I want to add the following. I'm an IT professional. In the course of my professional duties, I'm expected to…

News 9/10/21

Top News

Canada-based Intelerad acquires enterprise imaging provider Insignia Medical Systems.

Insignia, whose offices are in the UK, has 250 UK customer sites.

Reader Comments

From Beeswax: “Re: interviews. It is amazing how many companies are acquired shortly after you interview their CEO. Too bad you aren’t getting a finder’s fee from the buyers!” The #1 reason I lose sponsors is that they get acquired. However, I assume that (a) the acquirer wasn’t just watching my interviews to decide who to buy instead of doing their own market research; and (b) companies may seek exposure to signal their acquisition interest in a robust investment market. Still, it’s like being a HIMSS conference exhibitor who knows that three positive outcomes can result — sales, creating partnerships, and making connections that can result in acquiring or being acquired.

HIStalk Announcements and Requests

Welcome to new HIStalk Platinum Sponsor Bluestream Health. The New York City-based company offers a simple yet powerful virtual-first care platform that works the way you work. Through a best-in-market connectivity, integrated interpreting, and a full range of clinical workflows, the platform delivers expert patient care through the virtual care experience. With Bluestream Health, customers get 10 times the visits at one-third the cost. That’s no exaggeration. It is helping major healthcare customers like NY H+H and Medstar boost visits and improve the bottom line. What sets Bluestream Health apart is how easy is to tailor the solution to how your organization works. APIs make it easy to configure to your clinical workflows and integrate with your systems. Add live interpretation services to address the needs of non-native speakers An intuitive user interface and no downloads mean that it’s incredibly easy to use for patients and physicians alike. Download the company’s white paper to learn how upgrading from telehealth to a virtual care solution can simplify the tech stack and increase profits. Thanks to Bluestream Health for supporting HIStalk.

Reader Bill send me a generous donation to support Donors Choose, to which I applied various matching funds, including those of my Anonymous Vendor Executive, to fully fund these classroom projects:

- Hands-on math lessons for Ms. B’s middle school class in Center, TX.

- A financial literacy kit for Ms. S’s middle school class in Baltimore, MD.

- A financial literacy kit for Ms. R’s pre-school special needs class in Indianapolis, IN.

- STEM kits for Ms. A’s elementary school STEM classes in Lithonia, GA.

- An Apple TV to support virtual and in-person instruction for Ms. D’s elementary school class in Pharr, TX.

I’m no longer shocked that many Facebook users aren’t technically bright enough (or ambitious enough) to use Google. Postings in Facebook groups are always full of shameless demands that someone else do their web work for them, such as (a) business postings that elicit indignant “Where is this place?” comments that one click would have resolved, (b) “anybody know” type group posts where someone can’t figure out how to Google to find a lunch restaurant or check a store’s business hours, and (c) users who complain about how Facebook works when it’s obviously a user issue (i.e., you can’t share a “lost dog” post from a private group). It’s a testament to the appeal of Facebook that it attracts loyal users / customers / addicts who can’t or won’t navigate the web or can’t use a keyboard to correct obvious speech recognition errors.

Wondering: have Patrick Dempsey or A-Rod inspired anyone to improve healthcare quality or cost since HIMSS21?

Webinars

September 16 (Thursday) 1 ET. “Patient Acquisition and Retention: The Future of Omnichannel Virtual Assistants.” Sponsor: Orbita. Presenters: Harris Hunt, SVP growth product, Cancer Treatment Centers of America; Patty Riskind, MBA, CEO, Orbita; Nathan Treloar, MSc, co-founder and COO, Orbita. Consumers want the same digital healthcare experience from healthcare that they get in online shopping, banking, and booking reservations, and the pandemic has ramped up the patient and provider need for frictionless access to healthcare resources and services. Health systems can improve patient acquisition and retention with the help of omnichannel virtual assistants that engage and delight. Discover how to open and enhance healthcare’s digital front door to offer care that goes beyond expectations.

