Monday Morning Update 10/16/23

Top News

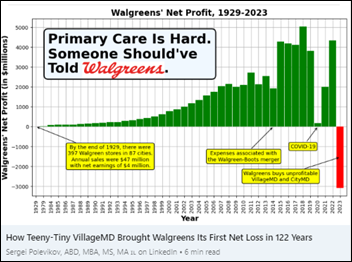

Walgreens will close 60 of its drugstore-attached VillageMD clinics as it pursues $1 billion in cost reductions following a Q4 loss that is the first in its 122-year history.

Walgreens paid $5.2 billion in late 2021 to increase its stake in VillageMD. The Walgreens interim CFO insisted in Thursday’s earnings call that the company will “unlock the embedded profits at Village” by cutting costs, improving execution, and “right-sizing the footprint” in focusing on the highest-opportunity markets and expanding integration of the company’s digital assets.

Walgreens also says it will reduce retail inventory and optimize product mix, which might make one wonder why the highly-compensated executives waited for a crappy quarterly earnings report to do so. Actually, maybe the company agrees since they have already canned the CEO, CFO, and CIO.

Worth a read is the analysis by AI company founder Sergei Polevikov, who says half of the company’s 2023 loss of $3 billion is due to money-losing VillageMD while the remainder is because of “kitchen sinking,” where all of the company’s problems are blamed on previous management in an opportunity to clean up the ugly books. He previously wrote a brilliant piece titled “Why did I say No to 100 SPAC offers? Because SPACs are Ponzi schemes” in which SPAC salespeople pushed him to take his AI company public, but didn’t bother to ask questions about profits or ROI since their interest was pumping and dumping, fueled by insiders hyping the company to unload shares to retail investors who shortly after took it in the shorts.

Reader Comments

From Boyd Blender: “Re: PE firm acquiring a health system. That would be an unwelcome intrusion.” The intrusion has already occurred, as private equity firms already own health systems, physician practices, clinics, ambulance services, hospices, insurers, drug companies, ED staffing firms, health IT software vendors, pharmacy chains, dental and vision offices, and funeral homes. Meanwhile, ever-larger health systems are exhibiting PE-like behavior in closing less-profitable sites, running investment firms, and strong-arming patients to pay balances due while generously enriching their executives. Patient expectations of empathy, customer focus, and an emphasis of quality over revenue – even when the patient is an executive of the same health system — usually lead to disillusionment.

HIStalk Announcements and Requests

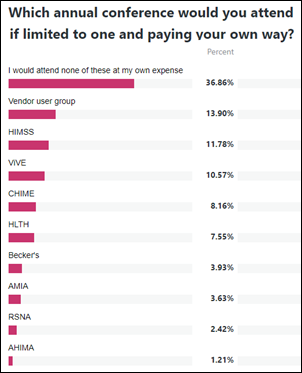

Many poll attendees wouldn’t attend any conferences if they had to pay their own way, but some say they would self-fund trips to a vendor’s user group meeting, HIMSS, or ViVE. I’ve long held that at least on the provider side, conferences are bestowed as paid vacations for executives with little expectation of ROI. I say that from experience, having enjoyed the budget and paid time off to traipse off to conferences about which my health system employer asked little and for which I held minimal expectation of benefit to my employer.

New poll to your right or here: Which of the following non-job issues were the main reason you left an employer? Everybody understands quitting over better opportunities, boss conflicts, or lack of challenge or inspiration, so I’m looking for broader, company-wide issues.

I’m never going to trust Google to lead AI innovation until it improves Gmail. I use it in the most basic ways possible, but still marvel that (a) selecting all items in Promotions and then clicking Delete All runs what looks like a primitive macro that leaves many emails undeleted; and (b) deleting emails on mobile brings up a pointless and unmovable “Conversation moved to trash” message that hides the next email. Only a UI-indifferent engineer could find Gmail easy to love. I’ve used it since mid-2005 and its appearance and sometimes frustrating behavior hasn’t changed much, like Google is reluctant to mess with it.

Sign up as a new HIStalk sponsor and Lorre will give you the rest of this year for free, a deal that rewards action rather than indecision.

Webinars

October 25 (Wednesday) 2 ET. “Q&A: What’s new with the NSA? A No Surprises Act update.” Sponsor: Waystar. Presenters: Joseph Mercer, JD, managing director, Marwood Group; Heather Kawamoto, VP of product strategy, Waystar. The No Surprises Act created a lot of change, and those changes are still coming. A panel of revenue cycle experts answer frequently asked questions and offer a concise update on the NSA, including legislative developments, FAQs, and tips for navigating changes.

October 25 (Wednesday) 2 ET. “AMA: The Power of Data Completeness.” Sponsor: Particle Health. Presenters: Jason Prestinario, MSME, CEO, Particle Health; Carolyn Ward, MD, director of clinical strategy, Particle Health. Is your healthcare organization looking to drive profitability and scale quickly? Our experts will explore how comprehensive clinical data can revolutionize the health tech landscape. This engaging discussion will cover trending topics such as leveraging AI and data innovation to enhance patient care and outcomes, real-world examples of organizations leading the charge in data-driven healthcare, overcoming challenges in data completeness and interoperability, and visionary perspectives on the future of care delivery.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Sphere will sell its Commercial Division to commercial enablement company NMI as a non-core business. UPDATE and correcting an earlier version of this item: the company is retaining the healthcare offerings as part of its specialized integrated verticals, selling only the Commercial Division that serves non-integrated SMB retail customers. Sphere says the sale will allow it to focus on fully integrated payment and software experiences, which in healthcare includes its TrustCommerce healthcare gateway and Health IPass patient engagement solutions.

