It is incredibly stressful once you leave the Epic center of gravity. I have spent my ex-epic career wondering if…

Monday Morning Update 10/14/19

Top News

Centra (VA) resumes billing and collections after a three-month hiatus caused by glitchy Cerner software that hospital officials say led to rejected claims, delayed billing, incorrect bills, and prematurely sending patients to collections for lack of payment. The $73.5 million Cerner system was installed in 2018, but Centra’s financial team didn’t notice any problems until a few months later. It estimates that 2,200 incorrect billing statements have been sent out.

To rectify the problem, Centra is rebooting its billing cycle, giving impacted patients a 5% discount, and making sure that its customer service reps have had Cerner-specific training so that they can be more empathetic to patients with billing problems.

Centra will continue with the second phase of its Cerner implementation at remaining ambulatory and post-acute care sites next year.

HIStalk Announcements and Requests

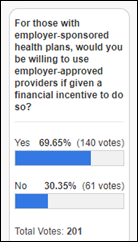

A majority of respondents would have no problem using employer-approved providers if it resulted in a discount on their employer-sponsored health plan. Nevertheless offers the employer perspective: “We have employees who work in at least 5 states today and that will grow. This approach is not at all manageable for a company like ours. I want to be LESS involved in my employees’ healthcare access, not more. I’m ok with paying for healthcare coverage for my employees – but I don’t want to micromanage how they get those services.”

MerryMe offers the employee’s: “Absolutely not. Employers shouldn’t be involved in healthcare – AT ALL. Not insurance. Not in/out of network. Not hey, save $100 if you stop smoking. If my employer or co-worker wants to send around an email saying ‘had great experience at XYZ’ or ‘hey, I found this website and maybe you can save on your Rx like I did,’ fine. Want to do a benefit dinner for a fellow employee who has cancer? Great. Otherwise, keep your nose and ‘help’ out of my business. I don’t trust that costs for types of procedures are not being shared with the employer – and what I’m seeking care for is none of my employer’s business.”

And Sorry that of the too-young-to-need-it: “As a young person who doesn’t use any healthcare right now and expects not to work at a place longer than five years, I’ll take that deal and then continue never going to the doctor. I would be interested to know how much of the cost of health insurance you could knock off this way though. I get the feeling that I’m subsidizing the old people’s healthcare at my company. Eventually we’ll move off employer-tied health insurance (since businesses are starting to hate it) and to something state-funded, at which point the young will still be subsidizing the old but 1. I’ll be old. 2. At least I’ll be able to see what’s going on rather than trying to interrogate my HR rep.”

New poll to your right or here: Would you avoid treatment at a hospital that has a history of suing patients for unpaid bills? Comments (anonymous or not) are welcome, especially if you’ve found yourself on the receiving end of relentless debt collectors.

Webinars

October 15 (Tuesday) 1:00 ET. “Universal Health Services Case Study: How to Improve Network Design and Management with Claims Data.” Sponsor: CareJourney. Presenters: Mallory Cary, regional director of ACO operations, UHS; Abbas Bader, director of product development, CareJourney. Universal Health Services (UHS), one of the nation’s largest hospital management companies, has more than 350 acute care hospitals, behavioral health facilities, and ambulatory centers across the US, Puerto Rico, and the UK. UHS has collaborated closely with CareJourney over the last three years in building high-performing networks in new markets, managing patient populations as they flow through those networks, and targeting areas for performance improvement within the network. Join the expert presenters for deep insights into network design and optimization.

October 24 (Thursday) 1:00 ET. “The power of voice: Will AI-drive virtual bedside assistants become mainstream?” Sponsor: Orbita. Presenters: Nick White, co-creator of DeloitteAssist and principal in Deloitte’s Smart Healthcare Solutions practice; Bill Rogers, CEO and co-founder, Orbita. Conversational AI and virtual health assistants are bringing new opportunities to care facilities to improve patient journeys and yield radical workflow efficiencies. Will the hospital rooms of the future continue to provide traditional bedside call buttons? Or will these be replaced with digitally reimagined, AI-driven, voice-powered agents? Learn from the expert who created today’s industry-leading, market-proven, virtual bedside assistant.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Announcements and Implementations

Alameda Health System (CA) goes live on Epic. AHS staff from what looks like every department put together this great video celebrating the install. The $200 million project was first announced at the beginning of 2018.

Virtua Health (NJ) implements SymphonyRM’s Next Best Action CRM.

