Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…

News 2/24/23

Top News

Teladoc Health reports Q4 results: revenue up 15%, EPS –$0.23 versus –$0.07, beating revenue expectations but falling short on earnings.

The company reported a staggering $13.7 billion loss for FY 2022, much of that attributed to goodwill write-downs related to its $18.5 billion acquisition of Livongo in August 2020.

TDOC shares have lost 56% in the past year versus the Dow’s 2% loss, valuing the company at $4.8 billion, having lost about 90% off its value since early 2021.

From the earnings call:

-

CEO Jason Gorevic called Q4 results a strong finish to a “challenging year” in a “more challenging macro environment” that he expects will persist.

-

The company will cut costs, including layoffs and restructuring.

-

Teladoc’s BetterHelp online behavioral health business, which it acquired in early 2015 for $4.5 million, performed well. Teladoc says it has become a billion-dollar business. The company will start reporting performance in two segments, integrated care and BetterHelp.

-

The company expects its employed physicians to eventually conduct more than 50% of visits versus its use of independent contractors, which it says will increase physician productivity and patient satisfaction.

Meanwhile, an outstanding article in MedCity News asks former Livongo CEO Zane Burke directly, “Did you sell a lemon to Teladoc or did they mess up?” Burke says Livongo was a “freaking good business” and that Teladoc was the pursuer of the transaction, but Teladoc’s executives “really liked themselves a lot” and thought they were “clever” in operating a roll-up business versus Livongo’s organic growth and intellectual property. He says Teladoc’s timing was terrible in hindsight and questions why Teladoc’s offer didn’t require Livongo’s executives to stay on board when the acquisition closed, after which 11 of 12 members of Livongo’s leadership team departed.

Reader Comments

From Another NY SR IT Leader: “Re: Sunrise. In addition to Northwell moving to Epic, Altera has Memorial Sloan Kettering, St. Barnabas Bronx, and Brooklyn Hospital all implementing Epic. NYC was once a stronghold for the former Eclipsys Sunrise.”

From Humeris: “Re: HIMSS. Sebastian Krolop, MD, PhD, global COO and strategy officer at HIMSS, has left. Cultural differences with Hal were cited. Another sore spot was his failure to get any traction with Accelerate, the networking platform that he engaged McKinsey to plan and develop.” Verified that he has left after four years, per his LinkedIn post of three weeks ago. As for Accelerate, even HIMSS CEO Hal Wolf hasn’t posted anything, and its LinkedIn page’s last updates were from HIMSS22.

Webinars

February 28 (Tuesday) 1 ET. “Words Matter: Simplifying Clinical Terms for Patients.” Sponsor: Intelligent Medical Objects. Presenters: Whitney Mannion, RN, MSN, senior terminologist, IMO; David Bocanegra, RN, nurse informaticist, IMO. The language of medicine can be confusing and contradictory to patients, challenging their ability to prepare for a procedure or pay their bills. This webinar will explore how the words that are used to communicate – online, in print, and in person – must be chosen carefully to allow patients to comprehend their diagnoses, treatments, and care plans. The presenters will also describe how the ONC Final Rule for the 21st Century Cures Act will make clinical and technical language more directly accessible through patient portals.

March 7 (Tuesday) noon ET. “Prescribe RPA 2.0 to Treat Healthcare Worker Burnout.” Sponsor: Keysight Technologies. Presenters: Anne Foster, MS, technical consultant manager, Eggplant; Emily Yan, MPA, product marketing manager, Keysight Technologies. Half of US health systems plan to invest in robotic process automation by the end of this year, per Gartner. The concept is evolving to help with staff burnout and physician productivity. The presenters will introduce RPA 2.0, explain how to maximize its value, demonstrate how to quickly start on RPA 2.0 and test automation in one platform, and answer questions about healthcare automation.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Amazon closes its $3.9 billion acquisition of primary care provider One Medical as the Federal Trade Commission fails to challenge the deal by the deadline. FTC has warned the companies that closing the acquisition before its approval is at their own risk, as FTC is still reviewing the transaction. Amazon has already launched a $144 first-year membership in One Medical, which offers 24/7 virtual care via messaging or video, online appointment scheduling, and prescription management. One Medical also runs physical offices in 22 metro areas that offer on-site lab services. One Medical is a concierge medical practice rather than direct primary care — it bills services to the patient and their insurance like any other non-DPC practice, promising only a more satisfying patient experience.

Independent primary care network operator Aledade acquires Curia.ai, which offers AI-based value-based care analytics for optimizing patient care and engagement.

Premier Inc. acquires the “Top 100 Hospitals” program from Merative, formerly IBM Watson Health, which it will integrate with its PINC AI technology and services brand.

Chartis acquires DES Health Consulting, whose workforce assessment tool will be offered as the Chartis Center for Burnout Solutions.

Axios reports that healthcare automation startup Olive AI will sell its payer prior authorization business, one of the company’s two remaining business lines. Olive’s headcount has been reduced by more than half via previous asset sales and layoffs.

Sales

- Memorial Healthcare System implements a virtual care service that is powered by KeyCare’s Epic-based platform.

- Augusta University Health chooses the turnkey virtual health solution of Biofourmis to expand its Virtual Care at Home program.

- Silverado will implement hospital and palliative care software and analytics from WellSky.

- Mount Graham Regional Medical Center (AZ) will implement BridgeHead Software’s HealthStore as a clinical data repository for retired applications.

