Anything related to defense will need to go to Genesis.

News 5/19/23

Top News

The VA and Oracle Cerner complete their scheduled five-year contract renegotiation.

The VA’s next five-year renewal period will be changed to five, one-year terms.

The revised contract will also include stiffer financial penalties if the Oracle Cerner system fails to meet specific performance metrics.

Reader Comments

From MmSEC Observer: “Re: Veradigm. This is how private equity firms steal shareholder value in taking public companies private. They are pillaging companies that misstep software accounting rules. See Avaya.” Publicly traded digital communications vendor Avaya filed bankruptcy a few weeks ago in a deal that allowed two private equity firm lenders to take control of the company, leaving Avaya’s shareholders with nothing. The company’s problems came to light after executive changes and delays in filing earnings reports that followed a previous bankruptcy filing in 2018. A bondholder class action lawsuit accuses Avaya’s board of “massive fraud” in misleading investors. MDRX shares have lost 34% in the past 12 months versus the Nasdaq’s 4% gain, valuing the company at just over $1 billion.

HIStalk Announcements and Requests

Reminder: if your company sponsors HIStalk and is participating in the MUSE conference, give me details for my conference guide.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

RCM automation vendor Adonis raises $17 million in a Series A funding round.

Virtual care management platform vendor HealthSnap raises $9 million in a Series A funding round.

CVS Health will close the clinical trials business that it launched in May 2021. The service provided technology-drive patient recruitment, real-world data collection, and clinical trial delivery.

A Business Insider piece says that Oracle is “crushing morale” among former Cerner employees since its $28 billion acquisition of the company by these actions:

- Laying off 3,000 of 28,000 employees.

- Freezing raises and promotions.

- Vacating Cerner’s former buildings in Kansas City.

- Sidelining former Cerner CEO David Feinberg to a “ceremonial” role as chairman of Oracle Health.

Doximity reports Q4 results: revenue up 18%, adjusted EPS $0.20 versus $0.21, beating expectations for both. Shares dropped 6% on the news to their year-ago price, valuing the physician networking company at $6 billion.

NextGen Healthcare reports Q4 results: revenue up 18%, adjusted EPS $0.31 versus $0.19, beating analyst expectations for both but sending shares down on the news. NXGN shares have lost 16% in the past 12 months versus the Nasdaq’s 4% gain, valuing the company at $1 billion.

Sales

- Gundersen Health System will implement cloud-based Visage 7 Enterprise Imaging Platform in its seven hospitals and 65 clinics.

- SUNY Downstate Health Sciences University will implement Memora Health’s care delivery platform.

Announcements and Implementations

Executives for Health Innovation, which was known as EHealth Initiative through 2021, will shut down, 22 years after it was founded.

UF Health will acquire Flagler Health+ (FL), with one of Flagler’s goals being to upgrade its IT systems. Flagler chose Allscripts Sunrise in 2011, while UF Health uses Epic.

UnitedHealthcare takes heat for its decision to require prior authorization for colonoscopies starting June 1, a move that left the American Gastroenterological Association “profoundly alarmed and disappointed.” The insurer says approval will be immediate for procedures that follow evidence-based guidelines and within two days otherwise.

OpenAI launches ChatGPT for the IPhone on the Apple App Store.

Government and Politics

A judge orders Theranos founder Elizabeth Holmes to report to prison to begin serving her 11-year sentence for investor fraud, rejecting her last-minute bid to remain free while she appeals. Holmes and former Theranos COO Sunny Balwani, who is serving a 13-year sentence, were also ordered to pay $452 million in restitution to 12 defrauded investors and former partners Walgreens and Safeway.

An Oklahoma doctor and pharmacist are charged with manslaughter in the death of a 75-year-old rehabilitation center patient from a methotrexate overdose. The physician admitted that he didn’t order correctly, while an investigation found that the pharmacist ignored the computer’s red-letter warning that the prescribed dose of 20 mg of methotrexate daily for seven days – instead of the intended 20 mg every seven days – was excessive.

Privacy and Security

A proposed Federal Trade Commission order would bar ovulation tracking app Premom from sharing user health data in charging the company with making unauthorized disclosures to third parties when its privacy policies claimed it doesn’t. The company will also pay $200,000 in federal and state fines.

