I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…

Readers Write 7/28/10

Submit your article of up to 500 words in length, subject to editing for clarity and brevity (please note: I run only original articles that have not appeared on any Web site or in any publication and I can’t use anything that looks like a commercial pitch). I’ll use a phony name for you unless you tell me otherwise. Thanks for sharing!

How to Use Meaningful Use Measures to Improve Internal Processes

By Shubho Chatterjee, PhD, PE

The final ruling on Meaningful Use was released by the Centers for Medicare and Medicaid Services in July of this year after a year of comment period and revisions. According to the final ruling, to be eligible for incentive payments, Eligible Professionals (EPs) are required to submit to the CMS, starting October 2011, 20 objective measures for 15 core objectives and an additional five from a menu of 10. For hospitals and Critical Access Hospitals (CAHs) the corresponding measures are from 14 core objectives and five from a menu of 10.

There are various efforts, dialogues, and debates underway regarding the ability of EPs, hospitals, and CAHs to meet the reporting requirements, whether the cost justifies the incentives, and the sheer human and technical capacity needed. I will not further add to the discussions but will rather focus on how the MU criteria can be used to further improve care delivery process, make it more efficient, and positively impact the operating margin. After all, a measure is related to the output of a process, and while a measure can be met, it can also be used to hone into the process and sub-processes for improvement.

Let us consider some of these Stage 1 measures and how the underlying processes supporting the reporting of the measure can be identified and improved to further improve the measure, the care delivery, and the operating margin.

Stage 1 Measure

More than 30% of unique patients with at least one medication in their list seen by the EP or admitted to eligible hospital’s or CAH’s ED have at least one medication order entered using CPOE.

Implication

Let’s assume that the provider meets the 30% threshold for the reporting period. A logical follow-through is to examine why the remainder are not CPOE and what were some barriers overcome to reach this threshold. Is it because for the remainder unique patient population, data entry is manual because other providing locations are not CPOE enabled, CPOE is available but under-utilized, or are there manual data entry requirements into and between various systems and consolidate the data to one final measure?

Each of these barriers point to a different challenge. The first is system unavailability (a business decision). The second is a change management (a people challenge). The third is a technical and process automation challenge requiring an interface or other electronic inputs, such as document management and integration.

Stage 2 and Stage 3 measures will increase the threshold. Thus the underlying process or system gaps should be identified not only to meet later Stage measures, but to improve process efficiencies as well.

Stage 1 Measure

More than 40% of all permissible prescriptions written by the EP are transmitted electronically using certified EHR technology.

Implication

Assuming the 40% threshold is met, what is necessary to increase the measure? Is it because of volume of data entry from single or multiple locations, or system not fully utilized, or could it be because the receiving pharmacy or is unable to manage additional increases to their receiving capacity from their customers? Again, the barriers are similar to the above and need to be analyzed and overcome.

Stage 1 Measure

More than 10% of all unique patients seen by the EP are provided timely (available to the patient within four business days of being updated in the certified EHR technology) electronic access to health information subject to EP’s discretion to withhold certain information.

Implication

This requirement has procedural, technical, and operational implications. The procedural requirements are in providing HIPAA compliant health information, while the technical requirements are in the mode of providing the information. For example, will a secure patient portal be created, will the information be provided in memory sticks or other portable devices, and if so, what is the encryption or data protection policy?

Note that, depending on the technical solution selected, there are supply chain and purchasing requirements as well, to maintain and increase the measure threshold.

Summary

While the MU provides financial incentives for healthcare organizations, it ends in 2015. It is important for healthcare organizations to use this opportunity, not only to prepare, apply for, and receive the incentives, but to examine their organizations deeply from People, Process, and Systems perspective to utilize and enhance the measures.

Only when these three supports are robust and reliable will the Meaningful Use be truly meaningful to the healthcare system, where the improvement of quality of care is the most important objective and operational improvements and business growth will likely follow.

Shubho Chatterjee is chief information officer of Miami Jewish Health Systems of Miami, FL.