People

Benefits administration technology vendor Bridgeway Benefit Technologies hires Todd Plesko, MBA (GHX) as CEO. He replaces Jenny Morgan, MS, who will retire and serve as board chair.

Deborah Norton, MBA, who retired as CIO/SVP for operations from Harvard Pilgrim Health Care in mid-2021, died Saturday at 69.

Announcements and Implementations

A new KLAS report on long-term care EHRs finds that PointClickCare has the highest market share and customer satisfaction, while Epic performs well for health system-owned LTCs.

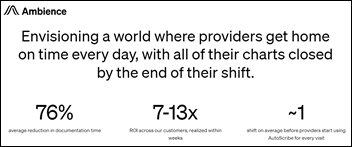

Ambience Healthcare launches an AI-powered, human-free medical scribe that embeds in EHR workflow to allow providers to review, edit, and sign off on their notes nearly immediately. The company has raised $30 million through a Series A round.

Government and Politics

A VA official warns that the problem that forced a delay in the planned Oracle Cerner go-live at its Ann Arbor operation, which it announced last week, is likely to affect any VA hospital that conducts clinical research and needs integration with research-based systems.

Companies may no longer require laid-off employees to sign confidentiality agreements or non-disparagement clauses as a condition of receiving severance benefits, per a National Labor Relations Board ruling that takes effect immediately.

The American Hospital Association writes a letter of opposition to the FTC’s proposed rule that would prohibit employee non-compete agreements. AHA says that FTC doesn’t have the authority to enforce the rule, it would affect only new agreements since FTC doesn’t have retroactive authority, the rule should not apply to highly paid hospital executives and physicians, and FTC does not have legal authority over non-profit entities and therefore a non-compete ban would place for-profit hospitals at a disadvantage.

Other

Folks who tamp ear wax into their skulls by using Q-tips like Civil War cannon rammers might want to swap out for Smart Visual Ear Cleaner, a $30 smartphone-paired tool that features an in-ear camera and a series of silicone scrapers. Although I might spring an extra $5 for the Bebird version that Best Buy sells (pictured above). Some people are addicted to shoving swabs into their ears with the regularity of brushing teeth, sometimes puncturing their ear drum and surely knowing from a basic anatomical standpoint that it’s a bad idea. The third, non-technical hygiene option is perhaps best – use an ear wax removal kit that contains a peroxide solution that fizzes wax right out, which offers comfort of knowing it is working by the sounds of percolation that seem to emanate from deep inside your head and the trickle of the resulting output running down your cheek.

Sponsor Updates

- Ellkay will exhibit at Rise National March 6-8 in Colorado Springs.

- GHX has been named a Notable Vendor in the 2022 Gartner Vertical Industry Context: ‘Magic Quadrant for Multienterprise Supply Chain Business Networks.’

- InterSystems announces that its HealthShare Unified Care Record has earned a Certified Data Partner designation from NCQA’s Data Aggregator Validation Program.

- Clearsense posts a new case study, “Accelerating Research and Delivering Enhanced Patient Insights with Population Health.”

- VA names NeuroFlow one of the winners of its Mission Daybreak Grand Challenge, designed to discover new solutions to reduce veteran suicides.

Blog Posts

- Is Your Clinical Data Analytics Solution Missing Vital Drug Data? (First Databank)

- Partnering to Improve COVID-19 Vaccine Outreach (Get Well)

- How Cloud Technology Transforms the Life Sciences Organizations (Healthcare Triangle)

- How to Succeed in HIT Implementation: Taking Technological Change to the Next Level (HealthTech Resources)

- How Patient Education Improves Patient Experience (Healthwise)

- Achieving scale in health IT: The power of terminology-based normalization solutions (Intelligent Medical Objects)

- 2022 Cost of a Data Breach Report: What You Need to Know (Medhost)

- Using technology for more efficient transitions of care and a better patient experience (Meditech)

- Overcoming Staffing Shortages in the Lab: Finding the Right Fit Consulting Firm (JTG Consulting Group)

- 4 Questions to Drive Effective Data Management for the Future in Healthcare Analytics (Net Health)

- Navigating outpatient best practices, part 2: How AI-powered workflows drive appropriate documentation accuracy and reimbursement (Nuance)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Eclypsis dead now ( been on the decline since Allscripts purchase) the last bastion Northwell move to Epic

Most of the IT leadership said they would quit if they saw Epic coming so that’s what happened. They held out so long thanks to Bosco being friendly w/ the allscripts senior brass and golf outings

Terrible to see a good product like Sunrise … hmmm sunset in this fashion first with the acquisition by Allscripts and then lack of integration etc.

Northwell was Allscripts biggest customer paid over $100M in EHR support fees and Managed services probably upwards of $500M

Teladoc patient experience is pathetic and so are some of the physicians who are probably the bottom of the barrel

If you tie all this up, connection to Glen Tullman, Lee Shapiro and gang rope in Zane Burke and some cerner ppl probably having had the last laugh after being fired at Allscripts, starts Livongo and again a massive pay day awaits selling a shaky at best business at a premium. shame on Teladoc execs however… not that Teladoc business was any great shakes, but for the pandemic they would be nowhere and most of them would have not had huge pay days. not a sustainable business though technology should be embraced physician adoption remains a huge barrier as does the technology itself that fails > 50%