Fear not Epic sycophants. If real interoperability and patients owning their records on a standard uniform file that could be…

News 4/22/09

From Susie Adamo: “Re: CCHIT. Definitely adding headcount. They just hired Bobbie Byrne, who is a pediatrician who recently left Eclipsys, where she ran clinical strategy.” Unverified – not yet reflected on her LinkedIn profile or on the CCHIT site.

From Stella Artois: “Re: Being John Glaser. I love the column. I had dinner with John one night, touched his shirt sleeve, and didn’t wash my hands for days (despite all infection control precautions). He is my idol and I do so love his latest inspirational post that I am handing it out to wannabe CIOs.” John’s postings may be less frequent as he starts his ONCHIT gig in a couple of weeks, so he may be busy and/or muzzled. I replied to his e-mail asking if he’ll get to bunk over in the Lincoln Bedroom, run up a big expense account tab, and enjoy the thanks of a grateful nation. He said he’s not sure about all that, but he’ll be able to to see the Capitol from his office window. Well, that’s fairly cool.

From The PACS Designer: “Re: Oracle buys Sun. Mr. H. and HIStalk readers know that TPD has been fond of Oracle for their focus on the healthcare space. Now, an Oracle-Sun Microsystems combination will bring a powerful offering of open software solutions that prospective customers can choose to meet their upgrade needs. Additionally, Sun Microsystems storage solutions can further enhance the performance when integrating numerous databases within the enterprise to create a neutral archive.”

From Californian: “Re: the data model that nearly killed Joe. It’s from Epic. Would you have the courage to publish this factoid?” Apparently I would. Still, to single out Epic wouldn’t really be fair since the problems he describes mostly involve (a) caregivers who didn’t use the system; (b) caregivers who didn’t deliver patient care all that well; and (c) caregivers who were using a system that they claim wasn’t designed well for their work (or could it be that their work wasn’t all that well designed and standardized that no amount of programming could support it?) and (d) caregivers dealing with patient information stuck in the the never-ending and very deep chasm between outpatients and inpatients (which are actually the same patients, of course) created by different billing rules (they don’t even speak the same language, such as “episodes” vs. “visits”). Nobody puts a gun to the head of a hospital and/or practice group to buy a company’s software, so if it doesn’t work well for their situation, I’d put the blame on the user for voluntarily choosing it. I wouldn’t be able to critique the data model without seeing it and neither would a patient who experienced what they felt was substandard care, no matter how technical their background. I doubt any hospital could say with certainty that they don’t have stories just like that one in their own place.

Former Wipro executive Ramesh Emani starts Insta Health Solutions, a Bangalore-based hospital information systems company selling low-cost systems for small hospitals. It has 20 customers already and plans to have 2,000 within five years.

The New England chapter of HIMSS will have its public policy event on May 8 in Norwood. Agenda here (warning: PDF).

Thailand’s medical tourism hospital Bumrungrad International Hospital will deploy a medication verification system that runs on Motorola (aka Symbol) MC50 PDAs.

A reader asks: are companies out there asking employees to resign rather than calling it a layoff (which would allow affected employees to collect unemployment, continue COBRA, etc.)?

Eclipsys announces a new release of its PeakPractice PM/EMR aimed at ambulatory surgery centers.

Mayo Clinic announces a Mayo Clinic Health Manager, a personal health Web site that uses Microsoft HealthVault to provide reminders and guidance.

Jim Stalder, former CIO of Mercy Health Services, joins call center operator The Beryl Companies as CIO.

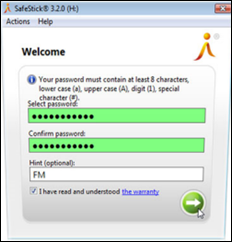

UK hospitals roll out 100,000 SafeStick USB devices that are password-protected and encrypted.

A London hospital raises privacy concerns by trialing the use of body-worn video cameras connected to video recorders for its security guards.

A Hartford Courant article points out astronomical non-profit salaries even while big company CEOs and Wall Streeters take their public lumps: UPMC’s CEO made $3.3 million in 2006 and hospital CEO Gary Mecklenburg made $16.5 million the year he retired. One state United Way CEO made $1.2 million in a year. From the article: “Every year I sit in editorial board meetings in which CEOs of nonprofit hospitals come to press their case for more public money. They want taxpayers — bus drivers, small-business owners and public school teachers — to send them more to cover the hospital’s charity cases. And every year I can’t help but think: Before you come asking for more public money, you need to reassess your own remuneration. Until top salaries are more in line with, let’s say, the salary of a U.S. Supreme Court justice, a position that currently pays $208,100 and has no trouble attracting top talent, the poor-mouthing is a little too self-serving.”