In Illinois, Pivot Point Consulting assists in the implementation of Christie Clinic’s Epic system through a Community Connect affiliation with Carle Foundation Hospital.

IBM Watson Health Imaging will discontinue support for its Merge Eye Station digital imaging technology and Merge Eye Care PACS by the end of 2020. Topcon Healthcare Solutions will offer transition assistance to Merge customers who want to transition to its Harmony data management system. IBM acquired Merge Healthcare in 2015 for $1 billion.

Brigham and Women’s Hospital (MA) will use digital lifestyle tracking and telemedicine tools from Fruit Street Health in a six-month brain health improvement study of patients at risk for cognitive decline and dementia.

Privacy and Security

A look back at WannaCry’s impact on the NHS finds that the 2017 ransomware attack resulted in a $7.6 million loss due to a decrease in admissions and appointments. Over 600 NHS facilities were affected. The health service spent considerably more – some analysts estimate nearly $90 million – on IT to fix the fall-out.

Men’s online health and wellness company Ro alerts customers to a potential breach that occurred when hackers attempted to access information on the laptop of an affiliate physician. The physician’s computer, which was the property of the MD’s health system employer, was infected with malware. Ro fired the physician for violating its Physician Code of Conduct by downloading unapproved software. CEO and co-founder Zachariah Reitano brings up a point relevant to telemedicine vendors who hire physicians with other employers: “The challenge Ro and others face is that, in addition to securing our own systems, we need to account for systems outside of our direct control. Ro has taken and will take a number of steps to implement additional security measures to help further protect personal information, including enhancing the security on our physicians’ computers.”

Other

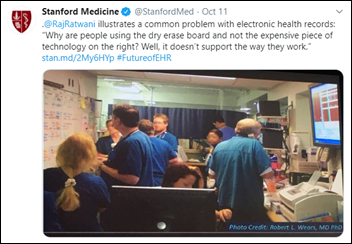

Stanford Medicine (CA) hosted its second annual EHR National Symposium featuring speakers from its health system, Epic, ONC, UnitedHealthcare, Microsoft, Cleveland Clinic, Cerner, and Livongo, among others. Videos from the event should be on the symposium’s website soon.

Researchers find that opioid dosages decreased 22% per new prescription after the University of Pennsylvania Health System implemented EHR alerts in New Jersey practices notifying prescribers if prescriptions exceeded the legal five-day limit.

Researchers at UC San Francisco’s new Center for Intelligent Imaging will work with Nvidia’s AI computing technology to develop new solutions for radiology. Ci2’s initial work will focus on an NIH-directed project using AI and data analysis to evaluate chronic back pain.

Sponsor Updates

- Elsevier rebrands its Via Oncology cancer care management and clinical decision support tool to ClinicalPath.

- The Women Tech Council honors Health Catalyst Chief People Officer Linda Llewelyn with its award for culture leadership.

- Mobile Heartbeat will host an event on Enhancing Clinical Communications October 16 in Dallas.

- Netsmart will exhibit at the NAHC Annual Meeting October 13-15 in Seattle.

- PMD adds a two-click Instant Capture option to its Charge Capture software.

- Clinical Computer Systems, developer of the Obix Perinatal Data System, will exhibit at AWHONN WA Fall Meeting October 13-15 in Bremerton.

- Authority Magazine features “’5 Things I Wish Someone Told Me Before I Became CEO of Experity,’ with David Stern.”

- Redox will host its Interoperability Summit October 15 in Boston.

- The Touch Point podcast features StayWell President Pearce Fleming.

- Surescripts will exhibit at the EClinicalWorks National Conference October 18-20 in Orlando.

- Vocera will exhibit at the Indiana Organization of Nurse Executives Fall Conference October 16-18 in French Lick.

- Spok publishes a new e-book, “Why the future of healthcare is in the cloud.”

Blog Posts

- Part 2 of Our Breakdown of the CMS Primary Care Initiatives: Direct Contracting (Lightbeam Health Solutions)

- Tackling Rampant Waste in Healthcare – A Guide for Healthcare Providers in the New Consumer-Driven Marketplace (Loyale Healthcare)

- MHUG 2019 is Approaching! (Mobile Heartbeat)

- An Inside Look into IT Support from our Support Services Director: Rhonda Mech (CereCore)

- Why Patient Experience Should Play a Bigger Role in Your Collections Process (PatientBond)

- The New Discharge Planning Rule: What You Need to Know (PatientPing)

- Expert Tips for a Better Patient Payment UX (Patientco)

- Identity & Access Management: The Cornerstone of Enterprise Security (SailPoint)

- Top 3 Lessons Learned from Meditech Training (Santa Rosa Consulting)

- #EndNurseAbuse: When Protocols Are Not Enough (Vocera)

- Protecting Patient Data: Lessons Learned from the Anthem and Equifax Data Breach Settlements (WebPT)

- How Leaders Establish Organization Success (EClinicalWorks)

- Meet Terri LeFort: President of Healthtech, Nordic’s Canadian partner (Nordic)

- Pause to Consider: Managing Connected Medical Device Security Program (Fortified Health Security)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates. Send news or rumors.

