Nasdaq.

- Agfa HealthCare enterprise imaging goes live at Policlinico Umberto I in Rome.

- Altera Digital Health upgrades the Singapore Ministry of Defence’s Sunrise EHR system while also implementing Altera Opal document management software.

- Bamboo Health will exhibit at Behavioral Health Business Value March 11-13 in Miami.

- Biofourmis partners with GE HealthCare to scale and deliver innovative care-at-home solutions.

- Care.ai partners with CHIME to launch an industry advisory panel that will help to develop the Smart Hospital Maturity Model.

- Censinet announces the winners of its Cybersecurity Transparent Awards, which include HIStalk sponsors Divurgent, Ellkay, and Fortified Health Security.

- DrFirst announces that nominations are now open for its 2024 Healthiverse Heroes Award.

- AvaSure adds episodic care capabilities to its Intelligent Virtual Care Platform.

Blog Posts

- The New Year Ushers in Sweeping Changes to OPPS (AGS Health)

- Going on offense: Barriers to implementing offensive cybersecurity programs (Altera Digital Health)

- The Pre-competitive Space for Drug or Vaccine Development: What Does it Look Like Now and What Could it Look Like in the Future? (Aridhia Informatics)

- Come on Barbie, Let’s Go Party: Artera iO Hosts its Second Annual Hackathon Demo Day (Artera)

- How Predictive Editing Can Boost Revenue Cycle Performance (Availity)

- The Hospital Room of the Future: Episodic Care Powered by AvaSure’s Intelligent Virtual Care Platform (AvaSure)

- How Commitment to ROI can Improve a Health System’s Bottom Line (CereCore)

- Build a Business Case for Data Governance (Divurgent)

- With an AI-Powered EHR, Sunoh.ai, and Healow Patient Engagement, ECW is a One-Stop Solution for Small and Independent Practices (EClinicalWorks)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Wait. What? Can someone explain how Veradigm is acquiring another company for $140 million and then expects to be regulatory filing non-compliance?

My accounting might have been patchy but I do have money in the bank, and that’s what the buyer cares about

Because at its core, the Veradigm business is very sound, and they are flush with cash.

The problem is that they brought the Allscripts executive team to the Veradigm party. The Allscripts executive teams were toxic, and frankly incompetent. But the Veradigm side of the house, which was largely left alone before the divestiture has a solid business model, had/has good leadership, and is generally firing on all cylinders. With few exceptions the Allscripts leadership couldn’t be honest, and they really didn’t understand what they had, or what they had sold. Silo walls meant that there could be no honesty or trust, without trust nobody knew exactly what they had, or what was actually sold. While they had a Quality Management System, most of the QMS participants were those who were squared away in their dealings and a lot of Allscripts business organizations refused to participate.

Those same leaders did the due diligence on the M&A activities, then left the leadership intact (or promoted them to senior positions) and never got to the bottom of what they had actually bought. A startup is generally not going to be mature about what they build and are running like bats on fire to get to minimally viable. Minimally viable is not what you want in healthcare and it showed in the products purchased. Spaghetti code, technical debt, quality problems, and in some cases fraud.

The e-suite didn’t show leadership and force those orgs to get onboard.

So, when they went to a new revenue system, they didn’t know how to add all the things they didn’t know they had. Then, the mirage fell apart