Look, I want to support the author's message, but something is holding me back. Mr. Devarakonda hasn't said anything that…

Monday Morning Update 1/22/24

Top News

Massachusetts regulators worry that Steward Health Care’s financial problems may force it to close hospitals, with the resulting loss of jobs and access to care.

Steward operates 33 hospitals in nine states, nine of them in Massachusetts. It is one of the top employers and taxpayers in towns where it operates hospitals. It has 30,000 employees nationally and operates 25 urgent care centers and 107 skilled nursing facilities.

The real estate company that bought and then leased back some of Steward’s hospital buildings says that the company is $50 million behind in rent payments.

Steward, which gets 70% of its revenue from Medicare and Medicaid, says that community hospitals in Massachusetts are paid less than academic medical centers. It has asked for state help with the cost of caring for Medicaid patients and undocumented immigrants.

Reader Comments

From Industry CEO: “Re: HIStalk. The first thing my earliest investors advised me to do as a founder was to read HIStalk every day. So I have, for many years. My team and I think really highly of HIStalk.” Thanks. These comments give me a push since I sit alone at keyboard each day, and even when I emerge into the wild, I decline to divulge my HIStalk identity because who cares anyway. I’m happy to leave it as a blank screen in an empty room with someone occasionally reading over my shoulder.

HIStalk Announcements and Requests

Attention HIStalk sponsors: complete my information form for ViVE and/or HIMSS if you are participating and I’ll include you in my online guide. Also attention non-sponsors, because it’s not to late to get signed up for exposure for the other 359 days of the year when the exhibit halls go dark and attention is more focused.

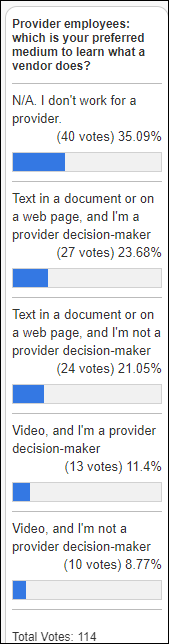

Twice as many provider decision-makers would rather learn about companies by reading a document or web page instead of watching a video, which is about the same percentage of those who aren’t provider decision-makers. I agree with commenter B. Efficient, who says that it shouldn’t be either-or — they won’t even look at video alone because it’s inefficient and often ends up being an advertisement, but a text-based overview with video detail such as screenshots is the way to go.

New poll to your right or here: what will be General Catalyst’s biggest challenge in its plan to buy Summa Health?

Thoughts About General Catalyst Acquiring Summa Health

Venture capital firm General Catalyst promised to buy a non-profit health system when it formed Health Assurance Transformation Corporation (HATCo) in October 2023. The firm says that it evaluated several acquisition candidates, but it said last week that it has been talking to Summa for nine months, so perhaps that was always its choice.

Summa’s Advantages to GC

- It is relatively small and can be acquired at a reasonable price.

- Its market is geographically compact.

- Its size allows changes to be implemented faster.

- Summa has acute care hospitals, a rehab hospital, a physician network, and a small health insurance business.

- It has been successful as an early participant in value-based care.

GC’s Health Assurance Network

GC had already formed its Health Assurance Network of health systems – their “partnership” terms have not been announced — that includes HCA, Jefferson, Intermountain, WellSpan, Banner, UC Davis, UCI Health, UHS, and others. Its goals:

- Pair startups with health systems to develop and scale products.

- Share best practices.

- Move from sick care to wellness via population health.

- Explore new care models.

Acquisition Financials

Three-hospital Summa recorded a $57 million loss on $1.5 billion in revenue in its most recent tax filing.

GC said with the original announcement that it would spend $1 billion to $3 billion for its acquisition. For-profit companies that buy non-profit health systems usually pay slightly less than 1x revenue, so GC will likely spend at least $1 billion. HCA paid $1.5 billion for North Carolina’s Mission Health, whose revenue and bed count were nearly identical.

Summa’s CEO says the health system’s financial challenges, which include $800 million of debt, didn’t give it a lot of options. He says that Summa has been seeking a partner for more than 10 years, Summa announced plans to sell itself to Beaumont Health in late 2019 until COVID caused both parties to change their minds.

GC will need to finance the deal. It has $25 billion of assets under management, but probably not $1 billion in cash sitting around. The financial details of the transaction will come out when they look for investors or lenders, or perhaps before then in the likely event that the information leaks out. The resulting leverage and carrying costs, not to mention extraction of resources to give the buyer immediate reward, often bring down acquired health systems that were already struggling.