Bringing Medical Terminology Management into the 21st Century — Just in Time for ICD-10

By George Schwend

ICD-10 promises to improve patient safety, the granularity of diagnosis codes, and diagnostic and treatment workflows as well as billing processes. Sounds like a dream, right? But close to three years from the mandated switch on October 1, 2013, most hospitals and health systems are still thinking of it as a nightmare, dreading the massive amount of time, effort, and money the transition will require.

What many fail to grasp is that ICD-10 is just one step on an endless road. There are already dozens of code sets that will probably eventually need to be integrated with each other — from SNOMED-CT and LOINC to RxNorm to local terminologies and proprietary knowledge bases — and all of them are constantly evolving. Look down the road and you can see ICD-11, already in alpha phase in Europe.

Instead of tackling each new iteration as if they were setting off on a major road trip through uncharted territory, providers, payers, and IT vendors need to ditch the proverbial roadmaps and get themselves a GPS unit. That way, they can simply enter each new destination as it comes along and travel there automatically.

And automation is what true semantic interoperability requires. Our metaphorical GPS could either be embedded in proprietary HIT software or plugged into a hospital’s or payer’s information system and triggered by specific events such as an update or the need to create new maps. It would allow users to automatically:

- update, map, search, browse, localize, and extend content

- incorporate and map local content to standards

- update standard terminologies and local content

- generate easy-to-use content sets to meet the needs of patients, physicians, and customer support professionals

- reference the latest terminology in all IT applications

- codify free text

- set the stage for converting data into actionable intelligence

Happily, software that fits the bill is already available, in use today at more than 4,000 sites on five continents. It provides mapping and terminology for leading HIT vendors, for health ministries like the UK National Health Service, and for standards organizations such as the IHTSDO, owner of SNOMED-CT., allowing them to not only implement new codes but synchronize codes throughout an enterprise, be it a physician practice or a country.

If you are still having nightmares about ICD-10, this your wake-up call. The ability to merge and manage diverse content from multiple sources — including free text from physician dictation — is what will turn ICD-10 from a frantic, one-off billing upgrade to one in a series of opportunities seized: to move clinical diagnosis to a new level, for example, to optimize EMRs, to meet meaningful use requirements, to satisfy quality initiatives such as the Physician Quality Reporting Initiative and to support robust analytics and reporting.

Can a roadmap do all that? Hardly.

George Schwend is president and CEO of Health Language, Inc. of Denver, CO.

HIE Market, A Shot in the Arm

By Tim Remke

The HIE market finally got a shot in the arm with the passage of the federal stimulus. This and other tailwinds sent hundreds of millions of dollars over the next few years toward the HIE market. From this point on, the HIE market gets muddled. Questions such as who is marketing their solutions to which markets, what deployed-use cases are functional or even operate at a high level, and what differences exist between multi-stakeholder, state, and private HIEs are mixed among many other multi-faceted questions.

The definition of a health information exchange has diluted the significance of surveys and results, particularly when they seek to understand what types of data are exchanged, the number of HIEs in the market and their respective operational capacity, and technological and governance structures. Simply, too many results are ‘self-reported’ and produce statistically insignificant, inaccurate, or misleading data points.

Of particular concern, several market surveys and reports related to the HIE market have commingled data by combining statistics from provider organizations that use solutions developed for basic hospital portals — a far cry from a broader HIE platform. Finally, HIEs may be private, multi-stakeholder, or statewide entities. In addition, payer system and public health play a role of delineation. The idea of ‘community HIE’ is limiting, and does not tier appropriately the HIE market.

With this perspective and understanding, we assess a few basic aspects of the current state of the HIE market.

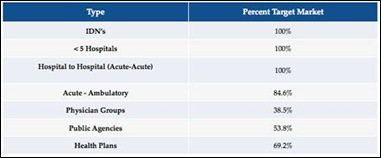

Target Markets

A tremendous amount of friction exists over what specific HIE markets are accelerating at a pace greater than others, and which companies target each market. For example, a few vendors are persistent in their belief that the private HIE market is really the first ‘go-to-market strategy’ place. They look for localized geographies or a few hospitals to install an HIE platform as an overlay solution to act as a ‘buffer’ to a larger regional or statewide exchange.