Contact us.

I have good insurance and significant personal cash reserves. However, my main reason for avoiding hospitals that sue people for outstanding bills is that billing staff have a habit of getting things royally mucked up and then turning people over to collections. For example, they bill the secondary insurer instead of the primary and then claim you owe the whole amount when the secondary won’t pay (because the primary wasn’t billed first). They collect the copay in cash but then don’t credit it and send you to collections over $20 that you already paid. At my own institution, where I’m a clinical researcher, they even charged research subjects’ labs to me personally rather than my grant (as instructed) and threatened to garnish my salary when the insurer (appropriately) wouldn’t pay.

I’ll readily admit that the billing in the current health care delivery system is a nightmare but they have a whole movie cast of employees, so you’d think they could figure things out before they start calling in collections companies (or lawyers) and ruining people’s credit ratings.

Fascinated by “Sorry”‘s comment, yes, that’s how distributed risk *works*. Paying for healthcare (or anything via insurance) via a distributed risk model isn’t a bank where you put your money and then withdraw exactly the money you put in. The risk of payout is distributed across as large a population as possible, so that the burden of cost doesn’t fall one any one person so onerously that they can’t recover. See also: fire insurance, auto insurance, homeowners insurance, flood insurance, etc.

As to their not planning on using medical care any time soon: I wish you well with that plan. I was a very healthy and athletic 34 year old until I nearly dropped dead one day from a massive PE, so I’m very glad I didn’t take that gamble.

How about I get to be in a risk pool with millennials? I’ll get cheap prices now because I’m young. Once I’m old, I and the rest of country will vote for a responsible and affordable healthcare system since the boomers on up will be dead. Why do I have to pay out the nose for problems the greatest generation inflicted on themselves and their children? I’m the working age person now and I’m paying for Medicare that won’t be there when I’m old. That’s not distributed risk – that’s generational wealth transfer from the young to the old.

How do you get into a risk pool with millennials? Get hired at Epic. All those healthy young whippersnappers with their hula hoops and their crossfit. Keeps the group rates down.

More seriously: insurance exists because people overall are risk adverse, but from your comments that’s not you. You sound pretty confident of the outcome, so you prefer to gamble. It’s interesting that if you take the gamble and lose, it’s not actually you paying for it. If you’re uninsured or under insured today (because you don’t feel like you need it), and then a catastrophic event happens, your fellow tax payers will be conducting a wealth transfer to you. Would you plan on refusing it because it’s unfair to them?

You’re also gambling that by the time you need the healthcare system all the Boomers will be gone and the rational Gen X, Gen Y, and Gen Z folks will vote in an affordable and responsible system. This is a huge gamble and by George I’d love if it ended up going your way. However, the idea that once “the Boomers” are gone the way will be clear for sweeping reform is a massive oversimplification of US healthcare politics. Would be nice, but I’m skeptical.

You are the opposite of “risk adverse”, you are “risk loving”. So maybe insurance doesn’t make sense for you. But that doesn’t mean that insurance (as a concept) is a fraud designed to steal from people.

Health insurance isn’t insurance in the traditional sense as someone pointed out in this sense. IF it worked like car insurance I’d be down for it. Last year my girlfriend’s auto insurance rate went down! (when she price shopped to a different carrier) If I was able to pay a risk-adjusted premium I would take that option in a heartbeat. That option isn’t legally available to me. Or if I got to be in a risk pool with everyone in the US, I would also be fine with it. Again, not legally available for purchase. Instead, they 1. take a cut of my paycheck to spend on the over-65 crowd and 2. I thankfully now get thrown in my employer’s group. I understand how insurance and risk pools work and it largely has nothing to do with the point I’m making. Here’s two different ways to think about it: 1. Medicare part A (the expensive one) will have solvency issues in the next couple decades. Basic accounting says that they have to cut benefits or raise taxes. Say you are 75 when they cut benefits. You’ve got ten years of extra benefits that no one else will get and that your age group didn’t have to pay for. 2. My girlfriend and I hope to have a child someday. To be fair to him or her, when I’m old and (s)he’s young, I’ll want him to pay about what I paid into the system when I was young (either inflation or income adjusted.) But since healthcare gets more expensive every year, I’ll get much less healthcare for his dollar than the current group of old people gets from my dollar. He’ll get even less benefits when he gets old. As for the greatest/boomers and their theft, they are the ones who are the most against reform, which makes sense because they are fleecing us.