GC Says It’s Not a Typical Private Equity Acquisition

GC makes it clear that as a venture capital firm, it won’t follow the model of a private equity acquisition, where the goal is to cut costs (often recklessly) to increase profits to allow a quick flip of the business. However, it could be argued that this transaction is more like PE than VC, other than GC’s assurance that it is in for the long haul:

- GC is buying a mature business that has stable revenue, not a high-potential startup whose success is not assured.

- It is acquiring a 100% share rather than partial ownership.

- GC may or may not become actively involved in Summa’s management.

For-Profit versus Not-for-Profit

For-profit companies own a significant percentage of US hospitals, but as their core business rather than one of several business lines. GC is an investor with no experience running a health system. Regulators have grown wary of what happens after the deal is done, when the acquirer may close locations, let quality slide, sell real estate to generate cash, or shut down money-losing core community services such as obstetrics to move into high-profit ventures such as ambulatory surgery centers.

For-profit status could make it easier to raise capital, but with significant downsides:

- They lose the tax benefits.

- They lose the 340B drug discount program, which can be a big profit-booster.

- They will need to renegotiate contracts.

- They will need to retire or refinance Summa’s $800 million of debt, probably at higher interest rates as a for-profit.

Operational Challenge

GC has promised that Summa’s executive team, employee base, service lines, and name won’t change. That may be challenging if profits don’t materialize, especially when most Summa executives have no experience running a for-profit hospital. Continued losses might be hard to swallow even if Summa helps GC make money from its other investments. The business structure will be important for the availability and cost of financing.

Buying a Software Sandbox

GC is buying a sandbox for its health tech portfolio companies. The original participants in GC’s Health Assurance Network are:

- Commure (interoperability and data).

- Tendo (analytics).

- Transcarent (connecting consumers with providers).

- Olive (process automation, but the company has been shut down).

GC may also be eyeing the value of Summa’s data for AI training.

GC will need to track the value that Summa adds to its portfolio companies, especially if the health system keeps losing money, to determine if its investment is paying off.

Health System and Software Companies Sharing an Owner

GC portfolio companies benefit from bypassing the “death by pilot” process in being implemented and measured at a health system that is a fellow portfolio company. That could generate convincing proof-of-concept studies. It could also backfire if Summa’s core business struggles despite using corporate-mandated software.

Epic

Summa previously ran on Mercy Health’s shared instance of Epic, then spent $850 million in late 2022 to launch its own instance. UPDATE: That number came from a Summa interview in which CIO Elbridge Locklear, MBA says what sounds like $850 million and remains transcribed that way on Summa’s website, but tax filings say they spent $50 million, suggesting that he may have stumbled verbally.

GC companies will have a leg up on Epic integration. That assumes that GC doesn’t run into issues with Epic’s willingness to work with a health system whose parent company also owns many dozen health technology competitors. The health system cannot risk having Epic shut its system down over IP concerns or contract renegotiation, and walking away from an expensive Epic contract to self-develop software would be unprecedented and risky.

Your Thoughts

I’m interested in your opinion. Leave a comment or message me.

Webinars

January 24 (Wednesday) noon ET. “Medication Management Redefined.” Sponsor: DrFirst. Presenters: Nick Barger, PharmD, VP of product, DrFirst; Caleb Dunn, PharmD, MS, senior product manager, DrFirst. Clinical workflow experts will paint a reimagined vision for e-prescribing that offers enhanced patient adherence, customizable clinical support, intelligent pharmacy logic, and data integrity and safety. Join this first chapter of an ongoing conversation about what medication management should be, how to deliver greater benefits today, and how to prepare for the future. Elevating your solution and customer benefits isn’t as hard, scary, or economically challenging as you may think.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

23andMe CEO Ann Wojcicki says that tech investors who understand its consumer genetics testing business don’t like the burn that is involved with its drug development side, while pharma investors don’t understand its consumer business. She declined to say if the company might split into two companies, but notes that it is selling customer genetics data to drug companies under non-exclusive relationships, one of which just yielded a $20 million, one-year contract. ME shares have lost 94% of their value since the company went public via a SPAC merger in June 2021 at a valuation of nearly $4 billion, now $340 million. 23andMe reported in January that hackers had exposed the information of 6.9 million people who had activated its DNA Relatives sharing feature.