September 16 (Thursday) 1 ET. “ICD-10-CM 2022 Updates and Regulatory Readiness.” Sponsor: Intelligent Medical Objects. Presenters: June Bronnert, MSHI, RHIA, VP global clinical services, IMO; Theresa Rihanek, MHA, RHIA, mapping manager, IMO; Julie Glasgow, MD, clinical terminologist, IMO. IMO’s top coding professionals and thought leaders will discuss the coding changes in the yearly update to allow your organization to prepare for a smooth transition and avoid negative impacts to the bottom line. The presenters will review new, revised, and deleted codes; highlight revisions to ICD-10-CM index and tabular; discuss changes within Official Coding Guidelines, and review modifier changes.

October 6 (Wednesday) 2 ET. “Solving Patient Experience Challenges Through a Strong Digital Front Door.” Sponsor: Avtex. Presenters: Mike Pietig, VP of healthcare experience, Avtex; Jamey Shiels, MBA, VP of consumer experience, Advocate Aurora Health; Chad Thorpe, care ambassador, DispatchHealth. Patients expect healthcare providers to offer them the same digital experience they get when banking, shopping, and traveling. This webinar will describe how two leading healthcare providers created digital front doors that exceed patient expectations, improve patient outcomes, drive loyalty and acquisition, and future-proof their growth strategies in competitive markets.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

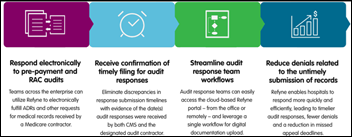

Health information exchange platform vendor Vyne acquires Ahana Health, which offers a connected care solution that allows providers to collaborate with each other and their patients. Vyne will incorporate the solution into its cloud-based Refyne product, which streamlines the exchange of medical documentation between providers and CMS.

Credit reporting agency TransUnion is reportedly seeking a buyer for its TransUnion Healthcare business for up to $2 billion.

Teladoc will integrate Proximie’s surgical and diagnostic procedure recording technology into its Solo hospital platform to support virtual surgical mentoring, proctoring, and support.

Dermatology diagnosis app vendor LuminDx changes its name to Piction Health.

Denmark-based Corti.ai, which offers AI analysis of patient encounters for guidance, documentation and quality improvement, raises $27 million in a Series A funding round.

Provider collaboration platform vendor CareMesh announces Transitions for EHR-integrated referral management.

Sales

- The Verland Foundation chooses the SmartCare EHR of Streamline Health Solutions.

- Temple Health chooses Gozio Health’s mobile platform for patients.

People

WellSky hires Andy Eilert, MBA (Evernorth) as president of emerging markets.

Clinical communications platform vendor Diagnotes promotes Sherry Henricks, MBA to CEO. She replaces founder Dave Wortman, who will remain on the board.

Remote patient monitoring system vendor Optimize Health hires Todd Haedrick (Covetrus) as CEO. He replaces Jeff LeBrun, who will move to chief strategy officer and retain his board chair position.

Altruista Health hires Dan Vnuk, MS (Cotiviti) as CTO.

Woebot Health names Sheetal Shah (SymphonyRM) as SVP of commercial.

Long-time Meditech executive Roberta Grigg, who retired in 2001, died last month at 79.

Announcements and Implementations

MarinHealth goes live on PatientKeeper’s physician charge capture.

Sanford Health (SD) will develop a virtual care center using a $350 million gift from donor Denny Sanford.

In Canada, Bayshore HealthCare launches an after-hours symptoms management app that allows cancer and palliative care patients to connect with a nurse instead of visiting the ED. The CareChart app offers online and telephone triage, self-assessment ahead of virtual visits, and real-time information submission to the patient’s care team.

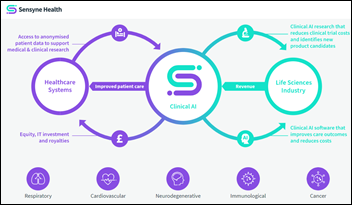

UK-based real-world data analytics platform vendor Sensyne Health launches Sensight, which provides AI research capability using de-identified data from hospitals in the US and UK for $35,000 per user per year.