Related to the Premom order, FTC seeks comments on its intention to extend the Health Breach Notification Rule to cover health apps.

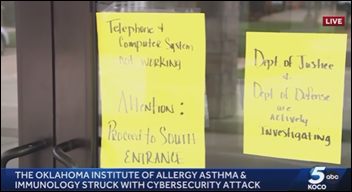

An Oklahoma allergy clinic shuts down permanently following a cyberattack. The clinic’s physician owner says all of the practice’s technology was impacted when she and her husband downloaded an unspecified IPhone app, locking them out of all of its systems even as patients were receiving appointment reminder text messages. The owner says that the FBI, Department of Justice, and Department of Defense are investigating, but the FBI says it has received no reports about the issue. Social media comments claim that the same doctor abruptly shut down other clinics, including a medical spa, for reasons unrelated to technology.

Sponsor Updates

- Divurgent releases a new episode of The Vurge Podcast, “Digital Mental Health Insights: Breaking the Stigma with Data.”

- Fortified Health Security names Candace Manning (Lifeway) client success manager.

- Loyal wins Best Patient Registration and Scheduling Solution in the MedTech Breakthrough Awards.

- Consensus Cloud Solutions partners with Hyland Software to offer a digital cloud fax solution that integrates with OnBase.

- AvaSure, which offers acute virtual care and remote safety monitoring solutions, establishes a chief nursing executive advisory board with 10 inaugural members.

- CereCore will recruit and train hundreds of EHR and clinical informatics staff over the next one to three years to support HCA Healthcare’s deployment of Meditech Expanse.

- Nordic releases a video titled “The Download: Valuing IT as an Asset to Improve Patient Care.”

Blog Posts

- What does Consensus CTO, Jeffrey Sullivan, have to say about Generative AI? (Consensus Cloud Solutions)

- Can AI Replace Your Doctor? (Dimensional Insight)

- HIPAA: 4 Enforcement Discretions Expire with End of PHE (Experity)

- The key to better, faster innovation: Healthcare data standardization (Intelligent Medical Objects)

- Demystifying Compliance: How Interoperability Solutions Can Simplify Healthcare Regulations (Medhost)

- In Healthcare, an AI Pause Isn’t Feasible. But, an AI Strategy Is. (Lucem Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

I don’t have the feeling VHA considered options other than negotiating a revised deal with Cerner. Ed Meagher makes a pretty compelling case in Fed News Network with “Time for VA to admit the EHR system is a failure, revert back to VistA”.

As a recently-departed Cerner farmhand, I can tell you that morale *is* awful and has gotten steadily worse through the Oracle acquisition. But it’s laughable that Feinberg’s relegation to “Chairman” is at the root of anyone’s dissatisfaction. He showed up, took some selfies and high-fived some clients, cashed $30m in checks, and now takes selfies and high-fives the clients who are left. Not a single person below the EVP level cared before and they certainly don’t care now.

The VHA / Cerner deal was always going to be highly scrutinized and problematic. VistA was built/customized over a 25 year plus span of time. No system will be able to duplicate the process. Not Cerner nor Epic. Everyone points fingers. All the parties need to settle down, get the lobbyists out of the way and make good decisions at the table. The system will work, and it does work but no one wants to change. Change is good when thought out And understood.

As for the morale at Cerner in Kansas City and across the world this is disappointing. Neal never wanted this to happen he was all about technology enhancing healthcare. The one thing Neal failed at was leaving a solid legacy plan. Clients are dropping Cerner. I don’t understand has the VA drained Cerner of its ability to still meet the needs of its clients?

Not to be rude or speak ill of the deceased, but Neal had several large-scale failures besides the legacy plan (which they probably should have just given the job to Zane, but that’s another story)

– Never having a remotely competent Revenue Cycle platform

– Never really integrating Siemens after he acquired them (They offered both products for years which was ridiculous)

– Never having a competing offering to Epic’s MyChart

– The over reliance of CCL

– Never really utilizing the original AWS partnership to its full potential

– Not forking the code for CommunityWorks, as many code releases and new solutions weren’t multi-tenet compliant

All of these happened under his leadership. The man built, at one time, a solid company and product, but he is also just as responsible for its demise…

Shame on you UnitedHealth for slowing down access to care and increasing system costs in the form of requiring prior authorizations for colonoscopies.