UnityPoint Health and Presbyterian Healthcare Services end their plans to merge.

Venture capital firm Andreessen Horowitz provides vendor advice from health system digital health leaders on selling AI products:

- Frame the problem instead of assuming that buyers seek AI for AI’s sake.

- Identify the person who is charged with fixing the problem, not the one who is most excited about AI.

- Understand the buyer’s roadmap to solving problems, their buy versus build framework, and their value proposition for choosing a startup versus an incumbent vendor.

- Define the ROI case and KPIs to avoid “death by pilot.”

- Focus on user workflow since organizations aren’t interested in standalone solutions and those that add steps the clinician’s work.

- Be transparent about why you need data and how it will be managed.

- Pricing methods include mirroring the cost of an existing solution that will be replaced, API-based pricing that allow customers to build their own applications, a straight SaaS subscription, and charging based on what employees would be paid to achieve similar results.

- Raise investor funds based on the high cost of compute resources that are needed to develop products. Those funds are one form of product moat, along with hiring skilled AI people, gaining access to proprietary data, and achieving market lock-in where health system customers are reluctant to replace incumbent vendors.

Announcements and Implementations

A Kerala, India-based startup creates user-friendly scheduling software that updates the assigned appointment time with a prediction of when the visit will actually begin based on the doctor’s real-time schedule. The system also allows doctors to transfer their appointments.

Financial Times-backed European startup publication Sifted asks investors which digital health companies they like, although the investors don’t indicate any financial interest in the companies they name:

- Abtrace (UK) – preventive care monitoring.

- Floy (Germany) – radiology image analysis.

- Lighthearted.AI (UK) – wearables for heart condition detection.

- Lindus Health (UK) – clinical trial platform.

- Nabla (France) – ambient documentation.

- Nebu-Flow (UK) – smart nebulizers.

- Nelly Solutions (Germany) – digital signatures and credit.

- Nyra Health (Austria) – digital stroke rehabilitation.

- Phare Health (UK) – medical coding.

- Sohar Health (UK) – insurance eligibility.

- Tortus.ai (UK) – EHR task automation for physicians.

- Upheal (Czech Republic) – note-taking for mental health professionals.

- Verisian (UK) – clinical data analysis.

Atrium Health surveys primary care users of Nuance’s DAX Copilot. Almost all report ease of use and an improved documentation experience, while two-thirds think it has improved their care delivery experience.

A LinkedIn post describes Northwestern Medicine’s pilot project for IT Locker, in which employees who forget their laptops at home can submit a quick form to receive a PIN that allows them to withdraw a loader.

Other

Doctors, nurse practitioners, and physician assistants at Allina Health System’s clinics vote to unionize and will be represented by Service Employees International Union. Physicians who were involved in the organizing campaign complained that understaffing at the clinics is swamping them with managing refill requests, patient messages, and lab results.

The parents of 28-year-old Ohio hospital ED nurse Tristin Kate Smith, who died by suicide in August, discover and publish “A Letter to My Abuser,” which they found on her laptop. The abuser she references is profit-driven health systems, which she said compromise patient care by laying off staff, ignoring nurse input, and failing to supply security to protect workers, all while providing gratuitous pizza parties and “healthcare heroes” pens. She blames health systems for exploiting nurses who are constantly being asked to do more with less while lining their pockets delivering overpriced healthcare. She concludes, “If I stay, I will lose my sanity – and possibly my life – forever.”

Sponsor Updates

- NTT Data sponsors the US Marshals Golf Classic, supporting the families of fallen officers.

- The 2023 Surescripts White Coat Award recognizes 11 healthcare industry leaders in performance, innovation, and accuracy.

- Aga Khan University Hospital in Nairobi, Kenya implements Meditech Expanse.

- Spok releases the 2023 State of Healthcare Communications Report.

- The Dermatology Specialists realizes a 50% reduction in claim submission lab and a 33% reduction in payer rejections after implement RCM optimization services from EClinicalWorks.

- Atrium Health reports that Nuance’s DAX Copilot solution has improved the documentation experience for almost 85% of physicians.

- Netsmart will exhibit at the National Association for Home Care and Hospice Conference and Expo October 15-17 in Washington, DC.

- PerfectServe will exhibit at the American Association of Physician Leadership Fall Institute October 26-29 in Scottsdale, AZ.

- Sectra releases a new podcast, “The power of remote reading – why radiologists should never settle for less.”

- Symplr partners with the Daisy Foundation to celebrate nursing excellence with the Moments that Matter video series.

- Artera, Availity, Consensus Cloud Solutions, Dimensional Insight, EClinicalWorks, HealthMark Group, Linus Health, Meditech, MRO, and Nuance will exhibit at MGMA’s Leaders Conference October 22-25 in Nashville.

Blog Posts

- What Meditech’s top podcasts reveal about healthcare drivers (Meditech)

- The 5 Biggest Takeaways from ‘Bridging the Gap,’ Our First Ever user Summit (NeuroFlow)

- Burnout’s triple threat: Compromising care, clinicians, and cash flow (Nordic)

- Top 3 Considerations for an EHR Upgrade (Optimum Healthcare IT)

- Highly Trained, Under-Utilized: Advocating for a Shift in Pharmacy Care (OmniSys)

- The healthcare executive’s guide to AI (Redox)

- NASP Recap: How Tech is Closing Info Gaps in Specialty Medication Fulfillment (Surescripts)

- For Epic Implementations the Right Project Manager is Crucial (CereCore)

- Revenue cycle 101: Referral status, authorizations vs. referrals + more (Waystar)

- The $150K Email (VisiQuate)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

The story from Jimmy reminds me of this tweet: https://x.com/ChrisJBakke/status/1935687863980716338?lang=en