Is this reasonable? An uninsured man had what he admits was life-saving surgery. He couldn’t pay the bill, so the hospital turned it over to a collection agency. His only asset is his house, so he’s going into bankruptcy but will still have to sell the house to pay up. He calls it a “gross injustice” and wants people to demand “affordable health care”. If the hospital writes it off for him (not unusual when the press runs stories like this), someone else gets stuck helping the hospital make its margin. Should surgeons be paid less, or drug and supply companies, or hospital CEOs ($300K in this case), or nurses? The “healthcare should be cheaper” argument requires a corollary that “someone is overpaid,” so who? If someone asked him before the surgery, “You will die unless you’re willing to sell your house,” wouldn’t he have done it? Healthcare is run like a semi-business, but we seem to want it to be a charity again like it used to be (without the multi-million dollar CEOs plotting takeovers and layoffs, anyway).

HERtalk by Inga

From Large and In Charge: "Re: consultants. I have plenty of consultant names now. Thank you! More than I expected."

From John T: "Re: ICE. So, now that there is a new acronym in the marketplace, ICA finally has a solid place in the market. We’re an ICE Vendor – pretty cool. Actually, downright cold!" In case you missed it, ICE stands for Integrated Community EHR.

Dr. Lyle, a regular HIStalk commentator has initiated his own blog entitled, The Change Doctor. His initial post focuses on the "Three Is" for EMR adoption. One likely to create some controversy is Dr. Lyle’s take on interoperability: "While many say that we don’t have enough, I’d actually argue that we are so obsessed with this issue that we are losing the forest for the trees. In other words, let’s get doctors using systems first, and worry about interoperability later."

Ontario Systems signs a multi-year contract with Memorial Sloan-Kettering Cancer Center, which includes the purchase of Ontario Systems Revenue Savvy software.

Montefiore Medical Center’s IT subsidiary Emerging Health Information Technology signs a multi-year hosting agreement with the North Shore-LIJ Health System (NY). Emerging will provide support for a portion of North Shore’s computer network.

The folks at Vitalize Consulting Solutions collected almost $2,000 for the hungry during the HIMSS conference. Vitalize accepted food donations and cash to benefit the Greater Chicago Food Depository. Wouldn’t it be great if more vendors used such creative "marketing ploys?"

2008 was something of an off year for Cerner’s Neal Patterson, who received 8% less compensation than the previous year. His total package — including base pay, stock options, use of the company aircraft, and other benefits — was approximately $3.5 million.

Perot Systems signs a multi-year agreement with The Christ Hospital (OH) to provide revenue cycle services.

RelayHealth introduces FastTrack5010, a online informational resource center to help health insurers prepare for and comply with new HIPAA 5010 transaction standards. The deadline for the new claim version, by the way, is January 1, 2012.

The FCC approves $35.6 million to fund the development for five telehealth networks to link rural hospitals in nine states. The Rural Health Care Pilot Program is allocating the money, plus an additional $10.4 million for the Alaska Native Tribal Health Consortium to connect rural healthcare providers.

EHNAC announces a new accreditation program for application service provider-based EHRs. The new ASPAP-EHR (catchy name) is seeking participants for both its ASP and HIE accreditation programs. Do we seriously need another certification program? And really seriously, enough with all the acronyms already.

The ever-turbulent MedQuist names Dominick Golio as CFO. Golio previously served as North American CFO for D&M Holdings.

The Children’s Hospital of Pittsburgh of UPMC celebrates the grand opening of its new campus with a ribbon-cutting ceremony. The first outpatients are being seen this week and the hospital officially opens May 2nd.

The New York eHealth Collaborative partners with InterComponentWare and Surescripts on a prototype project to facilitate prescription routing and the the delivering of prescription histories.

Tenet Healthcare announces its preliminary Q1 numbers. Net income is expected to be $178 million compared to a $31 million loss in 2008. EPS is projected to be $.37/share compared to last year’s $.06/share loss.

