Sounds reasonable, until you look at the Silicon Valley experience. Silicon Valley grew like a weed precisely because employees could…

News 7/12/19

Top News

Health data integration and exchange companies Corepoint Health and Rhapsody will merge.

Orion Health sold off a 75% share of its Rhapsody business last year for $137 million to private equity firm Hg, which also has a stake in Corepoint. Orion Health has since repositioned itself as a population health management technology vendor.

Webinars

July 18 (Thursday) 2:00 ET. “Healthcare’s Digital Front Door: Modernizing Medicine’s Mobile-First Strategies That Are Winning Patient Engagement.” Sponsor: Relatient. Presenters: Michele Perry, CEO, Relatient; Michael Rivers, MD, director of EMA Ophthalmology, Modernizing Medicine. Providers are understandably focused on how to make the most of the 5-8 minutes they have on average with a patient during an exam, but what happens between appointments also plays a significant role in the overall health of patients. Modernizing Medicine is driving high patient engagement with best practice, mobile-first strategies. This webinar will describe patient engagement and the challenges in delivering it, how consumerism is changing healthcare, and how to get started and navigate the patient engagement marketplace.

July 25 (Thursday) 2:00 ET. “Meeting patient needs across the continuum of care.” Sponsor: Philips Population Health Management. Presenters: Cindy Gaines, chief nursing officer, Philips Population Health Management; Cynthia Burghard, research director of value-based healthcare IT transformation strategies, IDC. Traditional care management approaches are not sufficient to deliver value-based healthcare. Supplementing EHRs with advanced PHM technology and a scalable care management approach gives health systems proactive and longitudinal insights that optimize scarce resources in meeting the needs of multiple types of patients. This webinar will address the key characteristics of a digital platform for value-based care management, cover the planning and deployment of a scalable care management strategy, and review patient experience scenarios for CHF and diabetes.

Previous webinars are on our YouTube channel. Contact Lorre for information.

Acquisitions, Funding, Business, and Stock

Waystar acquires prior authorization automation startup Digitize.AI.

Nashville-based healthcare data analytics business Stratasan raises $26 million.

Some nuggets from the always-fascinating and sometimes poetic midyear market report from Healthcare Growth Partners:

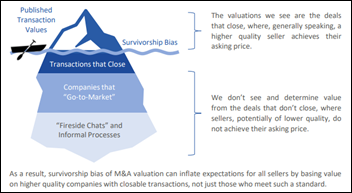

- More companies are for sale than we hear about, as they discretely and sometimes informally test the waters to see what price they might attract. Sometimes this results in a quick company sale without the usual auction process, which also allows the selling company to complete a deal without admitting publicly that their own valuation was a stretch.

- Deals that close at a high price introduce “survivorship bias,” where potential sellers think their companies are worth more because a higher-quality company attracted a high selling price. This encourages them to pass up reasonable deals that don’t match their fantasy number.

- A 20-year backlog exists of health companies that are backed by private equity and haven’t yet reached a liquidity event.

- A startling 82% of health IT transactions involved bootstrapped sellers, while PE-backed companies must hit a higher valuation because investment valuations are higher than M&A valuations.

- HGP concludes that the rising supply of available health IT companies will be resolved only if sellers hit performance levels that are in line with their valuation expectations or more potential buyers enter the market.

- Health IT companies that earn high valuations have these characteristics: (a) they use SaaS architecture that creates scale and recurring revenue; (b) their business model involves making money only when customers achieve ROI; (c) they can acquire customers efficiently; (d) they retain data rights; (e) they sell healthcare reform-centric products; and (f) they seek a selling price that aligns with the company’s market leadership and profit.

- Big publicly traded winners (in terms of share price) in the first half of 2019 are EHealth, Invitae, Streamline Health Solutions, while the big losers are Evolent Health, Care.com, and Benefitfocus.

- Four companies plan to IPO this year (Health Catalyst, Peloton, Phreesia, and Livingo Health) and Change Healthcare has already done so, ending the 2017-2018 drought in which no health IT companies went public.

Sales

- Emory Healthcare selects MedCurrent’s OrderWise clinical decision support software for medical imaging orders.

- Mercyhealth will implement EndoTool insulin dosing software from Monarch Medical Technologies at its facilities in Illinois and Wisconsin.

- Cerner will take over revenue cycle management at its IT outsourcing client Medical Center Hospital (TX).

- Dana-Farber Cancer Institute (MA), San Antonio Regional Hospital (CA), and Summit Medical Group select release-of-information software and services from Ciox Health.

- Choctaw Nation Health Services Authority (OK) will deploy Wellsoft’s EDIS technology.

People

Guillaume Castel (Inova Health System) replaces Terry Edwards as CEO of PerfectServe. Edwards will transition to chairman of the board.

