Monday Morning Update 11/22/21

Top News

The Wall Street Journal reports that two private equity firms are close to a deal to acquire Athenahealth for $17 billion, including debt.

Bain Capital and Hellman & Friedman LLC are reported to be the high bidders in an auction of the company, which its owners planned to have completed in early 2022.

A private equity firm and hedge fund took Athenahealth private four years ago after they forced the ouster of CEO Jonathan Bush, combining the company with a GE Healthcare unit it had acquired and renamed to Virence Health. Their total acquisition cost was $6.8 billion.

HIStalk Announcements and Requests

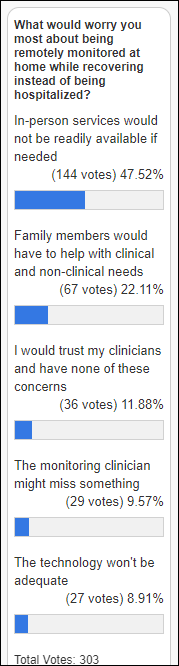

The significant concern poll respondents have about remote patient monitoring is that they will need services that aren’t readily available, which explains why investor-backed companies are springing up to provide paramedics and other licensed people to visit patient homes for the hands-on component that would otherwise require a trip to a provider’s location. IANAL questions why a patient would choose care at home when it is perceived as inferior and may not save the patient money, while Paula says triaging will be important since not all recoveries or home situations support at-home care. I agree with both comments – it may be that at-home care isn’t appropriate for many or most patients and will never deliver on “hospital at home” expectations, but could provide a way to reduce the length of hospital stays and make some patients happier. Payment will likely drive adoption as it always does in healthcare, so the ball is in the hands of CMS and insurers.

New poll to your right or here: How are your employer’s 2022 business prospects looking compared to 2021?

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

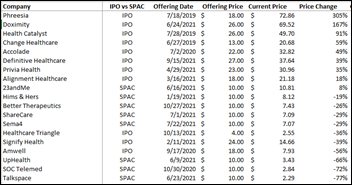

I was curious about the stock performance of digital health companies that have gone public in the last couple of years, so I asked Chris McCord of Healthcare Growth Partners – which is my go-to source for brilliant market analysis – if he could save me some legwork with a list of companies. I excluded those that I consider marginally tech related, such as Medicare Advantage insurers and primary care operators, which left me with this list:

- About half of the companies are trading at below their initial offering price.

- Companies that went public via a SPAC merger performed much worse than those that did an IPO. SPAC popularity as a mechanism to go public has plummeted in the last few months, with some of the shell companies failing to find acquisition targets within the required timeframe.

- Buying an equal number of shares of each company at their IPO price would have increased the investment by about 37%, but obviously over various time periods.

- While Phreesia is the big winner in price change, Doximity has earned the highest market cap at nearly $13 billion after just five months of public trading.

- Livongo fell off the list since it was acquired by Teladoc Health, whose share price has increased 516% since its July 2015 IPO even though share price is down 56% from its January 2021 high.

Nuance announces Q4 results: revenue up 8%, adjusted EPS $0.09 versus $0.14. The company’s acquisition by Microsoft is expected to close in early 2022.

People

Population health management platform vendor AssureCare hires Ankit Rohatgi, MD, MBA (Medpulse) as chief clinical officer.

Announcements and Implementations

Vocera releases a skill for Amazon Alexa that allows patients to reach the right care team member and obtain stay information using voice requests made to an in-room Echo device.

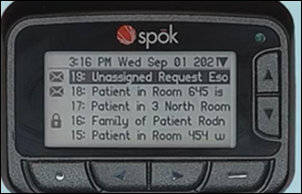

Spok launches GenA, a one-way alphanumeric pager that includes a high-resolution display, advanced encryption, and over-the-air remote programming to provide reliable, survivable, and affordable critical communications capability regardless of cell coverage.

Sponsor Updates

- Clearwater publishes a new report, “Connecting the Dots Between Cyber Risk and Patient Safety.”

- PMD celebrates its 23rd anniversary.

- Sonifi Health publishes a new case study, “How technology can improve HCAHPS Scores: A 5-year impact case study.”

- Sphere releases the results of a consumer survey focused on the use of online payment tools for medical bills.

- HIStalk Sponsors exhibiting at RSNA November 28-December 1 in Chicago include Agfa HealthCare, Change Healthcare, Elsevier, Lyniate, Mach7 Technologies, Nuance, OneMedNet, Sectra, Visage Imaging, and Wolters Kluwer Health.

Blog Posts

- Be there when your ideal patient and provider meet (OptimizeRx)

- You can’t always get what you want (Nordic)

- 7 reasons payers should adopt AI and join the Internet of Healthcare (Olive)

- Just Say No to Drug(s) Discount Cards (OmniSys)

- How COVID-19 Impacted Timeliness of Care (PatientBond)

- 6 Questions an EHR Consultant Can Help You Answer (Pivot Point Consulting)

- Leveraging Supplemental Benefits: Moving from Extras to Essentials (Dina)

- Accelerating Speed to Care with Unified Healthcare Communication (PerfectServe)

- Benefits of Physician Peer Review (Symplr)

- Advancing Clinical Research with the PINC AI Research and Innovation Collaborative (Premier)

- 3 Steps to Elevated Diversion Monitoring: Takeaways from the 2021 NADDI conference (Protenus)

- How Leading NextGen Users Leverage Our Revenue Cycle Engine (RCxRules)

- ‘Tis the season. Reflections on 2021 and the storm brewing for health plans in 2022. (Redox)

- 7 Tips to Address Medical Practice Burnout (Relatient)

- Let Doctors Be Doctors with Better Patient Data (RxRevu)

- Sky’s the Limit! Two Nuance Managers Share Their Advice (Nuance)

- Why Pagers Still Matter: The History of Pagers (1921-2021) (Spok)

- Magic at the Hospital (Summit Healthcare)

- Nurses are Uniquely Positioned to Bridge Gaps in Care (Twistle)

- Breaking News: CMS Greenlights Automatic MIPS Flexibilities for 2021 (WebPT)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Healthcare data sucks - that song turned my Friday to Friyay!!! Gave me the much needed boost to get through…