Within the same HIE market, but more counter to this strategy, are the vendors who seek larger contracts from statewide or vast regional, multi-stakeholder exchanges. Two different approaches that produce some small and other more significant variation in solution focus and offerings. However, the data indicates a consistency that is expected. A

ll vendors will market to almost any market. However, slicing through the data, we see vendors that are targeted. All focus on hospital to hospital environments. Approximately 85 percent focus on providing an acute to ambulatory framework, also; and less than 40 percent offer a platform that readily integrates physician groups.

In addition, and somewhat paradoxically, many solutions are simply not designed to operate as platforms for vast geographic or state exchanges. Therefore, for the multi-stakeholder market, HIE solutions are discriminating. Contrast arises between target markets and the ability of the solution to match the specific market. Unlike other segments, HIEs seem as equally conflicting in details as they are syncopated — characteristics of a nascent market (relative to the past few years).

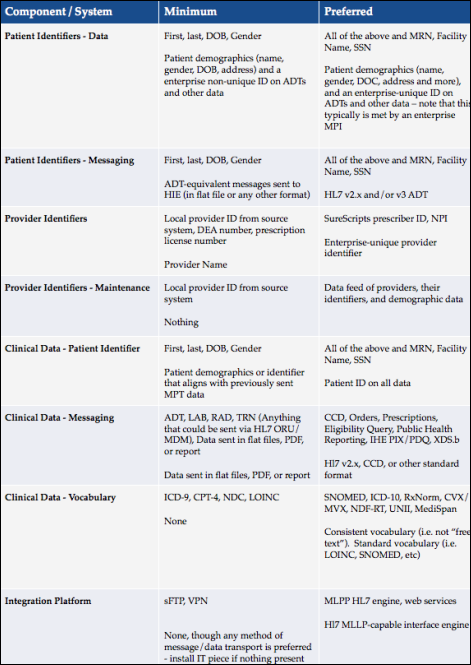

Critical Minimal Requirements

In recent months, we have seen a number of RFPs that contain a significant number of demands. However, they mask a serious issue in the HIE market. The reality is most HIEs are ill-equipped to take on sophisticated and complex solutions, use-cases, and technical architectures they greatly desire. Furthermore, over 65 percent stated the minimal exchange of data from information systems were posing “mission critical problems” with their respective exchange, and will succumb to “serious delays”. The table below looks at minimum versus preferred requirements for an exchange structure.

Conclusion

Finally, the HIE market is dynamic and has hit full stride. Companies that have weathered the storm seek potential exits (i.e. merger and acquisitions) while others are ramping their solution for the future. The market will likely extend an abnormal growth rate for the next one to two years.

However, many unanswered questions will remain. Business models, measured quality improvements, and funding, among other items persist into the future as open question marks. For example, initial stimulus funds will jump start statewide HIEs. However, after these funds have been depleted, real concerns about long-term viability and funding sources will endure.

Tim Remke is vice president of business development for HealthcareCIO, which produced the Health Information Exchange (HIE) Comprehensive Analysis & Insight report from which aspects of the above article were taken.

Tim is correct:”However, after these funds have been depleted, real concerns about long-term viability and funding sources will endure.”

These systems will require $ billions in maintenance which will be money that otherwise would go to patient care. Overhead has just quintupled.

Docotrs should avoid the temptaion to participate in this scheme that has no proven safety or efficacy.

Rather than blame HIT for adding overhead costs, why not demand a single payer system. That alone could reduce overhead across the board and free up vast resources for patient care.

Another HIE study? At least this one looks like it might be a bit more grounded in reality and has some potentially unique stuff I would be very curious to see including some of the figures in the ‘Data Growth Analysis and Projected Patterns’ section.