James Wellman (Comanche County Memorial Hospital) joins Blanchard Valley Health System (OH) as CIO.

Redox names Elif Eracar (American Well) chief customer officer and Ben Waugh (Twilio) chief security officer.

Announcements and Implementations

Geisinger Health System (PA) will implement Medial EarlySign’s LGI-Flag software to help providers more quickly identify patients at risk for lower gastrointestinal disorders. Geisinger’s Steele Institute for Health Innovation will work with the company to develop and deploy similar technology for other diseases.

The State of Louisiana goes live on an end-of-life care planning registry developed with the Louisiana Health Care Quality Forum using software from Vynca. The company announced a $10 million Series B funding round last month.

Novant Health (NC) moves its Epic system to Virtustream’s hosting service.

Tanner Health System goes live on Epic in its ambulatory locations, with its five hospitals to follow in November.

Government and Politics

Amazon’s Alexa serves up information from the NHS website when patients in the UK ask it health-related questions.

Privacy and Security

Wickenburg Community Hospital (AZ) reveals that it was the victim of a Ryuk ransomware attack on June 28 that impacted its phone system and shared files. Rather than pay the ransom, it worked with its technical team and vendors to restore functionality.

Other

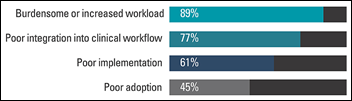

A Spok survey of 470 clinical hospital staff finds that an overwhelming majority believe increased or ineffective technology contributes to burnout. Sixty-five percent say their organization doesn’t focus on or offer resources to address burnout. While 95% believe that addressing EHR usability will alleviate burnout, only 30% work at organizations that are attempting to do so.

Healthcare executives cite improved quality and satisfaction, reduced costs, and growth and higher revenue as top benefits of patient navigation programs, according to a Docent Health survey. Top patient navigation technologies include phone calls, EHRs, and portals. Text messaging and CRM software seem underused, with slightly more than a third of respondents using each.

Experts question whether private equity firm Paladin Healthcare bought Hahnemann University Hospital last year with lip service about patient care, but with every intention of closing the money-losing facility and selling off its prime real estate to the highest bidder, a strategy that PE firms have used in taking positions in dying businesses such as Marsh Supermarkets and Sears. Paladin also bought hospitals in Los Angeles, Philadelphia, and Washington, DC that mostly serve public assistance patients. It has made few capital improvements and has not rounded out its portfolio with profitable hospitals. Hahnemann’s bankruptcy filing does not include real estate, so the PE company is free offer the property to developers once the hospital closes in September, just 18 months after it paid Tenet $170 million for Hahnemann and St. Christopher’s Hospital for Children. A private equity expert summarizes:

This is an industry where once somebody does this successfully, lots of other private equity firms will follow. You just have to think to yourself how many hospitals are in gentrifying neighborhoods in urban America, where the property is worth a lot more than the hospital itself.

Sponsor Updates

- EclinicalWorks will exhibit at the 2019 FSASC Annual Conference & Trade Show July 17-18 in Orlando.

- Penn National Insurance selects Goliath Technologies for its virtual workspace initiative.

- Vocera President and CEO Brent Lang joins the Forbes Technology Council.

- Wolters Kluwer Health reports that 700 hospitals in 25 countries now use its UpToDate Advanced interactive clinical pathways.

Blog Posts

- Implementing a patient safety culture (EClinicalWorks)

- Deploying a Model That Maximizes Staff Time and Patient Management: The Third Attribute in a Modern Care Management Model (Ensocare)

- Blue Cross Blue Shield of North Carolina: How we increased security and productivity with Chrome Browser (Google Cloud)

- Education, communication make EHR implementation easier (Greenway Health)

- Alzheimer’s Awareness Month: Getting Smarter with Data (HBI Solutions)

- Why EHR Integration and Testing Resources Should Receive HIPAA Training (The HCI Group)

- Patient Engagement in 2019: Can it Impact Patient Outcomes? (Spok)

- Healthwise’s Commitment to Health IT Innovation (Healthwise)

- Hyland’s UK Healthcare User Forum promotes interoperability and innovation (Hyland)

- Are Your Revenue Cycle Processes Working Optimally? (Impact Advisors)

- Balancing security and usability in a connected mobile ecosystem (Imprivata)

- Reflections from FHIR Dev Days 2019 (InterSystems)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates. Send news or rumors.

Contact us.

When my college peers and I decided to major in one of the many healthcare professions, including the nascent HIT, the reason was to help people and (albeit slightly) improve the world. Now, when I read Mr.HIStalk’s news updates, all I see coming from the industry are dollar signs, dollar signs, and more dollar signs. I tell people that I used to be cool but, sadly, I am not anymore!

Trust me, you were never cool.