TeraMedica Healthcare Technology and Compressus partner to offer an enterprise-wide solution to provide comprehensive clinical workflow, data management, and a unified view to the resident EMR system. Teramedica is a provider of enterprise imaging and information management solutions, while Compressus specializes in interoperability and workflow solutions.

The New York State Department of Health selects APS Healthcare and Thomson Reuters to manage its state Medicaid clinical practice utilization review program. The program examines how Medicaid patients utilize medical services and explores patterns of potentially unnecessary care and opportunities for improving patient safety or quality of care.

The LA Times explores the huge industry of outsourced transcription to Asian countries. In the Philippines, 34,000 transcriptionists generated $476 million in revenue last year. Experts predict revenues to exceed $1.7 billion by the end of 2010. Most work costs $.10 to $.15 per line and is delivered within 24 hours. In the Philippines, a fast transcriptionist can earn about $6,000 annually, which is about three times a nurse’s salary. The median income for American transcriptionists is $31,250 a year.

Kentucky Lt. Gov. Dan Mongiardo proposes that Northern Kentucky University become a national laboratory for testing the financial viability of EHRs and is seeking up to $500 million in federal money to get it started. His proposal includes a study of how healthcare providers can set up cost-effective e-health systems. I suppose a good way to make it cost-effective is to have the government give you $500 million up front for an EHR. Mongiardo happens to be running for a US Senate seat that becomes open next year, so one has to wonder if his actions are at all politically motivated. Nothing like working to get a little extra pork for the home state!

I was flattered that Matthew Holt forwarded me an invite to the Health 2.0 conference that starts Wednesday in Boston. I won’t be able to make it, but if you are attending, make sure Matthew wears his Inga 2.0 sash.

What Will Oracle’s Acquisition of Sun Microsystems Mean for Healthcare?

By Orlando Portale

Reading about the acquisition of Sun by Oracle yesterday brought back some fond memories for me. I recall a discussion that my team had while sitting in the lobby of Oracle’s headquarters in 2003. We were there to meet with John Wookey, the head of healthcare (now at SAP) to discuss how we would continue to align Sun and Oracle’s business development programs.

While hanging around Oracle’s lobby, my team began discussing how a potential Sun/Oracle merger made a lot of sense. Our products fit together very well and both companies had a strong culture of innovation. We discussed how Oracle had embraced Java as its standard for software development and the many deals we had captured together. Unfortunately, the discussions didn’t go anywhere, although in hindsight, it could have been a game-changer. Better late than never, I guess.

In my view, the acquisition of Sun by Oracle is synergistic for the following reasons:

- Oracle invested millions in standardizing all of its applications to Java. Therefore, outright ownership of Java is a plus for Oracle. IBM has also embraced Java, but Oracle will have increased leverage over them.

- Oracle and Sun already have a large installed base in common. Many of the largest databases in the world run on these platforms.

- Sun recently acquired MySQL, the open source alternative to the Oracle database. Oracle can now control MySQL’s destiny and any negative revenue impact it could have had against its own flagship database product.

- Sun and Oracle have always been in the anti-Microsoft camp. Sun owns Open Office, a robust and cheap alternative to Microsoft’s cash cow. This represents another opportunity for Larry Ellison to stick it to Microsoft. In addition, there are opportunities for tighter Open Office integration with Oracle enterprise applications (e.g. Peoplesoft, Siebel), thereby obviating the need for third party Microsoft licenses.

What effect will the acquisition have on the HIS software vendors?

Cerner has a sizable installed base already on Oracle. Most of these systems are hosted on IBM hardware under the AIX operating system, and NOT on Sun Solaris. Cerner has always refused to support Sun’s Solaris OS. That may change now, if Larry Ellison drops a dime. During my time at Sun, I tried to broker a meeting between Sun CEO Scott McNealy and Cerner CEO Neal Patterson. McNealy was eager, but Patterson said he saw no reason why they should speak. "Open systems, Java, Solaris … who cares.” Hello Neal, it’s Larry calling.

With respect to Cerner and Oracle, here are three potential scenarios:

- Oracle Wins/IBM Loses = Cerner + Oracle + Solaris OS

- IBM Wins/Oracle loses = Cerner + IBM DB2 + IBM AIX OS

- Status Quo = Cerner + Oracle + IBM AIX

Note: Other vendors such as Epic have a MUMPS installed base and are mostly hardware and operating system agnostic. Therefore, I believe this acquisition will have a minimal impact on Epic.