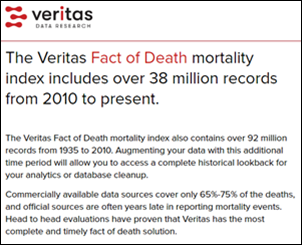

Today I learned from LinkedIn about Veritas Data Research, which appears to have solved the longstanding healthcare data problem of not knowing if a patient/consumer has died. The company’s Fact of Death captures over 90% of US deaths, usually within a month. Tuva Health is partnering with the company, saying that it’s surprisingly hard to know whether a patient survived or not because CDC’s data takes up to a year to published, is available only to researchers, and becomes less reliable as more people choose to die outside the hospital. The use cases for providers include creating better population health and risk models and eliminating the embarrassment of sending bills and marketing communications to people who have died. Veritas has just added Cause of Death, which allows researchers to identify whether deaths may not be related to their study topic. The two founders previously co-founded Universal Patient Key, a healthcare data de-identification service that was acquired by Datavant in 2018.

People

Darcy Nett (Wellbe) joins HealthX Ventures as principal.

Announcements and Implementations

FDA clears DermaSensor’s AI-powered handheld device for detecting skin cancer.

Optum seeks EHR/PM vendors to test its prior authorization inquiry API.

Government and Politics

HHS OIG bans Theranos founder and federal inmate Elizabeth Holmes from participating in federal healthcare programs for 90 years, the same exclusion it gave to former Theranos President Sunny Balwani.

Privacy and Security

The American Hospital Association warns that offshore hackers are impersonating hospital revenue cycle employees to have their passwords reset by the hospital IT help desk, using stolen information about the employee to answer security questions. They then ask to have a cell phone with a local area code enrolled, which allows them to defeat multi-factor authentication to log on to financial systems to send money to their offshore accounts.

Other

Epic CEO Judy Faulkner tells a fun story about opening the first buildings of its new campus in Verona, only to find that the entrances to their underground parking lots were too short for fire trucks. They had to buy the Verona Fire Department a new truck, which Carl Dvorak drove over with the sirens and lights on. Judy sat in the back with her white Samoyed dog, to which they had affixed black spots made of construction paper to make him look like a Dalmatian.

Unrelated, but bizarre. The founder and CEO of a large Chicago-based ERP software company dies and its president is seriously injured during a company celebration in India. The two executives were leading the audience in singing while hanging from a cage that was suspended above the stage when its chain broke, tumbling them 15 feet to the concrete stage.

Sponsor Updates

- Spok staff pack gift boxes for patients and gift bags for nurses at Inova L.J. Murphy Children’s Hospital in Virginia.

- CereCore International hires Andrew Hine (Babylon) as managing director.

- EClinicalWorks shares a new customer success story, “Boosting Wellness Visits & Incentive Revenue in Healthcare.”

- Nordic releases a new Designing for Health Podcast, “Interview with David K. Butler, MD.”

- Optimum Healthcare IT publishes a new case study, “ServiceNow Clinician Connect EMR Help.”

- SBI’s Growth Advisory Podcast features Symplr CEO BJ Schaknowski and President Nicole Rogas.

- The American Journal of Nursing awards Wolters Kluwer Health with eight Book of the Year awards.

- Waystar will exhibit at ASA Advance 2024 January 26-28 in Las Vegas.

Blog Posts

- Healthcare Revenue Cycle Management: What to Expect in 2024 (Nym)

- The Importance of Governance in Large-Scale On-Call Software Implementations (QGenda)

- Patient Care in 2045: Predicting the Singularity of Life-Changing Medications (and More) (Surescripts)

- Your Complete Guide to Meditech Expanse (Tegria)

- Pharmacist POV: Patient Safety with Meditech Expanse Pharmacy (CereCore)

- Strategies for Effective Revenue Cycle Automation – Start Small (VisiQuate)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Commenting on Readers Comment from Industry CEO: During my 14 years in private practice, when advising health IT software startups or emerging companies, either as clients or as mentees participating in incubators, one of my first bits of advice is always to tune in to HIStalk. Great work MrH !

I want to throw in my support for HIStalk.

I have a LOT of links to various Tech and Medicine sites. HIStalk is the one I consistently return to. HIStalk has been a reliable source for Healthcare IT news for me, for a very long time now. It could be 25+ years!

Good show.