I’m likely “preaching to the choir” here, but the lengths that you will go to prioritize profits above access to care never ceases to amaze me. As a former Optum employee, the decisions I continually saw and the associated rhetoric were more than I could handle.

Reckless journalism by promoting the comparison of Avaya to Veradigm. One was profitless and riddled in debt (avaya), the other (Veradigm) is debt free and turns a profit each year. Poor editorial review to post this comment by someone who seems biased and maybe even ill intentioned.

Hold your horses there, SLOMI. Never shame reporting, especially when it is transparent and 100% fact based regarding a PUBLICLY TRADED COMPANY who is ON NOTICE with NASDAQ!

Avaya is very profitable as a stand alone business (may not be the case moving forward as clients sprint away after 2nd BK yet that takes some time). Last filed 10k/earnings was $750m Revenue. Valued at over $3b before the Private Equity Landgrab, which was precipitated by “Review of Internal Controls around Revenue Recognition”

{Veradigm statement about 10k delays “The reason for the expanded audit procedures stems from detected internal control deficiencies related to revenue recognition, and this reasoning has not changed”} Hmmm…

Yes. It carried historical debt from legacy businesses (Nortel/Lucent), yet had a more significant reoccurring revenue base of business than Veradigm/Allscripts.

Here is the CEO after the 10k delay (actually same exact place in timeline as Veradigm is now)

https://youtu.be/5XZg-59yjPE

What’s actually funny is your comment is EXACTLY what the Avaya leaders claimed 3 mos before bankruptcy filing. What you fail to acknowledge is Avaya DID NOT “GO Bankrupt”, it Chose Chapter 11 in order to wipe out debt and take it private, driven by private equity manipulation BECAUSE of Accounting Irregularities. Have you not followed the stakeholders involved with Veradigm?

Please follow the breadcrumbs. Certainly, the Private Equity Goons who are working hard to take it over don’t have as much leverage without the debt situation as Apollo had with Avaya, yet they have ALL the LEVERAGE IF there were any Accounting Irregularities.

While they line up the levers to accomplish their goal, they COUNT on people like you to gaslight any doubter. Same. Exact. As Avaya.

Here are some resources to educate you further on where your facts are missing:

https://www.theatlantic.com/ideas/archive/2023/05/private-equity-firms-bankruptcies-plunder-book/673896/

Now, I personally LOVE the Faraday Future Story, where PE plotted via few board seats and a planted interim CFO, to take them BK, and the EMPLOYEES FOUGHT BACK!!!!!!!! It’s a Diamond in the Rough. Most companies gaslight their haters and give the runway for the PE to do the deed. If you don’t want this for Veradigm, you better take a chapter out of the Faraday Book!

https://pandaily.com/faraday-future-employees-decry-bankruptcy-efforts-by-malicious-board-members/

KEEP TOP OF MIND that some boards find giving equity to PE is a lot easier than rolling over for the SEC if there is a paper trail of improper reporting of ARR.

Advice to you? FIGHT BACK Faraday Style!

My issues is your statement is inaccurate, the companies are in starkly different situations. You agree with me too, “Private Equity Goons who are working hard to take it over don’t have as much leverage without the debt situation as Apollo had with Avaya.”

Yet you miss the critical end of that sentence

—- “..yet they have ALL the LEVERAGE IF there were any Accounting Irregularities”

Avaya didn’t go BK because of debt. They had enough cash to pay down the bonds. They went BK b/c PE needed them to to take it private. They got the BoD to agree to it to avoid SEC charges due to FINANCIAL IRREGULARITIES.

The 10k delays are NOT because they can’t figure out the #s, past and present. They are b/c they are still lining up the plan to take Veradigm private. They are dotting the i’s and crossing the t’s. They will avoid filing any new 10ks or 10qs to avoid handing the SEC details that could incriminate them.

I don’t agree with you. I just share that everyone foolishly believed Avaya was saddled with unmanageable debt. They were not. It was a choice to take the road they did. And PE goons blackmailed then because of financial reporting irregularities.

Again….Avaya didn’t need the debt for PE to do what it did. Debt is just what grabs headlines. It was 💯 a consequence of financial irregularities.

{GREAT TRIVIA QUESTION ❓ When is the last time a public company delayed multiple 10ks and then reported a positive 10k? I will wait for it. As it does not happen. They go private instead}