https://i.kinja-img.com/gawker-media/image/upload/c_scale,f_auto,fl_progressive,q_80,w_800/daik08xmlpe33tnefcwv.jpg

The youngest Baby Boomers are 54, so they have another 25+ years of living to do before they hit the *median* life expectancy, by which time us Gen Xers will be in our 60s, and the Millennials will be experiencing back spasms, trick knees, and menopause, so we’ll all be oldheads together. GenZ is going to come along and wipe us all out, which is fine, they’re the ones really inheriting the mess so if they want to transform society “Logans Run”-style I can’t say I blame them.

I second the question on whether or not Sorry would accept subsidized care if they eschewed insurance and then got hit by a drunk driver and wound up with a TBI.

Just to yammer on about it, until recently I was forced to buy insurance on the exchange with no Medicaid expansion help. So I was forced into a risk pool with all the other poor people with ill health. It was the explicit goal of the ACA to force young people into the risk pool while I was in my twenties. I was forced to pay for the old. Now we aren’t forcing young people into the risk pool anymore!!! I got screwed out of my money!

Flood insurance is a great example to bring up – it’s mostly a transfer of wealth from the taxes of people who don’t live in flood plains to the people who purchase federal flood insurance. I rent in an area that rarely floods. I don’t see why I should pay to insure someone who wants to build a new house in Miami when we know it is going to be underwater in my lifetime. At least I can and have opted out of having a car + car insurance. These are fundamentally unfair policies that favor the old and homeowning population on the backs of the young, poor, working, and responsible citizens. If you are below the age of 40 and not furious about it, you’re not paying attention.

Health insurance doesn’t really function like other distributed risk pools. Your car insurance doesn’t pay for your oil change. Your homeowner’s insurance insurance doesn’t have in and out of network providers that can’t tell you whether they are in or out of network. Fire insurance doesn’t negotiate with all of the contractors in the area on your behalf. It sounds like Sorry is frustrated and trying to opt out of a system that he or she perceives as unfair. Talking down to him or her might mak you feel good but it is just going to cause more resentment.

@RevenueCycleRambo

You are spot on! But I would take it a step further by stating that I believe many hospitals design their billing staff to be this way. Willful ineptitude allowing them to bill what they want, when they want and not get caught. But should they get caught, they are prepared with statements like, “Oh it’s a coder training issue. Oh the person is question is retiring, so we’ll get someone in here who is up to date on billing.” Banking on the fact that what they will have to pay back will just be a pittance compared to what they got away with.

The rumor that I heard from my Cerner friends is that centra didn’t pay for any consulting or implementation help from Cerner.

Here might be a significant difference betw Cerner and Epic. Is it ethical for a vendor to sell a mission critical system to a client that refuses to buy what the vendor (and we all know) is a boatload of training/support? Cerner had to know this was a bust situation for both the client and them. It was inevitable it would come back to bite them in the butt.

But when you are a public company, with salespeople driven by commissions, striving to make next quarters numbers, hey a sale is a sale. Under similar circumstances Judy would walk from the sale. Next quarter pressure is non-existent and why risk a blow-up down the road for a few million bucks?

HISJunkie, I’ve worked on 2 Cerner implementations and 2 Epic implementations. The Cerner implementations had, in my opinion, sleezy sales men who showed up to take the director out to lunch/drinks/strip clubs, whatever it took to get the sale and expand the services. The Epic implementations, I never saw any of that going on, not that some client sites didn’t want to be wined/dined and tried to get the Epic AC/AMs to do that. I think you are correct in stating that because Epic is not a public company, Judy does not have the Wall Street pressure, but I also think there is just a generally more clean approach from Epic overall. Maybe that has to do with Judy being a woman, maybe it has to do with Epic’s staff are so young and turnover is high. Not really sure, I just know that I appreciate Epic’s approach to sales much more so than Cerner’s.