Government and Politics

The fraud trial of Theranos founder Elizabeth Holmes began Wednesday. A traffic ticket issued that same day to her husband – who is a 27-year-old heir to a hotel chain fortune — revealed that she is commuting to court from an estate that is listed for sale at $135 million.

COVID-19

The US COVID-19 death count has reached 650,000, about the same number of American deaths as in the Civil War or in the 1918 influenza epidemic. The US fully vaccinated rate is #52 among the world’s countries at just over 52%.

More than 50 Georgia hospitals, including Grady Memorial, are postponing elective surgeries and turning away ambulances because of COVID-19 patient loads. Governor Brian Kemp rejected calls to halt elective surgeries in all state hospitals and to extend licensure waivers, adding that he will issue no new mandates and instead asks the federal government to limit the hourly rates of staffing companies as “states are forced to outbid one another using federal coronavirus relief dollars in order to obtain adequate hospital staffing.”

Idaho’s state government activates “crisis standards of care” that allow hospitals to ration their services. Patients whose likelihood of survival is lower will be denied ICU beds and hospitals can admit patients to classrooms and conference rooms. Less than 40% of the state’s residents are fully vaccinated, trailing only Alabama, Mississippi, and Wyoming.

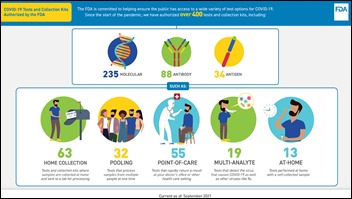

FDA notes that it has authorized more than 400 COVID-19 tests, including 13 rapid at-home ones. It would be helpful to see FDA issue plain-language advice on those 13 – cost, where to get them, advantages and disadvantages, etc. I got a text message while writing this that my latest four-pack of $10 BinaxNow tests was dropped off at my door from Walmart.com, but they are sold out of them again. I’m all for the free market, but I would rather see a single manufacturer’s test sold for $1 and available everywhere rather than making it confusing and expensive to the point that nobody bothers. Other countries are doing this far better.

A randomized controlled trial of hospitalized COVID-19 patients finds that using convalescent plasma did not improve outcomes and may have worsened them. FDA issued its Emergency Use Authorization in the pandemic’s early days, with HHS Secretary Alex Azar touting it as a “very historic breakthrough” as evidenced by a single retrospective study that was published as a pre-print.

Microsoft indefinitely postpones a return to in-person work in the US, providing no date to replace its original October 4 target. Amazon, Facebook, and Google had already delayed in-person work until 2022, meaning that many of their employees will not have worked in company offices for two years.

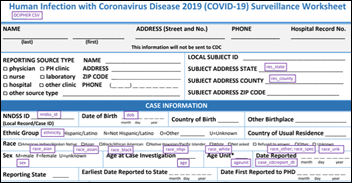

Texas, Missouri, Louisiana, West Virginia, and Wyoming are submitting detailed COVID-19 health equity data for less than one-tenth of their total cases, with erratic reporting causing data to be missing for 20% of US cases. Two-thirds of the submitted information is also unusable because of fields left blank or filled in as “unknown.” CDC collects where patients live, whether they were hospitalized or died, and demographic information. The most commonly missing information includes race / ethnicity and symptoms experienced.

Other

Pune, India’s efforts to connect hospitals for real-time COVID-19 data sharing via HL7 hits a bump when the the pilot project hospitals decide not to share their information.

Illinois-based Edward-Elmhurst Health and NorthShore University HealthSystem announce plans to merge.

Providence Chief Digital Officer Aaron Martin, MBA – who worked 10 years ago for Amazon’s on-demand publishing group – says Amazon and other tech companies aren’t exiting healthcare for good, but instead are changing their approach. He makes these points:

- Amazon’s failures often turn into successful pivots, such as an auction platform that turned into its third-party sales platform and the Fire phone that died quickly but created Alexa.

- Healthcare is decades behind other industries as it continues to use technologies that create data silos.