The other area of interest for healthcare customers will involve the status of Sun’s SeeBeyond SOA/Integration platform. At one time, SeeBeyond held considerable market share in healthcare, particularly for HL7 messaging and system integration. However, in recent years, Sun has let SeeBeyond slip by the wayside. Oracle could gain considerable traction in the healthcare space by bolstering investment in SeeBeyond. This is a particularly useful platform for enabling HIE/NHIN integration.

What will Oracle do with Sun’s assets after the acquisition?

First 180 days:

- Rapidly cut Sun’s sales, marketing and back office functions by integrating them into Oracle.

- Consolidate the Sun software and R&D organizations into Oracle.

- Create a separate hardware division. Consider either continuing the hardware business or divesting the assets to companies such as Fujitsu or Cisco.

Post 180 days:

- Oracle will begin create tightly bundled system stacks which incorporate hardware and software components. Oracle will now have all layers of the systems stack under its umbrella, including the storage, server, operating system, programming language, database, Web services, etc. If Oracle goes to market with integrated system stacks, it could put considerable pricing pressure on its hardware competitors.

- Integrate Sun’s open source cloud computing solution infrastructure with Oracle technology. These solutions are ideal for startup companies looking for cheap entry level systems.

What will be the potential impact on IBM, HP and Dell?

From a hardware stand point, HP and Dell may have the most to lose. Today, both companies have captured significant revenues from their relationship with Oracle. If Oracle retains Sun’s hardware business and begins going to market with integrated hardware and software systems, it will find itself in a channel conflict with HP and Dell. Will HP and Dell be forced to work more closely with IBM to capture DB2 deals? This is problematic as well, given that IBM already sells competitive hardware platforms and can embrace a similar integrated system strategy. Should this scenario play out, clearly HP and Dell will be at a disadvantage by virtue of not owning the components of the software stack.

IBM will need to revisit its long-held Java strategy, including its heavy dependence on Java for the Websphere platform. IBM will seek assurances from Oracle that it will have equal access to Java in the future. Otherwise, the only other major development platform for IBM to embrace would be Microsoft’s .NET. A shift by IBM away from Java and toward the Microsoft .NET platform would be a monumental and costly move. In years past, when confronted with this situation, IBM would just release its own new proprietary competitive development platform, but IBM no longer has that leverage in the industry. Hello, Sam, it’s Larry calling again.

Orlando Portale is Chief Innovation Officer, Palomar Pomerado Health District, San Diego, CA, and former GM Global Health Industry, Sun Microsystems.

Re: asking folks to resign vs. layoffs…in either case, an individual can elect COBRA.

Ugh, the high-level Oracle/Sun strategy discussion disgusts me, and I’m not sure if I think Orlando is mostly right or not. Disgusting if he’s wrong, because I could come up with crazier strategy shifts (IBM shift away from Java?) Disgusting if he’s right.

Also, for the record this is an HIT site, not a shareholder meeting, so instead of writing “Oracle can now control MySQL’s destiny and any negative revenue impact it could have had,” just say “Oracle can now kill the Sun-sponsored MySQL development/enterprise support and totally screw MySQL users.” Except thankfully, this is only partially true.

To put the UPMC CEO’s salary in perspective, despite being the first or second largest employer in the region (depending on how you define the region), he doesn’t even make the top 30 in CEO salary just for Western PA. Dick’s CEO made >$61 million.

http://www.pittsburghlive.com/images/video/2008_pdfs/GX-CEOpay-ch-05-25.pdf

And he just took a 25% cut.

http://pittsburgh.bizjournals.com/pittsburgh/stories/2009/02/09/daily50.html

I have no idea what you or the Hartford Courant are complaining about.

Oracle can’t soon forget the JAVA mantra…….”write once, run anywhere”

Great answer for Californian and the “Joe” episode. Many times a bad carpenter always blames his tools.

“Note: Other vendors such as Epic have a MUMPS installed base and are mostly hardware and operating system agnostic. Therefore, I believe this acquisition will have a minimal impact on Epic.”

Epic does NOT run Mumps…it’s Cache and that’s a long way from Mumps…and alot more expensive!

Cache is mumps….. it’s the mumps pig wearing lots of lipstick, but under the covers its still mumps.

I do agree that it is pricey, though.