- Amazon will probably succeed in mail-order pharmacy and eventually pharmacy benefits management, although Amazon Care is a less-sure undertaking because of the complexity involved.

- Walmart may use its large pharmacy footprint to expand into care delivery.

- Microsoft is sticking to its technology offerings in selling cloud services, competing with Google and Amazon.

- Google still has fitness trackers and other projects, but de-centralizing its healthcare efforts into individual operating units may de-emphasize its focus.

- Apple has the Watch that could be used for remote patient monitoring, although it is IOS-only and expensive.

- The big change could occur with acquisitions like Microsoft buying Nuance.

- Health systems should not assume that disruption is no longer needed now that the big tech threat has diminished. They will always come back and they are learning from their failures.

Sponsor Updates

- LexisNexis Risk Solutions will sponsor the Whole Person Care Virtual Summit September 21-22.

- The Bulls ‘n Bears Podcast features Mach7 Technologies CEO Mike Lampron.

- Meditech shares preparatory guidance for COVID-19 vaccine booster shots.

Blog Posts

- The Most Essential HIT Partnership in a Health System Portfolio (Halo Health)

- Get a Better Night’s Sleep: What Healthcare Leaders Should Know About Blockchain (Healthcare Triangle)

- COVID Boosters & Beyond – Automated Patient Engagement (Intrado)

- What’s in a variant? Part II – Making sense of data through harmonization (Intelligent Medical Objects)

- New Study Shows How Clinical AI Can Improve End-of-Life Care for Cancer Patients (Jvion)

- Best Practices for Managing Seconds-to-Minutes Emergencies (Medhost)

- Must EHRs become platforms? (Nordic)

- 5 ways Expanse addresses the next big challenges in healthcare (Meditech)

- Mentorship 101: How Newfire’s Culture of Support Leads to Career Growth & Success (Newfire Global Partners)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Aaron Martin worked for Amazon. I don’t think I have heard that before from him in every one of his articles or posts.

I would assume someone from Amazon would have some story about how they significantly made Providence cheaper and faster, but maybe hiring people from out of industry to shake things up is just as ineffective as outside companies shaking up healthcare.

Agreed- none of those “insights” are very deep. Does anyone really assume that disruption is no longer needed in healthcare?

But most importantly: Mr H.- “siloes”? I hope that was a [sic]

The thing that caught my eye from the Aaron Martin article was the quote about health tech companies compared to health systems. Talking about Apple and Amazon or whatever is how you get CEOs to pay attention to you bc CEOs eat up those business book style quotes from Jeff Bezos or whatever. Big tech companies aren’t interested in changing healthcare but they have so much cash that it is coming out their ears and so they’ll try whatever.

Healthcare services companies with tech dressing are the ones who are really taking a run at traditional payers and providers. As an outside of healthcare example, Wework billed itself as a tech company but they were a real estate company with a website, some good lawyers, and a sales pitch to media and investors. That’s a services with tech dressing company. Teladoc is a great example in healthcare services with tech dressing. These companies will carve out specific pieces of healthcare that traditional healthcare providers will then not get to offer anymore. Like 20 years ago, Davita and Fresenius cornered the market on dialysis; now hospitals simply can’t get that dialysis money anymore. And now you can tell investors you are a tech company and they will throw gobs and gobs of money at you for the better part of a decade which you can spend on doctors and software engineers. Healthcare systems used to have the financial advantages of tax exemptions and access to low interest rates but those advantages are available to other companies now. These tech services companies are going to take a run at being the national provider for a specific area of musculoskeletal or home health or bargain basement individual ACA plans or whatever.

“Remember, health tech companies (big and small) have several disruptive advantages compared to health systems. They are digital first; have fewer financing constraints; have lower fixed cost and capital infrastructure; they target only our profitable services; have (sometimes) massive audiences; and they have a focused value proposition and brand. Furthermore, they are getting traction. Teledoc grew over 100% in Q2 in which their comp was the beginning of COVID in 2020.”